Gaby Coulthard

Key points

- Gross value of sheep meat and live sheep production to rise by 18% to $5.2 billion in 2024–25.

- Lamb and sheep saleyard prices to rise with improved saleyard demand.

- Value of sheep meat and live sheep exports to rise by 17% to $5.7 billion.

- Strong export demand supporting prices and lamb turn-off despite expected improvement in seasonal conditions in 2024–25.

- Rising world demand for sheep meat expected to outweigh higher world supply.

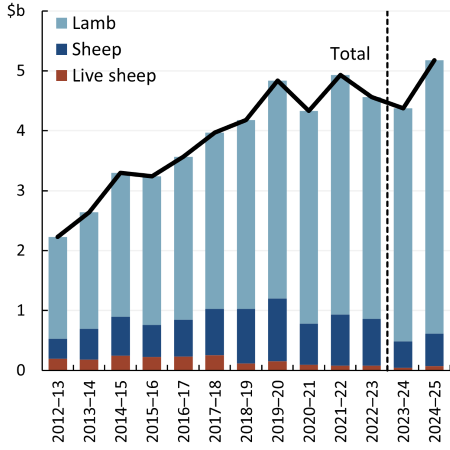

The gross value of sheep meat and live sheep production is expected to rise by 18% to $5.2 billion in 2024–25 (Figure 1.1). Rising production values reflect both higher lamb and sheep saleyard prices and higher sheep meat production. Saleyard prices are forecast to rise as demand from processors – driven by high world demand for sheep meat and elevated export prices – is expected to rise by more than supply. Production volumes are also forecast to rise despite improving seasonal conditions as strong export and processor demand drive up lamb turn-off.

Figure 1.1 Value of annual lamb, sheep and live sheep production

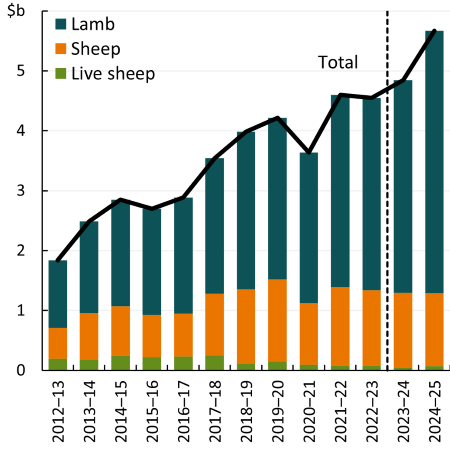

Figure 1.2 Value of annual sheep meat and live sheep exports

The value of sheep meat and live sheep production in 2024–25 is forecast to be $560 million higher than expected in the June Agricultural Commodities Report. This reflects an upwards adjustment to average saleyard prices for lamb and sheep reflecting recent data.

The value of sheep meat and live sheep exports is forecast to increase to $5.7 billion in 2024–25, up by 17% from an estimated $4.8 billion in 2023–24 (Figure 1.2). Rising export values reflect:

- Sheep meat export values are forecast to rise by 16% to $5.6 billion in 2024–25, driven by both rising export volumes and export prices. Export volumes are expected to rise with higher sheep meat production volumes and rising global demand for sheep meat.

- Live sheep export values are forecast to rise by 61% to $75 million in 2024–25 as both export volumes and live sheep export prices rise.

The value of sheep meat and live sheep export values is forecast to be $460 million higher than expected in the June Agricultural Commodities Report. This mostly reflects an upwards adjustment to lamb export prices and volumes for 2024–25.

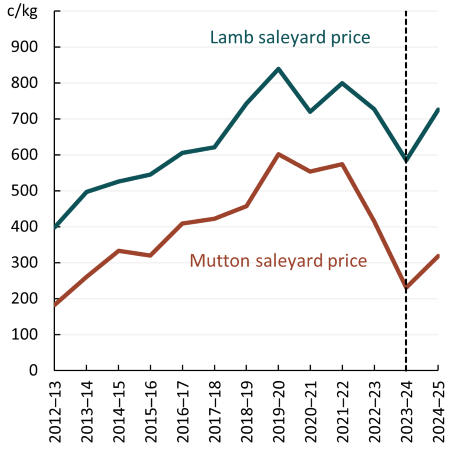

Average lamb saleyard prices are forecast to rise by 24% in 2024–25 to 725 cents per kilogram (carcase weight), up from 584 cents per kilogram in 2023–24 (Figure 1.3). This reflects a recovery in saleyard demand compared to 2023–24. Together, high processing capacity and world demand for lamb are expected to increase competition between processors in saleyards, driving up prices for finished lambs. Despite this strong rise, average lamb saleyard prices are expected to be 12% below the 5-year average to 2023–24 in real terms.

