Download Full Report and Data

The Australian Crop Report contains ABARES forecasts for the area, yield and production of Australia’s major winter and summer broadacre crops. Forecasts are made at the Australian state level.

Key points

- National planting to winter crops to remain historically high in 2024–25 at 23.6 million hectares.

- National winter crop production to increase to 51.3 million tonnes, reflecting a generally favourable winter rainfall outlook.

- Summer crop production in 2023–24 forecast to remain above average at 4.6 million tonnes, but below previous year’s highs.

Above average national winter crop production

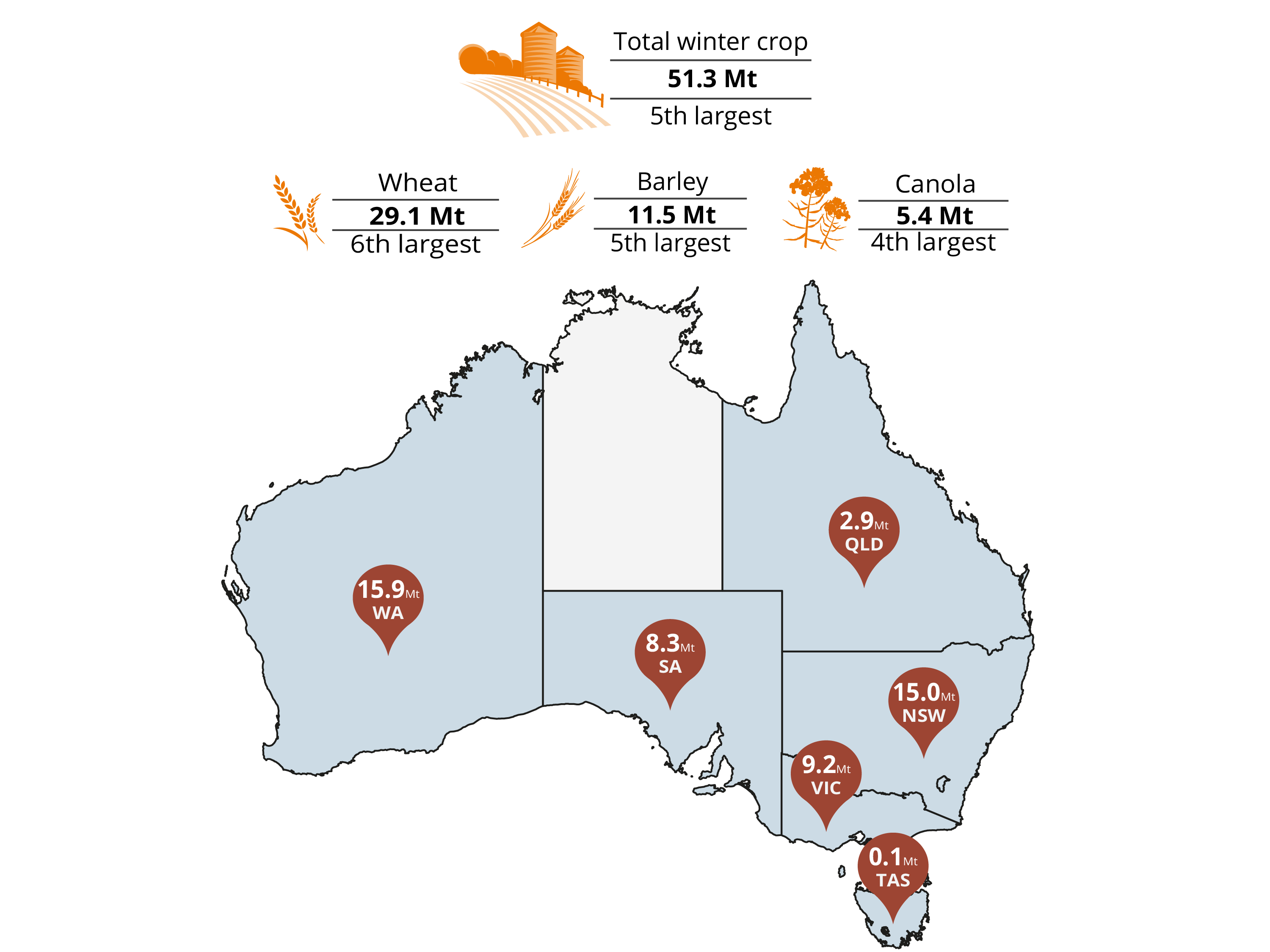

Australian winter crop production is forecast to increase by 9% to 51.3 million tonnes in 2024–25 (Figure 1). This is 9% above the 10-year average to 2023–24 of 47 million tonnes and if realised, would be the fifth highest on record. This forecast increase reflects expected improvements in production in Queensland, New South Wales and Western Australia. However, we are seeing highly variable production conditions across Australia’s major cropping regions at the start of the 2024–25 winter cropping season.

- Conditions have been mostly favourable in Queensland and northern and central New South Wales. This follows above average summer rainfall and timely autumn rainfall that continued to improve soil moisture profiles. The conditions have provided a close-to-ideal start to the winter cropping season in these areas.

- By contrast, autumn rainfall has been lower than average across major cropping regions in western Victoria, South Australia and Western Australia, and soil moisture levels have remained low. This means that much of the 2024–25 winter crop across these three states has been dry sown and will require adequate and timely rainfall during June to allow for crop germination and establishment. For areas with below average levels of stored soil moisture, dry autumn conditions are expected to have discouraged some growers from committing to their full planting intentions.

According to the latest three-month rainfall outlook (June to August), issued by the Bureau of Meteorology on 23 May 2024, there is a 40% to 60% chance that winter rainfall will be above average across cropping regions in Queensland, New South Wales, Victoria and South Australia. Meanwhile, cropping regions in Western Australia have a higher chance of receiving above average rainfall (between 50% and 75%). This generally favourable rainfall outlook for June to August is expected to support the germination of dry sown crops and follow up winter crop planting towards the end of the ideal planting window.

