In 2021, ABARES was commissioned by the Queensland Department of Agriculture and Fisheries and Sugar Research Australia to conduct a survey of Australian sugarcane farms. The survey was conducted in mid-2021 and collected a comprehensive set of financial, physical and management information on farm businesses that grow sugarcane. The results of this survey will help benchmark industry financial performance and inform industry policy and investment.

Results from the survey are presented in this publication using a data visualisation product and incorporate estimates from a previous survey conducted in 2013–14.

How to use this data dashboard

- Choose between the different pages shown at the bottom of the dashboard.

- In the pages, select the desired fields — from region, farm size and profitability options.

- Download the data showing in the dashboard by clicking the ‘Download Data’ button in each page. For more information on the results and definitions of items, click the ‘More information’ button in each page.

The PowerBI dashboard may not meet accessibility requirements. For information about the content of this dashboard contact ABARES.

The Australian sugarcane industry is mainly located along Australia’s north-eastern coastline, from Grafton in northern New South Wales to Mossman in Far North Queensland (Map 1). Sample farms were selected to be representative of the population of sugarcane farms in each of the six sugarcane producing regions of Queensland and the single sugarcane producing region in northern New South Wales.

In 2020–21, an estimated 4% of Australian farms were classified by the Australian Bureau of Statistics as sugarcane farms (around 3,000 farms) (ABS 2021). These are defined as agricultural businesses with an estimated value of agricultural operations (EVAO) of $40,000 or more and receive the major part of their farm receipts from sugarcane. A further 370 agricultural businesses were classified as sugarcane farms, but with an EVAO less than $40,000. These are regarded as non-commercial businesses for the purposes of the ABARES survey and excluded from the target population. Around 100 farms produce sugar but are not classified as sugarcane farms because they receive the majority of their farm receipts from other crops or livestock activities.

- The average financial performance of sugarcane farms was better in real terms in 2020–21 compared to 2013–14. In 2020–21, average farm cash income (Box 1) was around $190,800 per farm, 91% higher than the average in 2013–14.

- The average rate of return to capital (excluding capital appreciation) is estimated to have been 2.0% in 2020–21, compared with an average of 0.7% in 2013–14. This is comparable with other agriculture industries in 2020–21 such as broadacre cropping (2.9%), livestock (0.8%) and dairy (2.5%).

Box 1 Definitions of major financial performance indicators

Total cash receipts: total income received by the business during the financial year

Total cash costs: payments made by the business for materials and services, interest and finance lease payments, and payments for permanent and casual hired labour (excluding owner–manager, partner and family labour)

Farm cash income: a measure of cash funds generated by the farm business for farm investment and consumption after paying all costs incurred in production: this includes interest payments, but excludes capital payments and payments to family workers. It is a short–term measure of farm performance

total cash receipts – total cash costs

Farm business profit: return to the resources used in the business (capital and management). This is a measure of longer–term business profitability, taking into account the requirement to replace some capital over time (capital depreciation) and also accounting for changes in inventories of farm products

farm cash income + change in trading stocks – depreciation – imputed labour costs

Profit at full equity: farm business profit adjusted to a full equity basis to enable comparison of returns across businesses regardless of the financing arrangements in place

farm business profit + rent + interest + finance lease payments – depreciation on leased items

Rate of return to total capital used: efficiency of businesses in generating returns from all resources used

(profit at full equity/total opening capital) x 100

The improved financial performance of sugarcane farms in 2020–21 compared to 2013–14 is due to a number of factors, including:

- adjustment in the industry, with the number of sugarcane farms (as defined above) declining from around 3,500 to 3,000. Much of this decline was smaller sugarcane farms (as measured by total sugarcane production) exiting the industry and these farms had lower financial performance on average than larger farms. In 2013–14, 62% (around 2,200 farms) of sugarcane farms produced less than 8,000 tonnes of sugarcane. By 2020–21, this proportion had declined to 49% (around 1,500 farms). The gross value of Australian sugarcane production increased over the period, from around $1.23 billion in 2013–14, to $1.33 billion in 2020–21 (ABARES 2021).

- Average sugarcane receipts per farm were 11% higher in 2020–21 than in 2013–14. The increase in sugarcane receipts is partly due to increases in average sugarcane area planted per farm and higher average yields, but these changes were not uniform across the regions.

- The largest percentage increases in average sugarcane production per farm were in the Bundaberg and New South Wales regions. In New South Wales, there was an increase in yields and area planted to sugarcane while in Bundaberg the increase in production was due to an increase in the average area planted to sugarcane.

