Authors: Tim Westwood, John Walsh and Mihir Gupta

Data visualisation

Source: ABARES

The PowerBI dashboard may not meet accessibility requirements. For information about the contents of these dashboards contact ABARES.

Summary

The purpose of this report is to provide a forecast for water allocation prices and irrigation activity in the southern Murray-Darling Basin (sMDB) for the year ahead (2021‑22). Prices are forecast under four representative scenarios aligned with state water agency allocation outlooks: extreme dry, dry, average and wet. Also presented is a summary of market conditions in the previous year (2020‑21), providing context for the likely market outcomes in 2021‑22.

Based on the current climate outlook from the BOM, ABARES considers the most likely scenario to be the average scenario. The forecasts presented in this report are based on the latest data from the BOM and state water agencies, and changes in this underlying data will result in changes to the forecasts. Readers should consult the BOM and state water agencies websites, to keep abreast of the latest outlook for seasonal conditions and water supply.

Favourable water supply conditions set to continue

In the average scenario, allocations in 2021‑22 are projected to be higher than the historical averages for most of the major entitlement types. A total of 2,587 GL of water carried over from 2020‑21 will further support the volume of water available in 2021‑22, the highest volume since 2017‑18. The overall water supply in the average scenario is expected to remain similar to 2020‑21 across the southern basin. Even in the extreme dry scenario, water supply is expected to remain above the levels seen during 2019‑20.

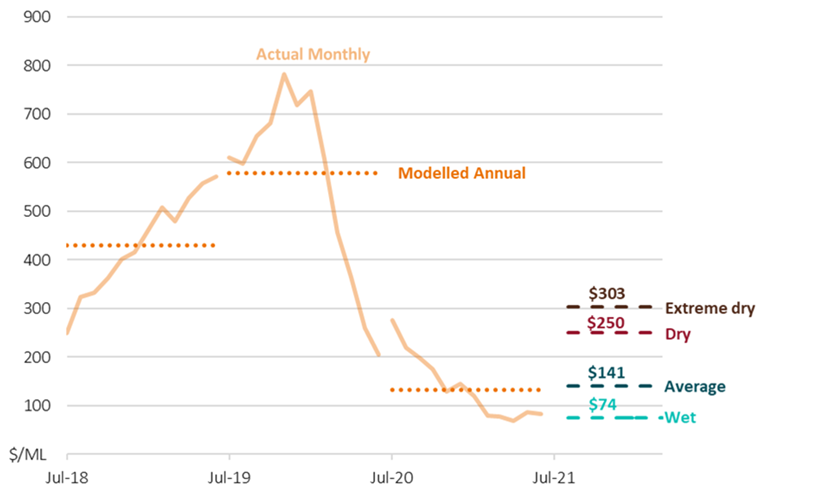

Prices forecast to remain low in 2021‑22

In the average scenario, the average weighted price across the sMDB is forecast to reach $141 per ML, relatively similar to prices experienced in 2020‑21 ($130 per ML). In the wet scenario, prices are forecast to decrease compared to 2020‑21, to an annual average weighted price of $74 per ML. In the dry and extreme dry scenarios, prices are forecast to increase to $250 per ML and $303 per ML respectively but will remain well below prices experienced in 2019‑20 ($587 per ML).

Changing trade rules to reduce trade out of the Goulburn

As of 1 July 2021, the Victorian Department of Environment, Land, Water and Planning (DELWP) has introduced revisions to the Goulburn to Murray Inter-Valley trade (IVT) rules to encourage more sustainable trade (DELWP 2021). These changes will collectively lead to:

- Trade of allocations made against legacy water commitments being quarantined during winter-spring, until an opportunity to deliver the water appears.

- Capped opportunities to trade water during the summer-autumn period. Water may be released from quarantine, depending on seasonal conditions, providing additional trading opportunities.

The net impact of these measures remains to be seen. However, with demand for water expected to remain high in the almond growing regions below the Barmah choke, the Goulburn to Murray IVT limit is likely to bind more frequently and for longer durations. This is partly reflected in the outlook for 2021‑22, with prices forecast to be lower in the Goulburn compared to Murray catchments below the Barmah choke across all scenarios in 2021‑22 ($44 per ML lower in the average scenario).

[expand all]

Market intelligence: 2020 21

In this chapter, trends in sMDB water markets during 2020‑21 are assessed, to inform the forecasts for market and irrigation activity outcomes in 2021‑22.