Area planted to winter crops in Australia is forecast to remain historically high in 2024–25, rising slightly to 23.6 million hectares, 6% above the 10-year average to 2023–24. A forecast increase in area planted to winter crops in Queensland and New South Wales is likely to more than offset a fall in area in Victoria, South Australia and Western Australia.

Area planted to wheat is forecast to rise by 3% to 12.7 million hectares in 2024–25. Area planted to barley is forecast to increase by 3% to 4.3 million hectares in 2024–25. These forecast area increases mostly reflect an increase in Queensland and New South Wales. The longer planting window for cereals is also expected to result in some late plantings following upcoming forecast rainfall events.

Area planted to canola is forecast to fall by 9% to 3.2 million hectares in 2024–25. The reduction in area reflects a less favourable start to the season in some major cropping regions. Lower relative expected returns have also seen some substitution towards other crops, including wheat, barley and pulses.

Area planted to winter pulses is forecast to increase by 17% to 2.5 million hectares in 2024–25, driven by increases in chickpea and lentil plantings. Area planted to chickpeas is forecast to increase by around 80% to 730 thousand hectares in 2024–25. This is 24% above the 10-year average to 2023–24, reflecting high expected margins and a favourable start to the cropping season in Queensland and New South Wales. Area planted to lentils is forecast to increase further in 2024–25 to a record 885 thousand hectares, reflecting high lentil prices.

Above average winter crop production is expected, with most regions showing an increased likelihood of receiving average to above average winter rainfall. Yields are forecast to be above average in Queensland, New South Wales and Victoria which is likely to more than offset average to below average yields in South Australia and Western Australia.

- Wheat production is forecast to increase by 12% to 29.1 million tonnes in 2024–25, 10% above the 10-year average to 2023–24.

