ABARES has been conducting surveys of agricultural industries since the 1940s. Farm surveys conducted by ABARES provide a wide range of information on the current and historical economic performance of farm business units in the rural sector. This information is used for research and analysis on a range of industry issues of concern to government and industry.

An overview of results for Australian broadacre and dairy farms is released at the ABARES OUTLOOK Conference each March. This includes analysis of farm costs, receipts, income, profit, rates of return, performance by state and performance by industry (defined by ANZSIC). Farms are classified to ANZSIC-based industries based on the relative contribution of farm outputs to total output. This method allows analysis to focus on relatively homogeneous groups of farms.

Subsequent analyses of farm performance are published for beef, lamb, grain and dairy farms. These industries are classified more broadly than those published at OUTLOOK to provide a more complete picture of trends and variation in performance across farms by type of commodity produced, size and region.

The annual agricultural surveys currently undertaken by ABARES are:

- Australian Agricultural and Grazing Industries Survey (AAGIS)

- Australian Dairy Industry Survey (ADIS)

- Murray–Darling Basin Irrigation Survey

[Expand all]

Target populations

Each ABARES survey is designed on the basis of a target population, typically defined as farm businesses that have been categorised to an industry based on the 2006 Australian and New Zealand Standard Industrial Classification (ANZSIC06). This classification is in line with an international standard applied comprehensively across Australian industry, permitting comparisons between industries, both within Australia and internationally. Farms assigned to a particular ANZSIC have a high proportion of their total output characterised by that class. Further information on ANZSIC and on the farming activities included in each of these industries is provided in Australian and New Zealand Standard Industrial Classification (ABS 2013).

These industry categories mean ABARES surveys target unique segments of the Australian farm population. The Murray–Darling Basin Irrigation Survey specifically targets irrigation farms across a range of industries, including those covered by the other ABARES surveys.

Industry definitions by survey

A brief history of classifying farms by type

In the 1950s the Commonwealth Bureau of Census and Statistics began to experiment with ways of classifying farms by the nature of activity on individual holdings. Such classification allows for meaningful aggregation, grouping and comparison of relevant statistical data for farms sharing common characteristics. The appropriateness of classifying farms by type depends on the diversity of activities on individual farms and the number of relevant homogeneous groups.

Such classifications are a useful research tool in that they narrow the field of study to groups of farms that are more homogeneous than the entire group.

The Bureau of Agricultural Economics (BAE) began surveying the wheat-growing industry in 1948, the sheep industry in 1953 and the beef cattle industry in 1962. Each industry was originally surveyed separately. In 1973–74 the surveys of the sheep and beef cattle industries were amalgamated to form a single annual survey and in 1976–77 this survey was combined with the Australian Wheat Growing Industry Survey to form the Australian Agricultural and Grazing Industries Survey (AAGIS). Farms were classified into these early surveys on the basis of total area of crops or number of livestock on hand.

In 1985–86, BAE began designing AAGIS using the Australian Standard Industrial Classification to group farms by industry rather than using physical measures. The Australian and New Zealand Standard Industrial Classification (ANZSIC) was adopted in 1992–93 and provides the following industry classifications.

Australian Agricultural and Grazing Industries Survey (AAGIS)

| Industry |

ANZSIC industry class |

ANZSIC industry code |

|---|---|---|

|

Broadacre |

Sheep farming |

ANZSIC code 0141 |

|

Beef cattle farming |

ANZSIC code 0142 |

|

|

Sheep–beef cattle farming |

ANZSIC code 0144 |

|

|

Grain–sheep and grain–beef cattle farming |

ANZSIC code 0145 |

|

|

Rice growing |

ANZSIC code 0146 |

|

|

Other grain growing |

ANZSIC code 0149 |

Murray–Darling Basin Irrigation Survey

| Industry |

ANZSIC industry class |

ANZSIC industry code |

|---|---|---|

|

Broadacre |

Sheep farming |

ANZSIC code 0141 |

|

Beef cattle farming |

ANZSIC code 0142 |

|

|

Sheep–beef cattle farming |

ANZSIC code 0144 |

|

|

Grain–sheep and grain–beef cattle farming |

ANZSIC code 0145 |

|

|

Rice growing |

ANZSIC code 0146 |

|

|

Other grain growing |

ANZSIC code 0149 |

|

|

Cotton growing |

ANZSIC code 0152 |

|

|

Dairy |

Dairy cattle farming |

ANZSIC code 0160 |

|

Horticulture |

Vegetable growing (under cover) |

ANZSIC code 0122 |

|

Vegetable growing (outdoors) |

ANZSIC code 0123 |

|

|

Grape growing |

ANZSIC code 0131 |

|

|

Apple and pear growing |

ANZSIC code 0134 |

|

|

Stone fruit growing |

ANZSIC code 0135 |

|

|

Citrus fruit growing |

ANZSIC code 0136 |

|

|

Other fruit and tree nut growing |

ANZSIC code 0139 |

Note: covers farms engaged in irrigated agricultural activities the ANZSIC industry classes and codes above.

