High natural gas prices, export restrictions, and Russia’s invasion of Ukraine have placed pressure on the supply and price of fertilisers. There is no indication that prices are likely to experience substantial falls in the near-term.

Global fertiliser prices are rising

- Average global fertiliser prices have almost tripled since January 2020.

- Most commercial cropping and horticulture operations rely on a combination of nitrogen (N), phosphorous (P) and potassium (K) fertilisers.

- Nitrogenous fertilisers, such as ammonia and urea, are produced using natural gas. Rising gas prices are increasing costs for fertiliser producers, particularly in Europe, and have led to widespread production halts.

- International sanctions have limited exports from Russia and Belarus.

- In October 2021, China introduced additional inspection requirements for fertiliser exports. Exports have subsequently fallen to multi-year lows.

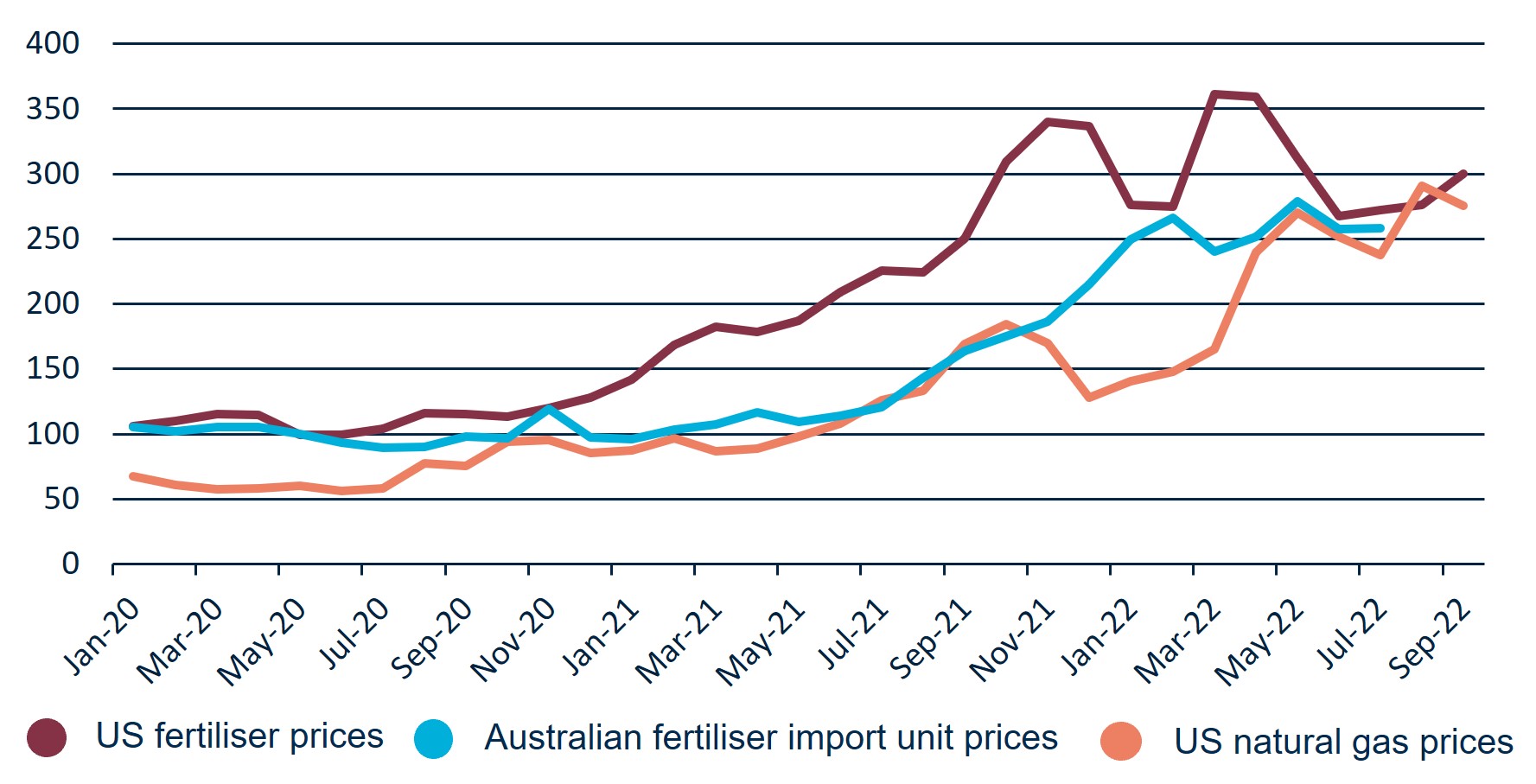

Figure 1: Price indices January 2020 - September 2022

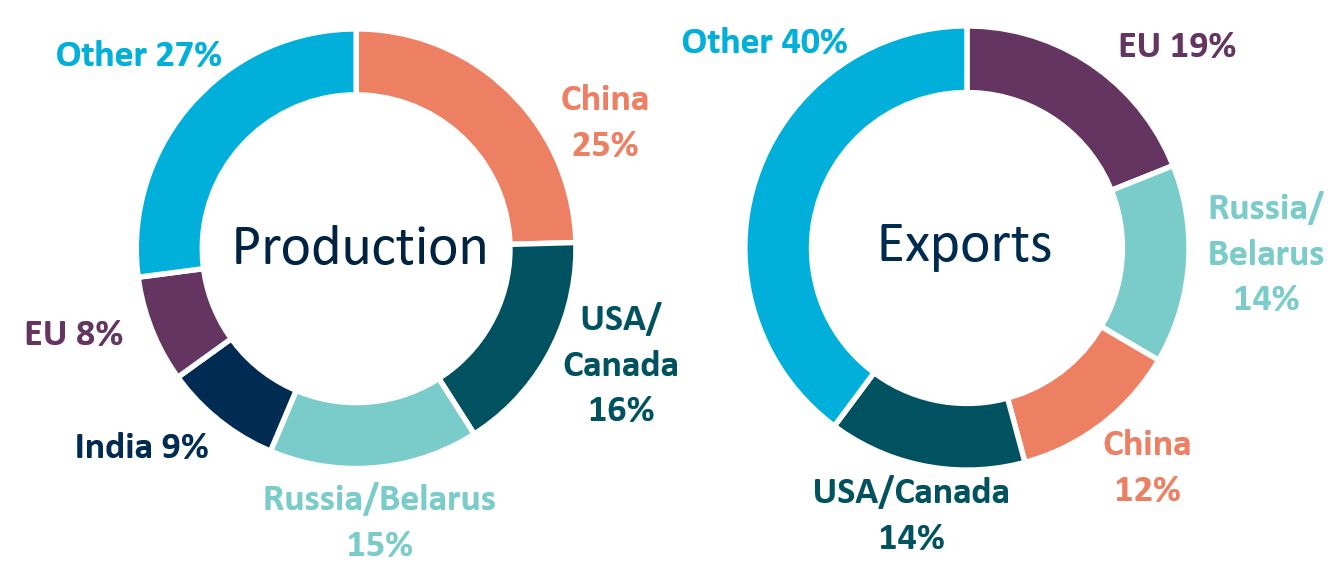

Figure 2: World fertiliser production and exports

World fertiliser production and export markets are concentrated.

- China, India, the US, Russia, and the EU, account for 66% of world nitrogen and phosphate fertiliser production.

- Canada, Russia, Belarus and China account for 80% of world potash (potassium) production.

- The EU, Russia, Belarus and China account for 46% of the value of world fertiliser exports.

- There are important differences across nutrient types. For example, India is a major producer of nitrogen and phosphate, but relies on Belarus and Canada for potash supplies.

