Authors: Peter Lock and Linden Whittle

Key facts

This report presents estimates of the potential production and use of harvest and sawmill residues in Australia in 2050. It provides insights into what the production and use of wood residues may look like in decades to come, once any required investment in infrastructure has taken place.

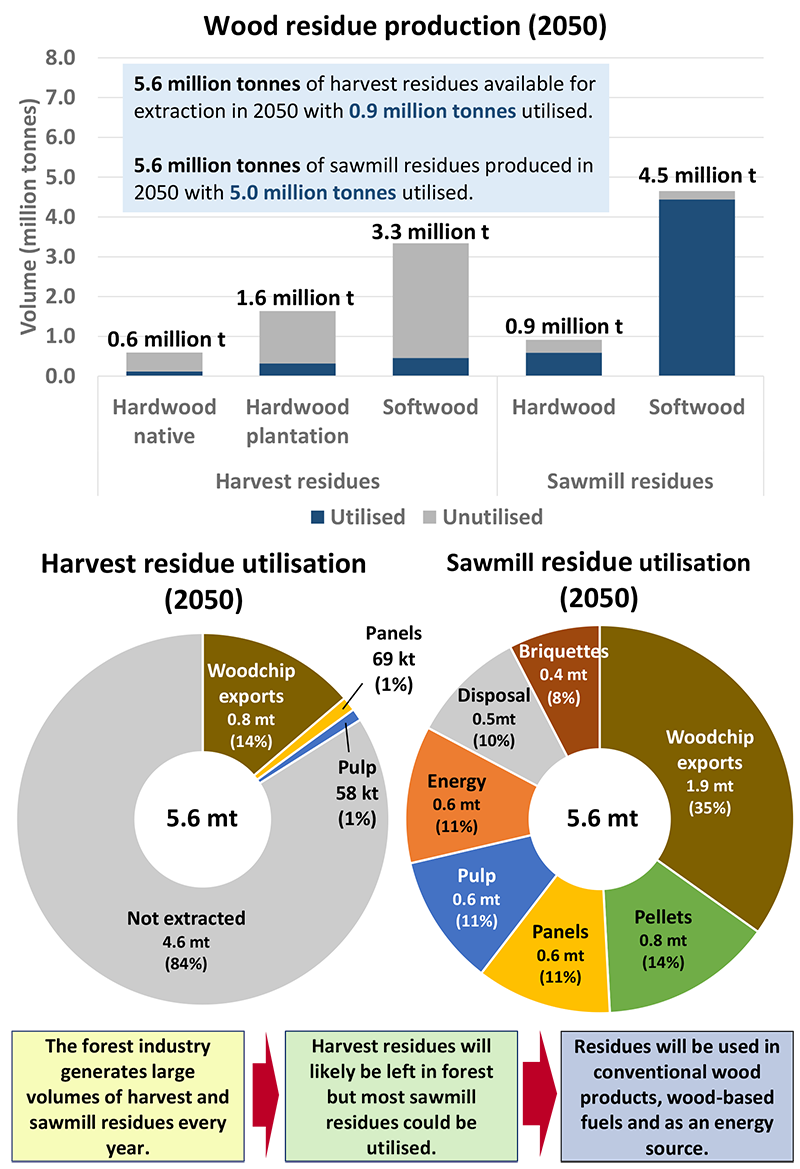

- 5.6 million tonnes of log harvest residues could be available for further use in 2050, based on a total log harvest of 28.6 million cubic metres.

- 1.2 million tonnes of harvest residues are assumed to be high quality, or suitable for producing export grade woodchips, and the remaining 4.4 million tonnes are assumed to be low quality

- 0.9 million tonnes, or 78 per cent of the available high-quality residues in 2050, could be exported as woodchips or used in wood-based panel production.

- 5.6 million tonnes of sawmill residues could be produced in 2050 as a by-product of processing 11.3 million cubic metres of sawlogs.

- 5.0 million tonnes or 90 per cent of sawmill residues are expected to be used in some form.

- Up to 1.9 million tonnes of sawmill residues (35 per cent of all sawmill residues) could be exported as woodchips in 2050.

