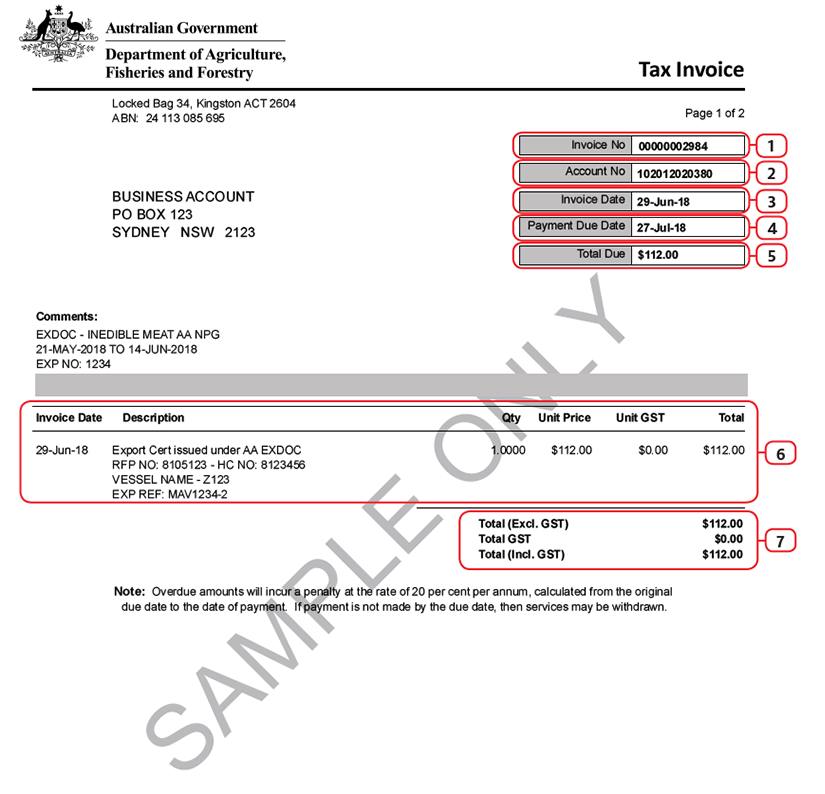

This page outlines the details listed on your Tax Invoice and provides a brief description of each section’s purpose.

- Invoice No – this number uniquely identifies the invoice and can be used to check the status of a payment or pay for this invoice using the department’s secure online payment service. Note: you cannot use the secure online payment service to pay by credit card if your invoice number is alpha numeric e.g. ELS012345678901.

- Account No – if you have an account, your account number will be listed here. Not all clients have account numbers.

- Invoice Date – the date the invoice was issued, not the date payment is due.

- Payment Due Date – payment of the Total Due amount (5) must be received by this date to avoid late payment penalties.

- Total Due – the total amount owed for the services listed on the invoice, including GST. This amount must be paid by the due date (4) to avoid late payment penalties.

- Service details – an itemised list of the department services being invoiced and their fees.

- Total Due details – summary of the total cost for services and GST (if applicable). The total including GST is the same as (5).

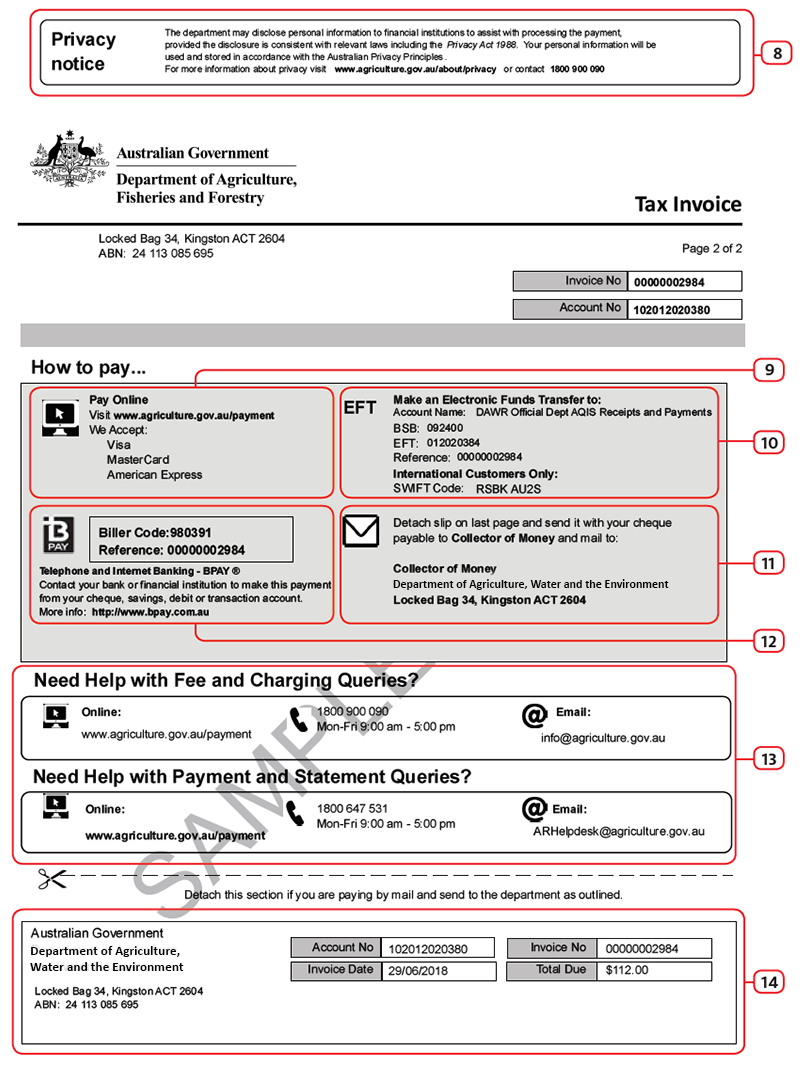

- Privacy Notice – the privacy notice explains that the department will handle your personal information in accordance with the Privacy Act 1988 and the Australian Privacy Principles. For more information visit privacy or phone 1800 900 090.

- Online payment – the web address of the department’s secure online payment service for credit card payment.

- Electronic Funds Transfer (EFT) payment details – the Account Name, BSB, EFT and Reference needed to make payment by electronic funds transfer using your financial institution’s online or phone banking services.

- Mail payment details – how to pay via mail using a cheque, including the mailing address.

- BPAY® payment details – how to pay using BPAY®, including the ‘Biller Code’ and ‘Ref No’ you will require to make a payment.

- Help Resources – in addition to the online help on this page and the How to pay page, you can contact Accounts Receivable by phoning 1800 647 531 or emailing AR Helpdesk for further assistance reading your invoice or making a payment.

- Payment Slip – to pay by cheque, this payment slip must be detached and mailed with an appropriate cheque as per the instructions at (11).