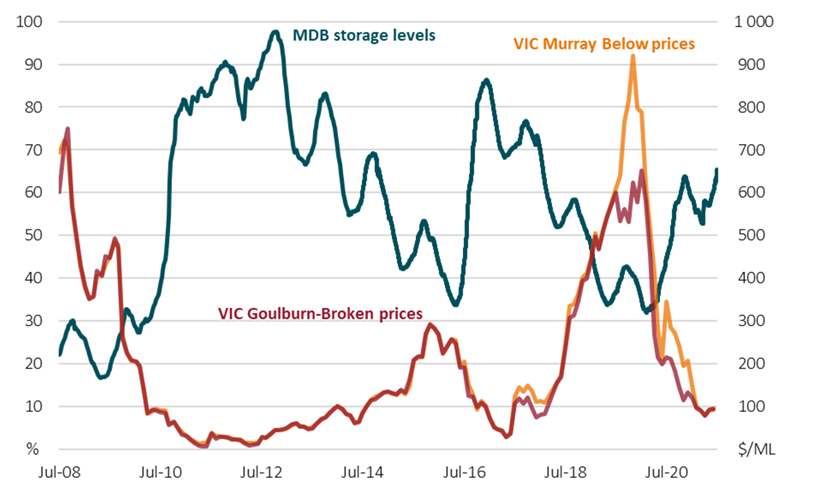

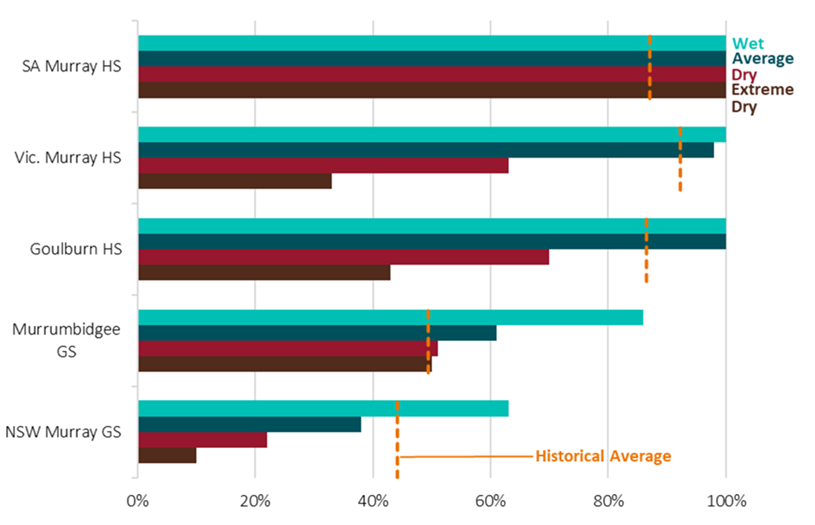

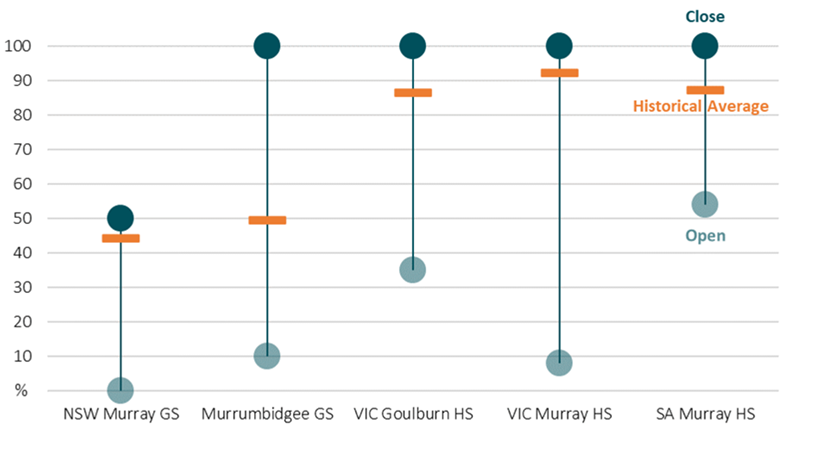

Water availability improved significantly in 2020‑21, driven by high water allocations, with all major securities ending the year above historical averages (Figure 1). Allocations for Murrumbidgee general security entitlement holders were especially high, reaching 100% in 2020‑21, compared to 11% in 2019‑20, and well above the historical average of 49% (DPIE 2020).

Note: Historical average calculated from 2000 01 to 2019 20. HS refers to High security entitlements. GS refers to General security entitlements. Open refers to allocation announcements made on the 1/7/2020. Close refers to allocations as at 30/6/2021.