The Australian Dairy Industry Survey (ADIS) covers farms that are engaged in dairying.

Sample lists

ABARES surveys are usually designed from a population list drawn from the Australian Business Register (ABR) and maintained by the Australian Bureau of Statistics (ABS). The ABR comprises businesses registered with the Australian Taxation Office. The ABR–based population list provided to ABARES consists of agricultural establishments with their corresponding geography code (currently Australian Statistical Geography Standard), ANZSIC, and a size of operation variable.

ABARES surveys target farming establishments that make a significant contribution to the total value of agricultural output (commercial farms). Farms excluded from ABARES surveys will be the smallest units and in aggregate will contribute less than 2 per cent to the total value of agricultural production for the industries covered by the surveys.

The size of operation variable used in ABARES survey designs is usually ‘estimated value of agricultural operations’ (EVAO). However, in some surveys in recent years other measures of agricultural production have also been used. EVAO is a standardised dollar measure of the level of agricultural output. A definition of EVAO is given in Agricultural industries: financial statistics (ABS 2001). Since 2004‒05 the ABARES survey has included establishments classified as having an EVAO of $40,000 or more. Between 1991‒92 and 2003‒04 the survey included establishments with an EVAO of $22,500 or more. Between 1987‒88 and 1990‒91 the survey included establishments with an EVAO of $20,000 or more. Before 1987‒88 the survey included establishments with an EVAO of $10,000 or more.

Survey design

The farm population to be surveyed was stratified by operation size using the estimated value of agricultural operation (EVAO). The size of each stratum was determined using the Dalenius–Hodges method (Lehtonen & Pahkinen 2004). The sample allocation to each stratum was performed using a mixture of the Neyman allocation, which takes into account variability within strata of the auxiliary variable (in this case EVAO), and proportional allocation, which only considers the population number in each stratum. The Neyman allocation allocates large proportions of sample to strata with large variability—in the case of this survey, strata of larger farms (Lehtonen & Pahkinen 2004).

A large proportion of sample farms is retained from the previous year’s survey. The sample chosen each year maintains a high proportion of the sample between years to accurately measure change while meeting the requirement to introduce new sample farms to account for changes in the target population, as well as to reduce the burden on survey respondents.

The sample size for AAGIS is usually around 1,600, ADIS around 300, and Murray–Darling Basin Irrigation Survey around 500.

The main method of collecting data is face–to–face interviews with the owner–manager of the farm. Detailed physical and financial information is collected on the operations of the farm business during the preceding financial year. Respondents to the AAGIS and ADIS are also contacted by telephone in October each year to obtain estimates of projected production and expected receipts and costs for the current financial year. Supplementary questionnaires may also be attached to the main survey. These additional questions help address specific industry issues. The COVID-19 pandemic impacted the 2020 survey collection process for the irrigation, broadacre and dairy surveys as a result of travel restrictions: face–to–face data collection was halted and the survey was completed by phone and email.

Sample weighting

Farm-level estimates published by ABARES are calculated by appropriately weighting the data collected from each sample farm and then using the weighted data to calculate population estimates. Sample weights are calculated so that population estimates from the sample for numbers of farms, areas of crops and numbers of livestock correspond as closely as possible to the most recently available ABS estimates from data collected from Agricultural Census and Surveys.

The weighting methodology for AAGIS, ADIS, Australian vegetable-growing farms survey and Murray–Darling Basin Irrigation Survey uses a model-based approach, with a linear regression model linking the survey variables and the estimation benchmark variables. The details of this method are described in Bardsley and Chambers (1984).

Generally, larger farms have smaller weights and smaller farms have larger weights. This reflects both the strategy of sampling a higher fraction of the large farms than smaller farms and the relatively lower numbers of large farms. Large farms have a wider range of variability of key characteristics and account for a much larger proportion of total output.

Reliability of estimates

The reliability of the estimates of population characteristics published by ABARES depends on the design of the sample and the accuracy of the measurement of characteristics for the individual sample farms.