- Barley production is forecast to increase by 7% to 11.5 million tonnes in 2024–25, 2% above the 10-year average to 2023–24.

- Canola production is forecast to fall by 5% to 5.4 million tonnes in 2024–25, 21% above the 10- year average to 2023–24.

- Lentil production is forecast to remain steady in 2024–25, at 1.6 million tonnes. This is more than double the 10-year average to 2023–24, with the expansion in area planted to lentils expected to be offset by lower expected yields.

- Chickpea production is forecast to increase by 133% to 1.1 million tonnes in 2024–25, 46% above the 10-year average to 2023–24.

Figure 1 Australian winter crop production, 2024–25

Summer rainfall boosts summer crop prospects

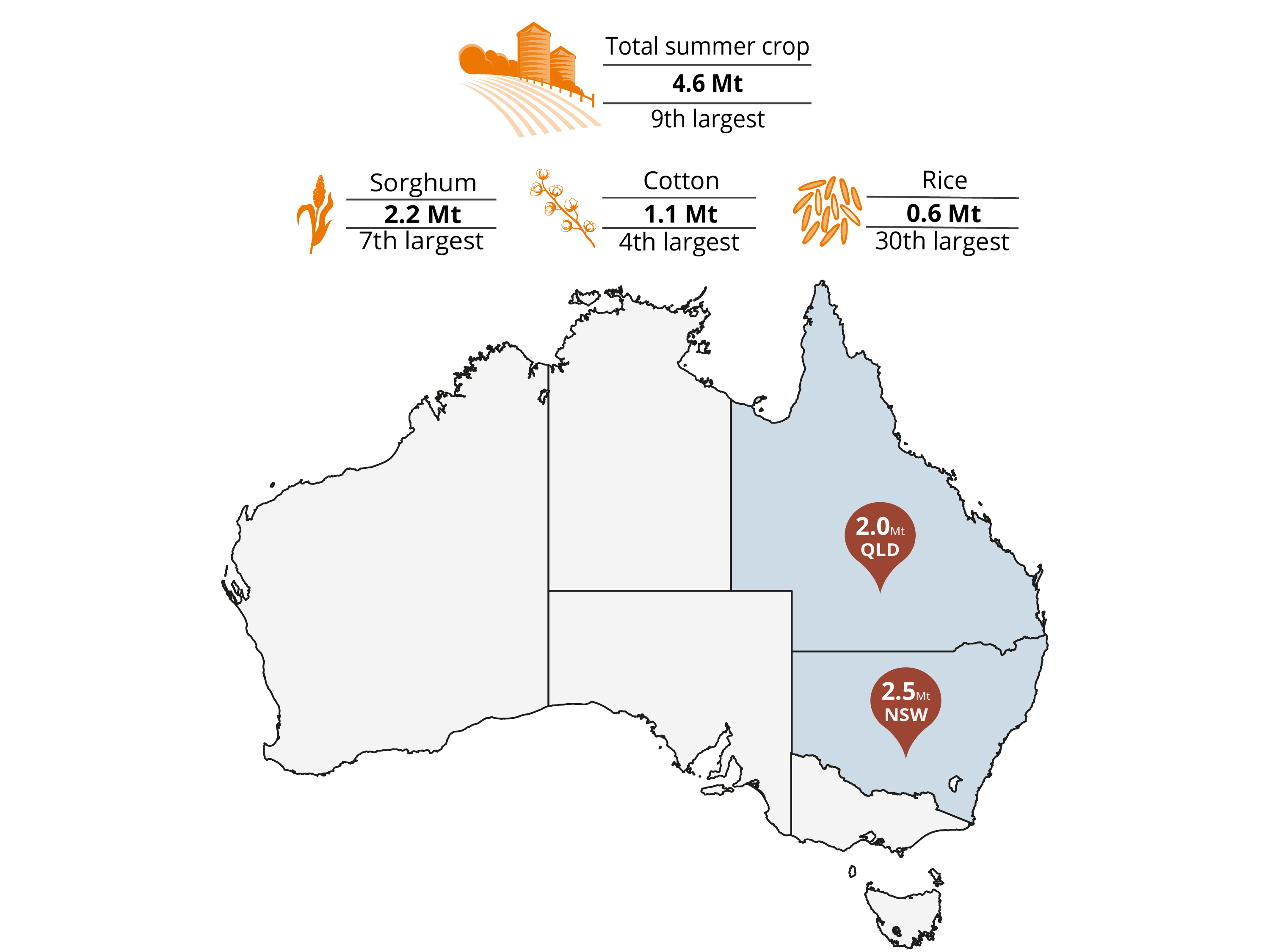

Australian summer crop production is estimated to fall by 11% to 4.6 million tonnes in 2023–24 (Figure 2). Despite falling from last year’s highs, this production forecast remains 31% above the 10-year average to 2022–23 of 3.5 million tonnes. Summer crop prospects improved significantly following better than expected seasonal conditions during late spring and summer in Queensland and northern New South Wales. Falling production reflects an overall fall in planted area more than offsetting higher forecast yields. Harvesting of some summer crops has been delayed by autumn storms and rain across key summer cropping regions. This has resulted in a fall in grain and lint quality in some unharvested crops but did not significantly affect the production volumes of most later maturing crops. It is likely that higher yields in other areas will more than offset any downgrades caused by wet harvest conditions. National summer crop production has been revised up by 8% compared to the March 2024 Australian Crop Report.

Sorghum production is estimated to fall by 16% to 2.2 million tonnes in 2023–24. While this is down year-on-year it represents a 10% upwards revision from the March 2024 Australian Crop Report and it now sits 38% above the 10-year average to 2022–23. The production of sorghum crops in Queensland and New South Wales has been higher than expected, with strong yields supported by above average summer rainfall