Lamb saleyard prices increased sharply during the June quarter 2024 to around 762 cents per kilogram (up by 23%) due to a limited supply of lambs in saleyards. However, lamb saleyard prices are expected to fall over spring with the arrival of new-season lambs. Over the last three years the average lamb saleyard price has fluctuated against seasonal patterns but has recently returned to seasonal trends (Box 1.1).

Average mutton saleyard prices are forecast to rise by 38% in 2024–25 to 319 cents per kilogram (carcase weight), up from 231 cents per kilogram in 2023–24 (Figure 1.3). The expected recovery in mutton saleyard prices reflects both a rise in saleyard demand – due to increased processor competition – and a fall in the supply of sheep to saleyards due to improved seasonal conditions. Despite rising, mutton prices are forecast to remain 41% below the 5-year average to 2023–24 in real terms as prices recover from the lows of 2023–24.

Figure 1.3 Average annual lamb and mutton saleyard price

Source: ABARES; MLA

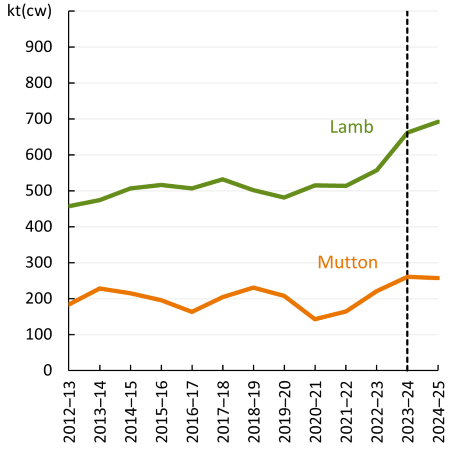

Figure 1.4 Annual Australian sheep meat production

Source: ABARES; ABS

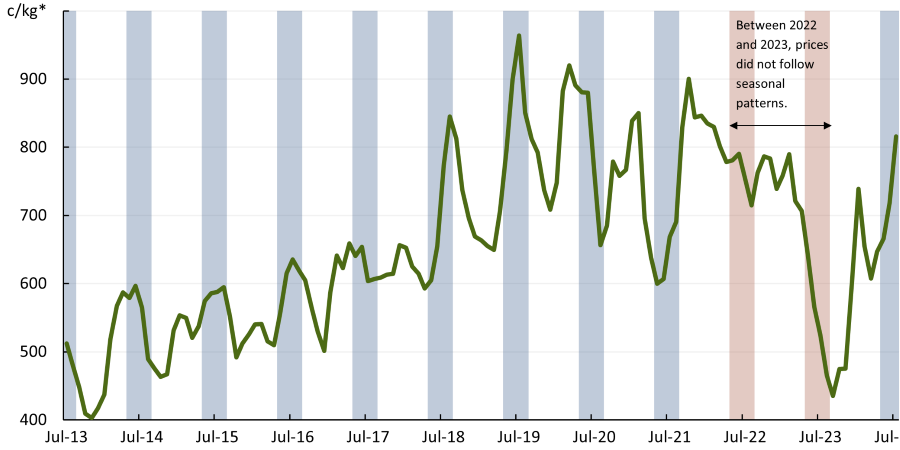

Box 1.1 Seasonal trends return in lamb saleyard prices

After two years of unusual price trends, lamb prices have returned to seasonal price trends. The trade lamb indicator price has been rising steadily since March (up by 23% over the June quarter), consistent with a diminishing seasonal supply of saleyard lambs.

Lamb prices usually follow a supply-driven seasonal price trend. At the beginning of the year, prices are typically low due to a high availability of lambs. Prices generally rise as the year progresses as the supply of finished lambs from the previous year decreases – prices typically peak in autumn/winter. Towards the end of July, the supply of new season lambs in saleyards increase, driving a fall in prices (Figure 1.5).

In 2022 and 2023, lamb prices drifted away from this seasonal trend as constrained demand from meat processors, and a rapid decline in restocker demand from producers led to a high supply of sheep in saleyards. These market conditions reflected the impacts of a peak in flock-size and shift towards destocking following three consecutive La Niña years and market uncertainty around the expectation of dry conditions.

In 2024, prices eased for the first few months due to increased supply of lambs from destocking – this runs counter to typical seasonal trends in which prices rise as numbers of finished lambs fall. However, prices have followed a more seasonal trend since March with the trend expected to continue for the rest of 2024.

