Due to Anzac Day public holiday, the Weekly Australian Climate, Water and Agricultural Update will not be published next week Thursday 25 April 2024. The next Weekly Update will be published on Thursday 2 May 2024.

Key issues

- In the week ending 17 April 2024, dry conditions were experienced across much of Australia.

- Isolated areas across cropping regions in Western Australia, northern New South Wales and southern Queensland recorded up to 25 millimetres of rainfall. Dry conditions in large areas of Queensland would have allowed resumption of summer crop harvests.

- While it is still early in the winter growing season, without adequate rainfall in the coming weeks many growers may opt to dry sow of winter crops, which would present some downside production risk for the 2024–25 growing season.

- Over the coming days, a high-pressure system will keep much of the country dry. Low pressure systems in the north and a tropical low in the east are expected to generate rainfall of up to 100 millimetres in some areas.

- A wet week across large parts of Queensland cropping regions will likely interrupt harvest of summer crops. Remaining cropping regions will remain largely dry, except for northern New South Wales.

- Globally, variable rainfall during March has led to mixed crop production prospects.

- Global production conditions were generally favourable for wheat and rice while variable for soybeans and maize.

- Global production conditions have generally remained largely unchanged, except for in South America, compared to those used to formulate ABARES forecasts of global grain supplies and world prices for 2023–24 in its March 2024 edition of the Agricultural Commodities Report. As a result, global grain and oilseed production are likely to remain similar to those presented in the March forecast, with falls in corn production to be offset by increases in rice and wheat production.

- Water storage levels in the Murray-Darling Basin (MDB) decreased between 11 April 2024 and 18 April 2024 by 111 gigalitres (GL). Current volume of water held in storage is 16 860 GL, equivalent to 76% of total storage capacity. This is 15 percent or 3085 GL less than at the same time last year. Water storage data is sourced from the BOM.

- Allocation prices in the Victorian Murray below the Barmah Choke decreased from $22 on 11 April 2024 to $21 on 18 April 2024. Prices are lower in the Murrumbidgee due to the binding of the Murrumbidgee export limit.

Climate

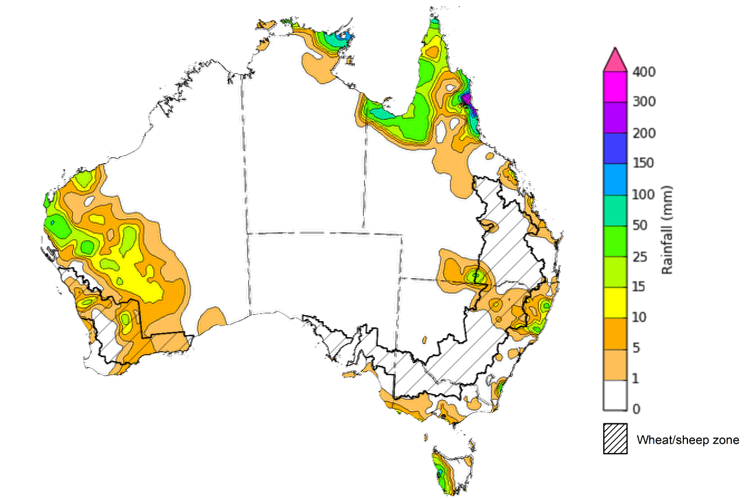

For the week ending 17 April 2024, much of Australia was dry. However, ex-Tropical Cyclone Paul and a series of low-pressure troughs brought rainfall totals of up to 300 millimetres to parts of the Northern Tropics and 50 millimetres to parts of Western Australia and eastern New South Wales. Additionally, a cold front brought rainfall of up to 50 millimetres western Tasmania.

In Western Australia, there have also been reports that the continued dry conditions during autumn are exacerbating the impact on livestock production following a hot and dry late spring and summer period. The availability of paddock feed for livestock feed is in short supply, which is leading to farmers mainly in southern production regions purchasing fodder at elevated prices to maintain animal numbers and condition.

In cropping regions, there was little to no rainfall in most areas for the week ending 17 April 2024. Rainfall totals did however reach up to 25 millimetres in parts of southwest Queensland and Western Australia and up to 15 millimetres in northern New South Wales.