and high soil moisture levels. Fall Armyworm is reported to have caused localised damage in sorghum crops in parts of Queensland and northern New South Wales. Later sown crops planted from December onwards were most heavily impacted. Higher yields in areas unaffected are likely to offset any crop losses caused by Fall Armyworm.

Production of cotton lint is estimated to fall by 13% to 1.1 million tonnes in 2023–24 but remain 41% above the 10-year average to 2022–23. Falling production reflects an estimated fall in area planted to cotton more than offsetting higher aggregate yields. Area planted to cotton is estimated to fall by 16% to 477 thousand hectares in 2023–24, reflecting a fall in irrigated cotton plantings in Queensland due to decreased water availability in some key cropping regions. By contrast, irrigated cotton production in New South Wales increased in 2023–24, supported by high water storages in the southern Murray–Darling Basin and favourable growing conditions. Dryland cotton production is forecast to fall slightly but remain higher than previously anticipated, supported by above average rainfall and favourable temperatures during the late planting and growing periods. Higher than expected dryland cotton yields and an increasing proportion of production from higher yielding irrigated areas has driven the 4% increase in the national cotton yield.

Rice production is estimated to increase by 20% to 611 thousand tonnes in 2023–24. An estimated 11% increase in area and higher yields with generally favourable growing conditions in southern New South Wales in autumn has increased the production of rice.

Figure 2 Australian summer crop production, 2023–24

Winter crop production in Queensland is forecast to increase by 68% to reach 2.9 million tonnes in 2024–25. This is 41% above the 10-year average to 2023–24. The upswing in production follows close to ideal climatic conditions leading up to the planting window, enabling growers to maximise cropping areas this season. Additionally, the average climate outlook for winter is expected to provide favourable conditions for crop growth and development, subsequently maintaining strong yield potentials.