The arrival of a La Niña event in 2020‑21, coupled with a negative Indian Ocean Dipole led to improvements in rainfall (ABARES 2021a). This led to storages recharging in 2020‑21, with the volume of water held in storage reaching 65% of total capacity, the highest level since 2017‑18 (Figure 2).

Water availability was further supported by a significant volume of water carried over from 2019‑20 into 2020‑21, despite 2019‑20 being one of the driest years on record. Carryover decisions in 2019‑20 were partly informed by a then poor seasonal outlook for 2020‑21, which could have led to a water supply position similar to the millennium drought in 2007‑08 (ABARES 2020). Once the seasonal outlook shifted towards more favourable conditions in early 2020, carryover decisions for 2020‑21 had already been made, with limited opportunities to use the stored water (BOM 2020a).

Source: BOM

Note: Water prices in 2020-dollar terms.

The overall improvement in water availability resulted in the average annual price across the basin falling sharply to $130 per ML in 2020‑21, down from $587 per ML in 2019‑20.

However, binding trade limits restricted the volume of trade that could occur in 2020‑21, leading to differences in prices between regions (Figure 2). In the past, wet conditions have led to reduced pressure for inter-regional trade (and hence fewer differences in prices between regions). However, in 2020‑21 all major IVT limits were binding for most of the year (VWR 2021a, MDBA 2021, WaterNSW 2021). For example, there were no opportunities to trade water from the Goulburn to the Murray until February (for more information on changes to the Goulburn IVT see Box 1). This resulted in an average annual price during 2020‑21 in the Vic. Goulburn-Broken of $128 per ML compared with $173 per ML in Vic. Murray below Barmah choke.

High demand for water in regions below the Barmah choke means that they are usually net importers of water, which leads to higher prices in these regions when trade limits are binding. The demand for water in these regions is driven by the concentration of water intensive perennial crops such as almonds and fruit trees (Goesch et. al. 2020). Farmers growing these crops typically have a greater willingness to pay for water compared to more opportunistic activities such as rice (Downham & Gupta 2021).

Changes to the Goulburn to Murray IVT

As of 1 July 2021, DELWP has introduced revisions to the Goulburn to Murray IVT rules to encourage more sustainable trade (DELWP 2021). The new rules will replace the previous 200 GL year-round trade rule with a two-part trade rule; a winter-spring rolling IVT balance (part 1) and a fixed summer-autumn cap (part 2) (VWR 2021b).

These changes will collectively lead to:

- More consistent opportunities to trade water from the Goulburn to the Murray, that will be higher than in most recent years, but lower than in years where record levels of trade have occurred (2017-18 and 2018-19).

- Trade of allocations made against legacy water commitments being quarantined during winter-spring, until an opportunity to deliver the water appears.

- Overall capped opportunities to trade water from the Goulburn to the Murray during the summer-autumn period, with trade of quarantined water (from legacy commitments) made available in dry years when allocations to Goulburn entitlements are unlikely to reach 100%.

- Trade of water from tagged entitlements made available only when the Goulburn to Murray IVT is open and allocation trade is permitted.

Part 1: Winter-spring rolling IVT balance (1 July 2021 to 15 December 2021)

Trade will be available until the IVT balance reaches 190GL. Once reached, trade out of the Goulburn is restricted, until additional trade opportunity is made available from back-trade (trading water from the Murray to the Goulburn) or through river operations.

The 190GL IVT balance includes quarantined legacy commitments, with the effective trade opportunity at 1 July approximately 50 GL. Additional trade opportunities are expected to become available through river operations. This quarantined water will only be released as trade opportunity dependent on seasonal conditions in Part 2.

Part 2: Fixed summer-autumn cap (15 December 2021 to 30 June 2022)

On the 15th of December, the trade cap will be announced, determining the net volume of trade available. Once the volume of trade reaches the cap, additional trade opportunities will only be available through back-trade (VWR 2021b). The intention of the summer-autumn trade cap will be to reduce the water owed from the Goulburn to the Murray to zero, so that additional trade opportunities are available at the start of the 2022‑23 season.

Legacy commitments quarantined in part 1 can be released to the market, as part of the summer-autumn cap. This will only occur if Goulburn High security allocations are not projected to reach 100% in 2021‑22.

Water market forecasts: 2021 22

ABARES has developed scenarios for water availability in 2021‑22 that draw upon the latest allocation outlooks from state water agencies as at 15 July 2021. Four representative scenarios are considered, ‘extreme dry’, ‘dry’, ‘average’ and ‘wet’, that align with the allocation outlooks published by state water agencies. ABARES uses these allocation forecasts and opening carryover (excluding environmental water) to determine the volume of water available for irrigation in the sMDB in each scenario for 2021‑22. See Appendix A for more details.

