Download Full Report and Data

The Australian Crop Report contains ABARES forecasts for the area, yield and production of Australia’s major winter and summer broadacre crops. Forecasts are made at the Australian state level.

Download the full report

- Australian Crop Report: September 2024 No. 211 (PDF - 870 KB)

- Australian Crop Report: September 2024 No. 211 (Word - 4.6 MB)

Download the data

Key points

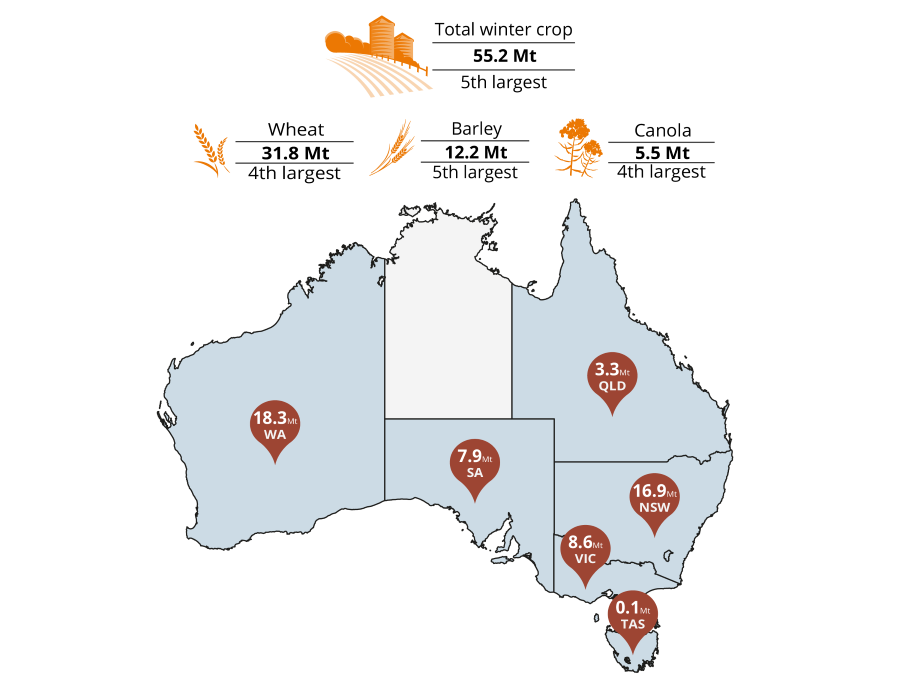

- National winter crop production to increase to 55.2 million tonnes in 2024–25, 17% above the 10-year average.

- Winter crop prospects are mostly favourable in New South Wales, Queensland and Western Australia.

- Less favourable conditions have reduced production prospects in South Australia and Victoria.

- Planting of summer crops to remain above average in 2024–25, reflecting an increased chance of above average spring rainfall in New South Wales and Queensland.

Above average winter crop production forecast for 2024–25

Australian winter crop production is forecast to increase by 17% to 55.2 million tonnes in 2024–25 (Figure 1). This is 17% above the 10-year average to 2023–24 of 47 million tonnes and if realised, would be the fifth highest on record. While production is forecast to increase overall, varying seasonal conditions across Australia point to different state-level outlooks.

- Winter crop production is forecast to rise to near-record levels in New South Wales and Queensland. Winter crops have excellent yield potential heading into spring following a strong start to the winter cropping season and above average rainfall in most cropping regions.

- Improved seasonal conditions in Western Australia have boosted production prospects, with winter crop production now expected to be above average. Despite a dry start to the season, winter crops have developed well following timely winter rainfall, particularly across northern and western cropping regions.

- By contrast, production prospects are lower in South Australia and Victoria. Planting and establishment conditions were unfavourably dry across major cropping regions in South Australia and parts of Victoria. Dry conditions throughout the season have led to moisture stress with winter crop yields in these regions forecast to be below average.