Area planted to winter crops in Queensland is forecast to be 1.4 million hectares in 2024–25, rising by 27% year-on-year and 23% above the 10-year average to 2023–24. The announcement of a tariff-free period for Australian chickpeas by India has supported a rapid rise in chickpea prices, acting as a catalyst for a significant expansion in chickpea area this season, increasing by 73% year-on-year. The area expansion in chickpeas comprises area left fallow during the 2023–24 season and area becoming available following the harvest of summer crops. The increase in wheat and barley area reflects above average subsoil moisture at the time of this forecast. However, below average rainfall during May in northern cropping regions of Queensland has led to a drying out of the upper soil moisture layer. This may result in a reduction in wheat planted area and instead favour chickpea and barley plantings.

Winter crop yields are forecast to rise by 32% to around 2.0 tonnes per hectare in 2024–25, 20% above the 10-year average to 2023–24. The climate outlook (issued by the Bureau of Meteorology on 23 May 2024) indicates no strong tendency toward either above or below average rainfall for most cropping regions in Queensland. Average to above average soil moisture levels across much of Queensland at the end of autumn, combined with a neutral rainfall outlook for winter, are expected to maintain above average yield prospects. However, following a relatively dry May 2024, yields in the northern cropping regions will be highly reliant on adequate and timely winter rainfall to realise current yield expectations.

| Crop | Area '000 ha | Yield t/ha | Production Kt | Area change % | Prod. Change % |

|---|---|---|---|---|---|

| Wheat | 840 | 2.14 | 1,800 | 17 | 67 |

| Barley | 170 | 2.65 | 450 | 13 | 50 |

| Chickpeas | 380 | 1.47 | 560 | 73 | 100 |

Note: Yields are based on area planted. Area includes planted crop that is harvested, fed off or failed. Percent changes are relative to 2023–24.

Source: ABARES

Summer crop production in Queensland is estimated to fall by 22% to 2.0 million tonnes in 2023–24. Despite the fall, it is still 24% above the 10-year average to 2022–23 and represents a 7% upwards revision from the March 2024 Australian Crop Report. This reflects an improvement in climatic conditions with above average rainfall during the second half of the summer cropping season. This upwards revision reflects an overall increase in production of all summer crops, with the exception of a slight reduction in rice production.

Despite localised quality damage caused by rainfall during harvest and an outbreak of Fall Armyworm, sorghum yield and production have risen overall but remain below the previous year’s high. Sorghum production is estimated to decrease by 17% to 1.5 million tonnes in 2023–24, 35% above the 10-year average to 2022–23. Cotton yields and production have also been revised up, reflecting a better-than-expected finish to the season with above average rainfall. However, wet conditions have restricted field access and slowed down harvest of summer crops, inadvertently delaying the start of winter crop planting.

Cotton lint production is estimated to fall by 39% to 310 thousand tonnes in 2023–24, driven by reduced plantings of both dryland and irrigated cotton. Dry conditions in early spring limited dryland plantings but facilitated planting of irrigated crops with uninterrupted field access. Lower irrigated planting was associated with a fall in irrigation water availability, with water storages in key cropping regions across southeast Queensland significantly lower than in the 2022–23 planting window. Above average rainfall in November saw limited increases in dryland cotton planting. Despite the fall in area, adequate rainfall and suitable temperatures during the growing season boosted yields. Higher yields partially offset reductions in planted area and supports 2023–24 production to remain above the 10-year average to 2022–23.

| Crop | Area '000 ha | Yield t/ha | Production kt | Area change % | Prod. change % |

|---|---|---|---|---|---|

| Grain sorghum | 415 | 3.61 | 1,500 | –15 | –17 |

| Cotton lint | 122 | 2.54 | 310 | –44 | –39 |

| Cottonseed | 122 | 2.91 | 355 | –44 | –40 |

Note: Yields are based on area planted, except cotton which is based on area harvested. Area includes planted crop that is harvested, fed off or failed. Percent changes are relative to 2022–23.