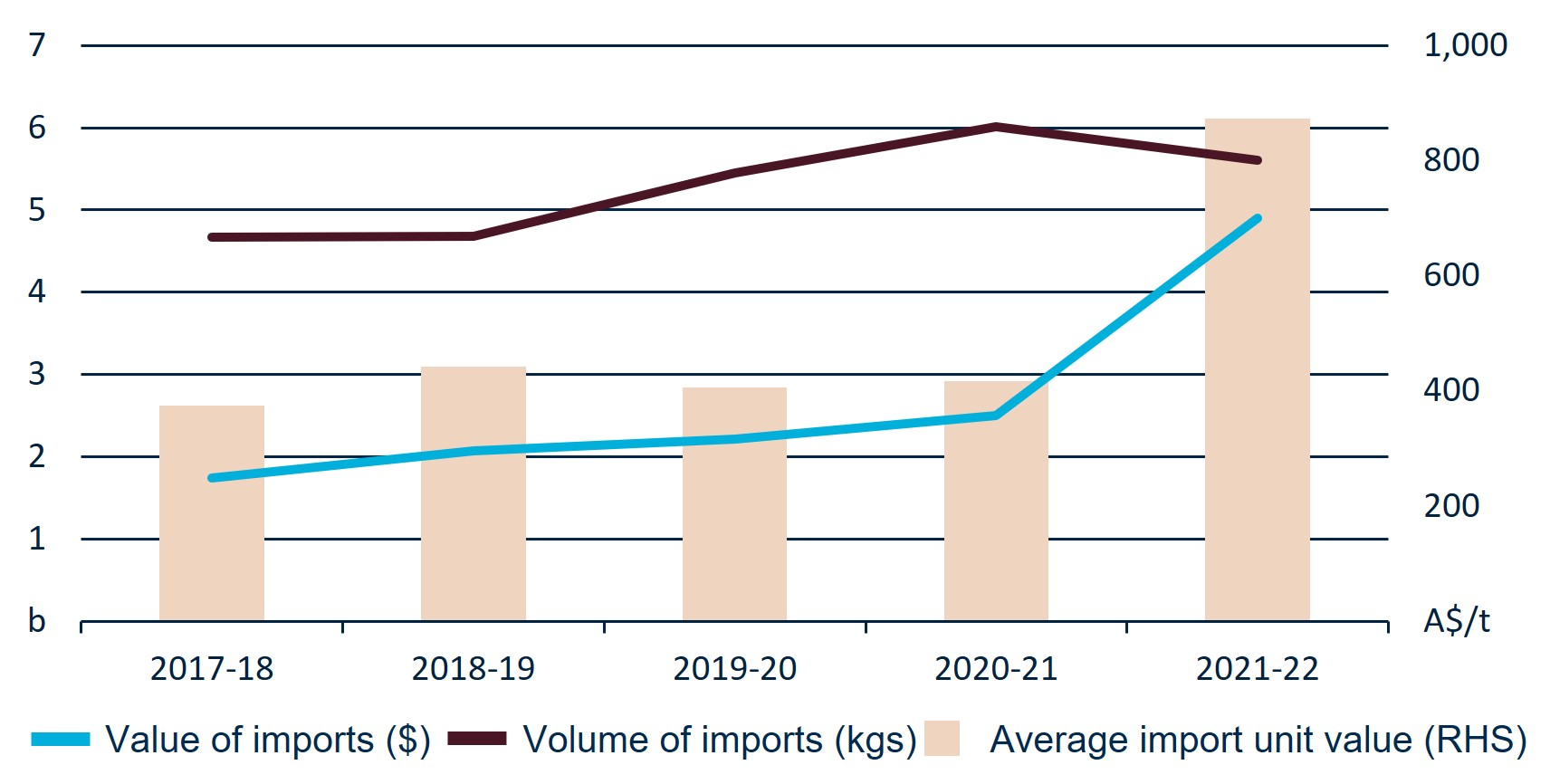

Figure 3: Australian fertiliser imports by financial year

Impact of high global prices on Australian fertiliser imports

- Figure 3 shows the volume of Australian fertiliser imports in 2021-22 was slightly down compared to 2020-21, but still at high levels.

- The value of imports increased from $2.5b in 2020-21 to $4.9b in 2021-22. This is due to a 110% increase in average import unit value.

- Ongoing high import volumes in 2021-22 are a good sign for Australian fertiliser supplies and indicate that Australian farmers are applying fertiliser at the same rate, despite high fertiliser prices.

How do price rises in Australia compare to the rest of the world?

- Figure 1 shows the relative price increases of fertiliser in North America, Australian fertiliser imports, and US natural gas.

- Australian import prices were slower to rise due to Australia’s limited imports from Russia and Belarus, seasonality, and the time lag between production overseas and imports entering Australia.

- Australian prices are now beginning to converge with global prices.

Outlook for fertiliser prices

- There is no indication that fertiliser prices will experience substantial falls in the near-term.

- Natural gas prices are likely to rise further during the European winter, particularly following the closure of the Nord Stream 1 pipeline.

- Neither export restrictions by China nor sanctions on Russia and Belarus are scheduled for removal.

- High prices are encouraging new investment in fertiliser and natural gas production, including in Australia. However, these projects will have a limited impact in the short-term.

Download

Snapshot of global fertiliser trade PDF

Snapshot of global fertiliser trade DOCX

Connect with us

Follow our @AusAgTrade Twitter account for all your #TradeTips and Market Intel.

Subscribe to our monthly Agriculture Market Intelligence Insights newsletter.