Author: Dale Ashton

Key performance results

- Average farm cash income for dairy farmers in the Murray–Darling Basin peaked in 2013–14, before declining in 2014–15 and 2015–16 because of lower milk prices and higher input costs. In real terms, dairy farm incomes in 2015–16 are estimated to have been the lowest since 2009–10.

- Average incomes for horticulture farms have risen each year (in real terms) since 2013–14. In 2015–16 average farm cash income for horticulture farms is estimated to have been the highest since the ABARES irrigation survey began in 2006–07.

- For rice farms, average farm cash income peaked in 2014–15 before falling sharply in 2015–16 as reduced water allocations resulted in a much smaller rice crop.

- Average farm cash income for cotton growers fell in 2014–15 as dry seasonal conditions affected water availability and resulted in reduced cotton production. While cotton production fell further in 2015–16, farm incomes rose because a fall in cash costs more than offset lower farm cash receipts.

[expand all]

Commodity prices and seasonal conditions

Changes in the farm business operating environment have an important influence on the financial performance of farm businesses. In 2014–15 and 2015–16 key factors directly affecting farm financial performance included changes in commodity prices, farm input costs (particularly temporary water prices) and water availability.

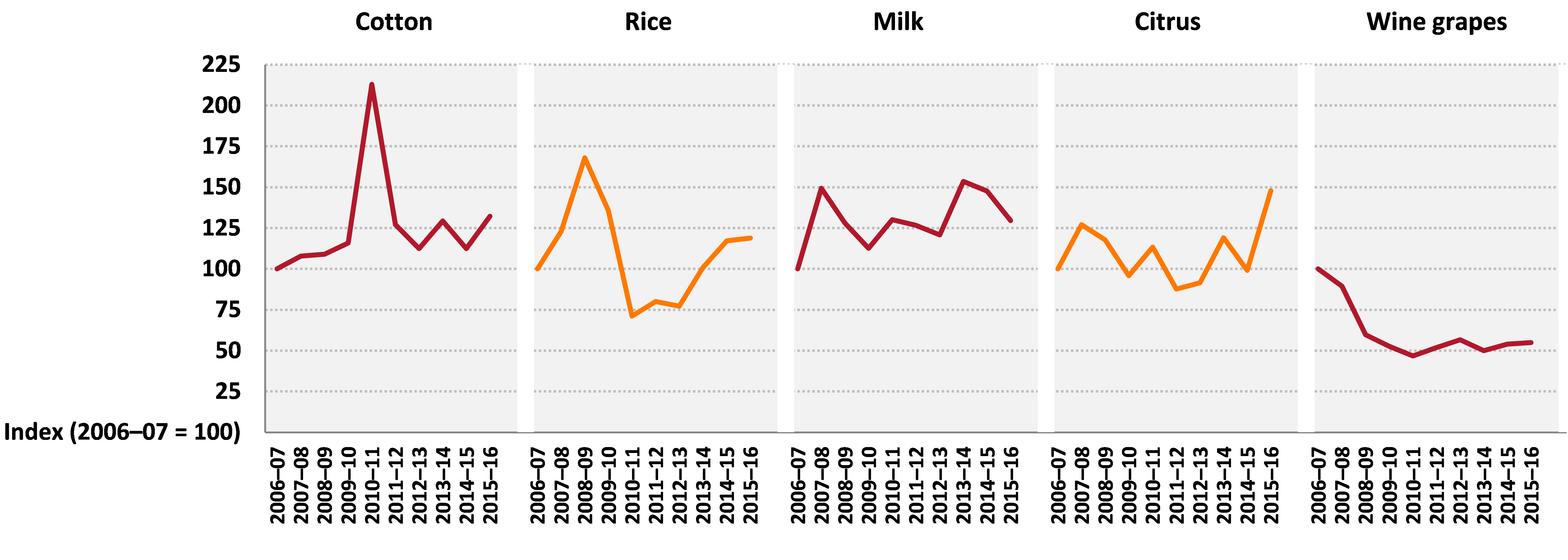

Commodity prices

Farmgate prices for agricultural products can vary widely from year to year (Figure 1). In 2014–15 cotton prices fell by 13 per cent before increasing by 18 per cent in 2015–16. Rice prices rose in both years—up by 16 per cent in 2014–15 and a further 2 per cent in 2015–16.