The scenarios are indicative only, and conditions could be better or worse than forecast, which would in turn affect prices. Readers should consult state water agencies forecasts (DPIE, NVRM, DEW) and BOM seasonal outlooks throughout the year to inform their decisions.

Based on the latest BOM seasonal outlooks, ABARES currently considers the most likely scenario to be the average scenario. However, all four outlook scenarios are discussed in each edition of the Water Market Outlook, to provide consistent information on the effects of different seasonal conditions and related on-farm decisions such as carryover and irrigation water use.

Seasonal outlook

The seasonal outlook for 2021‑22 forecasts rainfall average or better, with the major climate indicators either neutral or better (BOM 2021c). See Seasonal conditions: June quarter 2021 for further information regarding the outlook for 2021‑22. Readers should consult the BOM outlook to keep up to date with changing forecasts, to inform their decisions.

Water supply in 2021‑22

The state allocation outlooks are generally quite favourable and are higher than the historical averages for all major entitlement types (Figure 3). However, compared to 2020‑21, some regions (such as the Murrumbidgee) are projected to receive significantly less water. Further supporting water supply in 2021‑22, around 2,587 GL of water was carried forward from 2020‑21 across the southern basin – the highest level of carryover since 2017‑18.

Source: NVRM, NSW DPIE, SA DEW, ABARES

Note: Historical average calculated from 2000 01 to 2019 20. HS refers to High security entitlements. GS refers to General security entitlements

Thanks to highly favourable seasonal conditions between March and June 2021, the total water available for irrigation use is forecast to be higher than previously predicted by state water agencies in the ABARES March Water Market Outlook (ABARES 2021c).

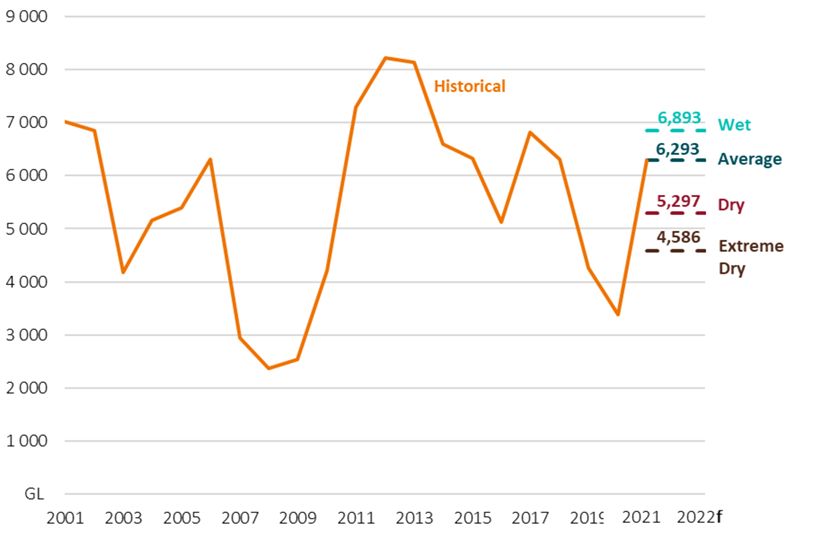

In the average scenario, water available for irrigation use (6,293 GL) is forecast to remain similar to water available in 2020‑21 (Figure 4). In the wet scenario water availability is forecast to increase to 6,893 GL. In the dry and extreme dry scenarios, availability is forecast to decrease to 5,297 GL and 4,586 GL respectively. However, even in the extreme dry scenario, water supply is expected to remain well above the 3,390 GL available in 2019‑20.

An additional consideration is the timing of water availability. Opening allocations for 2021‑22 are higher than at the same time last year. This, coupled with high volumes of carryover water and positive seasonal conditions, should provide irrigators with confidence in their planting decisions for winter crops.

Source: ABARES estimate using data from SA DEW, NSW DPIE, NVRM and CEWH

Note: ‘Water available for irrigation use’ is calculated as the sum of allocations, water carried over from the previous year and any water classified as uncontrolled flows, minus water allocated for the environment and water forfeited during the year. The calculation method for total water available for irrigation has been updated and is therefore not comparable to March 2021. f ABARES forecast.

