Alistair Read

Key points

- Feedlots, and grain-fed beef production, are becoming increasingly important for Australian beef production.

- Feedlots play an important role in smoothing out Australian beef production and export availability.

- Grain-fed cattle have made up a growing share of Australian beef exports over the last two decades.

- Drier seasonal conditions in 2023–24 are expected to increase the number of cattle in feedlots.

The Australian cattle feedlot industry is steadily growing

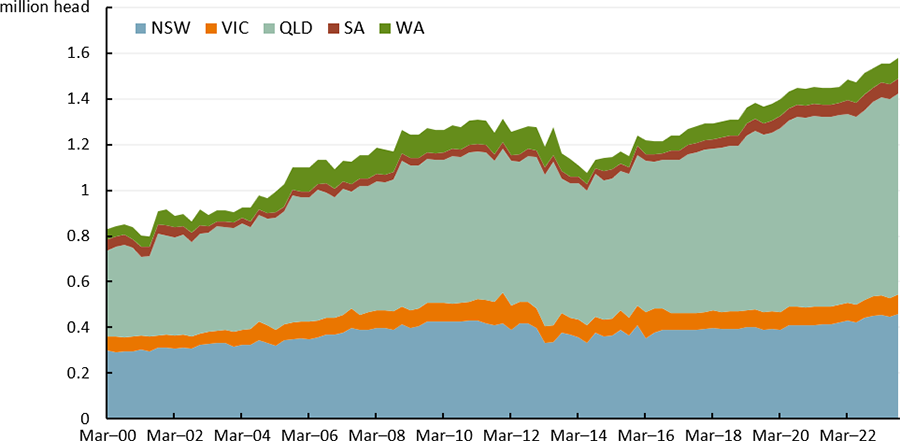

Australia’s cattle feedlot industry has been steadily growing over recent decades, driven by sustained growth in Queensland (Figure 1.1). Over the last decade, the capacity of the industry has grown by 36%. Queensland has led the increase in capacity (up by 49% or around 289,000 head since September 2013), followed by New South Wales (up by 21% or around 81,000 head).

Figure 1.1 Quarterly feedlot capacity by state

Growth in the cattle feedlot industry has primarily been driven by larger feedlots. The average number of cattle on feed at large feedlots (with more than 10,000 cattle on feed) has grown at an average of 5% per year over the last decade, while the number of cattle on feed at small feedlots has declined. The shift is likely driven by the improved efficiency and competitiveness that can be realised by operating a larger feedlot.

Feedlots are an integral component of Australia’s cattle production pipeline

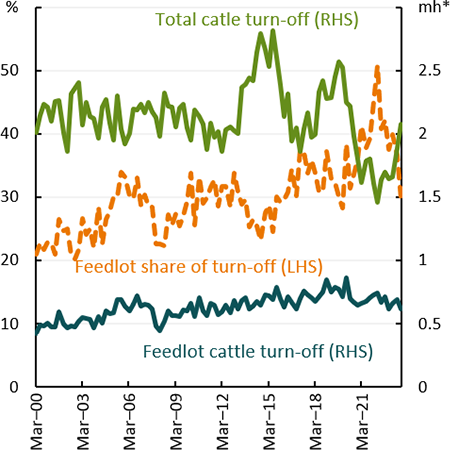

Historically, feedlots have played a role in ‘drought proofing’ Australia’s beef industry. Feedlots help Australia provide a consistent supply of beef to both domestic and export markets, as well as an option for farmers to ‘finish’ cattle that may not otherwise meet processor specifications. While cattle turn-off from feedlots has remained stable in absolute terms, it has increased as a proportion of total cattle turn-off in Australia. During years with good seasonal conditions, such as the period from 2020 to 2023, feedlots share of total turn-off typically increases. This reflects lower grass-fed cattle turn-off as farmers look to rebuild their herds.

The ability for feedlots to maintain a consistent cattle turn-off despite changes in seasonal conditions is beneficial to Australia’s beef production system as it provides Australia, and major trading partners, with a more consistent supply of beef products. For example, during drier years when herd destocking is occurring, feedlots ensure that Australia continues to be able to service beef demand from our key export markets. As such, feedlots play an important role in Australian cattle production (Figure 1.2). In the September 2023 quarter, feedlots accounted for around 30% of Australia’s total quarterly cattle turn-off. In Queensland, the largest cattle producing state in Australia, feedlots represented 39% of total cattle turn-off in the September 2023 quarter.