Only a subset of farms out of the total number of farms in a particular industry is surveyed. The data collected from each sample farm are weighted to calculate population estimates. Estimates derived from these farms are likely to be different from those which would have been obtained if information had been collected from a census of all farms. Any such differences are called ‘sampling errors’.

The size of the sampling error is most influenced by the survey design and the estimation procedures, as well as the sample size and the variability of farms in the population. The larger the sample size, the lower the sampling error is likely to be. Hence, national estimates are likely to have lower sampling errors than industry and state estimates.

To give a guide to the reliability of the survey estimates, standard errors are calculated for all estimates published by ABARES. These estimated errors are expressed as percentages of the survey estimates and termed ‘relative standard errors’.

Preliminary estimates and projections

Estimates for the year preceding the current survey year and all earlier years are final. All data from farmers, including accounting information, have been reconciled; final production and population information from the ABS has been included and no further change is expected in these estimates.

Estimates for the current survey year are preliminary, based on full production and accounting information from farmers. However, editing and addition of sample farms may be undertaken and ABS production and population benchmarks may also change.

The estimates for the year following the survey year are projections developed from the data collected pertaining to the current financial year, as well as from the preliminary estimates. Projection estimates include crop and livestock production, receipts and expenditure up to the date of interview together with expected production, and receipts and expenditure for the remainder of the projection year. Modifications are made to expected receipts and expenditure where significant production and price change has occurred post interview. Projection estimates are necessarily subject to greater uncertainty than preliminary and final estimates. The 2020‒21 estimates are based on farmpredict, a micro-simulation model of Australian broadacre farms based on the AAGIS data for the period from 1988‒89 to 2018‒19. Further information on farmpredict can be found at Introducing ABARES farmpredict.

Preliminary and projection estimates of farm financial performance are produced within a few weeks of the completion of survey collections. However, these may be updated several times at later dates. These subsequent versions will be more accurate, as they will be based on upgraded information and slightly more accurate input datasets.

Calculating confidence intervals using relative standard errors

Relative standard errors (RSEs) can be used to calculate ‘confidence intervals’ that give an indication of how close the actual population value is likely to be to the survey estimate.

To obtain the standard error, multiply the relative standard error by the survey estimate and divide by 100. For example, if average total cash receipts are estimated to be $100,000 with a relative standard error of 6 per cent, the standard error for this estimate is $6,000. This is one standard error. Two standard errors equal $12,000.

There is roughly a two in three chance that the ‘census value’ (the value that would have been obtained if all farms in the target population had been surveyed) is within one standard error of the survey estimate. This range of one standard error is described as the 66 per cent confidence interval. In this example, there is an approximately two in three chance that the census value is between $94,000 and $106,000 ($100,000 plus or minus $6,000).

There is roughly a 19–in–20 chance that the census value is within two standard errors of the survey estimate (the 95 per cent confidence interval). In this example, there is an approximately 19 in 20 chance that the census value lies between $88,000 and $112,000 ($100,000 plus or minus $12,000).

Comparing estimates

When comparing estimates between two groups, it is important to recognise that the differences are also subject to sampling error. As a rule of thumb, a conservative estimate of the standard error of the difference can be constructed by adding the squares of the estimated standard errors of the component estimates and taking the square root of the result.

For example, suppose the estimates of total cash receipts were $100,000 in the beef industry and $125,000 in the sheep industry – a difference of $25,000 – and the relative standard error is given as 6 per cent for each estimate. The standard error of the difference can be estimated as:

A 95 per cent confidence interval for the difference is:

$25,000 ± 1.96*$9,605 = ($6,174, $43,826)

Hence, if a large number (towards infinity) of different samples are taken, in approximately 95 per cent of them, the difference between these two estimates will lie between $6,174 and $43,826. Also, since zero is not in this confidence interval, it is possible to say that the difference between the estimates is statistically significantly different from zero at the 95 per cent confidence level.

Regions

AAGIS, ADIS and Murray–Darling Basin Irrigation Survey statistics are also available by region. These regions, shown in the below maps, represent the finest level of geographical aggregation for which the survey is designed to produce reliable estimates.

