Authors: Charley Xia, Amelia Brown, Benjamin Agbenyegah, Peter Collins, Matthew Miller, Andrew Cameron and Rohan Nelson

Information on national grain stocks supports the efficient operation of Australia’s grain markets by helping to ensure that all market participants have access to the information they need to make sound buying and selling decisions.

The ongoing drought of 2018 and 2019 has highlighted the importance of providing well-grounded and reliable public information about the amount of grain likely to be available for domestic consumption over the coming year.

As drought raised domestic grain prices during 2018 and the first half of 2019, intensive livestock and food manufacturing industries began to talk to me about the prospect of importing grain to secure supply.

ABARES revised its forecasts of national barley and wheat stocks for 2019–20 as part of the quarterly Agricultural commodities report, and these forecasts were published in the June 2019 edition.

This report explains how ABARES revised its grain stocks forecasts for 2019–20, and put in place a process that can be used to forecast grain consumption and stocks in future drought years.

[expand all]

Summary

This paper reports on a project conducted by ABARES from May to July 2019 to explore the role that public sector forecasts of grain stocks can play in reducing market uncertainty in years of low production – usually caused by drought. The project extended the methodology used to produce the Australian Crop Report to validate ABARES forecasts of consumption and stocks.

Poor winter crop harvests across Australia’s eastern states during 2018–19 reduced the availability of grain and led to significant increases in domestic grain prices. Uncertainty grew during the first quarter of 2019 about the availability of grain toward the end of the 2019–20 financial year if seasonal conditions were to remain unfavourable for crop production during the winter and spring of 2019. The prospect of uncertain grain supplies and poor pasture growth in 2019–20 created pressure to use bulk grain import pathways that were last used in 2006–07.

Constrained domestic supplies and prices increasing faster than world prices are unusual for grain consuming businesses in a country that normally exports more than 70% of its production. In most years, Australia’s grain prices are set in world markets because production and exports far exceed domestic use. In these years it is efficient for ABARES and other forecasters to limit the resources committed to forecasting grain stocks, and concentrate on forecasting production to estimate the volume of exports and the likely prices they will receive in world markets. Domestic grain use and stocks are - in most years - not significant determinants of price.

In drought years, the problem faced by bulk grain users such as intensive livestock and food manufacturers is whether to rely solely on domestic supplies when prices rise, or whether to commit to the costly process of importing. A key factor in deciding to import is the availability and price of grain from domestic sources, and public stock reporting provides an independent source of information that helps improve the efficiency of price formation.

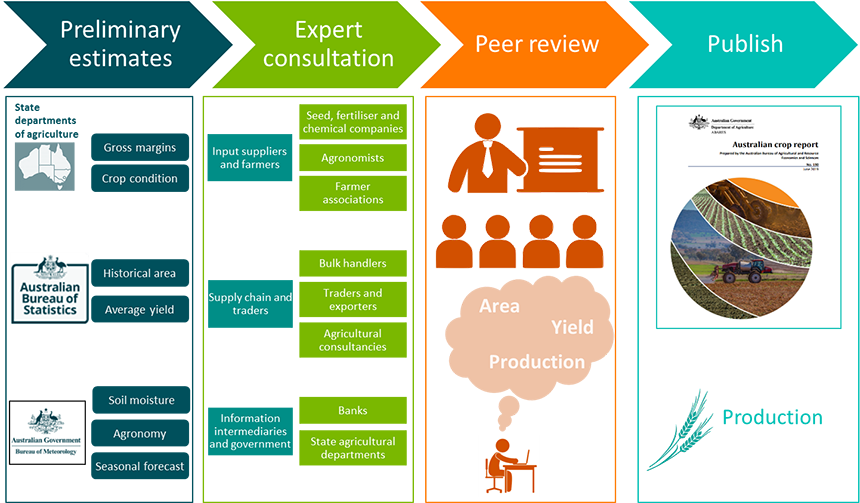

To support this process, ABARES improved its estimates of national grain stocks by extending consultations for the Australian crop report to bulk grain using industries such as intensive livestock and food manufacturing. Semi-structured interviews were conducted between May and July 2019 around scenarios that captured the impact of likely climate conditions in 2019 on grain production for the marketing year 2019–20.

The consultation process led ABARES to revise wheat and barley stocks downwards for 2018–19 and 2019–20. Consultations showed that as seasonal conditions deteriorated during 2017–18, domestic consumption of grain for livestock feeding increased more than initially estimated. Export forecasts were also revised downwards.

ABARES concluded that public reporting of national grain stocks in times of drought can help grain consuming businesses work out whether and when to invest in the cost of importing. However, in years conducive to crop production and exports, it is not efficient for ABARES to commit additional resources to estimating grain consumption and stocks.

Introduction

Poor winter crop harvests across Australia’s eastern states during 2018–19 reduced the availability of grain and led to significant increases in domestic grain prices. Uncertainty grew during the first quarter of 2019 about the availability of grain into 2019–20 if seasonal conditions were to remain unfavourable for crop production. In combination with poor grazing conditions, the prospect of uncertain grain supplies into 2019–20 created pressure to use bulk grain import pathways that were last used in 2006–07.

Constrained domestic supplies and prices increasing faster than world prices are unusual for grain consuming businesses in a country that normally exports more than 70% of its grain production. In most years, Australia’s grain prices are set in world markets because production and exports far exceed domestic use. In these years it is efficient for ABARES and other forecasters to limit the resources committed to estimating grain stocks, and concentrate on forecasting production and exports, and the price that exports are likely to receive in world markets. In years when production is low due to drought or other causes, estimates of domestic stocks become more important to price formation and assessing the need to import.

This paper presents the finding of research by ABARES exploring the role that public sector forecasts of grain stocks can play in reducing market uncertainty in years of low production. The research was conducted between May and July 2019. The project extended the methodology of the Australian crop report to validate ABARES forecasts of grain consumption and stocks.

Download the full report