Figure 1.2 Quarterly cattle turn-off

Source: ABARES; ABS; ALFA

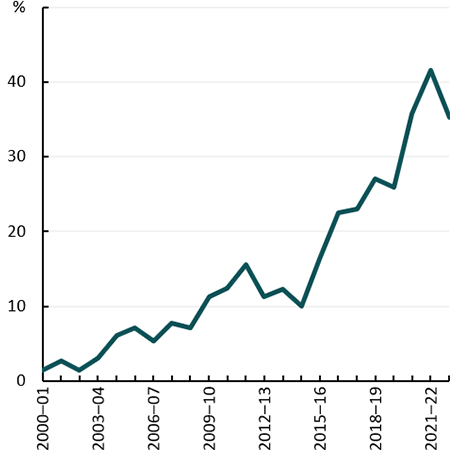

Figure 1.3 Proportion of annual Australian beef exports that are grain-fed

Grain-fed beef exports are rising

Australian grain-fed beef exports have become an increasingly important component of Australia’s beef exports. Over the decade to 2022–23, grain-fed beef exports have risen from 11% of total beef exports to 35%, reflecting the growing proportion of cattle on feedlots (Figure 1.3). The share of grain-fed beef exports peaked at 42% of exports in 2021–22. This peak was driven by favourable seasonal conditions and strong pasture growth which led to significant herd restocking in Australia. As a result, lower numbers of grass-fed cattle for slaughter reduced grass-fed beef production and exports. The ongoing growth of Australia’s feedlot sector is expected to support the reliability of Australia’s supply of exportable beef products by dampening the effect of seasonal conditions. This in turn is expected to incentivise importing countries to purchase Australian products.

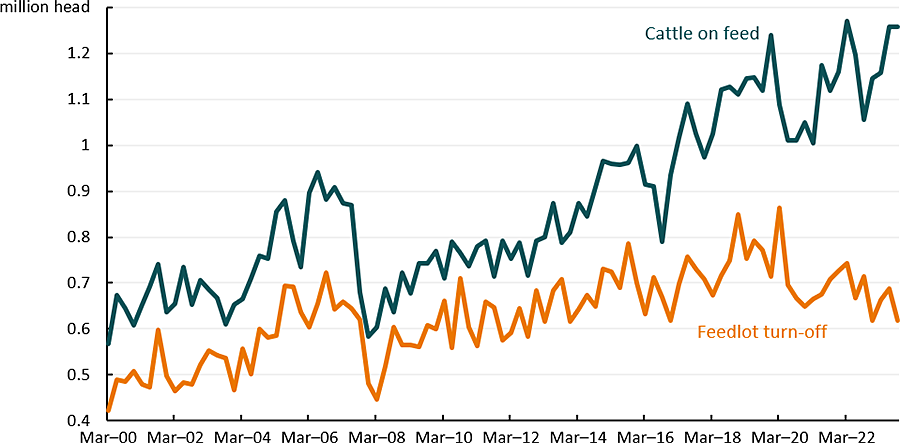

Feedlot profitability is rising, leading to more cattle on feed

The profitability of feedlots has been rising over recent months, incentivising feedlots to purchase more cattle. Drier conditions over recent months have reduced pasture availability, increased the supply of cattle to saleyards and lowered feeder steer prices. The price of feeder steers is a key input cost that affects the profitability of lot feeders, alongside feed barley and wheat prices. Lower feeder steer prices make it cheaper and easier for feedlots to purchase cattle, add weight to the cattle and then sell them off at a higher price.

In the September 2023 quarter, the average feeder steer price fell by around 14%. While the average prices of barley and stockfeed wheat prices remain elevated, prices fell in the Darling Downs, Queensland by 3% and 9%, respectively. Lower prices for these inputs, combined with relatively high beef prices contributed to the number of cattle on feed in the September 2023 quarter reaching the second highest level on record at 1.3 million head (Figure 1.4). This included a record number of cattle on feed in Queensland.

Figure 1.4 Quarterly Australian cattle on feed and feedlot turn-off

Drier conditions over 2023-24 to increase the number of cattle on feed

The number of cattle on feed is expected to continue rising in 2023–24 as drier seasonal conditions and lower cattle prices more than offset elevated grain prices. Growth in the number of cattle in feedlots is expected to be driven by:

- Significant herd growth over recent years, which is expected to increase the supply of cattle to saleyards in 2023–24. This is expected to lower saleyard cattle prices, a key input cost for feedlots.

