2020–21 to 2022–23

Key points

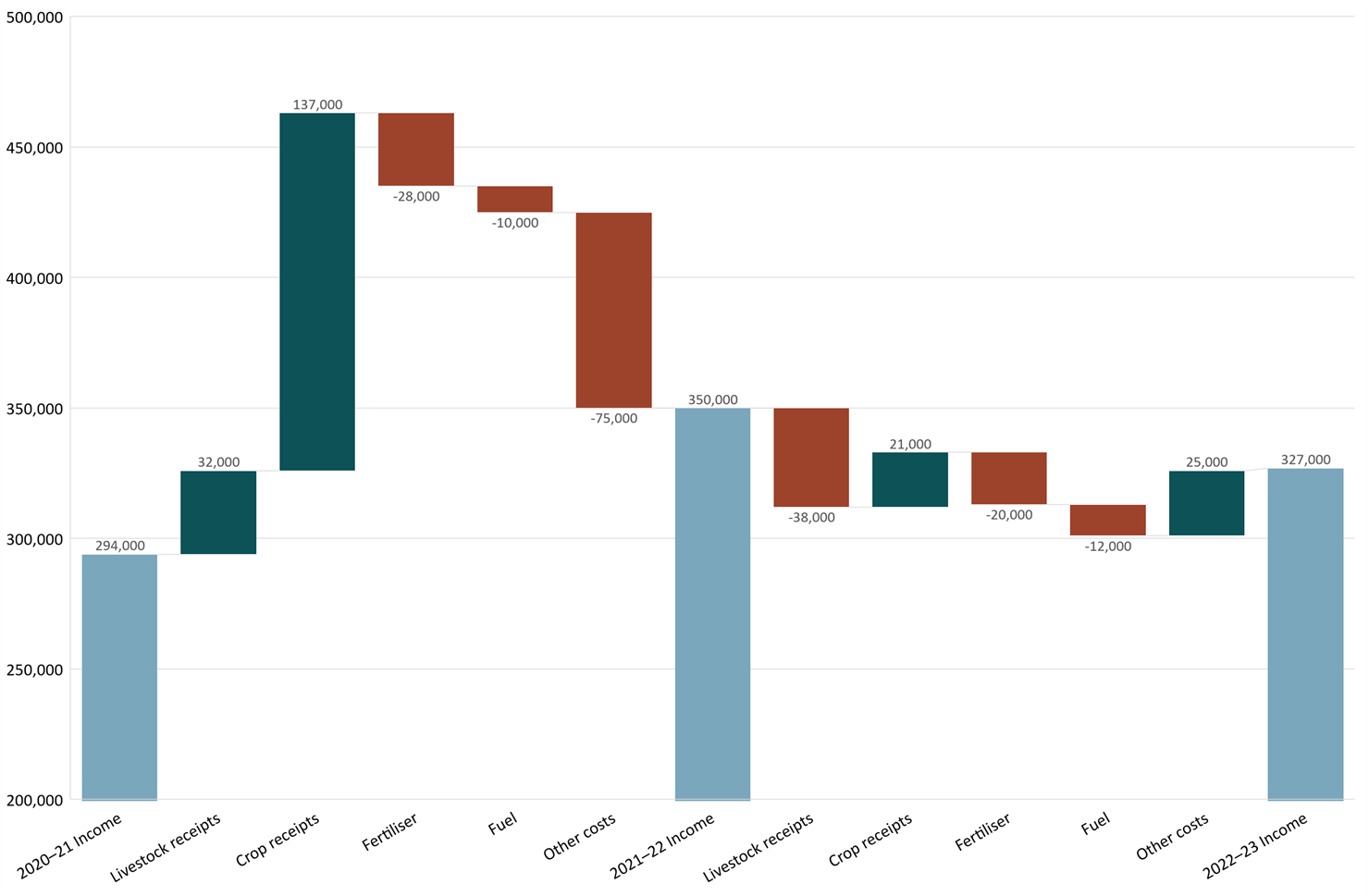

- Good seasonal conditions and higher commodity prices have been major drivers of improved broadacre farm performance in Australia in recent years. However, farm incomes are projected to fall slightly in 2022–23 because of lower prices for most commodities and input costs remaining high after significant increases in 2021–22. Significant increases in fuel and fertiliser prices in 2022–23 have been partly offset by falls in prices for other inputs.

- At the national level, farm cash income for all broadacre farms is projected to decrease by around 7% to average $327,000 per farm in 2022–23.