Source: ABARES

Winter crop production in New South Wales is forecast to increase by 36% to 15.0 million tonnes in 2024–25. This is 28% above the 10-year average to 2023–24. An excellent start to the winter cropping season has helped most growers to fully realise their strong planting intentions. The improvement in production prospects follows high levels of soil moisture at the time of planting, enabling growers to maximise cropping areas. The favourable winter rainfall outlook is also expected to support high yield potentials.

Area planted to winter crops in New South Wales is forecast to increase by 10% to 6.1 million hectares in 2024–25. This is 10% above the 10-year average to 2023–24. Similar to Queensland, chickpea plantings are showing the largest year-on-year percentage increase in New South Wales this season. The increase in wheat and barley area reflects above average subsoil moisture across much of New South Wales at the time of this forecast. This increase in wheat and barley area includes those areas that did not get planted last season due to dry conditions. However, drier conditions during autumn coupled with lower soil moisture levels in some southern cropping regions in New South Wales – where canola is predominantly grown – have resulted in a modest 1% year-on-year fall in area planted to canola. The reduction in canola plantings in these areas have favoured barley plantings, which are better suited to less favourable climatic conditions compared to canola.

Winter crop yields are forecast to rise by 24% to 2.5 tonnes per hectare in 2024–25, 23% above the 10-year average to 2023–24. The climate outlook, issued by the Bureau of Meteorology on 23 May 2024, indicates no strong tendency toward either above or below average rainfall for most cropping regions in New South Wales. Average to above average soil moisture levels across much of New South Wales at the end of autumn, combined with a neutral rainfall outlook for winter, is expected to support increased yield prospects. However, yield prospects in southern cropping regions will be highly reliant on adequate and timely rainfall to realise current yield expectations.

| Crop | Area '000 ha | Yield t/ha | Production kt | Area change % | Prod. Change % |

|---|---|---|---|---|---|

| Wheat | 3,600 | 2.72 | 9,800 | 9 | 38 |

| Barley | 870 | 2.87 | 2,500 | 9 | 30 |

| Canola | 830 | 1.93 | 1,600 | –1 | 19 |

| Chickpeas | 310 | 1.74 | 540 | 107 | 227 |

Note: Yields are based on area planted. Area includes planted crop that is harvested, fed off or failed. Percent changes are relative to 2023–24.

Source: ABARES

Summer crop production in New South Wales in 2023–24 is estimated to remain steady at 2.5 million tonnes. This is 37% above the 10-year average to 2022–23 and represents a 10% upwards revision from the March 2024 Australian Crop Report. The upward revision reflects an overall increase in production of all summer crops, owing to above average rainfall received during the second half of the growing season.

Sorghum production is estimated to fall by 13% to 710 thousand tonnes in 2023–24, but remain 46% above the 10-year average to 2022–23. Area planted to sorghum has been revised up from the previous forecast following rainfall in the later planting window that enabled growers to maximise planted area. Despite localised quality damage caused by rain events during harvest and an outbreak of Fall Armyworm, sorghum yield and production have been revised up. The damage is reportedly minimal compared to that in Queensland where late planted crops yet to be harvested were more prone to damage. However, wet conditions have restricted field access and delayed the harvesting of summer crops and planting of winter crops in northern New South Wales.

Cotton lint production is estimated to rise by 4% to 761 thousand tonnes in 2023–24 as higher yields more than offset a fall in area. This is 53% above the 10-year average to 2022–23. Timely planting of irrigated cotton and high water storages in the southern Murray–Darling Basin have supported an increase in irrigated cotton production. Below average rainfall and soil moisture in September and October led to disruptions in dryland cotton planting. However, above average rainfall in November prompted late planting across the state, leading to higher dryland production than previously anticipated. Aggregate cotton yields are estimated to increase in 2023–24, supported by above average rainfall and temperatures during late planting and growing seasons.