Water allocation prices in 2021‑22

Average annual allocation price forecasts are presented in Table 1 by region, with prices forecast to remain low in 2021‑22. Across the southern basin, prices similar to those experienced in 2020‑21 are forecast in the average scenario ($141 per ML). The exception is the Murrumbidgee, where prices are forecast to increase in this scenario from $95 per ML in 2020‑21 to $157 per ML in 2021‑22, due to a projected decrease in allocations for general security entitlements in 2021-22.

| Region | 2020–21 Average | Extreme Dry | Dry | Average | Wet |

|---|---|---|---|---|---|

| ($/ML) | ($/ML) | ($/ML) | ($/ML) | ($/ML) | |

| NSW Murrumbidgee | 95 | 268 | 261 | 157 | 83 |

| VIC Goulburn-Broken | 128 | 279 | 203 | 113 | 68 |

| NSW Murray Above | 132 | 311 | 256 | 131 | 57 |

| VIC Murray Below | 173 | 368 | 284 | 157 | 83 |

| SA Murray | 178 | 368 | 284 | 157 | 83 |

| Weighted sMDB average | 130 | 303 | 250 | 141 | 74 |

Source: BOM water register, ABARES, Waterflow

Note: 2020-21 is the water-year average from 01 July 2020 to 30 June 2021. Water prices in 2020-dollar terms.

In the wet scenario, prices are forecast to fall in all regions, to an annual average weighted price of $74 per ML for the southern basin. In the dry and extreme dry scenarios, annual average prices are forecast to increase relative to 2020‑21, to $250 per ML and $303 per ML respectively.

These are estimates of the average annual price. In practice, prices are expected to fluctuate throughout the year around the modelled annual average price (Figure 5 ). ABARES has also produced a dashboard visualisation to accompany this report, which presents visual price forecasts for each region in the sMDB.

Note: 2020 21 is the water-year average from 01 July 2020 to 30 June 2021. Water prices in 2020-dollar terms.

Demand and Trade in 2021‑22

Demand for water in regions below the choke is projected to remain high in 2021‑22, as almond trees continue to mature in this region, following record levels of production in 2021 (ABARES 2020c, ABC 2021a).

IVT limits will continue to play an important role in determining prices in 2021‑22. The Goulburn to Murray and the Barmah choke IVT limits are forecast to limit exports in all four scenarios, leading to higher prices in downstream Murray catchment regions. The Murrumbidgee IVT export limit is forecast to be binding in the dry and extreme dry scenarios, reflecting the nature of the opportunistic activities (such as rice and cotton) undertaken in this region, that rely on low water prices to remain profitable.

The combination of higher water demand, and binding trade limits, means that regions below the Barmah choke are forecast to experience higher water prices in all scenarios, compared to the average southern basin price.

| Industry | Units | 2020-21 modelled |

Extreme Dry | Dry | Average | Wet |

|---|---|---|---|---|---|---|

| Almonds | tonnes | 102,511 | 107,777 | 107,777 | 107,777 | 107,777 |

| Cotton | tonnes | 129,296 | 109,133 | 110,291 | 126,839 | 139,375 |

| Grapevines | tonnes | 1,194,367 | 1,132,536 | 1,155,249 | 1,201,258 | 1,203,652 |

| Rice | tonnes | 479,315 | 316,804 | 351,854 | 556,877 | 834,074 |

Source: ABARES, SunRice, ABS

The total gross value of irrigated agricultural production (GVIAP) in the southern basin is forecast to increase in the wet and average scenarios and decrease in the dry and extreme dry scenarios. Although cotton production is forecast to decrease relative to 2020‑21, cotton GVIAP is forecast to increase in the average scenario due to a forecast increase in cotton prices (ABARES 2021b). In contrast, the GVIAP for almonds is forecast to fall in 2021‑22 (despite an increase in production), due to falling almond prices. The world’s biggest almond producer, the USA, is expecting their second largest harvest on record and this, combined with a rising Australian dollar, could lead to a reduction in revenue for Australian almond producers relative to recent years (USDA 2021, RBA 2021).

| Industry | 2020-21 modelled |

Extreme Dry | Dry | Average | Wet |

|---|---|---|---|---|---|

| $m | $m | $m | $m | $m | |

| Almonds | 750 | 685 | 685 | 685 | 685 |

| Cotton | 327 | 288 | 291 | 334 | 367 |

| Dairy | 865 | 841 | 856 | 878 | 890 |

| Pastures for grazing and for hay | 641 | 577 | 600 | 641 | 630 |

| Horticulture (incl. fruit & vegetables) | 1,782 | 1,850 | 1,835 | 1,804 | 1,758 |

| Grapevines | 636 | 612 | 624 | 649 | 650 |

| Rice | 206 | 136 | 151 | 239 | 357 |

| Other cereals and broadacre | 282 | 258 | 261 | 275 | 245 |

| Total | 5,489 | 5,246 | 5,303 | 5,504 | 5,581 |

Source: ABARES

Appendix A: ABARES outlook scenarios

ABARES outlook scenarios

ABARES designed four outlook scenarios for 2021‑22 (Table A1). Outlook scenarios released by the states remain indicative only. Actual water allocations will depend on realised seasonal conditions. Outlook scenarios are also subject to updates throughout the year.

