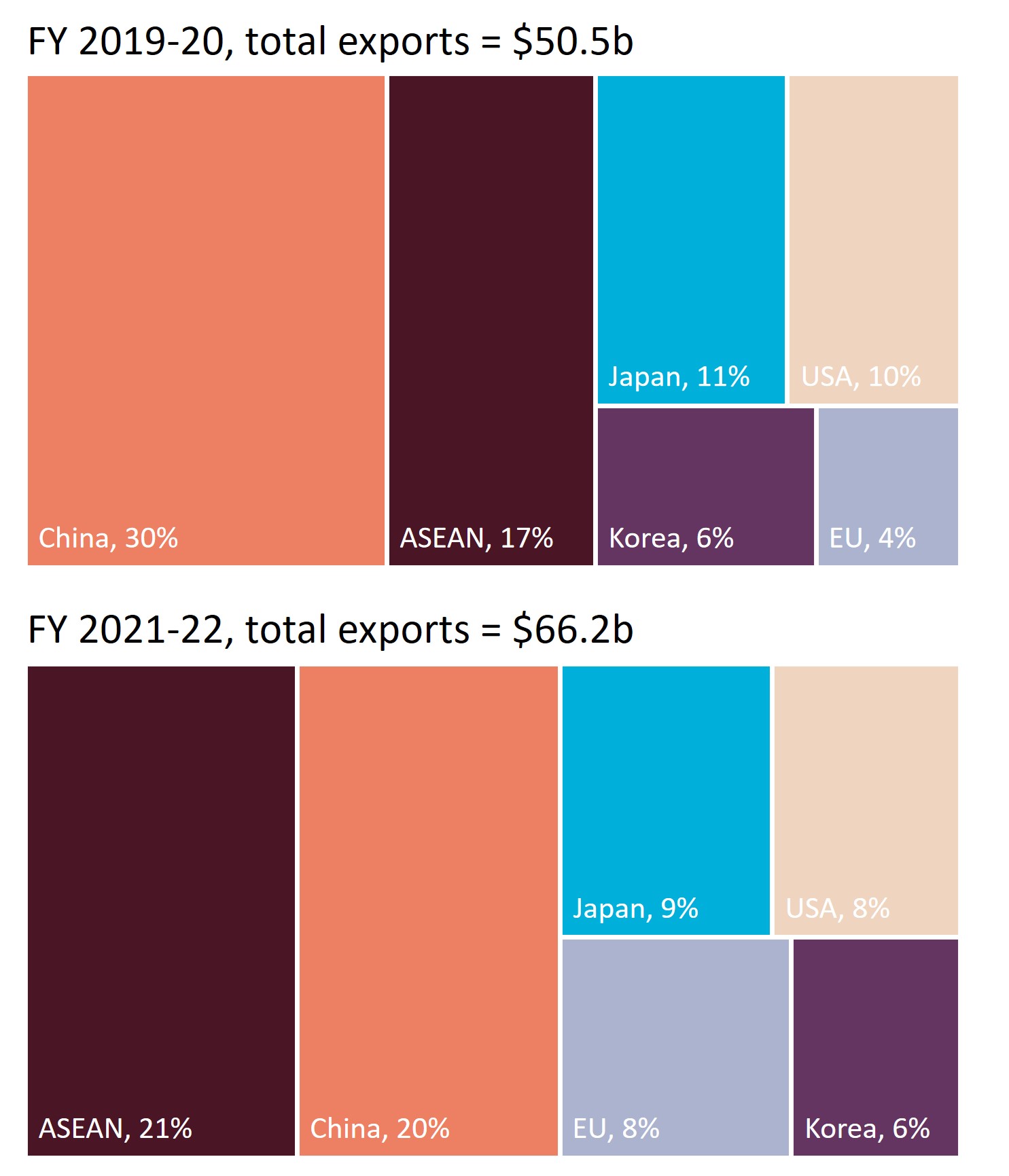

Australia’s agricultural and fisheries export markets were more diversified in 2021-22.

ASEAN overtakes China as Australia’s largest agricultural and fisheries export destination

- Australia’s agricultural and fisheries export markets were more diverse in 2021-22.

- The proportion of exports that went to Australia’s top-5 markets has fallen from a high of 60% in 2019-20 to 51% in 2021-22.

- Record wheat and cotton exports to ASEAN countries saw the proportion of exports to the ASEAN region exceed exports to China.

Drivers of export diversification in 2021-22

- Favourable seasonal conditions, commercial decisions by Australian industry and the Australian Government’s support of trade expansion initiatives all contributed to increased diversification in 2021-22.