Rice production is estimated to increase by 21% to 607 thousand tonnes in 2023–24, driven by greater area planted and above average yield. Generally favourable growing conditions in southern New South Wales boosted overall rice production, more than offsetting crop damage caused by blast disease to dryland rice in the Northern Rivers growing region.

| Crop | Area '000 ha | Yield t/ha | Production kt | Area change % | Prod. Change % |

|---|---|---|---|---|---|

| Grain sorghum | 180 | 4.17 | 750 | 3 | 6 |

| Cotton lint | 319 | 2.22 | 709 | –6 | –7 |

| Cottonseed | 319 | 2.55 | 812 | –6 | –7 |

| Rice | 49 | 10.5 | 515 | –14 | –17 |

Note: Yields are based on area planted, except cotton which is based on area harvested. Area includes planted crop that is harvested, fed off or failed. Percent changes are relative to 2022–23.

Source: ABARES

Winter crop production in Victoria is forecast to reach 9.2 million tonnes in 2024–25, down 13% from 2023–24, but still remains 16% above the 10-year average to 2023–24. Average rainfall during April at the start of the planting window supported above average soil moisture levels across the state following a wet summer. However, drier than average conditions throughout May meant that a high proportion of the 2024–25 crop has been sown dry. Topsoil moisture continues to dry out across the state, whilst subsoil moisture largely remains favourable, allowing farmers to realise their full planting intentions. This means that adequate and timely rainfall will be required in the coming weeks to support the germination of dry sown crops, particularly across the west and north of the state where a high proportion of winter crops are grown.

Area planted to winter crops in Victoria is expected to remain steady at 3.6 million hectares in 2024–25. This is 6% above the 10-year average to 2023–24. Area planted is expected to increase for barley (up 2%) and fall for wheat (down 3%) and canola (down 5%) as farmers look to further incorporate pulses into their rotations. Area planted to lentils is expected to increase to 400 thousand hectares, 79% above the 10-year average to 2023–24. It is expected that farmers will favour lentils over other pulses given their current strong export prices which are expected to continue throughout 2024–25.

The three-month rainfall outlook (June to August), issued by the Bureau of Meteorology on 23 May 2024, indicates that below average to average winter rainfall is likely for Victoria (35% to 55% chance of exceeding the winter median). These conditions are expected to constrain yields and production across the state. While there is an increased chance of below average winter rainfall across southern growing regions, cropping regions are likely to receive sufficient rainfall during June to allow for germination and establishment of dry sown crops.

Winter crop yields are forecast to fall by 12% in 2024–25 but remain above the 10-year average to 2023–24. Current stored soil moisture in key growing regions is currently supporting these forecasts. However, downside potential exists if the Mallee and Wimmera growing regions remain dry, with late crop emergence expected to result in yield penalties for these areas.

| Crop | Area '000 ha | Yield t/ha | Production kt | Area change % | Prod. Change % |

|---|---|---|---|---|---|

| Wheat | 1,500 | 2.90 | 4,347 | –3 | –16 |

| Barley | 850 | 2.93 | 2,492 | 2 | –10 |

| Canola | 520 | 2.03 | 1,057 | –5 | –16 |

| Lentils | 400 | 1.91 | 765 | 1 | –2 |

Note: Yields are based on area planted. Area includes planted crop that is harvested, fed off or failed. Percent changes are relative to 2023–24.

Source: ABARES

Winter crop production in South Australia is forecast to fall by 6% to 8.3 million tonnes in 2024– 25, reflecting continued dry conditions across most cropping regions. This is 4% above the 10-year average to 2023–24. A lack of rainfall during May and declining soil moisture levels across most cropping regions is expected to reduce production prospects in 2024–25.