As shown in Table A1, the definition of outlook scenarios and the level of information provided can vary by state water agency. The ABARES outlook scenarios are largely based on those used by the Northern Victoria Resource Manager (NVRM). Outlook scenarios from other states are matched against the ABARES scenario definitions.

| ABARES scenario | NVRM scenario | SA DEW scenario | NSW DPIE scenario |

|---|---|---|---|

| Extreme dry In 99 years out of 100, inflows to storages exceed those experienced in this scenario. Rainfall is in the 1st percentile of historical levels. |

Extreme dry Inflow volumes to storages that are greater in 99 years out of 100. |

Exceptionally dry 99% likelihood that actual allocations will exceed allocation forecast |

Extreme 99 chances in 100 of exceeding the allocation forecast |

| Dry In 90 years out of 100, inflows to storages exceed those experienced in this scenario. Rainfall is in the 10th percentile of historical levels. |

Dry Inflow volumes to storages that are greater in 90 years out of 100. |

Very Dry 90% likelihood that actual allocations will exceed allocation forecast |

Very Dry 9 chances in 10 of exceeding the allocation forecast |

| Average In 50 years out of 100, inflows to storages exceed those experienced in this scenario. Rainfall is in the 50th percentile of historical levels. |

Average Inflow volumes to storages that are greater in 50 years out of 100. |

Average 50% likelihood that actual allocations will exceed allocation forecast |

Average 1 chance in 2 of exceeding the allocation forecast |

| Wet In 10 years out of 100, inflows to storages exceed those experienced in this scenario. Rainfall is in the 90th percentile of historical levels. |

Wet Inflow volumes to storages that are greater in 10 years out of 100. |

Wet 25% likelihood that actual allocations will exceed allocation forecast |

Wet NSW has not released a forecast for this scenario. ABARES assumption. |

Source: ABARES, NVRM, SA DEW and NSW DPIE

Note: Allocation forecasts made by NVRM are created using a model of historical inflow volumes, and the chance that actual inflows will be higher than those presented. The wet scenario defined by SA DEW uses a higher likelihood measure, meaning this is a drier scenario than the wet scenario used by ABARES and defined by NVRM.

The scenarios describe four potential outcomes for the volume of water available for irrigation use in the southern basin in 2021‑22. In each scenario, the aggregate demand for irrigation water is assumed to be the same (i.e. at 2020‑21 levels). Therefore, prices in each scenario are primarily influenced by seasonal conditions, the volume of water available (which is affected by allocation and carryover), rainfall (which affects crop water requirements) and trade limits that restrict the flow of water between catchments.

Rainfall

Table A2 shows the level rainfall for 2020‑21 and 2021‑22. Scenario forecasts for 2021‑22 by catchment are calculated as a percentile of historical annual rainfall between 1990‑91 and 2019‑20.

| Region | 2020–21 | 2021–22 Extreme Dry |

2021–22 Dry |

2021–22 Average | 2021–22 Wet |

|---|---|---|---|---|---|

| (mm) | (mm) | (mm) | (mm) | (mm) | |

| NSW Lower Darling | 204.9 | 124.0 | 138.7 | 184.0 | 300.1 |

| NSW Murray Above | 299.7 | 163.7 | 211.2 | 290.5 | 442.8 |

| NSW Murray Below | 236.5 | 143.0 | 172.6 | 246.9 | 389.3 |

| NSW Murrumbidgee | 362.8 | 190.9 | 213.3 | 293.9 | 424.4 |

| SA Murray | 184.2 | 145.6 | 159.9 | 204.2 | 307.0 |

| VIC Goulburn-Broken | 356.3 | 193.6 | 260.4 | 348.8 | 526.9 |

| VIC Loddon-Campaspe | 385.6 | 200.6 | 262.1 | 347.5 | 505.2 |

| VIC Murray Above | 489.6 | 247.9 | 320.1 | 458.9 | 636.1 |

| VIC Murray Below | 209.4 | 142.6 | 154.6 | 208.0 | 348.8 |

Source: BOM

Carryover

Table A3 shows the volume of water carried over into 2021‑22 and ABARES forecast for carryover into 2022‑23. Carryover is modelled based on forecasts for rainfall, entitlements on issue and allocations, along with state-based carryover rules. Included in ABARES forecasts are modelled irrigator expectations around climate in 2022‑23 (See Hughes et al. 2021, for more details). In the average scenario less water is expected to be carried forward into 2022‑23 compared to 2021‑22, as irrigators draw down their reserves.