A mostly dry week in Queensland would have allowed for resumption of summer crop harvest. Elsewhere, the noticeable lack of rainfall, particularly in southern cropping areas is leading to a continuous decline in upper layer soil moisture levels. While it is still early in the winter growing season, without adequate rainfall in the coming weeks, this may lead to many growers opting to dry sow of winter crops that presents some downside production risk for the 2024–25 growing season.

Rainfall for the week ending 17 April 2024

Issued: 17/04/2024

Note: The rainfall analyses and associated maps utilise data contained in the Bureau of Meteorology climate database, the Australian Data Archive for Meteorology (ADAM). The analyses are initially produced automatically from real-time data with limited quality control. They are intended to provide a general overview of rainfall across Australia as quickly as possible after the observations are received. For further information go to http://www.bom.gov.au/climate/rainfall/

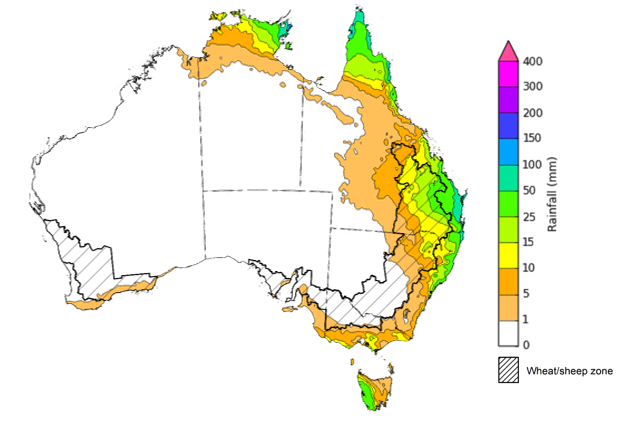

Over the 8 days to 25 April 2024, a high-pressure system is expected to keep Australia largely dry. Exceptions are in the tropical north where low pressure systems are expected to generate rainfall of up to 100 millimetres across the northern parts of Queensland and the Northern Territory, potentially more across isolated parts of north-east Northern Territory. A tropical low on the east coast is expected to generate showers of up to 100 millimetres of rainfall in eastern Queensland and northeastern parts of New South Wales. A cold front is expected to bring up to 50 millimetres of rainfall in Tasmania.

Across cropping regions, conditions are expected to be generally dry in the south. This continues to present a risk of declining soil moisture in these areas. In the east, a maximum of 25 millimetres is forecast for isolated areas in northern New South Wales. In Queensland, falls of up to 50 millimetres are expected. With the harvest of summer crops underway in Queensland, these wet conditions are likely to further interrupt harvesting activities.

Total forecast rainfall for the period 18 April to 25 April 2024

Issued 18/04/2024

Note: This rainfall forecast is produced from computer models. As the model outputs are not altered by weather forecasters, it is important to check local forecasts and warnings issued by the Bureau of Meteorology.

Crop production is affected by long-term trends in average rainfall and temperature, interannual climate variability, shocks during specific growth stages, and extreme weather events. Some crops are more tolerant than others to certain types of stresses, and at each growth stage, different types of stresses affect each crop species in different ways.

The precipitation anomalies and outlooks presented here give an indication of the current and future state of production conditions for the major grain and oilseed producing countries which are responsible for over 80% of global production. This is an important input to assessing the global grain supply outlook.

