This indicator measures the size and economic contribution of the wood products sector to Australia’s economy. Analysis of trends in the value and volume of wood and wood products enables socio-economic benefits derived from the forest industry to be assessed.

This is the Key information for Indicator 6.1a, published October 2024.

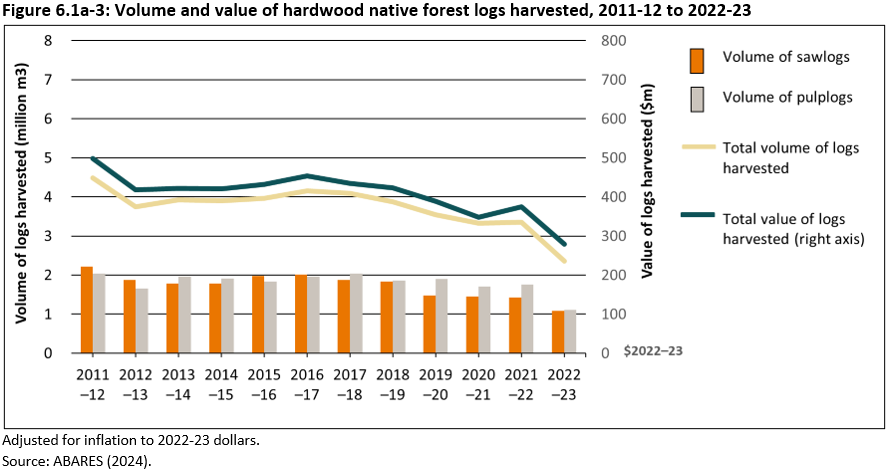

In Australia in 2022-23, compared to 2021-22:

- the total volume of all logs harvested fell by 3.9% to 25.0 million cubic metres while the total value was stable at $2.4 billion (adjusted for inflation)

- the total volume of logs harvested from softwood plantations fell by 5.4% to 14.0 million cubic metres, however, the total value increased by 4.5% (adjusted for inflation) to $1.35 billion

- the total volume of logs harvested from hardwood plantations increased by 10.3% to 8.5 million cubic metres and the total value increased by 5.6% (adjusted for inflation) to $800 million

- the total volume of hardwood native forest logs harvested fell by 30% to 2.4 million cubic metres and the total value decreased by 26% (adjusted for inflation) to $278 million

- the total volume of all logs harvested from native forest (including cypress pine softwood) fell by 29% to 2.5 million cubic metres and the total value decreased 25.5% (adjusted for inflation) to $296 million.

