Feasibility and implications for future plantation investment

Authors: Linden Whittle and Rhys Downham

[expand all]

Summary

The volume of global trade in wood products continues to grow, putting increased pressure on the Australian softwood sawmilling industry to remain internationally competitive. However, many softwood sawmills in Australia operate at much smaller scales than overseas competitors, potentially leading to higher processing costs and less competitive product prices (EY 2016).

This report was jointly commissioned by Forest and Wood Products Australia and the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) to estimate the area of new softwood plantations required to support a world-scale softwood sawmill in selected National Plantation Inventory (NPI) regions. It builds on previous work undertaken by ABARES (Whittle, Lock & Hug 2019) using the same framework but imposes additional conditions on the operation of world-scale sawmills.

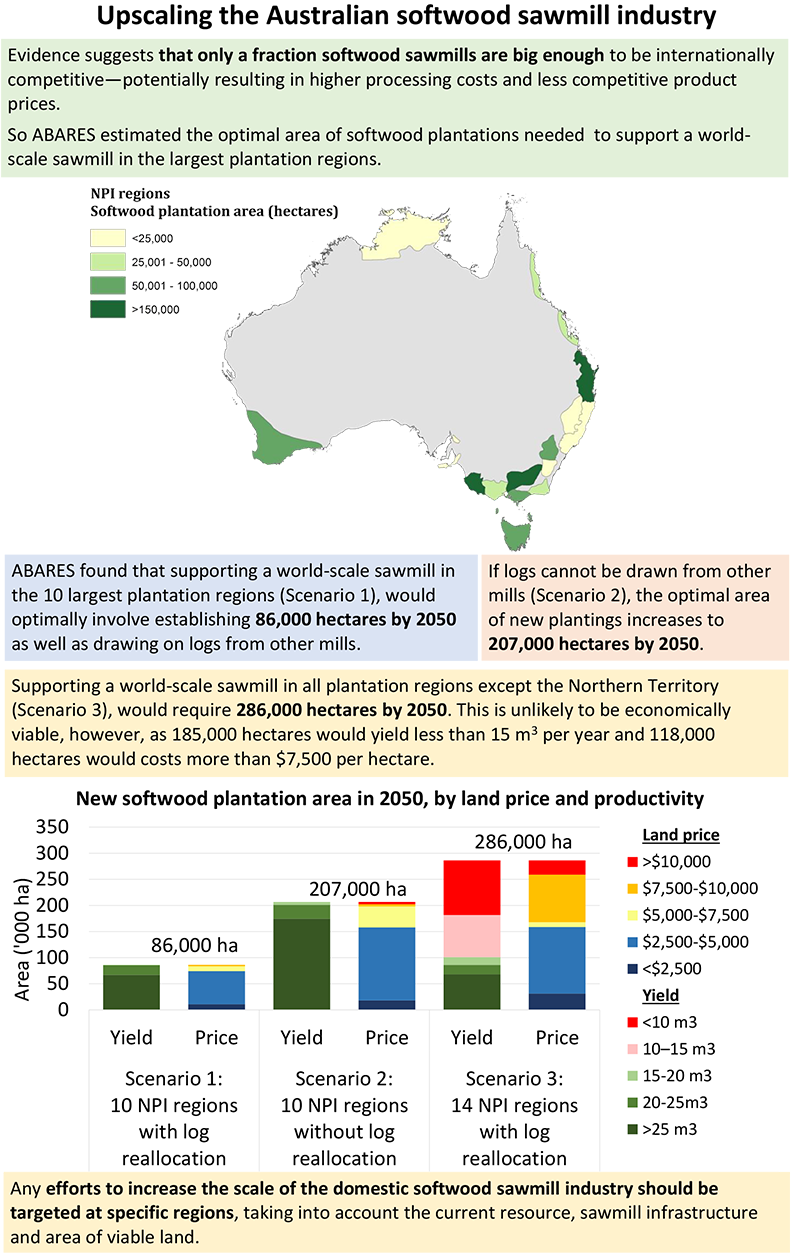

The area of new softwood plantations established depends on the number of NPI regions required to support a world-scale softwood sawmill and the extent to which logs can be reallocated between mills. Three alternative scenarios were considered. The first scenario assesses the optimal approach to supporting a world-scale softwood sawmill in the 10 NPI regions that currently have softwood estates larger than 30,000 hectares. No limits are placed on the reallocation of logs between mills under the first scenario. The second scenario imposes an additional constraint that logs cannot be reallocated between mills. This requires a larger area of new softwood plantations to be established. The third scenario assumes that a world-scale sawmill must operate in all NPI regions except the Northern Territory and that logs can be reallocated between mills.