Area planted to winter crops in South Australia is forecast to fall by 4% to 3.9 million hectares in 2024–25. This is 6% above the 10-year average to 2023–24. Area planted is forecast to fall for most crops reflecting well below average autumn rainfall. Canola is expected to see the largest percentage decline in area planted, as persistent dryness impacted planting at the start of the winter cropping season. Canola production is therefore forecast to fall in 2024–25, also reflecting delayed germination which has resulted in strong yield penalties particularly across the Eyre Peninsula. Area planted to wheat, barley and canola is expected to fall, especially in the Eyre Peninsula, with opportunistic farmers increasing the area planted to lentils to take advantage of higher lentil prices.

The three-month rainfall outlook (June to August), issued by the Bureau of Meteorology on 23 May 2024, indicates a 40% to 60% chance of above average winter rainfall for most cropping regions in South Australia. However, drier conditions are expected in the far south of the Yorke and Eyre Peninsulas, with a 60% to 80% chance of below average rainfall. These conditions are expected to negatively impact yields and production in these traditionally higher yielding cropping regions.

Winter crop yields are forecast to fall by 2% to 2.1 tonnes per hectare in 2024–25 and remain around the 10-year average to 2023–24. Despite below average soil moisture levels, an average rainfall outlook for winter will likely provide sufficient moisture to facilitate the germination and establishment of dry sown crops and the completion of intended planting programs.

| Crop | Area '000 ha | Yield t/ha | Production kt | Area change % | Prod. Change % |

|---|---|---|---|---|---|

| Wheat | 2,100 | 2.19 | 4,590 | –5 | –4 |

| Barley | 800 | 2.44 | 1,950 | –2 | –5 |

| Lentils | 460 | 1.76 | 810 | 5 | 1 |

| Canola | 260 | 1.81 | 470 | –10 | –18 |

Note: Yields are based on area planted. Area includes planted crop that is harvested, fed off or failed. Percent changes are relative to 2023–24.

Source: ABARES

Winter crop production in Western Australia is forecast to rise by 7% to 15.9 million tonnes in 2024–25. This is 8% below the 10-year average to 2023–24 of 17.2 million tonnes. The forecast year-on-year increase in production is largely attributed to higher expected yields more than offsetting a fall in area planted.

Area planted to winter crops in Western Australia in 2024–25 is forecast to fall slightly to 8.5 million hectares, but remain 2% above the 10-year average to 2023–24. This largely reflects a reduction in area sown in dry areas. Low levels of soil moisture have discouraged planting in some regions, especially for high risk crops such as canola.

Following drier and hotter than average conditions during autumn, soil moisture levels across most cropping regions in Western Australia have been below to very much below average during the winter crop planting window. This means that a high proportion of the 2024–25 winter crop has been sown dry. However, rainfall received so far during May in Kwinana down to Albany and Esperance have benefitted crop germination. Sporadic rain from thunderstorms has allowed for some crop germination in northern cropping regions. Adequate and timely rainfall will be required in the coming weeks to support germination of dry sown crops, particularly in the Geraldton cropping zone where topsoil is dry and subsoil moisture is severely deficient.

Winter crop yields are forecast to rise by 9% in 2024–25 but remain below the 10-year average, reflecting the drier start to the season and below average levels of soil moisture. The combination of rainfall in May and an above average winter rainfall outlook (issued by the Bureau of Meteorology on 23 May 2024), will likely provide sufficient moisture to support crop establishment and maintain current yield expectations if realised.

| Crop | Area '000 ha | Yield t/ha | Production kt | Area change % | Prod. Change % |

|---|---|---|---|---|---|

| Wheat | 4,700 | 1.81 | 8,500 | 1 | 10 |

| Barley | 1,650 | 2.48 | 4,100 | 3 | 11 |

| Canola | 1,550 | 1.45 | 2,250 | –14 | –10 |

| Lupins | 330 | 1.39 | 460 | 5 | 11 |

Note: Yields are based on area planted. Area includes planted crop that is harvested, fed off or failed. Percent changes are relative to 2023–24.

Source: ABARES