Peter Martin, Caroline Levantis, Walter Shafron, Paul Philips and James Frilay

Farm debt

Debt is an important source of funds for farm investment and ongoing working capital for the broadacre and dairy industries. This is because more than 95 per cent of farms in these sectors are family owned and operated. Funding by family farms for expansion and improvement is limited to the funds available to the family, the profits the business can generate and the funds it can borrow.

Change in farm debt over time is the balance between the amount of principal repaid and the increase in principal owed (new borrowing). The increase in broadacre and dairy industry debt is the result of increased borrowing and reduced loan principal repayments through much of the 2000s.

Lower interest rates from the late 1990s and increased lending fuelled the boom in land prices. This raised farm equity (net wealth) and induced lenders to provide more finance. This continued until there was a correction in land values in some regions after 2009 and a tightening of lending practices by banks in recent years. Provision of interest subsidies to farmers in drought through exceptional circumstances arrangements supported debt servicing. In many regions this assistance was sustained for most of the 2000s.

Several factors in addition to lower interest rates contributed to the growth in debt over this period. Structural adjustment resulted in broadacre farmers changing the mix of commodities produced and increasing farm size. An increase in the average size of farm enterprises resulted in higher borrowing for ongoing working capital. Factors that contributed to increased working capital debt included movement away from less input-intensive wool production into more intensive cropping, changes in grain payment methods, higher variability in crop incomes compared with livestock incomes and movement to more intensive production technologies involving greater use of purchased inputs such as herbicides.

Loan repayment slowed and borrowing to meet working capital requirements increased during the 2000s drought. Working capital debt accounted for 30 per cent of the increase in average farm debt for broadacre farms between 2000–01 and 2016–17.

From 2000–01 to 2016–17 average broadacre and dairy farm debt more than doubled, mainly resulting from an increase in average farm size. The increase in average debt per farm was modest relative to the increase in average equity of farm business owners. The capacity to repay debt also improved as the proportion of net income needed to meet interest payments increased by less than the increase in debt.

Borrowing increased most for land purchase and on-farm investment. Borrowing for ongoing working capital also rose in line with increases in average farm size and greater mechanisation and intensification of enterprises.

Broadacre farm debt is estimated to have increased by 5 per cent during 2016–17 to average $616,900 per farm at 30 June. In contrast, dairy industry debt declined by around 2 per cent to average $926,700 per farm (Table 7).

Borrowing to fund new on-farm investment, particularly the purchase of land, machinery and vehicles, was the largest contribution to the increase in average broadacre farm debt. In particular, debt to fund land purchase accounted for the largest share (an estimated 52 per cent) of the increase in average debt for broadacre farms between 2000–01 and 2015–16.

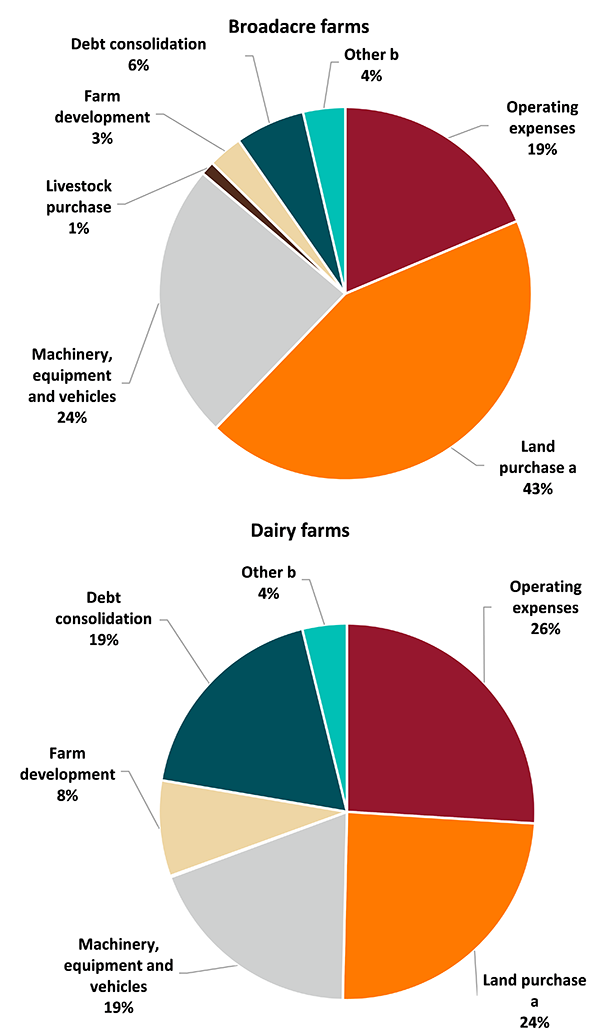

During 2016–17 most new borrowing for broadacre and dairy farms funded new on-farm investment (Figure 1). The proportion of new borrowing to cover operating expenses was higher in the dairy industry (26 per cent) than the broadacre industries (19 per cent). A higher proportion of borrowing for operating expenses is common for more intensive farm enterprises.

average per farm

a Includes purchase of permanent irrigation water entitlement. b Includes borrowing to fund changes in farm business ownership/partnership.

p Preliminary estimates.

Data and other resources

Broadacre and dairy industries data

AgSurf provides a large selection of ABARES farm survey data on the broadacre and dairy industries.

Beef, lamb and sheep industries data

A large selection of ABARES farm survey data on the beef, slaughter lambs and sheep industries.

Farm surveys definitions and methods

Further information about our survey definitions and methods.

Previous reports

See our publications page for previous versions of the report Australian farms surveys results.

About my region

ABARES has produced a series of individual profiles of the agricultural, forestry and fisheries industries in your region. Each regional profile presents an overview of the agriculture, fisheries and forestry sectors in the region, and the recent financial performance of the broadacre and, where relevant, dairy, vegetable, and sugarcane industries.