March precipitation percentiles and current production conditions

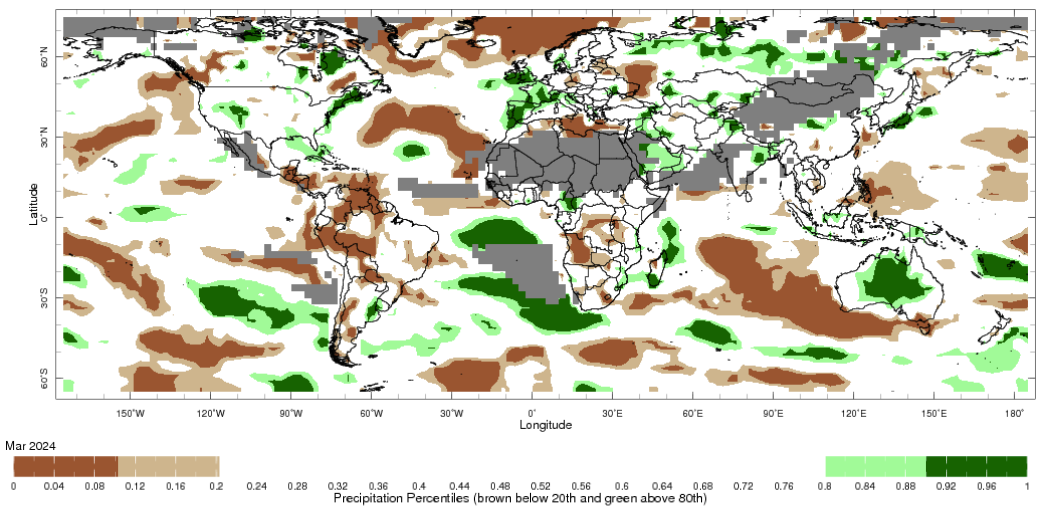

As of the end of March 2024, rainfall was mixed for the world’s major grain- and oilseed-producing regions.

Precipitation was below average across large parts of western Brazil and southern Argentina. It was above average in large areas of central Australia and eastern parts of Argentina, and average in the remaining grain- and oilseed-producing regions in the southern hemisphere.

Precipitation was generally average to above average in the most of northern hemisphere grain- and oilseed-producing regions, except for parts of China and western Canada.

Global precipitation percentiles, March 2024

Note: The world precipitation percentiles indicate a ranking of precipitation for March, with the driest (0th percentile) being 0 on the scale and the wettest (100th percentile) being 1 on the scale. Percentiles are based on precipitation estimates from the NOAA Climate Prediction Center’s Climate Anomaly Monitoring System Outgoing Precipitation Index dataset. Precipitation estimates for March 2024 are compared with rainfall recorded for that period during the 1981 to 2010 base period.

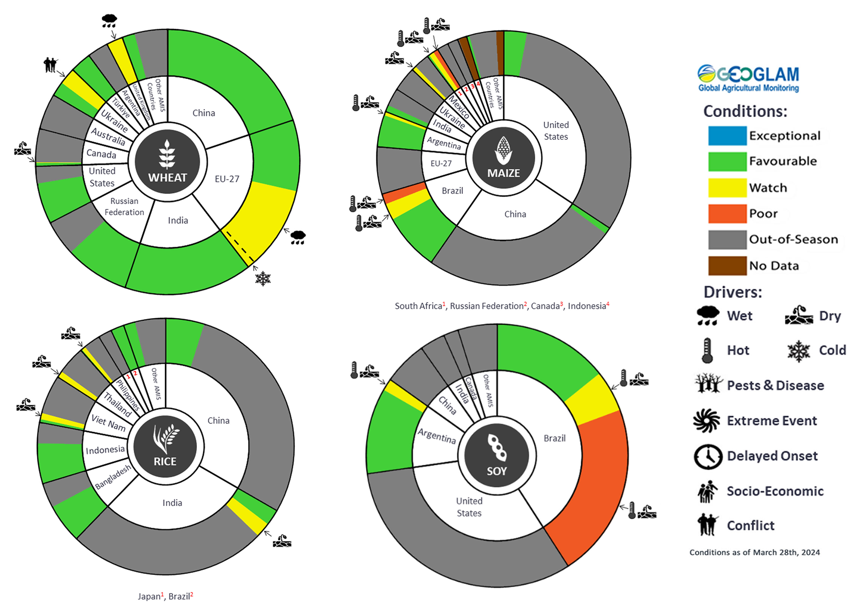

As of 28 March 2024, global production conditions were generally favourable for wheat and rice, but variable for maize and soybeans.

Wheat: In the northern hemisphere, winter wheat is breaking dormancy under generally favorable conditions except in parts of Europe and UK. Spring wheat sowing has begun in China.