For dairy farms, farmgate milk prices tend to fluctuate from year to year largely in line with changes in world prices for dairy products. After reaching a high of 51 cents a litre in 2013–14 milk prices have fallen in consecutive years, down by 4 per cent in 2014–15 and a further 11 per cent in 2015–16.

Horticulture farms have also faced significant variations in prices for individual fruit crops. Citrus prices fell in 2014–15—down by 4 per cent— before rising by an estimated 30 per cent in 2015–16. In contrast, wine grape prices remained relatively low in 2014–15 and 2015–16 but increased by 8 per cent and 2 per cent, respectively.

Seasonal conditions and water use

In 2013–14 much of the southern Basin received generally average rainfall, while Queensland and northern New South Wales received below average to very much below average rainfall (Map 1). As a result of ongoing below average rainfall, total water storage in the northern Basin fell to 30 per cent in 2013–14, down from 64 per cent in the previous year. Reflecting comparatively better conditions in the southern Basin, total water storage fell from 70 per cent to 63 per cent in 2013–14 (BOM 2015).

In 2014–15 rainfall in the northern Basin improved relative to the previous two years but rainfall in the southern Basin deteriorated. In particular, Victoria and South Australia received below average to very much below average rainfall in 2014–15 (Map 1).

In 2015–16 most of the central Murray–Darling Basin had above average rainfall, particularly in the second half of the financial year. Rainfall was around the average in the south-eastern part of the Basin—particularly in the catchments for Hume, Dartmouth and Lake Eildon water storages—but was average to below average across much of the remainder of the Basin.

The total volume of irrigation water applied by irrigation farms in the Murray–Darling Basin in 2014–15 was 24 per cent lower than the previous year (ABS 2016). The volume of water applied to pasture and cereal crops for grazing, hay or silage and to grapes increased in 2014–15 (both rising by 4 per cent relative to 2013–14), while the volume of water applied to all other major irrigated commodities declined (Table 1). The largest fall in the volume of water applied was for cotton (down by 58 per cent) and fruit, nuts and berries (down by 30 per cent).

Source: ABS 2016 (ABS cat. no. 4618.0)

The total volume of water used for irrigation is estimated to have fallen further in 2015–16 because of relatively low major storage levels at the beginning of the irrigation season and subsequent low allocations in some regions. Significant rainfall events in the southern Basin late in the financial year led to a higher volume of water in storage at 30 June 2016 than June 2015. In the northern Basin, the total volume of water held in major storages was slightly higher at 30 June 2016 than June 2015 (Figure 2).

Farm financial performance

Farm performance summary

Across the Murray–Darling Basin, farm cash income (see definitions) for dairy, rice, cotton and horticulture farms followed broadly similar trends for the period 2012–13 to 2015–16 (Figure 3). In particular, low incomes during the drought years of 2006–07, 2007–08 and 2008–09 were followed by significantly higher average incomes in subsequent years.

For dairy farmers, average farm cash income peaked in 2013–14 before declining in 2014–15 and 2015–16 because of lower milk prices and higher input costs. In real terms, dairy farm incomes in 2015–16 are estimated to have been the lowest since 2009–10.

Average incomes for horticulture farms have risen each year (in real terms) since 2012–13. In 2015–16 average farm cash income for horticulture farms is estimated to have been the highest since the ABARES irrigation survey began in 2006–07.

For rice farms, average farm cash income peaked in 2014–15 before falling sharply in 2015–16 as reduced water allocations resulted in a much smaller rice crop.

Average farm cash income for cotton growers fell in 2014–15 as dry seasonal conditions affected water availability and resulted in reduced cotton production. While cotton production fell further in 2015–16, farm incomes rose because a fall in cash costs more than offset lower farm cash receipts.

Source: ABARES Murray–Darling Basin Irrigation Survey

Horticulture farms

Average farm cash income for irrigated horticulture farms in the Murray–Darling Basin is estimated to have been $105,800 in 2014–15, around 14 per cent higher than in 2013–14 (Table 2). Average income is estimated to have risen by a further 15 per cent in 2015–16 to average $122,000. The rise in average income in 2015–16 was a result of a slight rise in total cash receipts (up by 4 per cent) and lower cash costs (down by 5 per cent). In 2015–16 average receipts increased for citrus, wine grapes and vegetables and declined for pome fruit, stone fruit and nuts. Costs fell for all major categories except hired labour (up by 8 per cent).

Note: Data for 2015–16 are provisional estimates.