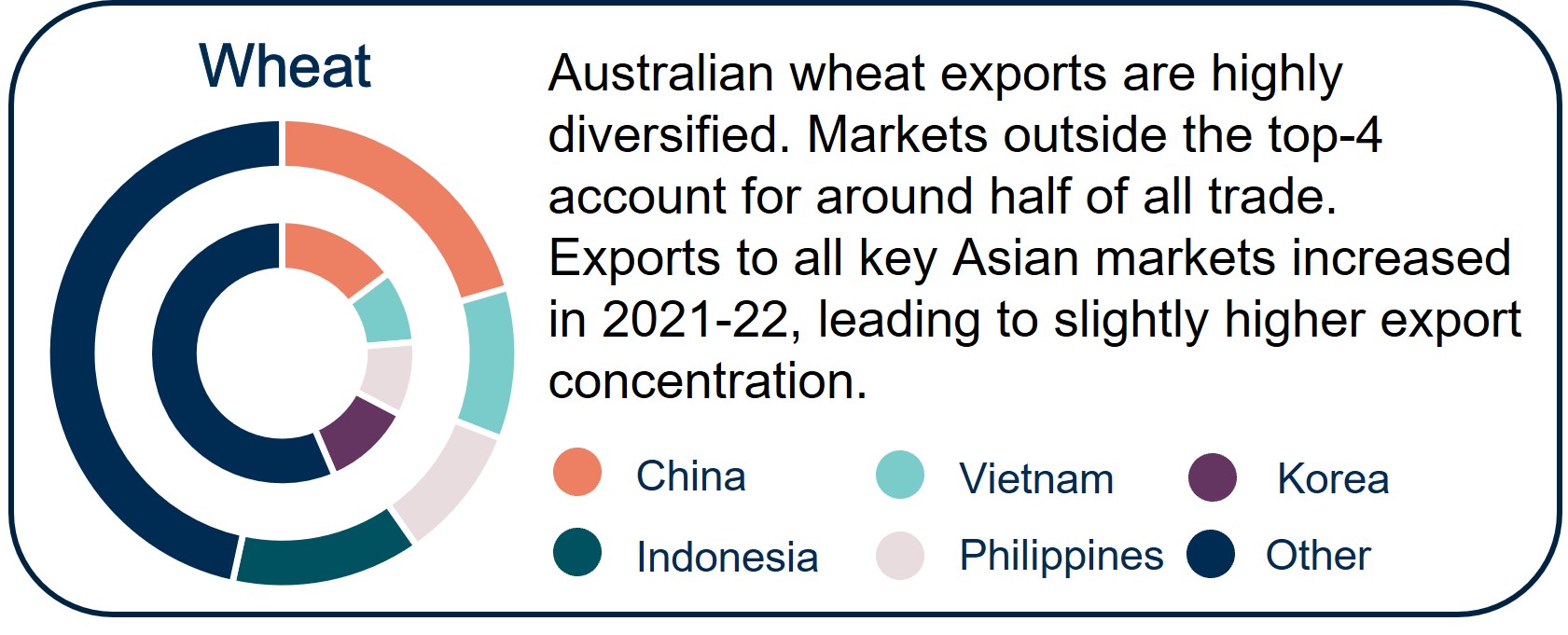

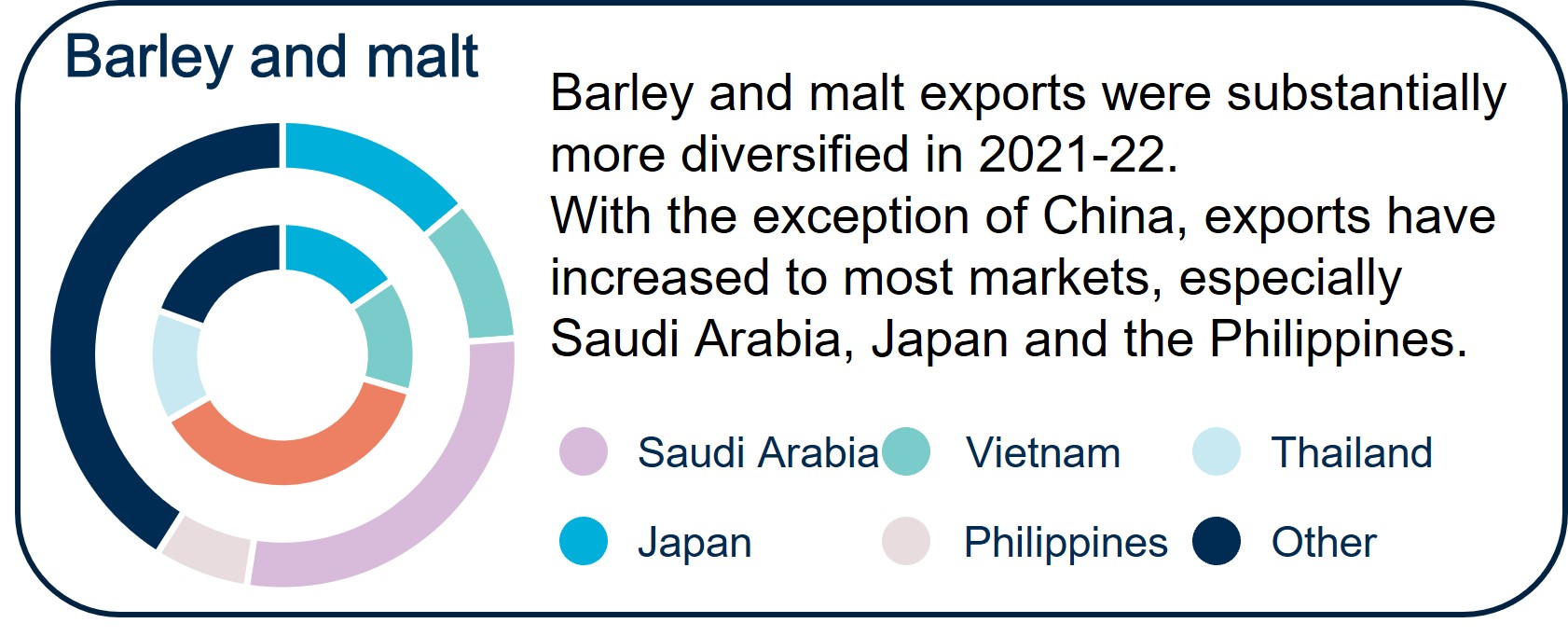

- Increased rainfall led to higher crop production, including wheat, canola, barley and cotton.

- Wheat exports to Indonesia, Vietnam and the Philippines increased.