Map Australian Agricultural and Grazing Industries Survey (AAGIS) zones and regions

![Map showing the ABARES high rainfall zone (eastern seaboard, Tasmania, south-east coast of South Australian and south-west coast of Western Australia); wheat–sheep zone (Darling Downs, Maranoa and Central Highlands of Queensland; North West Slopes and Plains of New South Wales, Central Western New South Wales and the Riverina, northern Victoria, South Australian Eyre Peninsula, Yorke Peninsula, Mid-North, Murraylands and Mallee and Western Australian wheat belt ); and pastoral zone (Northern Territory, northern and central Western Australia, northern South Australia, western New South Wales, and northern and western Queensland). The map also shows the ABARES regions within these zones.]](/sites/default/files/SiteCollectionImages/abares/data/aagis-zones-regions.png)

For states other than New South Wales and Victoria, the Australian Dairy Industry Survey regions comprise the entire state.

ABARES Region codes

| 111: NSW Far West | 312: QLD West and South West | 511: WA Kimberley |

| 121: NSW North West Slopes and Plains | 313: QLD Central North | 512: WA Pilbara and Southern Rangelands |

| 122: NSW Central West | 314: QLD Charleville - Longreach | 521: WA Central and South Wheat Belt |

| 123: NSW Riverina | 321: QLD Eastern Darling Downs | 522: WA North and East Wheat Belt |

| 131: NSW Tablelands (Northern, Central and Southern) | 322: QLD Darling Downs and Central Highlands | 531: WA South West Coastal |

| 132: NSW Coastal | 331: QLD South Queensland Coastal | 631: TAS Tasmania |

| 221: VIC Mallee | 332: QLD North Queensland Coastal | 711: NT Alice Springs District |

| 222: VIC Wimmera | 411: SA North Pastoral | 712: NT Barkly Tablelands |

| 223: VIC Central North | 421: SA Eyre Peninsula | 713: NT Victoria River District - Katherine |

| 231: VIC Southern and Eastern Victoria | 422: SA Murray Lands and Yorke Peninsula | 714: NT Top End Darwin and the Gulf |

| 311: QLD Cape York and the Gulf | 431: SA South East |

Map Australian Dairy Industry Survey regions, New South Wales and Victoria

Note: New South Wales and Victoria are divided into multiple regions. These regions are identified by a unique two digit code. The first digit indicates the state and the second digit indicates the region within the state.

Source: ABARES

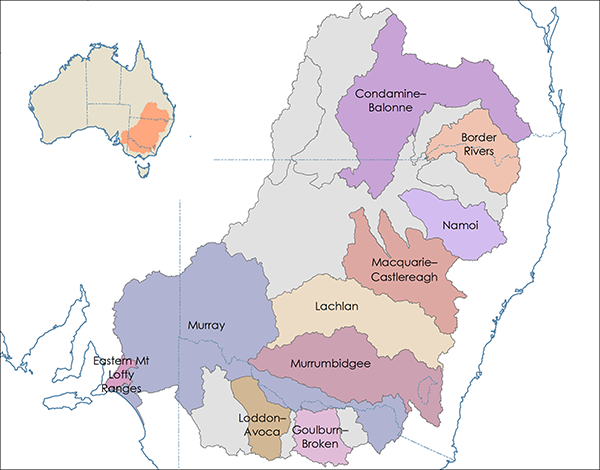

Map Murray-Darling Basin Irrigation Survey reporting regions

Note: Regional coverage was based on those defined by the CSIRO in its Sustainable Yields Project (CSIRO 2007)

Definitions of items

| Term | Definition | |

|---|---|---|

|

Owner–manager |

The primary decision-maker for the farm business. This person is usually responsible for day-to-day operation of the farm and may own or have a share in the farm business. |

|

|

Physical items |

||

|

beef cattle |

Cattle kept primarily for the production of meat, irrespective of breed. |

|

|

dairy cattle |

Cattle kept or intended mainly for the production of milk or cream. |

|

|

hired labour |

Excludes the farm business manager, partners and family labour and work by contractors. Expenditure on contract services appears as a cash cost. |

|

|

labour |

Measured in work weeks, as estimated by the owner–manager or manager. It includes all work on the farm by the owner–manager, partners, family, hired permanent and casual workers and sharefarmers but excludes work by contractors. |

|

|

total area operated |

Includes all land operated by the farm business, whether owned or rented by the business, but excludes land sharefarmed on another farm. |

|

|

Financial items |

||

|

capital |

The value of farm capital is the value of all the assets used on a farm, including the value of leased items but excluding machinery and equipment either hired or used by contractors. The value of 'owned' capital is the value of farm capital excluding the value of leased machinery and equipment. |

|

|

change in debt |

Estimated as the difference between debt at 1 July and the following 30 June within the survey year, rather than between debt at 30 June in consecutive years. It is an estimate of the change in indebtedness of a given population of farms during the financial year and is thus unaffected by changes in sample or population between years. |