- Average total cash costs were 3% lower in 2020–21 than in 2013–14 despite increased production. This was mainly due to a reduction in interest payments because of lower interest rates and lower average debt per farm.

Based on farmer’s estimates of their likely production and receipts from cane and other crops in 2021–22, financial performance of sugarcane farms is projected to improve on average in 2021–22. Average total cash receipts per farm are projected to increase by 11% from $591,300 per farm in 2020–21 to a projected $656,400 per farm. This increase is due to a combination of projected greater sugarcane production, higher yields and higher prices received. Farm cash income is projected to increase by 6% from an average of $190,800 per farm to around $202,500 per farm. Total cash costs are projected to increase by 13% from an average of $400,600 per farm to $453,900 per farm, mainly because of projected greater expenditure on fertiliser and fuel due to higher prices.

Farm cash income is projected to increase or remain steady in 2021–22 in all regions except New South Wales, where average incomes are projected to decline slightly in 2021–22. In percentage terms, the largest increase in farm cash income is projected in Far North Queensland (12%). These projections are conditional on final outcomes for crop production and crop prices in 2021–22 being broadly in line with farmer’s expectations when they were interviewed in mid-2021.

Farm receipts and costs

At the national level, sugarcane receipts accounted for an average of 78% of total cash receipts per farm in 2020–21. An estimated 14% of total cash receipts came from other crops, such as fruit and vegetables, and an estimated 8% came from other sources, such as livestock sales.

The largest components of sugarcane production costs in both 2013–14 and 2020–21 were contracts paid (for sugarcane harvesting, planting, spraying and cultivation) and fertiliser expenditure. Other farm costs vary somewhat by region. For example, electricity and rates were highest in irrigation regions such as the Burdekin and Bundaberg.

All regions — apart from Bundaberg — recorded reductions in average interest paid per farm in 2020–21 compared to 2013–14. This is due to reductions in interest rates over the period and lower average debt per farm, as many farms with high debt levels have left the industry.

Financial performance by rate of return

The characteristics of sugarcane farms differ by financial performance group. In 2020–21, the top 25% of farms (by rate of return) were larger on average by area operated, area planted to sugarcane, farm cash turnover and sugarcane production. These better performing farms also had the highest sugarcane yield at an average of 94 tonnes per hectare, compared to 74 tonnes per hectare for farms in the bottom 25%.

Financial performance by region

The physical and financial performance of sugarcane farms varied across regions in 2020–21. There was greater regional variability in the average level of cane production per farm than in the average area planted to cane, which was largely due to regional differences in cane yields – tonnes of cane produced per hectare planted (Figure 1 and Figure 2).

Average receipts per farm from cane production also differed substantially from region to region, reflecting differences in average cane yields but also differences in average receipts per tonne of cane produced. Farms in Bundaberg generated the highest sugarcane receipts per tonne produced (45) on average and farms in the Far North Queensland generated the lowest (35).

Figure 1 Area planted to sugarcane and sugarcane production, by region, 2020–21

average per farm

Figure 2 Sugarcane yield and receipts per tonne of sugarcane produced, by region, 2020–21