- Barley exporters found new markets in the Middle East, Asia and Latin America.

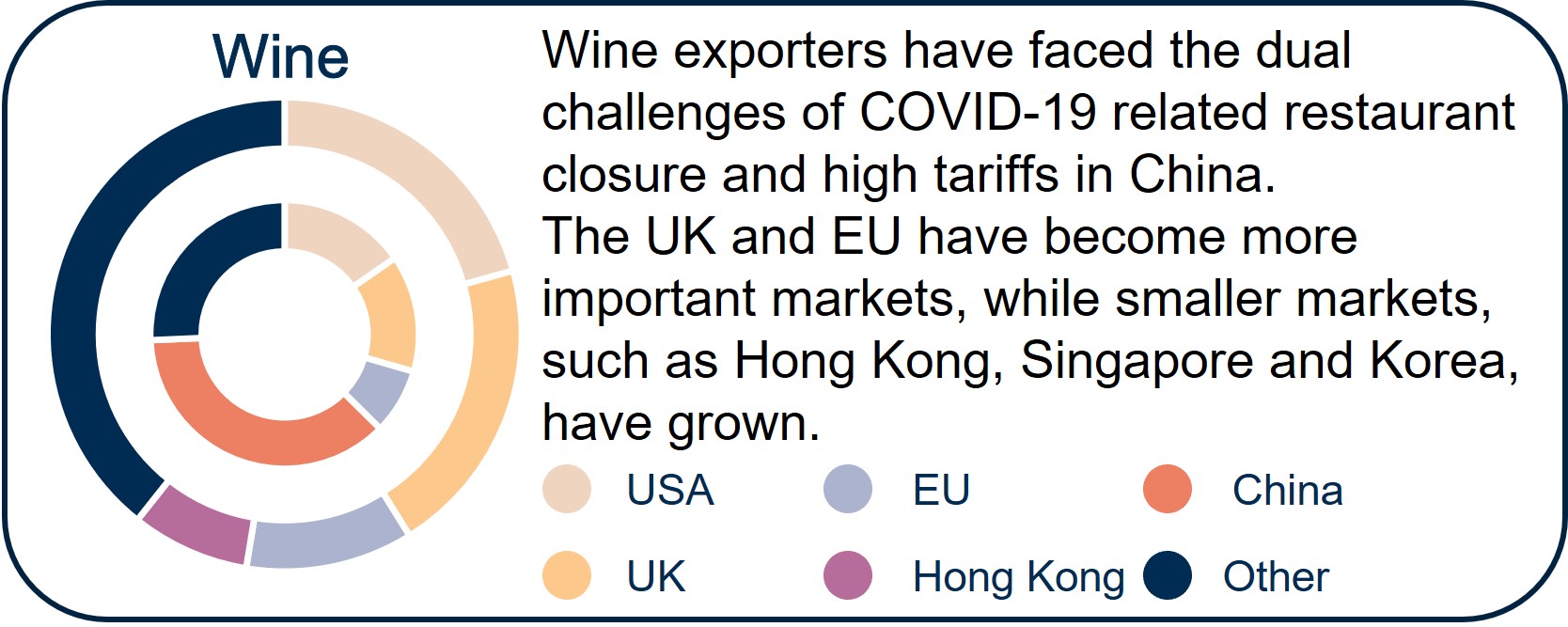

- Restrictive trade measures affected exports to China. However, China’s demand for Australian wheat and sorghum grew.

