Australian agricultural exports to the ASEAN region are increasing. This has been driven by strong economic growth, burgeoning food and fibre processing sectors, and efforts to diversify Australian agricultural exports.

Record level of Australian agricultural exports to ASEAN

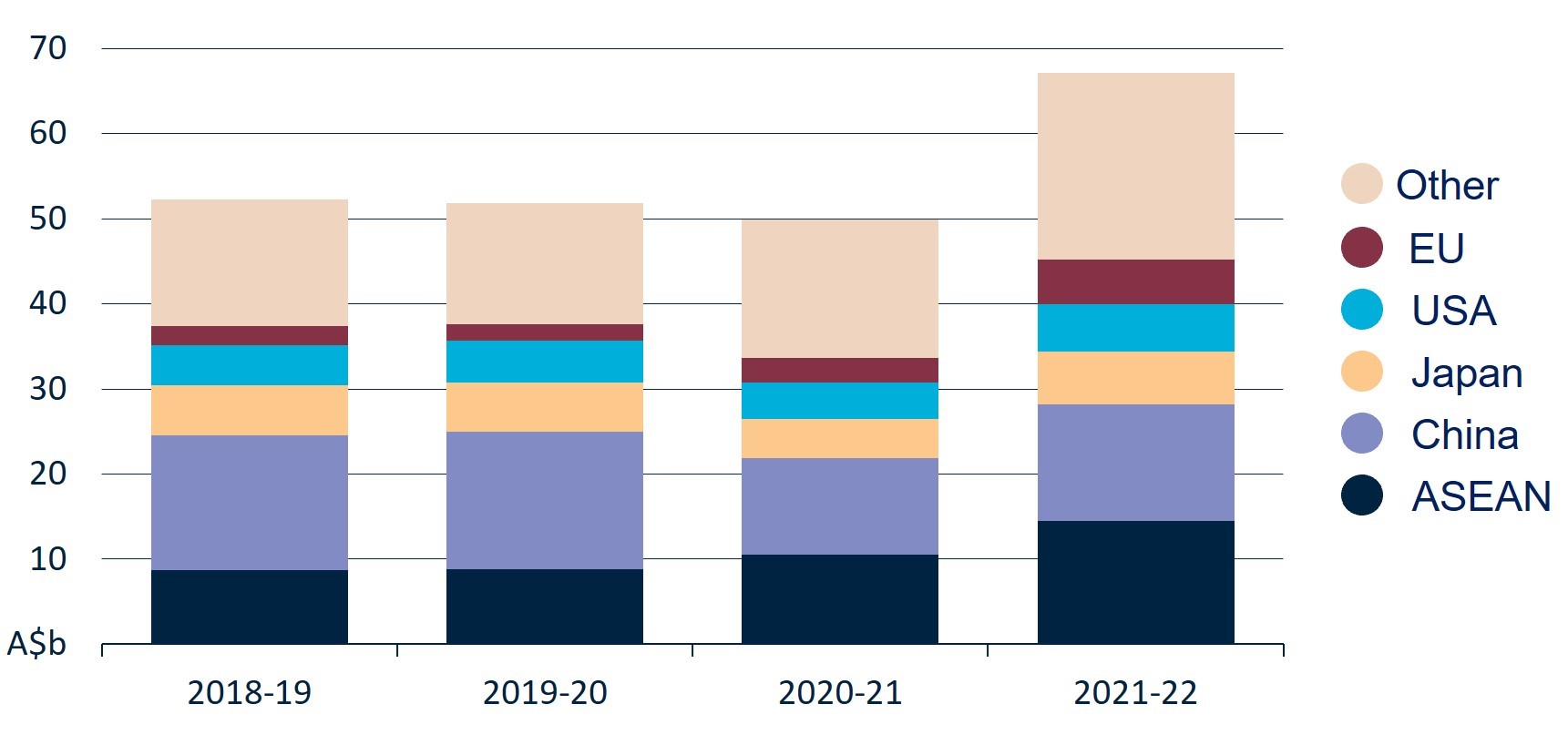

- In 2021-22, a record 22% of Australian agricultural exports went to ASEAN (Figure 1). This has risen to 27% in July-September 2022.

- The ASEAN region includes some of the fastest growing countries in the world. Between 2011 and 2021, total ASEAN GDP increased by 43%, while total global GDP increased by 30%.