Source: ABARES Murray–Darling Basin Irrigation Survey

The average rate of return (excluding capital appreciation) for irrigated horticulture farms increased to 2.8 per cent in 2014–15, before increasing further to 3.6 per cent in 2015–16 (Figure 4). In comparison, the average rate of return (excluding capital appreciation) over the survey period from 2006–07 to 2015–16 was 2.1 per cent.

average per farm

Source: ABARES Murray–Darling Basin Irrigation Survey

The survey results show that although farm financial performance for irrigated horticulture farms has improved on average, improvements have not occurred equally across all farms. The distribution of rates of return in 2015–16 shows around 59 per cent of horticulture farms recorded negative returns. An estimated 27 per cent of horticulture farms recorded a rate of return of –5 per cent or less (Figure 5). Horticulture farms with a rate of return of less than –5 per cent were mainly small farms that focused on a single crop enterprise, and included a mixture of mainly wine grape growers and citrus growers.

Nevertheless, around 16 per cent of horticulture farms record a rate of return above 10 per cent in 2015–16—these were mostly large farms with a range of horticultural crops including citrus, wine grapes, stone fruit, pome fruit and almonds.

proportion of farms

Source: ABARES Murray–Darling Basin Irrigation Survey

Dairy farms

Average farm cash income for irrigated dairy farms in the Murray–Darling Basin is estimated to have been $197,500 in 2014–15, around 18 per cent lower than 2013–14 (Table 3). Average income is estimated to have fallen by a further 33 per cent in 2015–16 to average $133,000. The fall in average income in 2015–16 was a result of lower farmgate milk prices and a reduction in total milk production. Cash costs fell for all major categories in 2015–16.

Note: Data for 2015–16 are provisional estimates.