According to the latest three-month rainfall outlook (September to November), issued by the Bureau of Meteorology on 22 August 2024, there are roughly equal chances of higher or lower than average spring rainfall across most Australian cropping regions. There is a higher chance that spring rainfall will be average to above average in New South Wales and Queensland. Daytime temperatures during spring are expected to be above average across cropping regions in all states except Western Australia. Most areas with average or better levels of soil moisture are likely to receive enough rainfall to support winter crops through critical development stages. However, the increased chance of warmer spring conditions presents a potential downside risk for winter crops that are already experiencing moisture stress – particularly in cropping regions in South Australia, Victoria and southern New South Wales where root zone soil moisture levels in August were below average.

National winter crop production has been revised up 7% compared to the June 2024 Australian crop report. This reflects improved production in New South Wales, Queensland and Western Australia which is expected to more than offset reduced production in South Australia and Victoria. The crop production forecast for all major winter crops represents an upwards revision from the June forecast.

- Wheat production is forecast to increase by 23% to 31.8 million tonnes in 2024–25, 20% above the 10-year average to 2023–24.

- Barley production is forecast to increase by 13% to 12.2 million tonnes in 2024–25, 7% above the 10-year average to 2023–24.

- Canola production is forecast to fall by 8% to 5.5 million tonnes in 2024–25, driven by a forecast year-on-year decrease in total area planted. Area planted, however, remains above the 10-year average resulting in expected canola production remaining 22% above the 10-year average to 2023–24.

- Lentil production is forecast to increase by 7% to 1.7 million tonnes in 2024–25. This is more than double the 10-year average to 2023–24, with the expansion in area planted to lentils expected to more than offset lower yields.

- Chickpea production is forecast to increase by 171% to 1.3 million tonnes in 2024–25, 70% above the 10-year average to 2023–24. This reflects a significant expansion in area and high expected yields in New South Wales and Queensland, given high expected margins and favourable conditions. If realised, this will be the second highest chickpea harvest on record.

Area planted to winter crops in 2024–25 is forecast to increase by 5% to 24 million hectares. This is slightly below the record highs of 2020–21 and 2021–22 but sits 9% above the 10-year average to 2023–24. The increase is driven by a greater area planted to winter crops in New South Wales (up 17%) and Queensland (up 34%) owing to improved conditions in both states.