Figure 1.5 National Trade Lamb Indicator

Source: ABARES; MLA

Australian sheep meat production volumes are forecast to rise by 3% to 948 thousand tonnes (carcase weight) in 2024–25 reflecting higher slaughter volumes more than offsetting lower lamb and sheep weights:

- Lamb production is forecast to rise by 4% to a record high 691 thousand tonnes in 2024–25. The increased processing of lighter lambs that require less labour – as they can be exported in whole carcass form – has increased processing capacity for lamb production.

- Mutton production is forecast to fall by 2% to 256 thousand tonnes in 2024–25.

The Australian sheep flock is forecast to decline by 3% to 68.5 million head in 2024–25 due to fewer lambs being promoted to sheep and turn-off of older sheep falling but remaining at elevated levels. Despite an expected improvement in seasonal conditions in 2024–25 relative to 2023–24, the sheep flock is expected to decline. This reflects sustained saleyard demand from processors – due to elevated slaughter capacity and strong export returns – supporting saleyard prices and higher lamb turn-off.

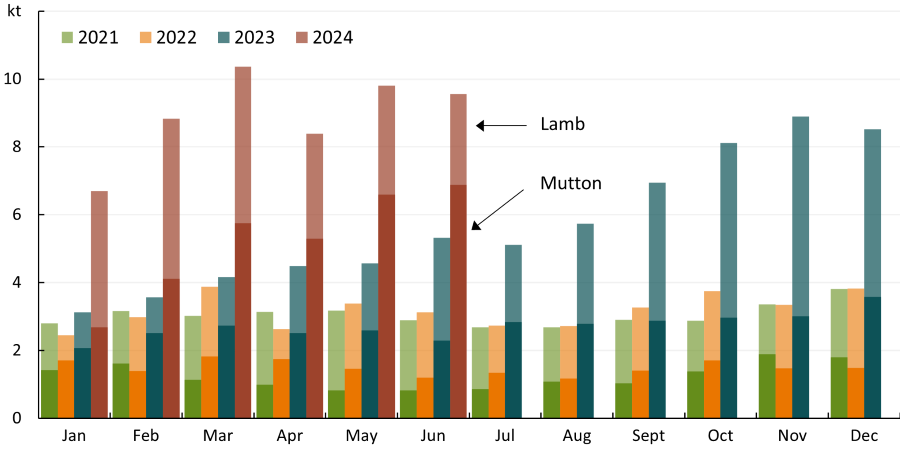

Australian sheep meat export volumes are expected to rise by 3% to reach a record 650 thousand tonnes (shipped weight) in 2024–25, reflecting strong lamb production volumes. Demand from the Middle East for both lamb and mutton grew significantly in 2023–24 and is expected to persist in 2024–25 (see Box 1.2):

- Lamb export volumes are forecast to rise by 8% to 425 thousand tonnes in 2024–25 with high lamb production and lamb export demand from the United States and Middle East.

- By contrast, mutton export volumes are forecast to fall by 6% to 225 thousand tonnes in 2024–25 as falling demand from China more than offsets high demand for mutton from Saudi Arabia, Oman and Singapore.

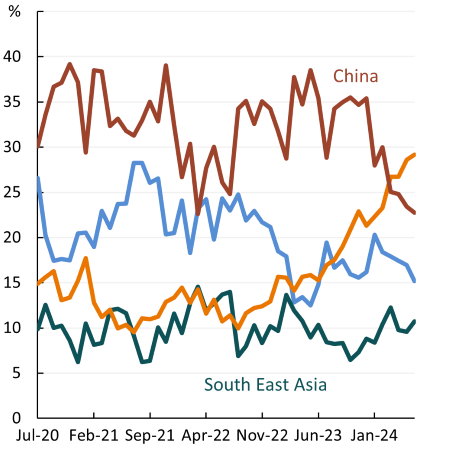

Box 1.2 Middle East now Australia’s biggest destination for sheep meat

Over the last 10 years, demand from the Middle East for sheep meat has grown rapidly and transformed the region into Australia’s biggest destination for sheep meat exports. In April 2024, the Middle East and North Africa region (MENA) overtook China as Australia’s largest export destination for sheep meat (Figure 1.6).

The Middle East has emerged as an important market for Australian sheep meat exports given relatively subdued demand for sheep meat from China. The Middle East region now accounts for 30% of total Australian sheep meat exports as of June 2024.