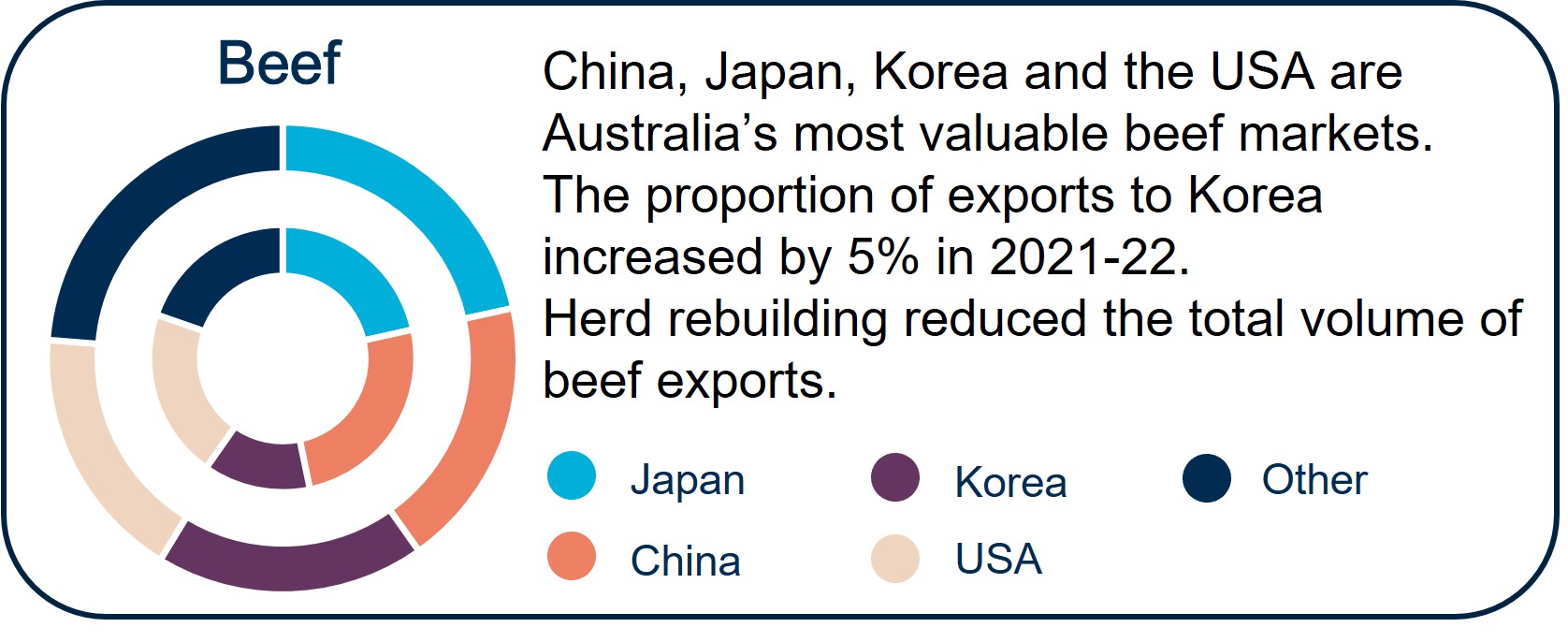

- Herd rebuilding affected the value of exports to major beef markets, such as Japan, Korea and the US.

- In 2021-22, the Australian Government opened or improved access to 46 agricultural and fisheries export markets, worth a potential $337 million.

Figure 1: Value of agricultural and fisheries exports by destination

Figure 2: Proportion of exports to top 4 markets, wheat, beef, barley and wine, FY 2019-20 and FY 2021-22

Outlook for diversification

- High grain production in 2022-23 is likely to see continued high export values to ASEAN.

- Beef production is likely to increase, leading to a larger proportion of exports to Japan, the US and Korea.

- Recent trade agreements with India and the UK have created new diversification opportunities.

Download

Agricultural export markets continue to diversify (PDF)

Agricultural export markets continue to diversify (Word)

Connect with us

Follow our @AusAgTrade Twitter account for all your #TradeTips and Market Intel.

Subscribe to our monthly Agriculture Market Intelligence Insights newsletter.