Figure 1 Australian winter crop production, 2024–25

Summer crop plantings to remain above average in 2024–25

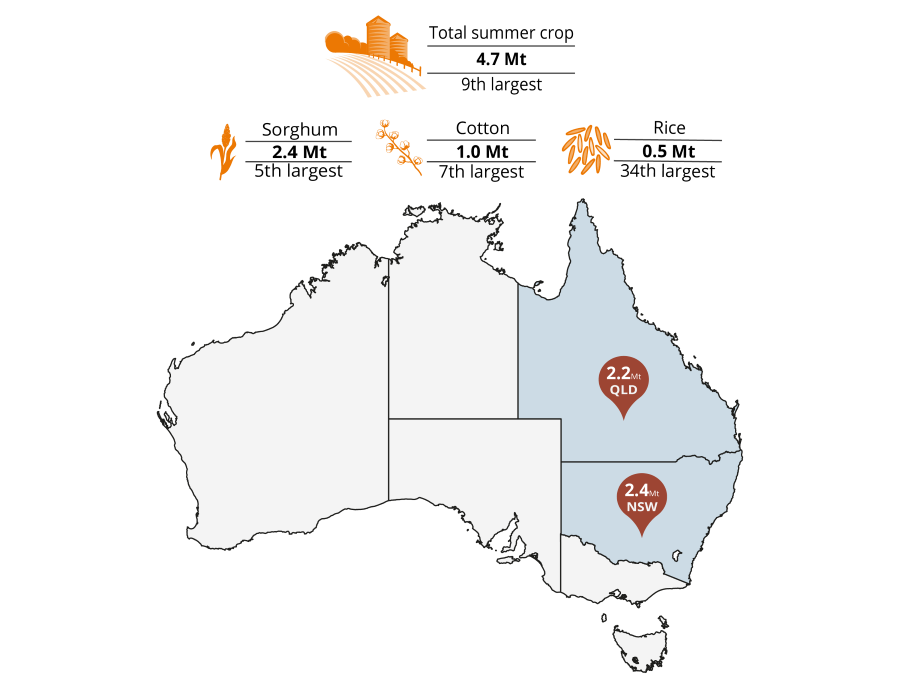

Area planted to summer crops in 2024–25 is forecast to remain above average at 1.3 million hectares. This is supported by above average soil moisture levels in late winter and the favourable spring rainfall outlook across key summer cropping regions in New South Wales and Queensland. Summer crop production is forecast to remain similar to 2023–24 levels at 4.7 million tonnes (Figure 2). This is 28% above the 10-year average to 2023–24 of 3.6 million tonnes.

Sorghum production is forecast to increase by 9% to 2.4 million tonnes in 2024–25. The increased chance of above average spring rainfall and above average soil moisture levels are expected to support the production potential of sorghum crops. Area planted to sorghum is forecast to increase by 5% to 622 thousand hectares, reflecting expected favourable conditions forecast during the planting window and higher expected margins relative to cotton.

Production of cotton lint is forecast to fall by 7% to 1 million tonnes in 2024–25, reflecting a reduction in planted area. Area planted to cotton is forecast to fall by 5% to 453 thousand hectares in 2024–25, as falling world cotton prices reduce expected returns relative to other crops such as sorghum, disincentivising cotton planting in dryland areas. Despite the reduction in area, high water availability and an above-average rainfall outlook across much of eastern Australia is expected to support yields, with the production forecast sitting 28% above the 10-year average to 2023–24.

Rice production is forecast to fall by 17% to 518 thousand tonnes in 2024–25. A forecast 14% decline in area planted in New South Wales motivated by lower global prices is expected to drive the decline in production. High water availability across the Murray-Darling basin and a favourable rainfall outlook through spring is expected to support average yields.

Figure 2 Australian summer crop production, 2024–25

Winter crop production in Queensland is forecast to increase by 94% to reach 3.3 million tonnes in 2024–25, the third highest production on record. This is 62% above the 10-year average to 2023–24 and represents a 15% upwards revision from the June 2024 Australian crop report. This increase in production is attributed to above average sub-soil moisture availability across most areas. Additionally, the spring climate outlook is expected to offer favourable conditions for crop flowering and grain-filling, helping to sustain strong yield potential.

Winter crop yields are forecast to rise by 45% to around 2.19 tonnes per hectare in 2024–25, 32% above the 10-year average to 2023–24 and represents a 10% upwards revision from the June 2024 Australian crop report. The climate outlook (issued by the Bureau of Meteorology on 22 August 2024) suggests a 50 to 65% chance of above average rainfall for most cropping regions in Queensland. Coupled with currently above average sub-soil moisture, this favourable climate outlook is expected to maintain above average yield prospects.

Area planted to winter crops in Queensland is forecast to be 1.5 million hectares in 2024–25, rising by 34% year-on-year and sitting 29% above the 10-year average to 2023–24. The year-on-year expansion in area is attributed to the optimal start to the cropping season, driven by adequate rainfall and high soil moisture levels at planting. Chickpeas saw the largest percentage increase in area, up 73% year-on-year. The announcement of a tariff-free period for Australian chickpeas by India has supported a rapid rise in chickpea prices, acting as a catalyst for a significant expansion in chickpea area this season.

| Crop | Area '000 ha | Yield t/ha | Production Kt | Area change % | Prod. Change % |

|---|---|---|---|---|---|

| Wheat | 900 | 2.33 | 2,100 | 25 | 94 |

| Barley | 180 | 2.83 | 510 | 20 | 70 |

| Chickpeas | 380 | 1.68 | 640 | 73 | 129 |

Note: Yields are based on area planted. Area includes planted crop that is harvested, fed off or failed. Percent changes are relative to 2023–24.