Source: ABARES Murray–Darling Basin Irrigation Survey

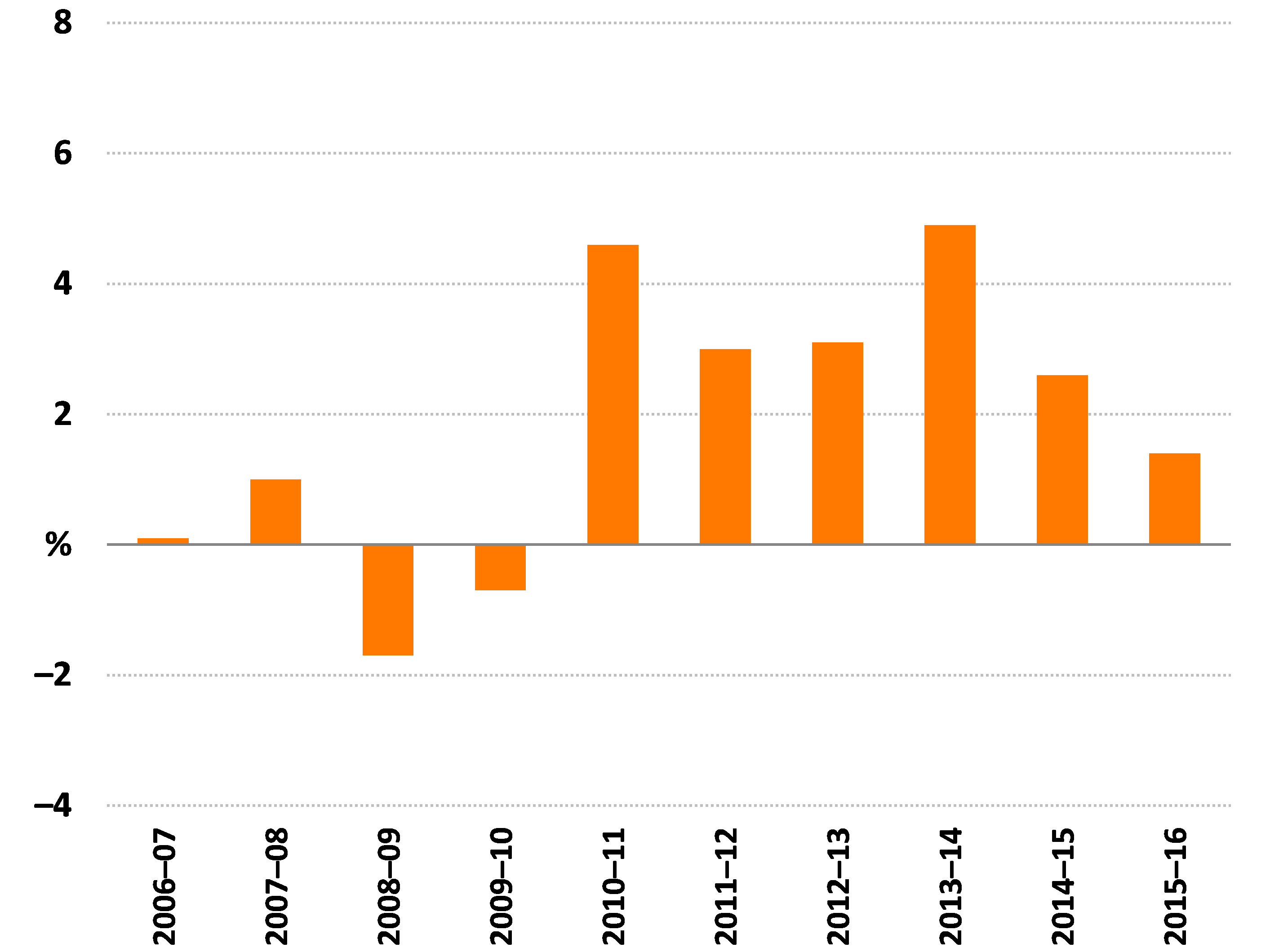

The average rate of return (excluding capital appreciation) for irrigated dairy farms fell to 2.6 per cent in 2014–15, before falling further to 1.4 per cent in 2015–16 (Figure 6). In comparison, the average rate of return (excluding capital appreciation) over the survey period from 2006–07 to 2015–16 was 1.8 per cent.

average per farm

Source: ABARES Murray–Darling Basin Irrigation Survey

The distribution of rate of return in 2015–16 shows around 52 per cent of dairy farms recorded negative returns. An estimated 30 per cent of dairy farms recorded a rate of return of –5 per cent or less and 10 per cent of farms recorded a rate of return more than 5 per cent (Figure 7). An estimated 39 per cent of dairy farms recorded a rate of return between 0 and 5 per cent.

The group of dairy farms with a rate of return of less than –5 per cent had significantly smaller dairy herds, on average, than the better performing farms. Some of these poorer performing farms were in the process of scaling back their milk production in favour of alternative enterprises (mainly beef cattle) or were ceasing dairying altogether.

proportion of farms

Source: ABARES Murray–Darling Basin Irrigation Survey

Rice farms

Average farm cash income for rice farms in the Murray–Darling Basin is estimated to have been $273,100 in 2014–15, around 48 per cent higher than in 2013–14 (Table 4). Average income is estimated to have fallen by 49 per cent in 2015–16 to average $139,000 because of a substantial fall in rice receipts. Lower water allocations in 2015–16 meant the total area planted to rice was considerably lower than the previous year. Overall, total cash receipts declined by an estimated 22 per cent in 2015–16 and total cash costs fell by around 10 per cent.

Note: Data for 2015–16 are provisional estimates.

Source: ABARES Murray–Darling Basin Irrigation Survey

The average rate of return (excluding capital appreciation) for rice farms increased to 4.2 per cent in 2014–15, before falling to 1.4 per cent in 2015–16 (Figure 8). In comparison, the average rate of return (excluding capital appreciation) over the survey period from 2006–07 to 2015–16 was 1.7 per cent.

average per farm

Source: ABARES Murray–Darling Basin Irrigation Survey

The distribution of rate of return for rice growers in 2015–16 was clustered around 0, with an estimated 53 per cent of farms recording a rate of return between 0 and –5 per cent and 19 per cent of farms with a rate of return between 0 and 5 per cent (Figure 9). The remaining 28 per cent of farms were distributed relatively evenly with 15 per cent of farms having a rate of return less than –5 per cent and 12 per cent of farms have a rate of return higher than 5 per cent.

The characteristics of farms differed little by rate of return, although better performing farms generally had a wider mix of irrigated and dryland crops.

proportion of farms

Source: ABARES Murray–Darling Basin Irrigation Survey

Cotton farms

Average farm cash income for cotton farms in the Murray–Darling Basin is estimated to have been $474,900 in 2014–15, around 34 per cent lower than 2013–14. This decrease resulted from drier seasonal conditions and a substantially lower cotton crop (Table 5). Average income is estimated to have increased by 14 per cent in 2015–16 to average $541,000.

In 2015–16 average total cash costs fell by an estimated 8 per cent because of lower cropping costs—particularly fuel and contracts—associated with smaller areas of cotton planted. Lower crop receipts resulted in a fall in total cash receipt by around 2 per cent. As a consequence, average farm cash income for cotton growers rose by 14 per cent in 2015–16.