average per farm

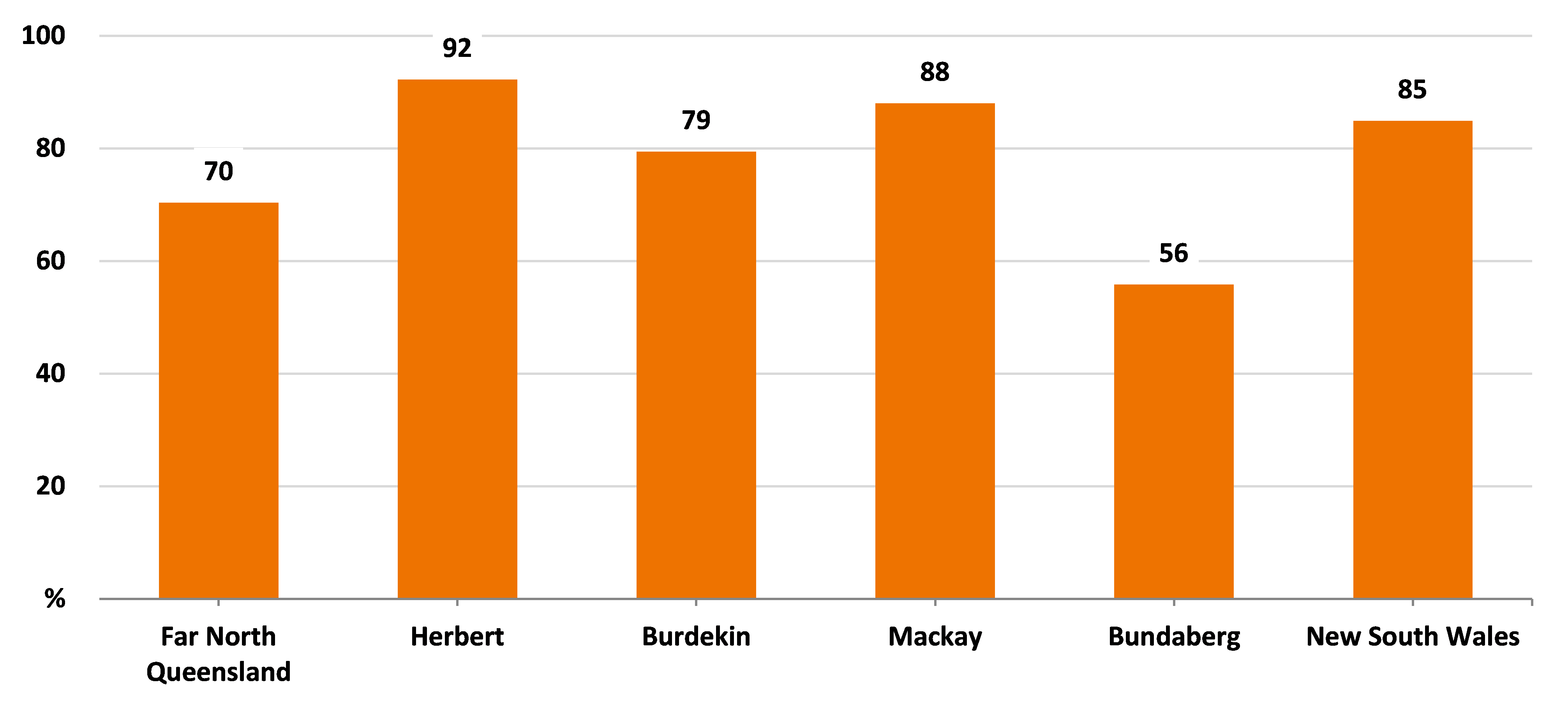

On average, sugarcane farms in four of the six regions — Herbert, Burdekin, Mackay and New South Wales — were relatively specialised producers, with receipts from sugarcane production representing around 80% or more of total cash receipts (Figure 3). Farms in Far North Queensland were slightly less specialised (with an average sugarcane to total receipts ratios of 70%), while farms in the Bundaberg region were the least specialised (56% of total farm receipts from cane sales).

Figure 3 Sugarcane receipts as a proportion of total cash receipts, by region, 2020–21

average per farm

Average farm cash income was highest in the Burdekin (averaging $300,100 per farm) in 2020–21 (Figure 4). In the Burdekin region, average sugarcane production and average sugarcane receipts were considerably higher compared to other regions, largely due to much higher sugarcane yields per hectare planted.

Sugarcane farms in northern New South Wales recorded the lowest average farm cash income in 2020–21, although farms in this region were much smaller (in terms of the average area planted to cane) than farms in other regions. However, sugarcane farms in New South Wales recorded the lowest ratio of costs to receipts — meaning they generated a higher level of farm cash income per dollar of receipts earned.

Figure 4 Farm cash income, by region, 2020–21 and 2021–22p

average per farm

Source: ABARES Sugarcane Industry Survey

Figure 5 shows the estimated average farm cash income by region in 2020–21 and the 95% confidence interval for the average statistic. A 95% confidence interval can be calculated using relative standard errors (RSEs) of the average, which gives an indication of how close the actual population average is likely to be to the average calculated from the survey results. The size of the RSE is most influenced by the sample size and variability across the population of farms within the region. More information on RSEs and confidence intervals can be found on the ABARES website.

The Burdekin had the greatest within-region statistical variability for farm cash income in 2020–21, with the 95% confidence interval for average farm cash income ranging from $125,000 per farm to $475,000 per farm. New South Wales had the smallest within-region statistical variability for farm cash income, ranging from $96,800 per farm to $136,700 per farm.

Figure 5 Farm cash income statistical variability, by region, 2020–21

average and 95% confidence interval

Questions about farm management practices were asked as part of the 2020ؘ–21 survey of the physical and financial performance of Australia’s sugarcane farms. The farm management questions covered a wide range of areas, including: perceived constraints to productivity and profitability; areas of focus over the next five years; cultivation, planting, and harvesting practices; nutrient management; pest and disease management; and use of farm technology. Some high-level observations about the results are provided below. The full set of survey responses can be viewed using the data visualisation.