Source: ABARES

Summer crop production in Queensland is forecast to rise by 7% to 2.2 million tonnes in 2024–25. This is 28% above the 10-year average to 2023–24. The year-on-year rise in production is attributed to a larger area planted to summer crops, supported by above average soil moisture levels and an increased probability of above median rainfall from September to November. This combination is expected to sustain a healthy soil moisture profile, and consequently, enhance yield potential. The total area planted to summer crops in Queensland is forecast to be 646 thousand hectares, which is an increase of 5% year-on-year and 5% above the 10-year average to 2023–24.

Sorghum production is forecast to increase by 10% to 1.7 million tonnes in 2024–25, 41% above the 10-year average to 2023–24. High levels of stored soil moisture and the favourable climatic outlook is expected to boost grower confidence and planting intentions, leading to an increase in the area allocated to sorghum. This shift also indicates a decrease in the area devoted to cotton for the current season. The forecast area increase reflects higher expected margins for sorghum relative to cotton. As such, the forecast area for sorghum is 440 thousand hectares, which is a 6% year-on-year increase and is 15% above the 10-year average to 2023–24.

Cotton lint production is forecast to fall by 6% to 292 thousand tonnes in 2024–25, driven by a reduction in planted area. Area planted to cotton is expected to decrease to 119 thousand hectares, as lower world cotton prices reduce expected returns relative to other crops such as sorghum. A favourable rainfall outlook for spring is expected to support soil moisture levels and allow for timely planting in dryland growing regions. Yields are expected to remain above the 10-year average to 2023–24.

| Crop | Area '000 ha | Yield t/ha | Production kt | Area change % | Prod. change % |

|---|---|---|---|---|---|

| Grain sorghum | 440 | 3.75 | 1,650 | 6 | 10 |

| Cotton lint | 119 | 2.45 | 292 | –2 | –6 |

| Cottonseed | 119 | 2.81 | 335 | –2 | –6 |

Note: Yields are based on area planted, except cotton which is based on area harvested. Area includes planted crop that is harvested, fed off or failed. Percent changes are relative to 2023–24.

Source: ABARES

Winter crop production in New South Wales is forecast to increase by 50% to 16.9 million tonnes in 2024–25 to the third highest production on record. This is 43% above the 10-year average to 2023–24 and represents a 12% upwards revision from the June 2024 Australian crop report. This improvement in production prospects follows high levels of soil moisture at the time of planting and average to above average rainfall in central and northern New South Wales throughout winter. The three-month rainfall outlook (issued by the Bureau of Meteorology on 22 August 2024) suggests a 50 to 65% chance of above average rainfall for most cropping regions in New South Wales. This is expected to continue to support high yield potentials throughout spring.

Winter crop yields are forecast to rise by 28% to 2.62 tonnes per hectare in 2024–25, 30% above the 10-year average to 2023–24. Average to above average soil moisture levels across New South Wales throughout winter, combined with the favourable rainfall outlook for spring, are expected to support increased yield prospects. However, yield prospects in southern cropping regions will be highly reliant on adequate and timely rainfall to realise current yield expectations due to the drier start to the season.

Area planted to winter crops in New South Wales is forecast to increase by 17% to 6.4 million hectares in 2024–25, the third highest planted area on record. This is 17% above the 10-year average to 2023–24 and represents a 6% upwards revision from the June 2024 Australian crop report. Favourable seasonal conditions at the time of planting led to area increases for all winter crops, with many expanding into regions not normally sown to winter crops such as northwest New South Wales.

Chickpea plantings are estimated to have increased by 133% showing the largest year-on-year percentage increase among winter crops in New South Wales this season. The increase in area planted is due to the Indian government’s announcement of a tariff free period for Australian chickpea exports. This saw an increase in Australian chickpea export prices and incentivised increased plantings.

The increase in wheat and barley area reflects above average subsoil moisture across much of New South Wales at the time of planting and favourable rainfall throughout winter. The increase in wheat and barley area includes those areas that did not get planted last season due to dry conditions.