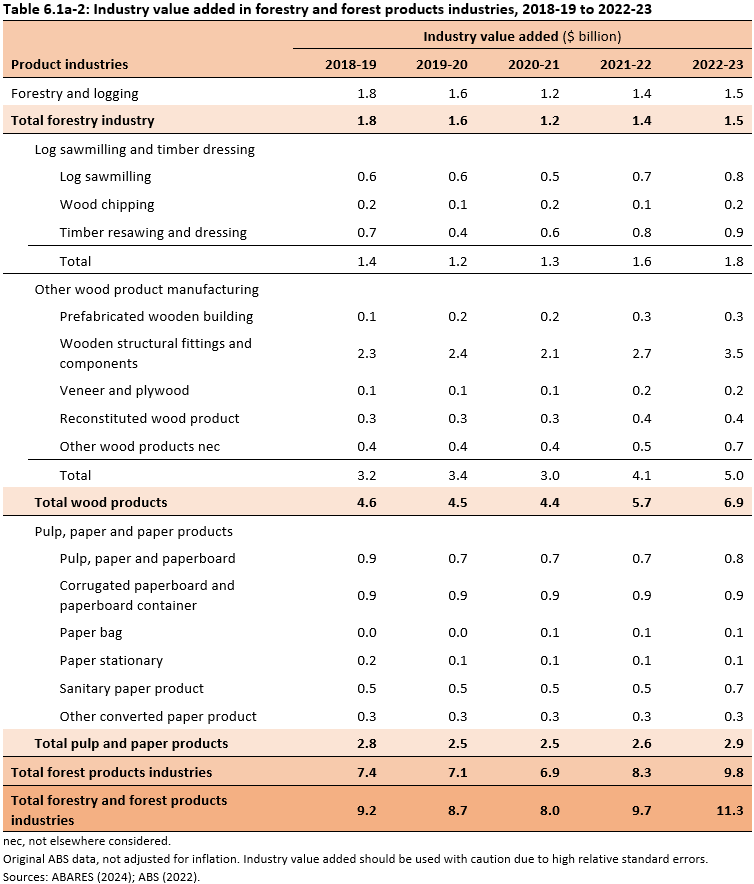

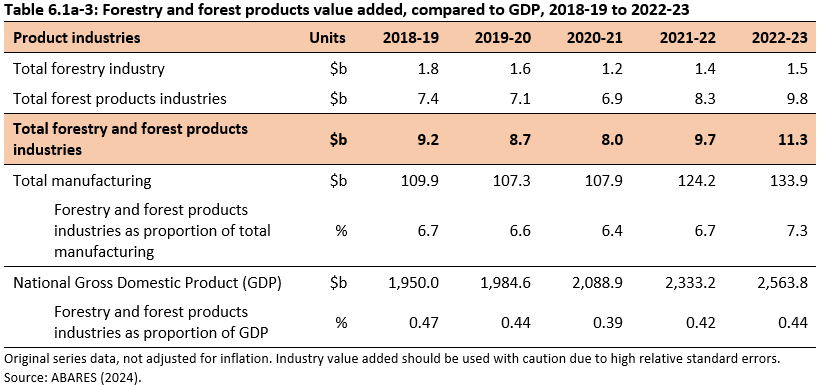

The value added by forestry and forest products industries, referred to as ‘industry value added’, was $11.3 billion, or 0.44% of Australia’s gross domestic product in 2022-23.

The total volume of logs harvested in 2022-23 fell by 3.9% to 25.0 million cubic metres compared to 2021-22, and fell by 17% from 30.1 million cubic metres in 2015-16.

The real (adjusted for inflation) value of logs harvested in 2022-23 was stable at $2.4 billion compared to 2021-22 (with a change of only -0.1%). Log prices increased significantly over the 12-month period, mostly driven by high levels of inflation, as measured by the consumer price index. Increases in the value of logs harvested from softwood and hardwood plantations offset the decline in value of logs harvested from native forests.

Click here for a Microsoft Excel workbook of the data for Table 6.1a-1.

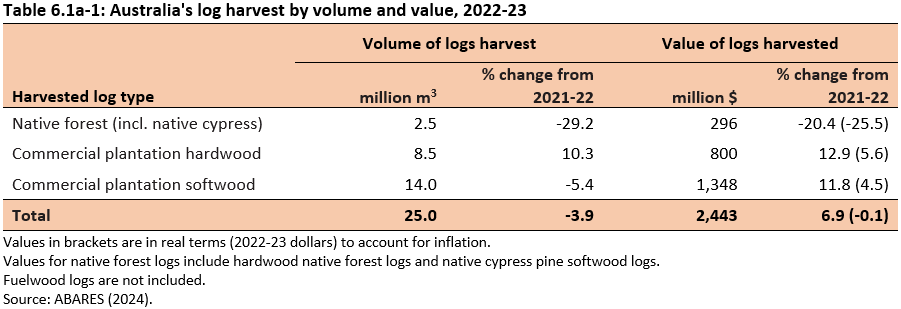

The total volume of logs harvested from Australia’s softwood plantations was 14.0 million cubic metres in 2022-23 which was a fall of 5.4% compared to 2021-22 (Figure 6.1a-1).

The total value of logs harvested from softwood plantations in 2022-23 increased by 11.8% (4.5% in real terms, i.e. adjusted for inflation) to $1.35 billion compared to 2021-22. This increase in value was driven by an increase in production costs and in turn the price of softwood logs.

The volume of softwood sawlogs produced in 2022-23 declined by 6.7% to 8.1 million cubic metres compared to 2021-22. The real (adjusted for inflation) value of softwood plantation sawlogs produced in 2022-23 increased by 1.7% to $916 million, largely due to the increase in production costs and in turn the price of sawlogs.

Click here for a Microsoft Excel workbook of the data for Figure 6.1a-1.