Summary

The Australian forest industry generates millions of tonnes of wood residues every year as a by-product of harvesting and sawmilling operations. Harvest residues consist of stumps, bark, crown material and tree heads and butts. They are typically left in forests to maintain forest and soil health for subsequent plantings. Sawmill residues consist of solid wood offcuts (including woodchips), sawdust, shavings and bark. These residues are typically used to produce woodchips or burned onsite for energy.

The efficient use of harvest and sawmill residues can reduce disposal costs and create additional revenue streams, contributing to the international competitiveness and sustainability of the Australian forest and wood processing industry.

Some regional analysis of the production of harvest and sawmill residues in Australia has been undertaken, but very little is known about the current volumes produced or used at the national level. In light of this, ABARES and Forest and Wood Products Australia jointly funded research into the long-term economic feasibility of using harvest and sawmill residues from production forests and sawmill operations in Australia.

Estimating the future potential for harvest and sawmill residues

This report presents estimates of the potential production and use of harvest and sawmill residues in Australia in 2050. Given uncertainties around the current use of residues, and potential timing of investment in emerging technologies, estimates for earlier periods are not presented. As such, the intention of this report is to provide some insights into what the production and use of wood residues may look like in decades to come, once any required investment in infrastructure has taken place.

Estimates of the production and use of harvest residues are broken down by forest type (hardwood native, hardwood plantation and softwood) and grade (high and low quality). Estimates of the production and use of sawmill residues are broken down by broad species (hardwood and softwood), residue type (solid offcuts, sawdust, shavings and bark) and mill size. End uses include conventional wood products (such as export grade woodchips, wood pulp and wood-based panels) and alternative uses such as wood-based fuels (wood pellets, bioethanol and briquettes) and burning for heat or electricity.

Forest growers and managers, sawmill operators and other wood processors can use these estimates to explore potential long-term opportunities and take advantage of future wood residue availability.

Using the Forest Resource Use Model

The estimates presented in this report are based on simulations run using the Forest Resource Use Model (FORUM) for the period 2020 to 2050. FORUM was developed by ABARES to estimate the optimal use of the wood resource over time (Burns et al. 2015; Whittle, Lock & Hug n.d), incorporating a range of factors such as infrastructure constraints, investment opportunities, transport costs and the available biomass from production forests and sawmills.

Prices, costs and technologies are assumed to remain constant over the modelling period. The estimates presented for 2050 largely reflect current market conditions but take into account resource constraints and market demand in 2050, and new mill investment over the period 2020 to 2050.

Key findings

Harvest and sawmill residues are a substantial resource

ABARES estimates that up to 6.5 million tonnes of harvest residues could have been available for extraction in 2016–17, based on a total log harvest of 33.1 million cubic metres. ABARES also estimates that at least 5.2 million tonnes of sawmill residues could have been produced in 2016‑17 from 10.2 million cubic metres of sawlogs processed domestically. However, the proportion of these residues that may have been used is uncertain.

Based on ABARES modelling around 5.6 million tonnes of log harvest residues could be available for further use in 2050, based on a total log harvest of 28.6 million cubic metres. Around 1.2 million tonnes of harvest residues are assumed to be high quality, or suitable for producing export grade woodchips, and the remaining 4.4 million tonnes are assumed to be low quality (Figure S1). Around 0.9 million tonnes, or 78 per cent of the available high-quality residues in 2050, could be exported as woodchips or used in wood-based panel production. In contrast, forward estimates indicate that extraction of low-quality harvest residues is unlikely to be viable.

ABARES also estimates that around 5.6 million tonnes of sawmill residues could be produced in 2050 as a by-product of processing 11.3 million cubic metres of sawlogs. Around 5.0 million tonnes or 90 per cent of these residues are expected to be used in some form. The proportion of softwood sawmill residues used (95 per cent) is much higher than the proportion of hardwood sawmill residues used (65 per cent) because softwood sawmills tend to be located closer to potential downstream users and have economies of scale to make investments in onsite cogeneration technologies viable.