Drier conditions during autumn coupled with lower soil moisture levels in some southern cropping regions in New South Wales – where canola is predominantly grown – limited canola area expansions across the state to a 7% year-on-year increase, the lowest expansion of all New South Wales winter crops. Despite this lower relative rate of increase, the canola area forecast represents the third highest on record for the state due to favourable planting conditions in central New South Wales.

| Crop | Area '000 ha | Yield t/ha | Production kt | Area change % | Prod. Change % |

|---|---|---|---|---|---|

| Wheat | 3,750 | 2.93 | 11,000 | 14 | 55 |

| Barley | 980 | 2.86 | 2,800 | 23 | 46 |

| Canola | 900 | 2.00 | 1,800 | 7 | 13 |

| Chickpeas | 350 | 1.86 | 650 | 133 | 294 |

Note: Yields are based on area planted. Area includes planted crop that is harvested, fed off or failed. Percent changes are relative to 2023–24.

Source: ABARES

Summer crop production in New South Wales in 2024–25 is forecast to fall by 5% to 2.4 million tonnes. This is 29% above the 10-year average to 2023–24. The forecast fall in production reflects an expected decrease in area planted to cotton and rice in 2024–25. Total area planted to summer crops is expected to fall by 3% to 627 thousand hectares.

Sorghum production is forecast to increase by 6% to 750 thousand tonnes in 2024–25. This is 45% above the 10-year average to 2023–24. Area planted to sorghum is forecast to increase by 3% to 180 thousand hectares in 2024–24, reflecting higher expected margins for sorghum relative to cotton. A favourable spring rainfall outlook and above average levels of stored soil moisture in northern New South Wales are also expected to incentivise growers to increase sorghum plantings by 3% across the state. The favourable conditions expected over spring are likely to support above average sorghum yields in New South Wales.

Cotton lint production is forecast to fall by 7% to 709 thousand tonnes in 2024–25, 37% above the 10-year average to 2023–24. The fall in production is driven by a forecast reduction in planted area (319 thousand hectares, down 6% year-on-year). Lower world cotton prices are expected to disincentivise plantings in 2024–25, with some growers expected to opt for alternative crops such as sorghum. Yields are expected to be similar to 2023–24, supported by high water availability and a favourable rainfall outlook.

Rice production is forecast to fall by 17% to 515 thousand tonnes in 2024–25, driven by lower area planted. Lower global prices are expected to disincentivise area expansions to rice in 2024–25. High water availability across the Murray-Darling basin and a favourable rainfall outlook for spring is expected to support average yields.

| Crop | Area '000 ha | Yield t/ha | Production kt | Area change % | Prod. Change % |

|---|---|---|---|---|---|

| Grain sorghum | 180 | 4.17 | 750 | 3 | 6 |

| Cotton lint | 319 | 2.22 | 709 | –6 | –7 |

| Cottonseed | 319 | 2.55 | 812 | –6 | –7 |

| Rice | 49 | 10.5 | 515 | –14 | –17 |

Note: Yields are based on area planted, except cotton which is based on area harvested. Area includes planted crop that is harvested, fed off or failed. Percent changes are relative to 2023–24.

Source: ABARES

Winter crop production in Victoria is forecast to reach 8.6 million tonnes in 2024–25, down 19% from 2023–24. While this represents a downward revision of 7% from the June 2024 Australian crop report, total winter crop production is forecast to be 9% above the 10-year average to 2023–24 and is the sixth highest on record. This reflects that expected production levels in 2024–25 remain higher than during the dry conditions from 2017–18 to 2019–20 and generally stronger than most years between 2010 to 2020.

Below average winter rainfall in key cropping regions, such as the South-West and North-West is expected to limit production in those areas, where a high proportion of winter crops are grown. Additionally, dry sowing conditions delayed crop emergence and development. As subsoil moisture continues to decline, timely and sufficient rainfall throughout spring will be important for supporting flowering and grain fill. In contrast, growing conditions in north-eastern cropping regions – where average crop yields are typically higher than western areas – have been more favourable, with adequate moisture levels supporting crop growth and development. This has helped to maintain close to 10-year average production levels across the state.