Note: Data for 2015–16 are provisional estimates.

Source: ABARES Murray–Darling Basin Irrigation Survey

The average rate of return (excluding capital appreciation) for cotton farms fell to 5.6 per cent in 2014–15, before rising to 6.4 per cent in 2015–16 (Figure 10). In comparison, the average rate of return (excluding capital appreciation) over the survey period from 2006–07 to 2015–16 was 5.0 per cent.

average per farm

Source: ABARES Murray–Darling Basin Irrigation Survey

In 2015–16 most cotton farms recorded a rate of return between –5 per cent and 5 per cent (63 per cent of farms), while an estimated 24 per cent of cotton farms recorded a rate of return of more than 10 per cent (Figure 11).

An estimated 7 per cent of cotton farms recorded a rate of return of less than 10 per cent in 2015–16. These farms operated much smaller areas (630 hectares) than the average area for better performing farms (more than 1,500 hectares). The poorer performing farms tended to have many dryland crops with only small areas of irrigated crops.

proportion of farms

Source: ABARES Murray–Darling Basin Irrigation Survey

Water use and trade

Variation in farm-level water use

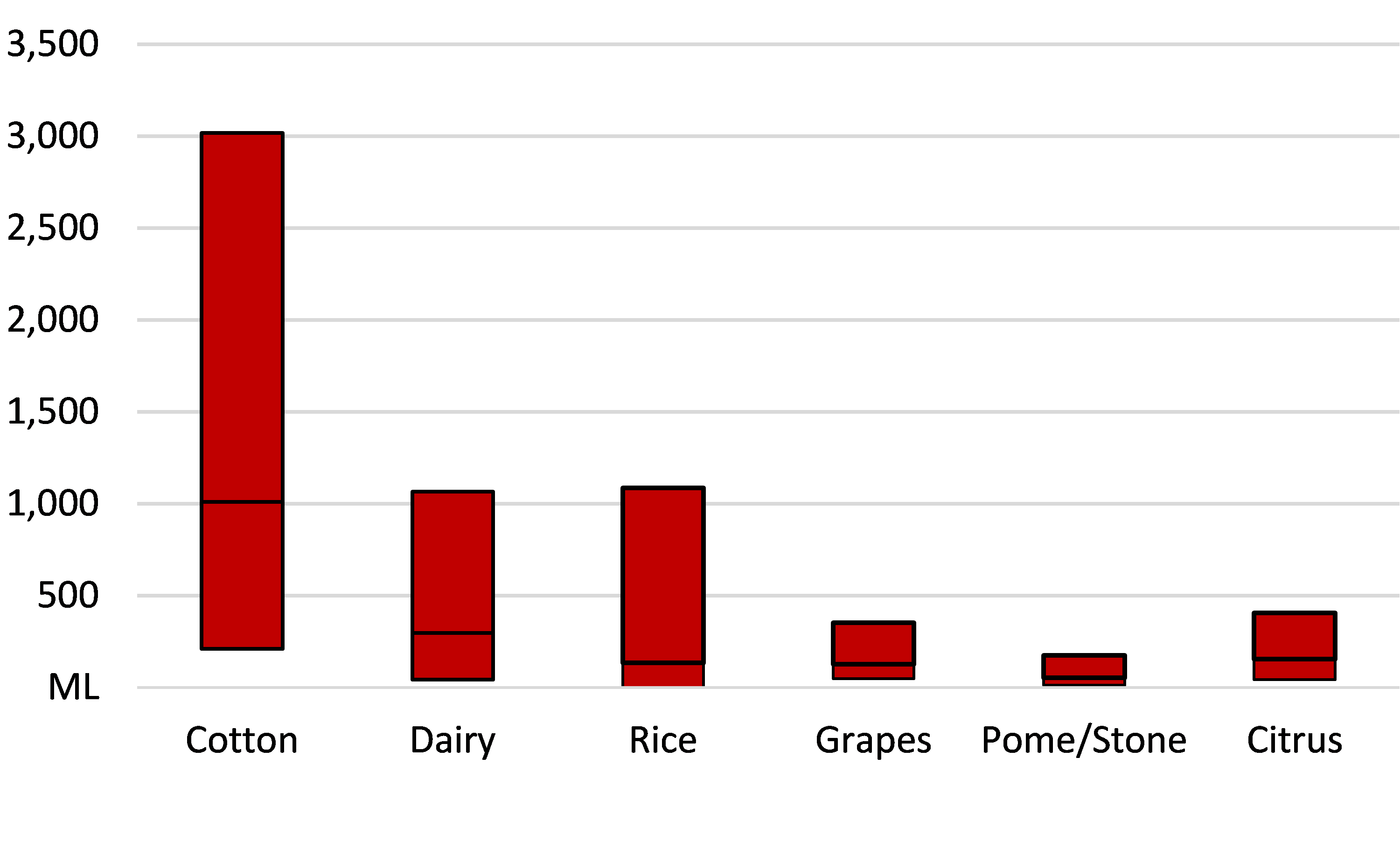

Water use on irrigation farms in the Murray–Darling Basin is highly variable from year to year (Figure 12). A range of factors influences the use of water on individual farms, including changes in seasonal conditions, water availability, the mix and type of irrigated enterprises and trade in seasonal water allocations and permanent water entitlements. These factors also influence changes in water use efficiency from year to year (discussed further in the next chapter).

Over the period 2006–07 to 2015–16 cotton, dairy and rice farms had the widest annual variation in average water use per farm (Figure 13). Horticulture farms (citrus, pome fruit, stone fruit and grapes) had relatively small annual variation in average water use per farm. These results reflect the flexibility that cotton, dairy and rice farms have in adjusting water use according to prevailing seasonal and market conditions. Horticulture farms, in contrast, have comparatively little flexibility in adjusting water use from one year to the next.

Source: ABARES Murray–Darling Basin Irrigation Survey

Trade in allocation water

The Murray–Darling Basin, particularly the southern Basin, is Australia’s main water market. In 2012–13 the Basin accounted for around 94 per cent of the total volume of permanent entitlement and allocation trade in Australia (National Water Commission 2014). The southern Basin contains several hydrologically connected water systems that cross the borders of New South Wales, Victoria and South Australia. With around 80 per cent of the Basin’s major storage capacity and a mature market for interstate trading, the southern Basin accounts for more than 80 per cent of total Basin water trading (BOM 2011; National Water Commission 2014).