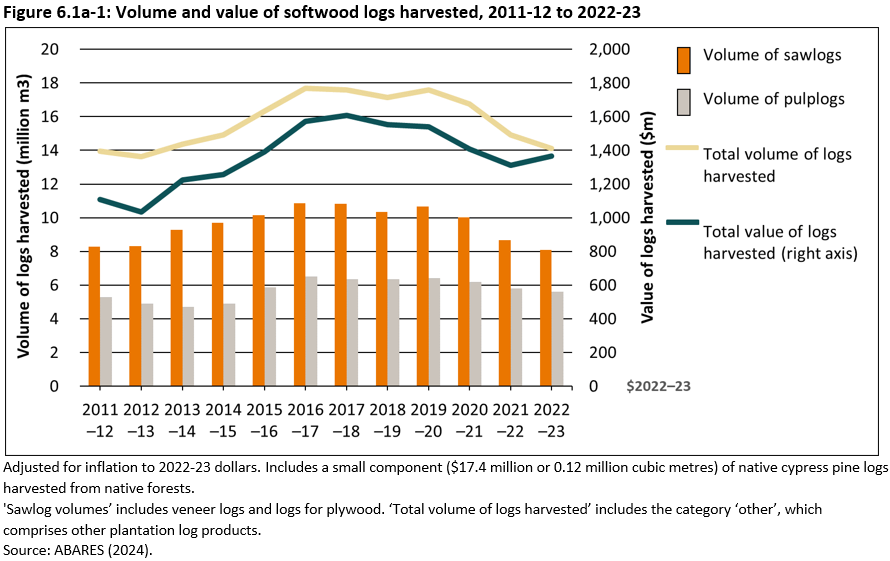

The total volume of logs harvested from Australia’s hardwood plantations was 8.5 million cubic metres in 2022-23, an increase of 10.3% compared to 2021-22.

Hardwood plantations produced 78% of the volume of all hardwood logs produced in Australia in 2022-23. Most (87%) of the logs harvested from hardwood plantations were pulplogs destined for export as woodchips. The nominal (unadjusted for inflation) value of hardwood plantation log production increased by 12.9% to $800 million in 2022-23 compared to 2021-22 (Figure 6.1a-2). In real terms (adjusted for inflation), the growth in value was 5.6%.

Click here for a Microsoft Excel workbook of the data for Figure 6.1a-2.

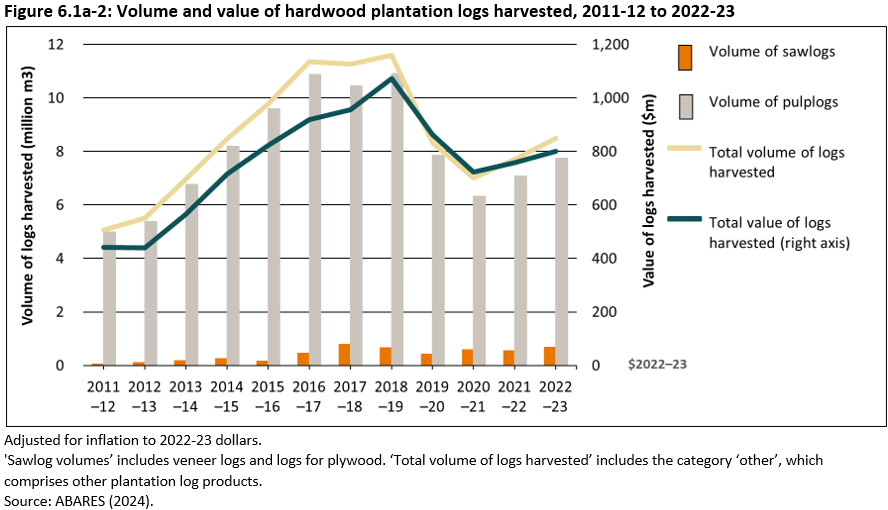

The volume of hardwood native forest logs harvested was 2.4 million cubic metres) in 2022-23 and fell by 30% compared to 2021-22 (Figure 6.1a-3), with sawlog and pulplog harvests reducing by 25% and 37% respectively.

The total value of hardwood native forest logs harvested in Australia in 2022-23 declined by 21% to $278 million, compared to 2021-22. This was a 26% decrease in real terms (adjusted for inflation).

The fall in the value and volume of production from Australia’s native forests over the 12 months to 2022-23 is a continuation of the trend observed over the past two decades.

Click here for a Microsoft Excel workbook of the data for Figure 6.1a-3.

The value added by the Australian forestry and forest products industries, referred to as ‘industry value added’, was $11.3 billion in 2022-23 (Table 6.1a-2). The ‘Other wood product manufacturing’ sub-sector drove most of this value-add ($5.0 billion), reflecting the value derived with the transformation of logs into high-value products such as wooden structural fittings and components.

Click here for a Microsoft Excel workbook of the data for Table 6.1a-2.

The Australian forestry and forest products industries contributed 0.44% of Australia’s gross domestic product (GDP) in 2022-23 (Table 6.1a-3).

Click here for a Microsoft Excel workbook of the data for Table 6.1a-3.

Further information

Click here for Supporting information on Indicator 6.1a: Value and volume of wood and wood products (2024), including:

- Industry definitions

- Data sources