The analysis in this report includes estimates of the optimal area of new softwood plantations established under the three scenarios. The area of new softwood plantations is broken down by NPI region, land price and productivity. The report also presents estimates of the total volume of softwood sawlogs harvested, the volume of softwood sawlogs reallocated between mills (where applicable) and the potential impacts on sawnwood production and trade.

Policymakers and industry can use the findings in this report to better understand the potential barriers to and implications of upscaling the domestic softwood sawmill industry.

Key findings

There is an abundance of agricultural land but not all of it is economically viable

Australia has millions of hectares of cleared agricultural land but only a small portion is likely to be suitable for establishing commercial softwood plantations. Based on ABARES assumptions about plantation establishment costs, log prices and transport distances, less than 500,000 hectares of agricultural land is potentially economically viable for conversion to softwood plantations. However, in a previous analysis undertaken by ABARES which took into account further constraints such as nearby mill capacity and regional demand, it was estimated that establish only around 24,000 hectares of softwood plantations by 2050.

The most efficient way to upscale the softwood industry would involve a combination of new plantation establishment and log reallocation

ABARES modelling suggests that in many cases redirecting logs away from other wood processing facilities or log exporters can be more efficient than establishing new plantations—once the costs of establishment, the product mix of existing mills and final product prices are taken into account.

For example, under the condition that a world-scale softwood sawmill operates in each of the 10 selected NPI regions (Scenario 1), ABARES estimates that it would be optimal to establish around 86,000 hectares of new softwood plantations by 2050 and reallocate an average of 1.7 million cubic metres of softwood sawlogs each year from other facilities.

Most of the plantation estate established under Scenario 1 is estimated to be concentrated in a handful of regions, with around 44,000 hectares or more than half of this area in North Queensland alone. A further 37,000 hectares or 43 per cent is estimated to be established in Western Australia, Tasmania and East Gippsland–Bombala. Regions that do not currently have significant softwood estates are more likely to need additional plantations established to support a world-scale softwood sawmill.

Without log reallocation more plantations would need to be established

To support a world-scale softwood sawmill in 10 NPI regions without reallocating logs between mills (Scenario 2), ABARES estimates that establishing around 207,000 hectares of new softwood plantations by 2050 would be optimal. This is around 120,000 hectares more than under Scenario 1 which allows logs to be reallocated between users.

Restricting log reallocation is likely to have a greater effect on the area of new softwood plantings in some regions than others. For example, in the absence of log reallocation (Scenario 2) 65,000 hectares of softwood plantations are estimated to be established across Central Victoria and East Gippsland–Bombala by 2050. This is around 57,000 hectares more than under Scenario 1 which allows log reallocation. Similarly, the total area of softwood plantations estimated to be established across Western Australia, Tasmania and North Queensland by 2050 was 46,000 hectares higher under Scenario 2 than Scenario 1.

A world-scale softwood sawmill is unlikely to be economically viable in some regions

ABARES modelling suggests that supporting a world-scale sawmill in all NPI regions except the Northern Territory (Scenario 3) is unlikely to be feasible. This is because of inadequate existing log supply and insufficient area of potentially viable agricultural land in some regions. As such, any efforts to increase the scale of the domestic softwood sawmill industry should be targeted at specific regions, taking into account the current resource, sawmill infrastructure and area of viable land.

Australia will likely continue to export and import sawnwood products

Australia will likely continue to export and import sawnwood products in the future, due to regional disparities between supply and demand for specific sawnwood products.

Under the condition that a world-scale softwood sawmill operates in each of the 10 selected NPI regions (Scenario 1), ABARES estimates that the annual volume of softwood sawlogs harvested would fall short of domestic log equivalent domestic demand by an average of 557,000 cubic metres per year from 2050 to 2054. With log exports estimated to be around 1.2 million cubic metres per year, the average annual domestic softwood sawlog supply shortfall is estimated to be around 1.7 million cubic metres per year from 2050 to 2054.

In contrast, in the absence of log reallocation (Scenario 2), ABARES estimates that the annual volume of softwood sawlogs harvested from 2050 to 2054 would exceed domestic log equivalent demand by an average of 2.4 million cubic metres per year. However, with annual log exports estimated to increase to around 2.5 million cubic metres per year, the domestic softwood sawlog supply shortfall is still estimated to average 77,000 cubic metres per year.

Download the full report

| Document | Pages | File size |

|---|---|---|

Upscaling the Australian softwood sawmill industry: Feasibility and implications for future plantation investment PDF  |

37 | 1.8 MB |

If you have difficulty accessing this file, visit web accessibility for assistance.