|

|

farm business debt |

Estimated as all debts attributable to the farm business but excluding personal debt, lease financed debt and underwritten loans, including harvest loans. Information is collected at the interview, supplemented by information contained in the farm accounts. |

|

|

farm liquid assets |

Assets owned by the farm business that can be readily converted to cash. They include savings bank deposits, interest bearing deposits, debentures and shares. Excluded are items such as real estate, life assurance policies and other farms or businesses. |

|

|

receipts and costs |

Receipts for livestock and livestock products sold are determined at the point of sale. Selling charges and charges for transport to the point of sale are included in the costs of sample farms. |

|

|

total cash costs |

Payments made by the farm business for materials and services and for permanent and casual hired labour (excluding owner–manager, partner and other family labour). It includes the value of livestock transfers onto the property as well as any lease payments on capital, produce purchased for resale, rent, interest, livestock purchases and payments to sharefarmers. Capital and household expenditures are excluded from total cash costs. |

|

|

total cash receipts |

Total of revenues received by the farm business during the financial year, including revenues from the sale of livestock, livestock products and crops, plus the value of livestock transfers off a property. It includes revenue received from agistment, royalties, rebates, refunds, plant hire, contracts, sharefarming, insurance claims and compensation, and government assistance payments to the farm business. |

|

|

Financial performance measures |

||

|

build-up in trading stocks |

The closing value of all changes in the inventories of trading stocks during the financial year. It includes the value of any change in herd or flock size or in stocks of wool, fruit and grains held on the farm. It is negative if inventories are run down. |

|

|

depreciation of farm improvements, plant and equipment |

Estimated by the diminishing value method, based on the replacement cost and age of each item. The rates applied are the standard rates allowed by the Commissioner of Taxation. For items purchased or sold during the financial year, depreciation is assessed as if the transaction had taken place at the midpoint of the year. Calculation of farm business profit does not account for depreciation on items subject to a finance lease because cash costs already include finance lease payments. |

|

|

farm business equity |

The value of owned capital, less farm business debt, at 30 June. The estimate is based on those sample farms for which complete data on farm debt are available. |

|

|

farm business profit |

Farm cash income plus build-up in trading stocks, less depreciation and the imputed value of the owner–manager, partner(s) and family labour. |

|

|

farm cash income |

The difference between total cash receipts and total cash costs. |

|

|

farm equity ratio |

Calculated as farm business equity as a percentage of owned capital at 30 June. |

|

|

imputed labour cost |

Payments for owner–manager and family labour may bear little relationship to the actual work input. An estimate of the labour input of the owner–manager, partners and their families is calculated in work weeks and a value is imputed at the relevant Federal Pastoral Industry Award rates. |

|

|

off-farm income |

Collected for the owner–manager and spouse only, including income from wages, other businesses, investment, government assistance to the farm household and social welfare payments. |

|

|

profit at full equity |

Farm business profit, plus rent, interest and finance lease payments, less depreciation on leased items. It is the return produced by all the resources used in the farm business. |

|

|

rates of return |

Calculated by expressing profit at full equity as a percentage of total opening capital. Rate of return represents the ability of the business to generate a return to all capital used by the business, including that which is borrowed or leased. The following rates of return are estimated: rate of return excluding capital appreciation; and rate of return including capital appreciation. |

|

References

ABS 2001, Agricultural industries, financial statistics, Australia, Preliminary, 1999–2000, cat. no. 7506.0, Australian Bureau of Statistics, Canberra.

ABS 2013, Australian and New Zealand Standard Industrial Classification ANZSIC, 2006 (revision 2.0), cat. no. 1292.0, Australian Bureau of Statistics, Canberra.

Bardsley, P & Chambers, RL 1984, ‘Multipurpose estimation from unbalanced samples’, Journal of the Royal Statistical Society, Series C (Applied Statistics), vol. 33, pp. 290–99.

CSIRO 2007, ‘The Murray–Darling Basin Sustainable Yields Project’, Canberra.

Hughes, N, Soh, W, Lawson, K, Boult, C, Donoghoe, M, Valle, H & Chancellor, W 2019, farmpredict: A microsimulation model of Australian farms, ABARES working paper, Australian Bureau of Agricultural and Resource Economics and Sciences, Canberra, November.

Lehtonen, R & Pahkinen, E 2004, Practical methods for design and analysis of complex surveys, 2nd ed., John Wiley & Sons, Finland.