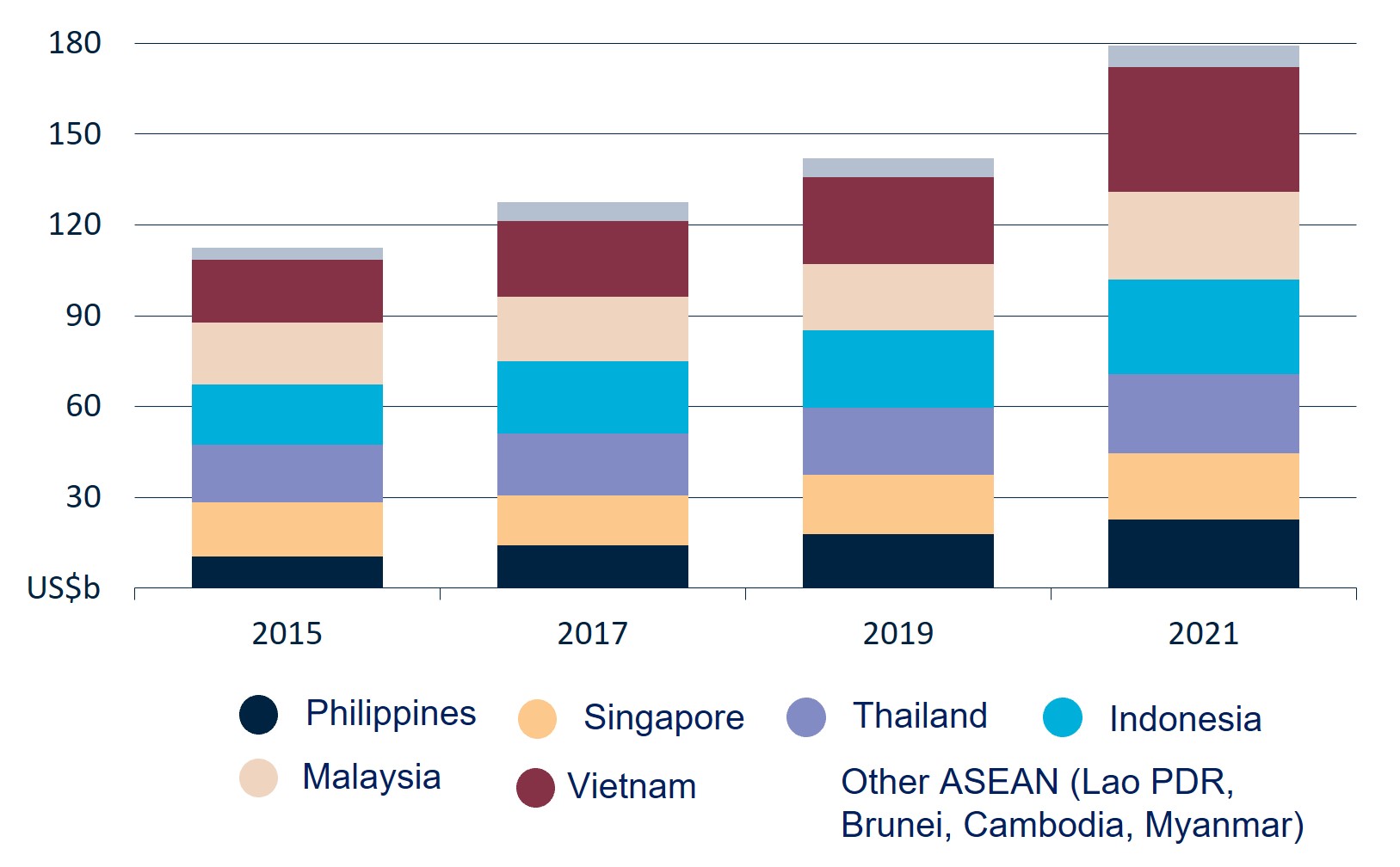

- The total value of ASEAN agricultural, fisheries, and forestry imports from the world has grown from US$112.5b in 2015 to US$179.3b in 2021 (8% per annum) (Figure 2).

Figure 1: Australian agricultural, fisheries, and forestry exports 2018-19 to 2021-22

Figure 2: ASEAN agricultural, fisheries, and forestry imports from the world

Major drivers of ASEAN agricultural imports

- ASEAN’s increasingly wealthy and urbanised middle class are consuming a wider variety of higher value agricultural products, including meat, seafood, and wine.

- ASEAN’s food and fibre processing industries are growing. This has increased demand for inputs, such as cotton.

- Blockages on some Australian agricultural exports to China has necessitated a shift to new markets.

- Geography and climate limit production of some agricultural commodities in the ASEAN region.