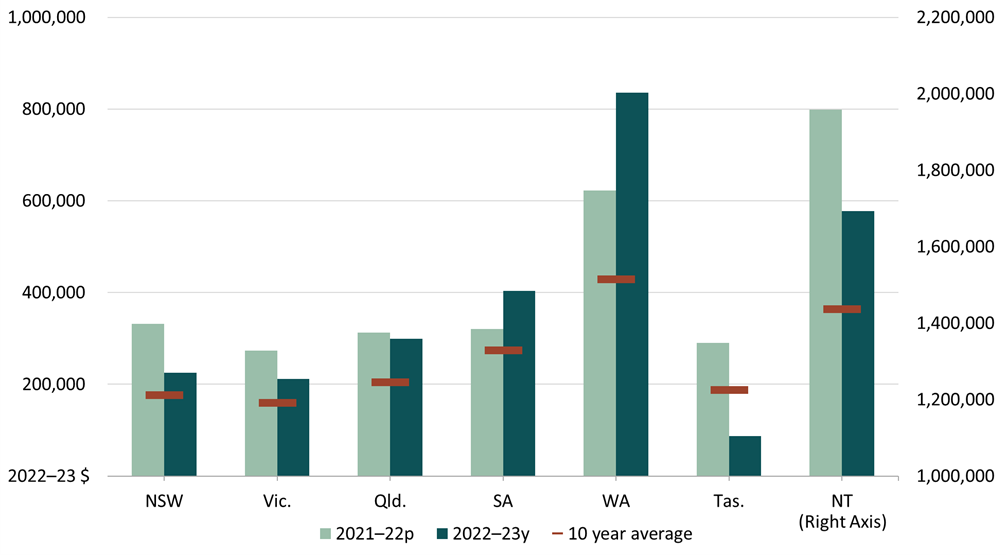

- Incomes for broadacre farms are expected to decrease in all states except Western Australia and South Australia in 2022–23, with incomes in New South Wales, Queensland and Victoria impacted by heavy rainfall and flooding during the year.

- Incomes for dairy farms are projected to increase by around 20% to average $391,000 per farm in 2022–23, mainly because of higher farm-gate milk prices.

Farm performance data visualisation

- Choose between the Broadacre and Dairy pages using the arrows at the bottom of the data visualisation.

- Select the desired fields—out of the jurisdiction and industry options.

- Download the data showing in the visualisation by clicking the ‘Download Data’ button in each tab. For more information on the results and definitions of items, click the ‘Definitions and more information’ button in each tab.

The Power BI dashboard may not meet accessibility requirements. For information about the content of this dashboard contact ABARES.

- Over the last 3 years, broadacre farms have recorded historically high incomes, driven by high commodity prices and favourable climate conditions.

- In 2022–23 average farm cash income for broadacre farms is projected to decline by around 7% to average $327,000 per farm.

- The projected fall in average incomes is mainly driven by lower receipts with the main drivers being lower prices received for livestock and to a lesser extent lower crop production in some regions.

- Farm costs are expected to increase slightly from the high levels of 2021–22 as increased expenditure on fuel and fertiliser is partly offset by decreased expenditure on other inputs (Figure 1).

- The average farm cash income projected for broadacre farms in 2022–23 is expected to be around 46% above the previous 10-year average of $223,000 per farm.

- Based on simulations of climate conditions experienced each year from 2002–03 to 2021–22, farm cash incomes for 2022–23 are projected to average between $316,000 and $338,000 under least and most favourable seasonal conditions respectively.

- Figure 2 shows farms incomes in each state for 2021–22, 2022–23 and the longer-term average (10 years to 2021–22). Incomes for broadacre farms are expected to fall in all states except for Western Australia and South Australia in 2022–23, although all states except Tasmania are expected to outperform the longer-term average. High prices and yields for wheat and barley were the main driver of above average incomes for many farms in the cropping regions of Western Australia and South Australia, while some cropping regions in New South Wales, Queensland and Victoria had production affected by heavy rainfall and flooding during the year.

- Incomes are projected to remain below the longer-term average in regions dominated by smaller livestock farms such as Tasmania, South West Victoria and the New South Wales Central and Southern Tablelands.

- At the national level, average farm business profit (farm cash income adjusted for changes in livestock and grain inventories, as well as capital depreciation and the imputed value of family labour) is projected to decrease from an average of $294,000 per farm in 2021–22 to $228,000 per farm in 2022–23 in real terms. The decrease in farm cash income ($23,000) is less than the decrease in farm business profit ($66,000) because of a smaller build-up in trading stocks in 2022–23 compared with 2021–22. Although herd and flock rebuilding continued in 2022-23, lower livestock prices lowered the value of additional stock on hand.

