The Australian Agricultural Forecasting System (AAFS) is the system that ABARES uses to produce forecasts for Australia’s agricultural markets. Although AAFS has been in development and use since 1945, this is the first time that it has been documented.

Documentation supports peer review and provides end–users with confidence that ABARES forecasts can be relied on. It facilitates collaboration with other forecasting agencies around the world and helps to train new generations of forecasters.

AAFS is made up of a database, a group of loosely–coupled, commodity–specific balance sheets used to produce forecasts, and a web-based publishing system for disseminating forecasts. ABARES uses AAFS to produce quarterly forecasts of the value, volume and price of Australia’s agricultural production and exports.

The current form of AAFS represents a long history of design choices, and these are documented and critiqued in the report.

In the early decades, effort focused on the development of structural models for Australia’s agricultural markets. These models proved expensive to build and maintain and didn’t add significantly to the accuracy of short–term market forecasts.

The primary advantage of structural models is an ability to explicitly represent cross-commodity interactions.

Balance sheet forecasting systems like AAFS do not automatically evolve mechanisms for incorporating cross–commodity interactions into forecasts. These have to be incorporated into AAFS by building systematic interactions between the forecasters who operate related balance sheets, supported by a range of process checks.

Balance sheets are the simplest and lowest cost method of forecasting individual commodity markets. They facilitate triangulation around incomplete data sources, and between methods to select the most efficient combinations for each commodity. They have intuitive appeal because they represent annual flows of commodities into and out of a country or region.

Recognising and managing its systems characteristics is an ongoing challenge for the management of AAFS that is documented in the report. Top-down forms of management have proven inadequate for managing difficult-to-predict interactions between diverse methods and models across the system. More successful approaches set clear system–wide direction and create a devolved and adaptive learning environment that supports a high degree of self–organisation.

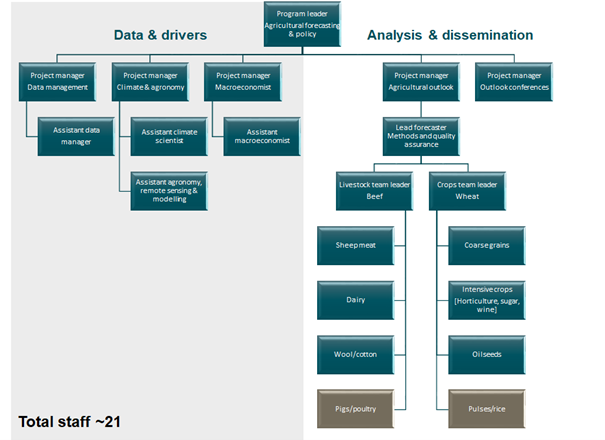

In mid–2021 ABARES forecasting team had around 18–20 staff, including the data, climate and macroeconomic teams.

Individual forecasters are usually allocated responsibility for operating the balance sheets for a single major commodity or commodity group. Forecasters are organised into crop and livestock teams because these groups of commodities share characteristics that support common approaches to forecasting and policy analysis.

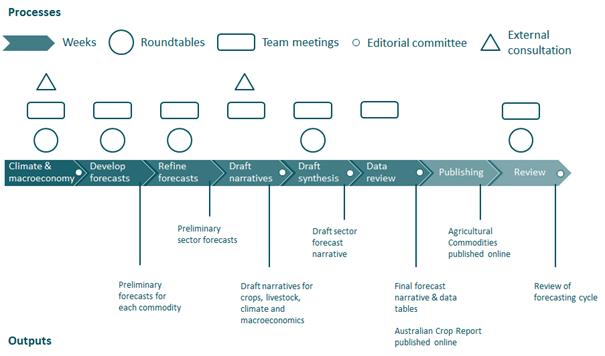

ABARES uses AAFS to produce quarterly forecasts in March, June, September and December. Each forecast cycle typically takes 8 weeks. The forecasting cycle begins with roundtable meetings to review seasonal climate and the macroeconomic factors affecting Australia’s agricultural commodities. Forecasts are developed and reviewed iteratively throughout each cycle, drawing on consensus forecasting processes with industry. Each cycle finishes with a review of significant challenges or revisions to methodology.

The accuracy of the Bureau’s forecasts improves as lead times between forecasts and final outcomes are reduced. Relative errors for price forecasts issued in March for the forthcoming July to June financial year averaged 16% over the period 2000 to 2019. This falls to 11% for September quarter forecasts and to 7% for the December quarter.

ABARES forecasting publications received around 25,000 unique page views per month in the 12 months to September 2021. Most views take place in Australian capital cities. ABARES forecasts also have a significant international audience with around one third of all page views originating outside of Australia.