Maize: In the southern hemisphere, harvesting of the spring-planted crop with reduced yields in Brazil is progressing under dry conditions. Significant rain in eastern Argentina has delayed harvest of early planted crops in Argentina and raises concerns for pests and diseases.

Rice: Sowing of the early-planted crop in China and harvesting of the Rabi crop in India and earlier sown crops in Indonesia has begun, generally under favourable conditions.

Soybeans: In the southern hemisphere, harvesting continues in Brazil generally under variable conditions with below average yields in many regions due to inadequate rainfall and high temperatures during the crop development stage. In Argentina, adequate rainfall since mid-February have supported crop development and recovery from earlier dry conditions. The harvest of early-planted crops has seen good yields being recorded.

Crop conditions, AMIS countries, 28 March 2024

Source: AMIS

The global climate outlook for May 2024 to July 2024 indicates that mixed rainfall conditions are expected for the world’s major grain-producing and oilseed-producing regions. Outlooks and potential production impacts for the major grain and oilseed producing countries are presented in the table.

Rainfall outlook and potential impact on the future state of production conditions between May 2024 to July 2024

| Region | May-July rainfall outlook | Potential impact on production |

|---|---|---|

| Argentina | Below average rainfall is more likely across much of Argentina. | Below average rainfall is likely to support the harvesting of sorghum, rice, millet, soybeans, corn, sunflower, cotton and nuts. However, the dry conditions may negatively impact the germination and establishment of wheat. |

| Black Sea Region | Generally, average rainfall is likely for Ukraine, Türkiye, Kazakhstan and the Russian Federation. | Average rainfall in Kazakhstan and Ukraine is likely to be sufficient to support grain filling of wheat and canola, as well as cotton, corn and sunflower from July 2024. Average rainfall across much of Türkiye and the Russian Federation is likely to support similar crops in the south and the heading of spring wheat in the north from June 2024. |

| Brazil | Below average rainfall is more likely across western and central parts of Brazil. Average to above average rainfall is likely in the eastern areas. | Below average rainfall across much of Brazil may support the harvesting of cotton and corn. Below average rainfall in the south is likely to impede the germination and establishment of wheat in June and July 2024. |

| Canada | Generally, average rainfall is likely across much of Canada. Above average rainfall is likely in scattered areas in the western regions. | Average rainfall is likely to positively impact yield potentials of winter wheat and canola as they enter critical reproductive phases from July 2024, as well as the growth and development of corn, soybeans and sunflower. |

| China | Above average rainfall is more likely across much of central and eastern China and average rainfall is more likely across remaining China. | Above average rainfall across much of China is likely to support the flowering of cotton, corn, groundnuts, single rice, soybeans, sorghum, sunflower and spring wheat. The wet conditions may also delay the harvest of early sown rice in July 2024. |

| Europe | Average rainfall is more likely for much of Europe between May and July 2024. | Average rainfall across Europe is likely to support corn, soybeans, sunflower, canola and winter wheat through critical reproductive stages between May and July. |

| South Asia (India) | Above average rainfall is more likely across much of southern India, while central India is likely to experience below average rainfall. Average rainfall is likely elsewhere. | Average to above average rainfall in the southern and eastern India may delay the planting of cotton, corn, groundnuts, millet, rice, sorghum and sunflower in May and June 2024. However, the increased soil moisture levels will support their germination and establishment. |

| Southeast Asia (SEA) | Below average rainfall is likely across SEA. Above average rainfall is forecast for much of Indonesia. | Below average rainfall across most of Southeast Asia is likely to negatively impact corn and rice planting and development from May 2024. |

| The United States of America (US) | Generally, average rainfall is more likely for much of the US with exceptions in the southern areas where below average rainfall more likely. | Average rainfall is likely to support yield potentials of spring wheat as it enters critical reproductive stages. |

Water

Water storages, water markets and water allocations - current week

The Tableau dashboard may not meet accessibility requirements. For information about the contents of these dashboards contact ABARES.

Commodities

Information on weekly price changes in agricultural commodities is now available at the Weekly commodity price update.