Figure 1.6 Proportion of volume of Australian sheep meat exports by region

Source: ABARES; ABS

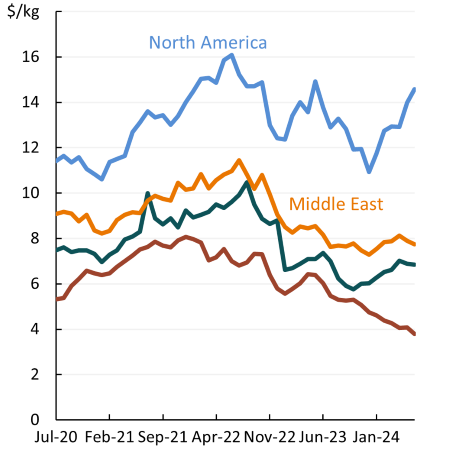

Figure 1.7 Export unit value of Australian sheep meat exports by region

Source: ABARES; ABS

While the Middle East is now Australia’s largest export destination for sheep meat by volume, North America remains the highest value region due to a higher proportion of lamb exports which are more expensive than mutton (Figure 1.7). The continued strength in the US dollar, as well as higher US prices, are also driving up Australian export prices which were at near-record levels as of June 2024.

The pace of growth of Middle Eastern demand for sheep meat has been very strong: sheep meat exports to the region more than tripled over the first half of 2024 compared to the same period last year, up by 213% (Figure 1.8). Rising Middle East demand for Australian sheep meat reflects higher disposable incomes and a growing tourism sector, particularly in the United Arab Emirates, Saudi Arabia and other Gulf countries. Over half of Australian sheep meat exports to the region are destined for the foodservices sector. Iran has also been a significant driver of the recent increase in demand for sheep meat from the Middle East.

Figure 1.8 Australian lamb and mutton export volumes to the Middle East

Source: ABS

Live sheep export volumes are forecast to rise by 28% to 650 thousand head in 2024–25 from 507 thousand head in 2023–24. This reflects seasonal conditions in Western Australia – where all Australian live sheep exports by sea occurred in 2023–24 – remaining relatively dry, reducing pasture availability and increasing sheep turn-off (For more information see The export of live sheep by sea from Australia to end on 1 May 2028).

World sheep meat demand is forecast to rise in 2024–25 by more than supply leading to an increase in world sheep meat prices. Higher demand for both lamb and mutton is expected from the United States, the Middle East and other emerging markets. This is expected to more than outweigh a fall in demand from China as challenging macroeconomic conditions weigh on Chinese consumption.

- United States demand for sheep meat is forecast to rise in 2024–25. Tight US sheep meat production and continued strength in the US dollar is expected to support demand for Australian lamb exports and elevated sheep meat export prices (Figure 1.7). Australian lamb export volumes to the US increased by 23% in 2023–24 to 79 thousand tonnes. This is 27% above the 5-year average to 2022–23 and the highest volume on record.

- Middle East demand for sheep meat is forecast to rise in 2024–25 due to both rising incomes and an expanding tourism sector. Demand is expected to rise for both lamb and mutton particularly across countries in the Gulf due to the increase in demand for premium lamb cuts (see Box 1.2).

- China's demand for sheep meat is expected to remain subdued in 2024–25 as a challenging economic environment for Chinese consumers limits spending on food services. High pork production and increased availability of other meats within China's domestic markets also pose a downside risk to Australian exports of sheep meat.

World sheep meat supply is forecast to rise in 2024–25 driven by higher Australian production. However, growth in world demand is expected to outpace the growth in supply, placing upward pressure on world sheep meat prices.

New Zealand sheep meat production is expected to fall in 2024–25, slightly offsetting the overall rise in world supply. This reflects the declining NZ sheep flock. The New Zealand Ministry for Primary Industries expects the sheep flock will continue to decline into the medium term to 2028 due to afforestation for carbon farming, high input costs and low crossbred wool prices. As a result, NZ sheep meat export volumes are forecast to fall, supporting global demand for Australian sheep meat.

The export of live sheep by sea from Australia to end on 1 May 2028

It is now law that the export of live sheep by sea from Australia will cease on and from 1 May 2028. Trade can continue until the end date without caps or quotas. The prohibition will not apply to other livestock export industries, such as live cattle exports or live sheep exports by air.

The Australian Government announced a transition plan and 5-year, $107 million transition support package in the 2024–25 Budget, to assist the Australian sheep industry and supply chain to phase out live sheep exports by sea. More information can be found on the DAFF website.

This policy may impact the production decisions of some sheep producers in Western Australia. However, at the national level ABARES expects this announcement will not significantly impact forecasts for Australia’s sheep meat and wool industry over the outlook period to 2024–25.