As water availability increased the indicator price for allocation water in the southern connected Murray–Darling Basin fell from around $925 a megalitre in 2007 to around $25 a megalitre in 2011 (Morey, Grinlinton & Hughes 2015). Prices thereafter gradually increased to around $130 a megalitre in 2014 as water availability declined (Figure 14). Factors affecting supply and demand in water markets include weather conditions (particularly rainfall amount and distribution), prices for irrigated commodities, physical and hydrological constraints to water supplies, and jurisdictional water policies and water market administration (National Water Commission 2014).

Source: Morey, Grinlinton & Hughes 2015

The proportion of irrigation farms trading water allocations has fluctuated in line with changes in water availability (Figure 15). During the drought years—2006–07, 2007–08 and 2008–09—the proportion of dairy, horticulture and rice farms trading water allocations increased (mostly in the southern Murray–Darling Basin). When seasonal conditions improved and water allocations increased in 2009–10 and 2010–11, participation in water allocation trading declined.

Source: ABARES Murray–Darling Basin Irrigation Survey

From 2011–12 to 2013–14 increased proportions of irrigators began trading water allocations because of drier seasonal conditions and as some farms reduced their holdings of permanent water entitlements and placed greater reliance on the market to source water supplies. Trends in the proportion of cotton farms trading water allocations differ from the other industries because of the greater concentration of cotton farms in the northern Basin, where there is less water trading than in the southern Basin. Nevertheless, increases in the number of irrigators growing cotton in the southern Basin has contributed to higher proportions of cotton growers trading allocations in 2014–15 and 2015–16.

Since 2012–13 dairy farmers have become large net buyers of allocations, partly in response to reduced holdings of water entitlements and adopting a strategy of purchasing water allocations on the market each year (Figure 16). Rice growers were also net buyers of allocations in 2013–14 and 2014–15; horticulture farms were net sellers of allocations in 2014–15.

Sales of water entitlements

The market for permanent water access entitlements has also provided irrigators with an important tool for managing their farm businesses. There have been fewer trades in entitlements than in water allocations because decisions on whether to buy or sell permanent entitlements are generally based on longer term considerations than for trading water allocations.