Constraints to higher productivity and profitability

There are large regional differences in major constraints farm managers face in relation to achieving higher productivity and profitability, for example:

- problems with weed management are common in New South Wales, but less common in all other regions

- concerns with harvesting processes (losses, stool damage etc) are common in New South Wales and the Burdekin region, but less so elsewhere

- problems associated with Yellow Canopy Syndrome are prominent among surveyed farms in the Mackay region, with smaller but still significant levels of concern among farms in the Herbert, Burdekin and Bundaberg regions. No farms in the other three regions identified Yellow Canopy Syndrome as a constraint.

The one constraint identified at relatively high levels across all regions was ‘poor varieties’. At the national level just over 40% of farms identified ‘poor varieties’ as a constraint on their productivity and profitability. There were still regional differences however, with responses varying from 20% of farms in Bundaberg to 93% of surveyed farms in the Herbert region. Almost every surveyed farm (96%) in the Herbert region also indicated that ‘production of higher yielding varieties’ would be a major focus for them to improve productivity over the next five years, which reflects the availability of the new high performing varieties SRA26 and SRA28.

Constraints associated with ‘climate’ were also high to very high in most regions, but less so in the Burdekin and Bundaberg regions.

When the surveyed farms were divided into groups based on their profitability (rate of return to capital), some differences in responses included:

- among the ‘least profitable’ group of farms, 22% identified ‘poor soil health’ as a constraint on their productivity and profitability, compared with just 5% of farms in the ‘most profitable’ group

- not surprisingly, the least profitable farms were more likely to feel constrained by an inability to afford new production technologies.

Where cane farmers intend to ‘focus’ in coming years

The main areas of focus over the next five years identified by farmers are higher yielding varieties and improving soil health. An estimated 54% of farms identified improved varieties as an area of focus (96% of farms in the Herbert region), and 45% of farms said they would focus on improving soil health.

Regional differences in areas of focus are apparent, and there are a few notable differences when farms are divided into profitability groups, for example:

- around 36% of farms in Far North Queensland expected to focus on improving the timeliness of farm operations over the next 5 years, compared with just 3% of farms in the Bundaberg region

- a higher proportion of farms in the most profitable group expect to focus on optimising nutrient inputs compared with farms in the least profitable group (47% compared to 19%).

Responses to other farm management questions

As with the questions about ‘constraints’ and ‘focus’, the survey results relating to the other questions about farm management practices show substantial variation in responses by region, and when farms are divided into groups based on profitability (rate of return to capital).

For some questions, regional variability in responses is greater than the variability observed when farms are divided into profitability groups. This suggests that region-specific factors are dominant determinants of the results in these cases, rather than farm-specific factors.

More generally, the results suggest that some aspects of farm management are conditioned by which region a farm is in, while others are influenced more heavily by the circumstances, decisions and preferences of individual farm managers.

Some care should be taken when interpreting the results broken down by profitability group. The allocation of surveyed farms to profitability groups is based on their estimated profitability in 2020–21, rather than (for example) their average profitability over a number of years. In which case the results could be affected by any region-specific influences on farm profitability in 2020–21.

Drivers of profitability

In relation to farm management practices, the most profitable cane farms in 2020–21 are more likely to:

- have completed the Smartcane BMP modules

- consider Smut resistance ratings when choosing new varieties of cane

- have wider crop rows

- use the SIX EASY STEPS program for nitrogen application, with adjustments based on factors like sodicity, waterlogging and late harvest

- apply mill mud to the sub-soil

- use precision steering for both tractors and harvesting

- use variable rate-controlled options for fertilizer and chemical application

- use electromagnetic mapping

- use yield mapping data

- engage with harvesting contractors who have implemented Harvesting Best Practice and new technologies (cane loss and yield monitors) to reduce harvesting loss.

This does not mean that all profitable farms undertake all of these practices, or that switching to these practices will automatically make farms more profitable. The results should be taken as indicating the sorts of farm management practices that are generally associated with higher profitability, conditioned by region and the other characteristics, features and circumstances unique to each farm and its owners/managers.

The data in this report are drawn from ABARES Sugarcane Industry Survey (SCIS). SCIS covers farms defined as sugarcane growing farms (see Map 1) with an EVAO greater than $40,000. SCIS was commissioned by the Queensland Department of Agriculture and Fisheries and Sugar Research Australia.