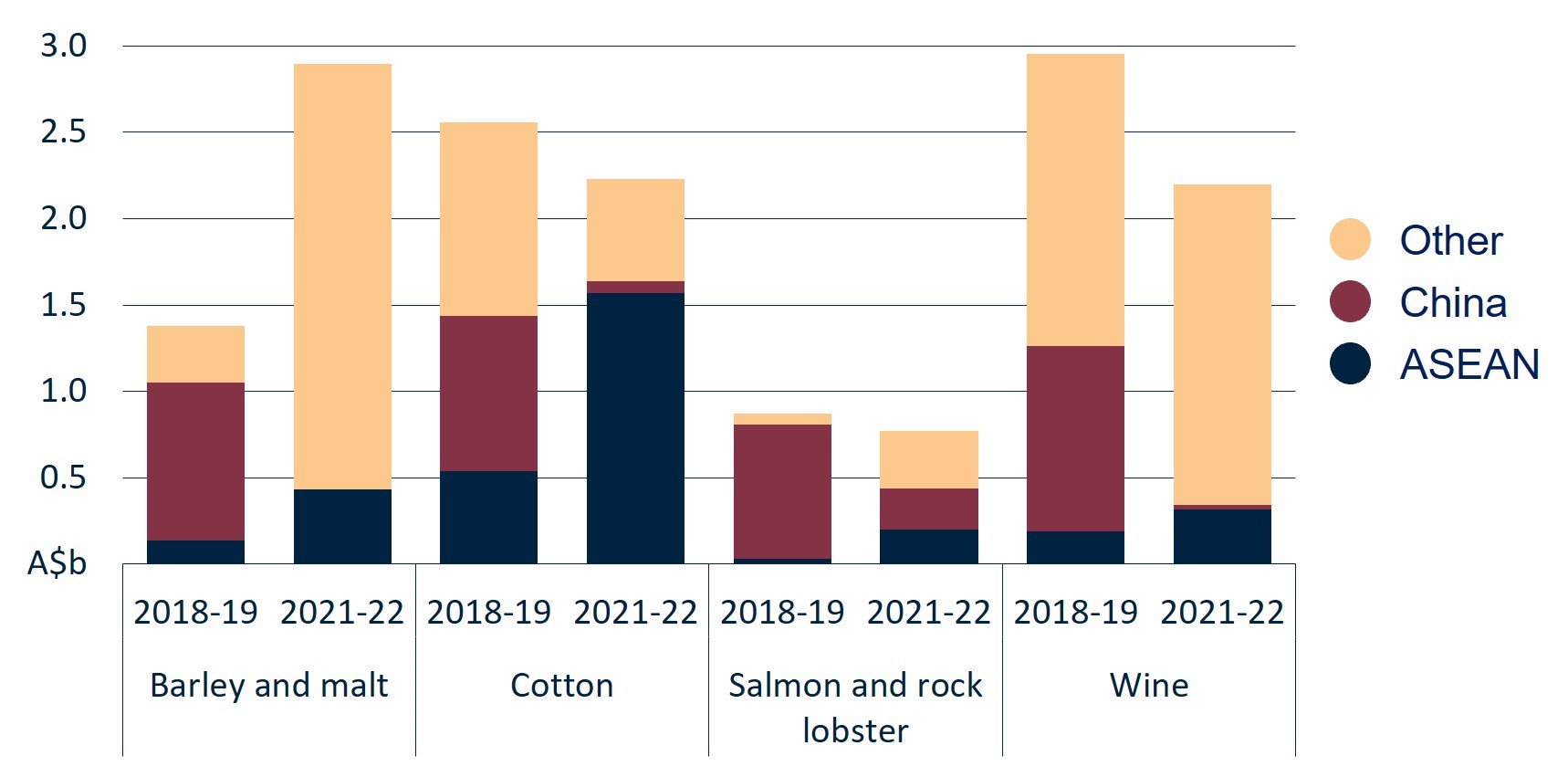

Figure 3: Selected Australian agricultural and fisheries exports, 2018-19 and 2021-22

Barley for food, drinks, and animal feed

- Since 2018-19, exports of Australian barley to ASEAN have increased by 214% (+$258.8m).

- Australian barley is being used in food processing, beer production, and as speciality animal feed.

- Demand for alcohol and meat will continue to rise in the region, creating more opportunities for malting barley and animal feed.

Imported seafood and wine on the menu

- Australian seafood and wine exports to ASEAN have increased by $490 million since 2018-19 (+80%).

- Seafood exports have been driven by increased salmon production in Australia and the diversification of rock lobster exports.

- Exports of Australian wine to most ASEAN markets has increased. Prices for Australian wine in ASEAN markets are 3-4 times higher than in the USA and EU.

- While wine prices are strong, the total volume of trade remains modest.

A cotton processing hub supporting Australian exporters

- ASEAN countries are an increasingly important part of the global fibre processing supply chain.

- In Vietnam, spinning mills import raw cotton and transform it into cotton yarn. The yarn is used in the Vietnamese textile and apparel industry or re-exported abroad, mainly to China and South Korea.

- In 2021-22, Australia exported a record $1.57b of cotton to ASEAN. The 2021-22 record will be easily surpassed this year as stored bales from previous seasons continue to be exported.

Download

December 2022 – Snapshot of agricultural export diversification to ASEAN (PDF)

December 2022 – Snapshot of agricultural export diversification to ASEAN (Word)

Connect with us

Follow our @AusAgTrade Twitter account for all your #TradeTips and Market Intel.

Subscribe to our monthly Agriculture Market Intelligence Insights newsletter.