- The onset of both El Niño and a positive Indian Ocean Dipole in 2023–24 is expected reduce pasture availability across eastern Australia, making it harder for farmers to finish cattle on pasture. This increases the need for farmers to use feedlots to finish cattle consistent with processor specifications.

- A relatively weak Australian dollar which increases the competitiveness of Australian beef exports denominated in Australian dollars.

These incentives for producers to increase the number of cattle on feed is expected to be somewhat offset by elevated grain prices. Australian grain prices are expected to fall, but remain historically elevated, due to continued uncertainty surrounding Ukrainian grain exports out of the Black Sea as well as reduced domestic production.

Feedlots are expected to respond to this combination of factors by reducing the length of feed programs and increasing capacity utilisation by purchasing more cattle. When cattle prices fall by more than grain prices, it becomes more profitable for feedlots to shift towards shorter feed programs and higher cattle throughput. This shift typically leads feedlots to prioritise buying heaver feeder cattle over lighter feeder cattle from saleyards as heavier cattle takes less time to reach the specifications desired by meat processors.

Feedlot capacity utilisation has remained relatively strong over recent years despite elevated feeder cattle and grain prices reducing feedlot profitability. Capacity utilisation is expected to rise in 2023–24 as lower feeder cattle prices reduce input costs.

Feeder cattle and grain prices are the two biggest input costs for feedlots, so changes in prices for these commodities can impact feedlot capacity utilisation rates. Historically, feedlot capacity utilisation is lower during the rebuilding phase of the cattle cycle as higher feeder cattle prices increase feedlot input costs and reduce profitability. By contrast, feedlot capacity utilisation rates are generally higher in the destocking phase.

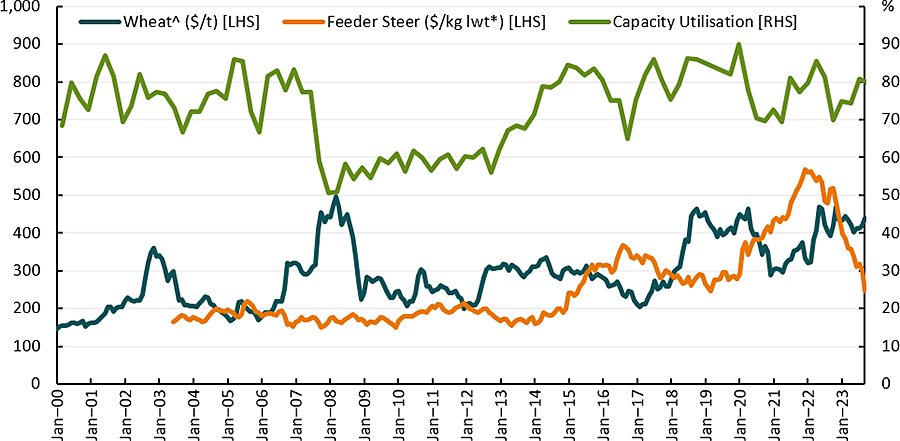

Grain prices are a smaller, but nonetheless important input cost for feedlots. Grain prices typically rise during drier seasonal conditions (as grain supply decreases). High grain prices increase input costs for feedlots, incentivising lower rates of capacity utilisation. However, grain prices are typically inversely related with cattle prices (Figure 1.5). For example, during a drought, domestic grain supply typically decreases while domestic cattle supply increases.

Feedlots have experienced difficult operating conditions since 2020 as restocking demand led cattle prices to record highs while the Russian invasion of Ukraine caused grain prices reach near record highs, raising input costs for feedlots (Figure 1.5). Despite difficult conditions, capacity utilisation between 2020–2022 remained relatively strong, averaging 76%. Previous periods of high input prices occurred in 2008 to 2013 and in 2015 to 2016 saw utilisation rates of 60% and 77% respectively.

Figure 1.5 Monthly wheat and feeder steer prices and quarterly feedlot capacity utilisation

Note: Capacity utilisation measured as the number of cattle on feed divided by feedlot capacity.

Source: ABARES; ALFA; MLA

Capacity utilisation rates are expected to rise in 2023–24 as falling cattle prices lead to an increase in the number of cattle in feedlots. In June 2023, the Australian feedlot utilisation rate was 81% (Figure 1.5). Capacity utilisation rates typically peak at 80–85%. The onset of dry conditions in 2019 saw the utilisation rate increase to a peak of 90%. If capacity growth follows recent trends, and capacity utilisation reached 85%, the quarterly number of cattle on feed could reach over 1.35 million head in 2023–24.