Wood residues could be used in numerous applications

ABARES estimates that combined generation of heat and electricity (cogeneration) for onsite use could be one of the most profitable uses of residues for some sawmills. By burning residues onsite for cogeneration, sawmills can avoid disposal costs and offset the costs of purchasing gas and electricity. ABARES modelling suggests that around 612,000 tonnes of sawmill residues (11 per cent of all sawmill residues) could be used to generate heat and electricity onsite in 2050. However, high upfront costs associated with installing cogeneration technology are likely to be a barrier for many sawmills, in particular smaller ones.

The benefits of burning wood residues to generate heat alone are far less than that of many alternative uses of residues. However, the high costs of transporting residues make this the most economic option for many regional sawmills.

ABARES modelling suggests that up to 1.9 million tonnes of sawmill residues (35 per cent of all sawmill residues) and 0.8 million tonnes of high-quality harvest residues (66 per cent of all high-quality harvest residues) could be exported as woodchips in 2050. This has the potential to make woodchip exports the single largest end use of harvest and sawmill residues in 2050. However, this is contingent on capacity being available at export facilities and a sufficient volume of residues being collected to achieve the necessary economies of scale.

ABARES also estimates that up to 626,000 tonnes of sawmill residues (11 per cent of all sawmill residues) and 69,000 tonnes of high-quality harvest residues (6 per cent of all high-quality harvest residues) have the potential to be used in the production of wood-based panels in 2050.

Wood pellet production is estimated to be the next main market for wood residues. ABARES estimates that around 796,000 tonnes of sawmill residues (14 per cent of all sawmill residues) could be used in the production of wood pellets in 2050, comprised mostly of sawdust and shavings, due to lower processing costs. ABARES also estimates that around 423,000 tonnes of sawmill residues (8 per cent of sawmill residues) and 6,000 tonnes of low-quality harvest residues could be used in the production of briquettes.

ABARES modelling suggests that under current market conditions, there is unlikely to be any new investment in bioethanol refineries or biomass electricity plants by 2050 due to high capital costs and more valuable alternative uses.

Changes in market conditions could have significant impacts on residue use

ABARES also estimated the potential production and optimal use of wood residues under a range of alternative scenarios, highlighting potential future opportunities and competition between uses of wood residues (Figure S2).

Increases in the prices of export grade woodchips, wood pellets and briquettes were estimated to increase the volume of harvest and sawmill residues used in these applications. A 25 per cent increase in wood pellet prices had the greatest impact on residue use with 1.4 million tonnes of harvest residues (25 per cent of all harvest residues) and an additional 344,000 tonnes of sawmill residues (43 per cent more than under the base case) being used in wood pellet production in 2050. Increases in wood pellet and briquette prices could also have a profound effect on the economic viability of extracting low quality harvest residues which, under current market conditions, are unlikely to be extracted.

While there is unlikely to be any investment in bioethanol refineries or biomass electricity plants under current market conditions, ABARES estimates that increases in bioethanol and wholesale electricity prices of 25 per cent could make investment in these facilities economically viable by 2050. If established, these facilities could use a substantial volume of residues in 2050, with 304,000 tonnes being used in bioethanol production and 520,000 tonnes used to generate electricity in standalone biomass power plants.

ABARES modelling shows how changes in market prices affect the optimal use of residues, providing insights into potential competition between specific uses of residues. For example, ABARES modelling suggests that an increase in wood pellet prices is likely to draw sawmill residues away from briquette production while increases in briquette and bioethanol prices could draw sawmill residues away from wood pellet production.

Finally, the findings from this analysis also highlight the inherent complexity of the Australian forest and wood processing industry—changes in market conditions often have unexpected effects on seemingly disconnected parts of the industry. For example, ABARES modelling suggests that increases in woodchip and briquette prices could potentially increase the volume of sawmill residues used in wood-based panel production. These unexpected impacts are primarily the result of a reallocation of sawlogs between sawmills to take advantage of proximity to particular downstream users. This highlights and further emphasises the important role that residue markets can play in the profitability of Australian sawmills.

[1.3 MB, 83 pages]

[1.3 MB, 83 pages] [3 MB, 83 pages]

[3 MB, 83 pages]