Figure 1 Drivers of changes in farm cash income, broadacre farms 2020–21 to 2022–23

average per farm

Figure 2 Farm cash income, broadacre farms by state, Australia

average per farm

Source: ABARES Australian Agricultural and Grazing Industries Survey

- For cropping farms (see methodology), average farm incomes are projected to rise slightly in 2022–23 with increases in receipts outweighing increases in total cash costs. Total receipts for cropping farms are projected to increase because of higher wheat production and prices, despite a decline in receipts for oilseeds.

- On average, farm cash income for cropping farms is expected to increase by around 2% in 2022–23 to $665,000 per farm.

- Substantial increases in incomes are expected for cropping farms in South Australia and Western Australia.

- Some cropping regions in New South Wales, Queensland and Victoria had production affected by heavy rainfall and flooding during the year, as mentioned above. New South Wales in particular was the worst affected by heavy spring rainfall, with an estimated 8% of the state's cropping land significantly damaged by floods. Crops damaged by prolonged waterlogging were even more widespread across eastern states, causing lengthy delays to harvests and extensive quality downgrades in some parts. For further information on flood impacts, see the Australian Crop Report.

- Average farm cash income for cropping farms is projected to be around 75% above the average for the 10 years to 2021–22.

- Lower prices for beef cattle, sheep, wool and lambs are expected to contribute to reduced incomes for livestock farms in 2022–23. However, increased turnoff of cattle and sheep is expected to moderate this decrease.

- On average, farm cash income for livestock farms is expected to decrease by around 18% in 2022–23 to an estimated $168,000 per farm.

- Average farm cash income for livestock farms is projected to be around 18% above the average for the 10 years to 2021–22.

- The financial performance of Australian dairy farms improved in 2021–22 and is projected to increase further in 2022–23 to reach a record high.

- Average dairy farm incomes are estimated to have increased in 2021–22 on the back of higher farm-gate milk prices and generally favourable seasonal conditions. This is the third year in a row that average farm cash incomes at the national level have increased compared with the previous year.

- The average farm cash income across Australia was estimated to be $326,800 per farm in 2021–22, a record in real terms and nearly double the longer-term average (average over the preceding 10 years).

- Average farm cash incomes increased in all states in 2021–22 except in Tasmania where average income remained at historically high terms at $383,000 per farm.

- Dairy farm incomes are projected to increase once again in 2022–23 to reach a national average of $391,000 per farm. This reflects a significant increase in average farm-gate milk prices, which are forecast to reach 72.6 cents per litre in 2022–23 compared with 61 cents per litre in 2021–22—an increase of 19% in real terms.

- Average milk production per farm is forecast to be lower in 2022–23 however, largely due to the adverse effects of above average rainfall in parts of eastern Australia during spring.

All dollar values in this industry report are reported in real terms, adjusted to 2022–23 values. Adjusting to real terms removes the effect of inflation and allows financial values across different time periods to be compared in like terms. ABARES adjusts for inflation using the consumer price index, supplied by the Australian Bureau of Statistics (Australian Bureau of Statistics, 2023).

The broadacre farm data in this report is drawn from ABARES Australian Agricultural and Grazing Industries Survey (AAGIS). AAGIS covers broadacre farms with an estimated value of agricultural operations (EVAO) greater than $40,000 and includes the following industries (defined by Australian and New Zealand Standard Industrial Classification (ANZSIC):

Cropping farms

- Specialised producers of cereal grains, coarse grains, pulses, and oilseeds. ANZSIC 0149.

- Farm businesses engaged in producing sheep and/or beef cattle in conjunction with substantial activity in broadacre crops such as wheat, coarse grains, pulses and oilseeds. ANZSIC 0145.

Livestock farms

- Specialised producers of beef cattle. ANZSIC 0142.

- Specialised producers of prime lambs, sheep, sheep milk or wool. ANZSIC 0141.Producers who have a mix of sheep and beef cattle. Farms classified to sheep-beef industry combine sheep and beef enterprises such that neither enterprise dominates the other. ANZSIC 0144.

The dairy farm data in this report is drawn from ABARES Australian Dairy Industry survey.Further information on the ABARES farm surveys and survey methodology can be found on the ABARES website.

Farm surveys data

Detailed ABARES farm survey data available through interactive tools and spreadsheets.

Farm surveys definitions and methods

Further information about our survey definitions and methods.

Farm performance: broadacre and dairy farms, 2019-20 to 2021-22

See our publications page for previous versions of the report Australian farms surveys results.

About my region

ABARES has produced a series of individual profiles of the agricultural, forestry and fisheries industries in your region. Each regional profile presents an overview of the agriculture, fisheries and forestry sectors in the region, and the recent financial performance of the broadacre and dairy industries.