SCIS provides a wide range of information on the current and historical economic performance of farm business units, including farm costs, receipts, income and profit, debt, assets, farm capital, labour and farm size. Previous surveys were conducted in 2005–06 and 2013–14. The survey was designed using a stratified random sample to be representative of the population at the region and farm size level. Further information on the ABARES farm surveys and survey methodology can be found on the ABARES website.

Map 1 Sugarcane regions, Australia

Target population

The Australian Sugarcane Farm Businesses Survey was designed from a frame (population list) drawn from the Australian Business Register (ABR) and maintained by the Australian Bureau of Statistics (ABS). The ABR based frame provided to ABARES consists of agricultural businesses registered with the Australian Taxation Office, together with their corresponding statistical local area, industry classification and size of operation variable. The size variable is an indicator of the extent of agricultural activity.

For the purposes of this survey, sugarcane farms in the sample were selected from units classified in ANZSIC 0151 (Sugarcane growing) or who had more than 5 hectares of cultivated sugarcane. Farms excluded from ABARES surveys are the smallest units, which in aggregate contribute little to the total value of sugarcane production.

The sugarcane growing industry definition is based on the Australian and New Zealand Standard Industrial Classification (ANZSIC). This classification is consistent with an international standard applied comprehensively across Australian industry, permitting comparisons between industries, both within Australia and internationally. Farms assigned to a particular ANZSIC class have a high proportion of their total output characterised by that class. Further information on ANZSIC and the sugarcane growing industry is provided in Australian and New Zealand Standard Industrial Classification (ABS 2013).

Survey design and sample weighting

The target population was grouped into strata defined by region and size of operation. The size of each stratum was determined using Dalenius–Hodges method (Lehtonen & Pahkinen 2004). The sample allocation to each stratum is a compromise between allocating a higher proportion of the sample to strata with high variability in the size variable and an allocation proportional to the population of the stratum.

In 2020–21, there were an estimated 3,044 sugarcane farm businesses in Australia (farm businesses with an estimated value of agricultural operations of at least $40 000). Results are based on a sample of 174 sugarcane farms (Table 1). Farms in South Queensland were surveyed and contribute to results at a national level, but the sample size was insufficient to provide stand-alone estimates for that region, instead a combined Bundaberg-South Queensland region was included in the results (with Bundaberg also included as its own region).

Farm-level estimates published in the report are calculated by appropriately weighting the data collected from each sample farm and using the weighted data to calculate population estimates. Sample weights are calculated to obtain population estimates from the sample for numbers of farms and areas of sugarcane planted that correspond as closely as possible (at a region level and by groups of farms by area of sugarcane planted) to the most recently available ABS estimates from data collected in the Agricultural Census and Agricultural Survey. The weighting process ensures estimates are applicable for all commercial sugarcane farms rather than just those in the sample.

The weighting methodology for the sugarcane survey uses a model–based approach with a linear regression model linking the survey variables and the estimation benchmark variables. The details of this method are described by Bardsley and Chambers (1984).

Benchmark variables used to weight the data provided by the ABS include:

- total numbers of farms in scope

- total area of sugarcane cultivated.

Generally, larger farms have smaller weights and smaller farms have larger weights, reflecting the strategy of sampling a higher fraction of larger farms than smaller farms (the former having greater variability of key characteristics and accounting for a much larger proportion of total output) and the relatively lower number of large farms.

| Region | Sample size (no.) |

Number of farms (no.) |

|---|---|---|

| New South Wales | 21 | 223 |

| Far North Queensland | 38 | 489 |

| Herbert | 23 | 519 |

| Burdekin | 37 | 540 |

| Mackay | 27 | 907 |

| Bundaberg | 20 | 308 |

| South Queensland | 8 | 58 |

| Australia | 174 | 3,044 |

Source: ABARES Australian Sugarcane Industry Survey

ABARES 2021, Agricultural commodities: September quarter 2021 , Australian Bureau of Agricultural and Resource Economics and Sciences, Canberra, September.

ABS 2013, Australian and New Zealand Standard Industrial Classification ANZSIC, 2006 (revision 2.0), cat. no. 1292.0, Australian Bureau of Statistics, Canberra.

ABS 2021, Agricultural Commodities, Australia, cat. no. 7121.0, Australian Bureau of Statistics, Canberra.

Bardsley, P & Chambers, RL 1984, ‘Multipurpose estimation from unbalanced samples’, Journal of the Royal Statistical Society, Series C (Applied Statistics), vol. 33, pp. 290–99.

Lehtonen, R & Pahkinen, E 2004, Practical methods for design and analysis of complex surveys, 2nd ed., John Wiley & Sons, Finland.