The three-month rainfall outlook (September to November), issued by the Bureau of Meteorology on 22 August 2024, indicates that there is no strong tendency towards either below average or above average spring rainfall for Victorian cropping regions, with a 45% to 60% chance of exceeding the spring median. These conditions are expected to be only sufficient to maintain current yield and production prospects due to the limited levels of subsoil moisture across the state. Additionally, warmer-than-average temperatures throughout spring present a potential downside risk to this forecast given the below-average levels of stored subsoil moisture.

Winter crop yields are forecast to fall by 17% in 2024–25 but remain 5% above the 10-year average to 2023–24. Due to the recent drawdown of subsoil moisture, sufficient and timely rainfall will be important in the coming weeks to maintain above average yields for some regions. Potential downside risks for the Mallee and Wimmera region persist if they continue to remain dry, which could further constrain yields.

Area planted to winter crops in Victoria is expected to decrease by 2%, to 3.6 million hectares in 2024–25. This is 5% above the 10-year average to 2023–24. Area planted is expected to decrease for barley (down 1%), wheat (down 3%) and canola (down 6%) as growers shift towards expanding area planted to lentils in crop rotations. Area planted to lentils is expected to increase by 13% to 430 thousand hectares, 94% above the 10-year average to 2023–24. Strong export prices, particularly compared to other pulses and crops such as oats, has incentivised increased lentil plantings in 2024–25.

| Crop | Area '000 ha | Yield t/ha | Production kt | Area change % | Prod. Change % |

|---|---|---|---|---|---|

| Wheat | 1,500 | 2.65 | 3,970 | –3 | –24 |

| Barley | 820 | 2.93 | 2,400 | –1 | –14 |

| Canola | 520 | 1.83 | 950 | –6 | –25 |

| Lentils | 430 | 1.84 | 790 | 13 | 1 |

Note: Yields are based on area planted. Area includes planted crop that is harvested, fed off or failed. Percent changes are relative to 2023–24.

Source: ABARES

Winter crop production in South Australia is forecast to fall by 9% to 7.9 million tonnes in 2024– 25, reflecting persistent dry conditions across most cropping regions. This represents a downward revision of 4% from the June 2024 Australian crop report, sitting slightly below the 10-year average to 2023–24 and is the seventh highest on record. Below average rainfall through winter has seen soil moisture levels continue to decline across most cropping regions, delayed crop establishment and reduced yield prospects. While overall yields are forecast to fall, there is some regional variability, with localised rainfall events in the lower and eastern Eyre Peninsula in June cushioning yield reductions in these areas.

According to the latest three-month rainfall outlook (September to November), issued by the Bureau of Meteorology on 22 August 2024, rainfall is likely to be below average across western and central cropping regions in South Australia, with above average temperatures also expected. The increased chance of drier and warmer conditions through spring presents a downside risk for winter crops that are already experiencing moisture stress. Given the late start to the season and with temperatures rising, final yield prospects will be highly dependent on adequate and timely rainfall in spring.

Winter crop yields are forecast to fall by 9% in 2024–25 to 2.02 tonnes per hectare, 6% below the 10-year average to 2023–24. Canola yields, typically more sensitive to dry conditions, are expected to fall by 23% to 1.58 tonnes per hectare, 9% below the 10-year average to 2023–24. Wheat and barley yields are also expected to fall year-on-year (8% and 5% respectively). Lentil yields are forecast to fall by 6% to 1.83 tonnes per hectare. Despite the fall, lentil yields are expected to be in line with the 10-year average to 2023–24, reflecting a transition towards higher yielding varieties in recent years.