| Region | 2021-22 | 2022-23 Extreme dry |

2022-23 Dry | 2022-23 Average |

2022-23 Wet |

|---|---|---|---|---|---|

| NSW Murrumbidgee | 406,941 | 324,512 | 348,463 | 395,364 | 567,599 |

| Above Barmah choke | 775,383 | 185,593 | 444,412 | 631,925 | 902,462 |

| Below Barmah choke | 606,247 | 56,585 | 242,693 | 367,080 | 634,613 |

| Northern Victorian | 796,806 | 163,688 | 475,977 | 698,884 | 969,274 |

| Total | 2,585,377 | 730,379 | 1,511,545 | 2,093,252 | 3,073,948 |

Note: Scenario values are ABARES forecast. Above Barmah choke includes NSW and Victorian Murray regions above the Barmah choke. Below Barmah choke includes NSW and Victorian Murray regions below the choke. No carryover is assumed for SA Murray. Northern Victorian regions include the Goulburn, Broken, Loddon and Campaspe.

Allocations

Table A4 shows the allocation forecasts by entitlement type for 2021‑22. While these predominantly reflect the outlook, scenarios released by the state water agencies, ABARES has also made some additional assumptions.

- In Victoria, ABARES has assumed no allocations are made against low reliability entitlements in 2021‑22.

- South Australian Class 3a entitlements are assumed to be comparable to high reliability entitlements in Victoria and NSW.

- For New South Wales catchments, a wet scenario forecast was not provided, and as such, ABARES assumes that in a wet scenario allocations forecasts will increase by 25% relative to the average scenario.

- Allocations for Vic. Murray above and below (the Barmah choke) are assumed to receive the same allocation percentage as each other. The same assumption is made for NSW Murray above and below regions.

| Region | Security | Extreme dry (%) |

Dry (%) |

Average (%) |

Wet (%) |

|---|---|---|---|---|---|

| NSW Murray | General | 10 | 22 | 38 | 63 |

| NSW Murray | High | 97 | 97 | 97 | 97 |

| NSW Lower Darling | General | 100 | 100 | 100 | 100 |

| NSW Lower Darling | High | 100 | 100 | 100 | 100 |

| NSW Murrumbidgee | General | 50 | 51 | 61 | 86 |

| NSW Murrumbidgee | High | 95 | 95 | 95 | 95 |

| VIC Murray | High | 33 | 63 | 98 | 100 |

| VIC Goulburn | High | 43 | 70 | 100 | 100 |

| VIC Campaspe | High | 23 | 35 | 100 | 100 |

| VIC Loddon | High | 43 | 70 | 100 | 100 |

| VIC Broken | High | 12 | 59 | 100 | 100 |

| SA Murray | High | 100 | 100 | 100 | 100 |

Note: NSW DPIE, NVRM, ABARES

References

ABARES 2020, ABARES water market outlook: March 2020, Canberra, March. CC BY 4.0. https://doi.org/10.25814/5e4f167c47904

ABARES 2021a, Seasonal conditions: June quarter 2021, Australian Bureau of Agricultural and Resource Economics and Sciences, DOI: doi.org/10.25814/r3te-d792, accessed 15 July 2021.

ABARES 2021b, Agricultural commodities: March quarter 2021, Australian Bureau of Agricultural and Resource Economics and Sciences, DOI: doi.org/10.25814/r3te-d792, accessed 16 March 2021.

ABARES 2021c, Water market outlook: March 2021, ABARES, Canberra, March. CC BY 4.0. https://doi.org/10.25814/8x1b-vb24

ABC 2021a, Record almond harvest is coming despite a challenging year for agriculture, Australian Broadcasting Corporation, Melbourne, 29 January, accessed 10 February 2021.

ABS 2021, Consumer price index, Australia cat. No. 6401.0, Australia Bureau of Statistics, Canberra, accessed 16 March 2021.