From 2006–07 to 2014–15, a relatively small proportion of irrigators in the Murray–Darling Basin sold permanent water access entitlements each year. Over this period, an average of 6 per cent of horticulture farms, 8 per cent of dairy farms, 5 per cent of rice farms and 2 per cent of cotton farms sold entitlements each year (Figure 17). Smaller proportions of irrigators purchased entitlements each year—1 per cent of horticulture farms, 3 per cent of dairy farms, and 3 per cent of irrigated broadacre farms. In aggregate the number of irrigators that sold entitlements over the period would have been much higher—that is, different irrigators selling each year—but it is not possible to accurately estimate the extent of this from the survey data.

Source: ABARES Murray–Darling Basin Irrigation Survey

Irrigation technology

As part of water policy reforms in recent years, the Australian Government has provided funds to assist irrigators invest in more efficient and productive on-farm irrigation technologies. The results from the survey show movements toward more efficient irrigation technologies in some industries (particularly citrus, wine grapes and vegetables), resulting in reduced average water application rates. The survey results also show overall reductions in water application rates for many individual farms within the Basin, but these can vary significantly from year to year because of changes in seasonal conditions and water availability.

Around 5 per cent of irrigators made additions to irrigation capital each year over the period 2006–07 to 2013–14. On average, those farms making investments added more than $80,000 in new irrigation capital in most years. New investment in fixed irrigation infrastructure accounted for around 5 per cent of the average opening value of irrigation capital over the period. A number of farms in the survey made new investments in on-farm irrigation infrastructure that were significantly higher than the opening value of their irrigation capital. It appears that many of these farms were completely replacing existing irrigation systems with newer technologies.

In 2014–15 more than 90 per cent of dairy, rice and cotton farms used flood/furrow irrigation systems to apply water to crops (Table 6). Travelling irrigators were used by 28 per cent of dairy farms and 19 per cent of cotton farms.

On horticulture farms, the most employed irrigation systems were drip/trickle (62 per cent of farms) and low throw sprinklers (28 per cent of farms). A further 11 per cent of farms used flood/furrow irrigation in 2014–15.

The least used irrigation systems across all four industries were overhead sprinklers, moveable spray lines and micro spray systems. The highest use of any of these three systems in any of the industries was just 5 per cent.

Source: ABARES Murray–Darling Basin Irrigation Survey

Although the results vary slightly by crop type, average water application rates tended to decline over the survey period for rice and cotton (Figure 18). For most crops and pasture, water application rates rose in 2011–12 and 2012–13 because of greater water availability. For some crops, particularly rice and irrigated pasture, lower traded water prices were associated with higher water application rates per hectare in the latter survey years.

Survey methods

The ABARES survey of irrigation farms in 2014–15 collected information from broadacre (including rice and cotton), dairy and horticulture irrigation farms within the Murray–Darling Basin. Regional coverage was based on those defined by the CSIRO in its Sustainable Yields Project (CSIRO 2007).

ABARES field officers conducted the irrigation survey using face-to-face interviews between March and May 2015. The farm financial and physical information collected included land area and value, crop and livestock production and sales, irrigation water use by crop type and pasture, irrigation water delivery methods, farm receipts and costs, labour use, debts and assets and market values of farm capital.

The survey also included questions on types of water licences held, participation in water trading, types of irrigation infrastructure, basis for irrigation scheduling decisions, and future intentions.

While every effort was made to interview the same farms in most years, this was not possible in all regions and industries. In some cases, changes in the composition of the sample resulted in relatively large differences in estimates between years. Relative standard errors can be used to indicate whether changes in the estimates are statistically significant or not.

Target populations

ABARES surveys are designed and samples selected on the basis of a framework drawn from the Business Register maintained by the Australian Bureau of Statistics (ABS). This framework includes agricultural establishments (farms) classified by size and industry in each statistical local area. To be eligible for this survey, farms had to have engaged in irrigated agricultural activities during 2013–14, had an estimated value of agricultural operations of $40,000 or more, and be defined as broadacre, dairy or horticulture industry farms.

The industry definitions used in this report are based on the Australian and New Zealand Standard Industrial Classification (ANZSIC). This classification is consistent with an international standard and permits comparisons between industries, both within Australia and internationally. Farms assigned to a particular ANZSIC class have a high proportion of their total output characterised by that class (ABS & SNZ 2006).