Area planted to winter crops is forecast to fall by 1% to 3.9 million hectares in 2024–25, with reductions in area planted to wheat, barley and canola partially offset by an increase in the area planted to lentils. However, this forecast remains 7% above the 10-year average to 2023–24. The largest reduction in area planted is seen in canola, down 7% year-on-year, driven by dry conditions at planting and substitution towards other crops such as lentils. Area planted to lentils is forecast to increase by 21% to 470 thousand hectares, driven by high export prices at the time of planting. The increase in lentil area comes at the expense of area planted to canola and minor crops such as field peas and lupins.

| Crop | Area '000 ha | Yield t/ha | Production kt | Area change % | Prod. Change % |

|---|---|---|---|---|---|

| Wheat | 2,100 | 2.05 | 4,300 | –2 | –10 |

| Barley | 810 | 2.37 | 1,920 | –1 | –6 |

| Lentils | 470 | 1.83 | 860 | 21 | 13 |

| Canola | 260 | 1.58 | 410 | –7 | –28 |

Note: Yields are based on area planted. Area includes planted crop that is harvested, fed off or failed. Percent changes are relative to 2023–24.

Source: ABARES

Winter crop production in Western Australia is forecast to rise by 24% to 18.4 million tonnes in 2024–25. Improved seasonal conditions have boosted production prospects, with winter crop production now expected to be 7% above the 10-year average to 2023–24 of 17.2 million tonnes. This represents a 16% upwards revision from the June 2024 Australian crop report and is the third highest production on record.

Following unfavourably dry conditions at the start of the winter cropping season, early June rainfall across northern and western cropping regions supported crop establishment and growth. Timely rainfall and warmer growing conditions in July and August accelerated crop development, which had been later than normal due to the dry start to the season. Improved seasonal conditions have reinforced yield potentials, mostly benefitting cereal crops. By contrast, planting and establishment conditions were largely unfavourable in some southern cropping regions of Western Australia, particularly in the Esperance zone and eastern cropping regions in the Albany zone. Drier conditions in these areas have led to crops experiencing moisture stress, limiting yield potential.

According to the latest three-month rainfall outlook (September to November), issued by the Bureau of Meteorology on 22 August 2024, there are roughly equal chances of higher or lower than average spring rainfall in most cropping regions in Western Australia. Above average rainfall is more likely in September and daytime temperatures are expected to be average to below average in most cropping regions during September and October. The outlook for early spring rainfall and mild temperatures should support winter crops through critical development stages and provide favourable growing conditions to maintain above average yields across most cropping regions.

Winter crop yields are forecast to rise by 25% to 2.13 tonnes per hectare in 2024–25, 5% above the 10-year average to 2023–24. The average state wheat yield is forecast to increase by 32% to 2.19 tonnes per hectare in 2024–25. This is the largest year-on-year percentage increase in yield, reflecting improved conditions in northern cropping regions where a high proportion of wheat is grown. This compares to the average state canola yield which is forecast to increase by 7% to 1.48 tonnes per hectare in 2024–25. The dry start to the season has led to patchy emergence and growth in most canola crops. This has reduced overall yield potential given the majority of canola is grown in southern cropping regions where conditions have been less favourable.

Area planted to winter crops in Western Australia in 2024–25 is forecast to fall slightly to 8.6 million hectares, but remain 2% above the 10-year average to 2023–24. This largely reflects the drier- and hotter-than-average conditions during autumn with a reduction in area sown in lower-rainfall cropping regions, especially for higher production risk crops such as canola.

| Crop | Area '000 ha | Yield t/ha | Production kt | Area change % | Prod. Change % |

|---|---|---|---|---|---|

| Wheat | 4,750 | 2.19 | 10,400 | 2 | 35 |

| Barley | 1,650 | 2.73 | 4,500 | 3 | 22 |

| Canola | 1,550 | 1.48 | 2,300 | –14 | –8 |

| Lupins | 330 | 1.48 | 490 | 5 | 18 |

Note: Yields are based on area planted. Area includes planted crop that is harvested, fed off or failed. Percent changes are relative to 2023–24.

Source: ABARES