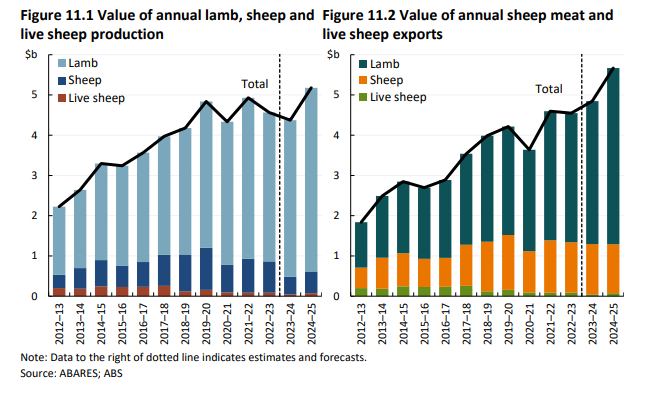

The Australian sheep meat industry has been experiencing consistent growth in recent years, which is expected to continue into 2025. The gross value of Australian sheep meat is set to rise to more than $5 billion in 2024–25, the highest number in more than 10 years.

This article explores how production volumes, demand for and prices of sheep meat have grown according to ABARES and MLA.

Production

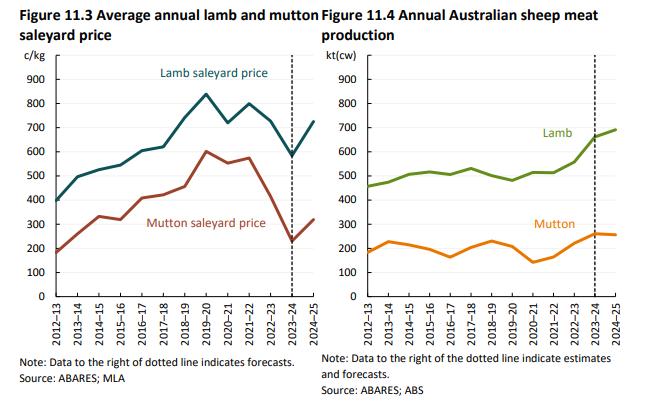

Overall, Australian sheep meat production volumes are forecast to rise by 3% to 942 thousand tonnes (carcass weight) in 2024–25 as a result of higher slaughter volumes. In particular, lamb production is forecast to rise to a record high 654 thousand tonnes in 2024–25. This is expected to be accompanied by an increased processing capacity for lamb production. Mutton production is expected to rise by 9% to 288 thousand tonnes in 2024–25.

Demand

There is sustained demand for Australian sheep meat domestically and internationally. Australia’s domestic market remains the largest single market for sheep meat. The domestic market consumes approximately 35% of Australia’s total sheep meat production. Of this, Australian consumer preference is strongly in favour of lamb, which accounts for 95% of domestic distribution. In 2022, for example, domestic expenditure on lamb was approximately $3.4 billion and $50 million on mutton. This makes Australia one of the largest per capita consumers of sheep meat in the world, roughly 6kg per person annually.

Meanwhile, internationally, Australia is the world’s largest exporter of sheep meat both by volume and value as of 2023. Sheep meat has surpassed wool as the most valuable export of Australia’s sheep industry as of 2019–20. Global demand for sheep meat, and specifically Australia’s world-renowned high quality sheep meat exports, has been trending upwards and is expected to continue on that same trajectory. Growing populations, increasing urbanisation and rising incomes in Australia’s key export markets are attributed to the increase. Australian sheep meat export volumes are expected to rise by 4% to reach a record 657,000 tonnes in 2024–25; over 50% higher than a decade ago. Lamb export volumes are forecast to rise by 5% to 413,000 tonnes in 2024–25, due to significant lamb export demand from the United States and Middle East. Meanwhile, mutton export volumes are expected to rise by 3% to 245,000 tonnes. Demand from the Middle East for both lamb and mutton has increased over the last 10 years to become Australia’s largest regional export destination for sheep meat by volume, and this is expected to continue in 2024–25. In addition, Australia’s top sheep meat export markets also include China, South-East Asia, and growing markets in the Republic of Korea and Japan.

Prices

World sheep meat prices are forecast to rise in 2024–25 due to the increases in world sheep meat demand. The average lamb saleyard price is forecast to rise by 32% in 2024–25 to 770 cents per kilogram (carcass weight), up from 584 cents per kilogram in 2023–24. Prices are expected to be driven up by increasing competition reflecting high processing capacity and world demand for lamb. The average mutton saleyard price is forecast to rise by 38% in 2024–25 to 319 cents per kilogram (carcass weight), up from 231 cents per kilogram in 2023–24. Increased processor competition and a fall in the supply of sheep due to improved seasonal conditions are key factors in the expected rise in mutton prices.

Investing in future growth

The $139.7 million assistance package for the phase out of live sheep exports by sea includes programs dedicated to ensuring the future growth of the sheep industry. This includes the $97.3 million producer and supply chain program to increase sheep processing capacity and assist the industry to transition, and the $27 million enhancing market demand program enabling the industry to capitalise on growing demand in Australia and overseas. For more information on these programs, visit the transition assistance webpage.

Outlook

Sheep farming has been and continues to be an important foundation of Australia’s economy and identity. The strength of the sheep meat industry, combined with the investments being made to ensure the industry meets demand from domestic and export markets, will allow sheep farming to remain fundamental to Australia’s agriculture and way of life.