The ANZSIC industry classes and codes associated with the broadacre, dairy and horticulture categories used for this study were:

| Industry | ANZSIC industry class | ANZSIC industry code |

|---|---|---|

| Broadacre | Sheep farming | ANZSIC code 0141 |

| Beef cattle farming | ANZSIC code 0142 | |

| Sheep–beef cattle farming | ANZSIC code 0144 | |

| Grain–sheep and grain–beef cattle farming | ANZSIC code 0145 | |

| Rice growing | ANZSIC code 0146 | |

| Other grain growing | ANZSIC code 0149 | |

| Cotton growing | ANZSIC code 0152 | |

| Dairy | Dairy cattle farming | ANZSIC code 0160 |

| Horticulture | Vegetable growing (under cover) | ANZSIC code 0122 |

| Vegetable growing (outdoors) | ANZSIC code 0123 | |

| Grape growing | ANZSIC code 0131 | |

| Apple and pear growing | ANZSIC code 0134 | |

| Stone fruit growing | ANZSIC code 0135 | |

| Citrus fruit growing | ANZSIC code 0136 | |

| Other fruit and tree nut growing | ANZSIC code 0139 |

Survey design

The farm population to be surveyed was stratified by operation size using the estimated value of agricultural operation (EVAO). The size of each stratum was determined using the Dalenius–Hodges method (Lehtonen & Pahkinen 2004). The sample allocation to each stratum was performed using a mixture of the Neyman allocation, which takes into account variability within strata of the auxiliary variable (in this case EVAO), and proportional allocation, which only considers the population number in each stratum. The Neyman allocation allocates large proportions of sample to strata with large variability—in the case of this survey, strata of larger farms (Lehtonen & Pahkinen 2004).

Sample weighting

Farm-level estimates published by ABARES are calculated by appropriately weighting the data collected from each sample farm and then using the weighted data to calculate population estimates. Sample weights are calculated so that population estimates from the sample for numbers of farms, areas of crops and numbers of livestock correspond as closely as possible to the most recently available ABS estimates from agricultural census and surveys data. The weighting methodology uses a model-based approach, with a linear regression model linking the survey variables and the estimation benchmark variables. The details of this method are described in Bardsley and Chambers (1984).

Generally, larger farms have smaller weights and smaller farms have larger weights, reflecting both the strategy of sampling a higher fraction of large farms than small farms (the former having a wider range of variability of key characteristics and accounting for a much larger proportion of total output), and the relatively lower number of large farms.

Reliability of estimates

Reliability of the estimates of population characteristics presented in this report depends on design of the sample and accuracy of the measurement of characteristics for the individual sample farms.

Sampling errors

Only a small number of farms out of the total number of farms in a particular industry or region are surveyed. The data collected from each sample farm are weighted to calculate population estimates. Estimates derived from these farms are likely to be different from those that would have been obtained if information had been collected from a census of all farms. Any such differences are called sampling errors.

The size of the sampling error is most influenced by the survey design and the estimation procedures, as well as the sample size and variability of farms in the population. The larger the sample size, the lower the sampling error is likely to be. Therefore, national estimates are likely to have smaller sampling errors than industry and region estimates.

References

ABARES 2015a, Agricultural commodities: December quarter 2015, Australian Bureau of Agricultural and Resource Economics and Sciences, Canberra, December.

ABARES 2015b, Agricultural commodity statistics 2015, Australian Bureau of Agricultural and Resource Economics and Sciences, Canberra, December.

ABS 2016, Water use on Australian farms 2014–15, cat. no. 4618.0, Canberra, April.

ABS & SNZ 2006, Australian and New Zealand Standard Industrial Classification 2006—ANZSIC, Australian Bureau of Statistics, cat. no. 1292.0, Canberra, February.

Bardsley, P & Chambers, R 1984, ‘Multipurpose estimation from unbalanced samples’, Journal of the Royal Statistical Society, series C (applied statistics), vol. 33, pp. 290–299.

BOM 2011, National Water Account 2011, Bureau of Meteorology, Melbourne.

BOM 2015, National Water Account 2014, Bureau of Meteorology, Melbourne.

CSIRO 2007, ‘The Murray–Darling Basin Sustainable Yields Project’, Canberra.

DPI Water 2016, ‘Real time data, major dams’, New South Wales Department of Primary Industries Water.

Lehtonen, R & Pahkinen, E 2004, Practical methods for design and analysis of complex surveys, 2nd edn, John Wiley & Sons, Finland.

Morey, K, Grinlinton, M & Hughes, N 2015, Australian water markets report 2013–14, ABARES report prepared for the Department of Agriculture and Water Resources, Canberra.

National Water Commission 2014, Australian water markets: trends and drivers 2007–08 to 2012–13, Canberra.