BOM 2021a, Climate outlook, Bureau of Meteorology, Melbourne, accessed 15 July 2021.

BOM 2021b, Water information: water storage, Bureau of Meteorology, Melbourne, accessed 15 July 2021.

BOM 2021c, Climate outlook maps, Bureau of Meteorology, Melbourne, accessed 15 July 2021.

BOM 2020a, Climate outlook for July to October 2020, Bureau of Meteorology, Melbourne, 11 June 2020, accessed 10 July 2021.

DELWP 2021, Summary of Regulatory Impact Statement: Goulburn to Murray Trade Review – assessing changes to trade, tagging and operating arrangements, Department of Environment, Land, Water & Planning, Melbourne, accessed 2 July 2021.

DEW 2021, Current allocations, Department for Environment and Water, Adelaide, accessed 15 July 2021.

DEW 2021, Historical allocations, Department for Environment and Water, Adelaide, accessed 1 July 2021.

DPIE 2020, Water allocation statement: Murrumbidgee Valley 15 May 2020 (pdf 860kb), Department of Planning, Industry & Environment, Sydney, accessed 15 May 2020.

DPIE 2021, Water allocation statement: Murrumbidgee Valley 15 July 2020 (pdf 886kb), Department of Planning, Industry & Environment, Sydney, accessed 15 July 2021.

DPIE 2021, Water allocation statement: NSW Murray and Lower Darling (pdf 1100kb), Department of Planning, Industry & Environment, Sydney, accessed 15 July 2021.

DPIE 2021, Water allocation statements, Department of Planning, Industry & Environment, Sydney, accessed 1 July 2021.

DPIE 2021a, Accounting Rules Summary Department of Planning, Industry & Environment, Sydney, 15 March, accessed 15 March 2021.

Goesch, T, Legg, P & Donoghoe, M 2020, Murray-Darling Basin water markets: trends and drivers 2002-03 to 2018-19, ABARES research report, Canberra, February, CC BY 4.0, DOI: 0.25814/5e409ea3cb1fc, accessed 7 March 2021.

Downham, R & Gupta, M 2021, Trends in water entitlement holdings and trade: Analysis of ABARES survey data, ABARES research report, Canberra, July, CC BY 4.0. https://doi.org/10.25814/z815-1w77, accessed 17 July 2021.

Luke, J 2021, Update on production at SunRice’s Riverina facilities (pdf 299kb), media release, SunRice Group, Leeton, New South Wales, 18 February, accessed 10 June 2021.

MDBA 2021, Barmah Choke trade balance and restriction, Murray Darling Basin Authority, Canberra, accessed 19 July 2021.

NVRM 2021, Current outlook Northern Victoria Resource Manager, Tatura, Victoria, accessed 15 July 2021.

NVRM 2021, Outlook - 15 July 2021 Northern Victoria Resource Manager, Tatura, Victoria, accessed 15 July 2021.

NVRM 2021, Seasonal determinations, Northern Victoria Resource Manager, Tatura, Victoria, accessed 15 July 2021.

NVRM 2021, Final 2020/21 seasonal determination, Northern Victoria Resource Manager, Tatura, Victoria, accessed 1 April 2021.

RBA 2021, Exchange rates, Reserve Bank of Australia, Sydney, accessed 15 July 2021.

USDA 2021, 2021 California Almond Objective Measurement Report, United States Department of Agriculture, Sacramento CA, accessed 15 July 2021.

Victoria Water Register 2021a, Trade opportunities, Victoria Water Register, Melbourne, accessed 18 March 2021.

Victoria Water Register 2021b, Interim Goulburn to Murray trade rules introduced from 1 July 2021, Victoria Water Register, Melbourne, accessed 20 June 2021.

Victoria Water Register 2021c, Carryover rules, Victoria Water Register, Melbourne, accessed 13 July 2021.

WaterNSW 2021, Murrumbidgee IVT Account Status, WaterNSW, accessed 19 July 2021.

Watch ABARES video presentation

Watch this short presentation from ABARES Water Analyst John Walsh as he summarises the key findings from this report.

Download the transcript of the video DOCX [119 KB]

In the August webinar, Tom Rooney, CEO of Waterfind presented his thoughts on the year ahead. To register for a copy of his slides.

Download the report

Water Market Outlook: August 2021 – PDF [2.23 MB]

Water Market Outlook: August 2021 – DOCX [2 MB]

Data dashboard -Water Market Outlook August 2021

Previous reports

Water Market Outlook: March 2021

For access to other past water markets outlook reports, visit the ABARES publications library.