Authors: Angus Robertson and Jenny Eather

Removal of an impediment to trade provided a pathway for the cherry and summerfruit (apricots, nectarines, peaches and plums) industries to successfully compete in a large and growing market in China.

Introduction

The value of Australian horticultural exports grew rapidly in the 20 years to 2018–19, increasing by nearly 3% per year on average to $3.4 billion (ABS 2020). In that year Australia exported horticultural products to over 30 countries, 14 of which were in Asia. Strong Asian demand growth for high quality, fresh fruit and vegetables and Australia's increasing international competitiveness in recent years underpinned this export growth. This competitiveness has been supported by the development of export-oriented horticultural industries and ongoing reform to industry-specific regulation (Xia & Nelson 2018). But other factors, such as exchange rates, food safety concerns, supply chain efficiencies and market access, have also been key drivers.

This report focusses on one important issue for Australia's horticultural industry: market access. Australia's market access for horticultural exports has been enhanced through successful negotiations with partner countries. The terms of the agreements have typically included a combination of agreed tariff reductions and protocols that set out the conditions that govern how a country's product may enter a given market. Notwithstanding the potential additional cost incurred by exporters to comply with these conditions, the protocols have allowed Australian producers to export a broader range of products to more markets.

Around 70% of Australian agricultural production is exported. Because of this export dependence, maintaining or improving access to overseas markets is essential for the sustainability and profitability of the Australian agricultural sector. Improvements to market access support the competitiveness of the industry and can be achieved through lower tariffs or clearer, less restrictive or less costly protocols for exporters.

This article uses a case study to analyse the impact of market access improvements on Australian stone fruit exports. The study illustrates how the removal of an impediment to trade provided a pathway for the cherry and summerfruit (apricots, nectarines, peaches and plums) industries to successfully compete in a large and growing market.

[expand all]

Role of non-tariff measures in agricultural trade

Free trade agreements are the most visible negotiations aimed at increasing international trade. These agreements focus on tariff reductions. However, tariff reductions are not always sufficient to guarantee better opportunities for agricultural exports. In some cases non-tariff measures may continue to hinder trade (ABARES 2019).

Non-tariff measures (NTMs) are defined as policy measures other than ordinary customs tariffs that can have an economic effect on international trade in goods. NTMs can change quantities traded, or prices or both (UNCTAD 2019). A common type of NTM imposed on agricultural products are sanitary and phytosanitary measures (SPS). SPS measures impose biosecurity, health and food safety requirements on imports to protect domestic production, human health or the environment from pests, weeds and diseases that may be present in import consignments. SPS requirements usually involve compliance costs that increase the price of an agricultural good. However, these requirements may facilitate trade by providing certainty of the quality, origin and pest or disease-free status of the exported product.

The WTO Agreement on the Application of Sanitary and Phytosanitary Measures sets out rules for the application of SPS measures (WTO 1995). The agreement allows importing countries to safeguard against any risks, or perceived risks, by restricting trade entirely or by placing SPS requirements on imported products. However, SPS measures should be based on scientific evidence and must not 'arbitrarily or unjustifiably discriminate between countries where identical or similar conditions prevail' (WTO 1998).

Protocols and improving access to China

Market access protocols for Australian stone fruit

Export protocols for Australian stone fruit are in place primarily to minimise the risk to importing countries of a possible incursion of Queensland fruit fly (Bactrocera tryoni) or Mediterranean fruit fly (Ceratitis capitata). In general, phytosanitary treatments against fruit flies can include methyl bromide fumigation, irradiation or cold disinfestation, which involves storing fruit for a period of time (typically 2 weeks) at a specified temperature. Some importing countries also have concerns about codling moth (Cydia pomonella), brown rot (Monilinia fructicola) and Jarvis' fruit fly (Bactrocera jarvisi). These pests and diseases all have the potential to negatively affect horticultural production because they can be introduced to new areas through imported fruit.

China, Hong Kong, Malaysia, Singapore and Vietnam were Australia's 5 most valuable stone fruit export markets in 2018–19 (ABS 2020). Australia has agreed protocols for exporting stone fruit to China (DAWE 2020a, b). Stone fruit must be treated to kill any fruit fly life stages that might be present in export consignments, unless they come from a recognised pest-free area. Vietnam has similar SPS requirements as China for Australian cherries (DAWE 2020i). However, Australia does not have access to export summerfruit to Vietnam (DAWE 2020h).

In contrast, Hong Kong, Malaysia and Singapore have minimal SPS requirements and do not require Australian stone fruit to be treated before export (DAWE 2020c, d, g). For example, Hong Kong requires that Australian stone fruit 'be free from pests, soil, weed seeds and extraneous material' (DAWE 2020c). Other countries, such as New Zealand, do not allow the importation of any Australian stone fruit (DAWE 2020f).

Further SPS measures imposed by importing countries can include a requirement that Australian stone fruit originates from a packing house accredited by the importing country or that export consignments be inspected. They may also mandate that a phytosanitary certificate accompanies export consignments. In the case of China, both a phytosanitary certificate and an export inspection are required in addition to a phytosanitary disinfestation treatment.

Improvements in stone fruit access to China

Improved market access to China has been a key focus for Australian horticultural exporters, particularly over the past decade. This has led to increased Chinese consumption of high-quality Australian horticultural products.

Following negotiations with the General Administration of Quality Supervision, Inspection and Quarantine (AQSIQ), Australia gained market access for cherries in 2014, subject to export protocols. Subsequent successful negotiations opened the Chinese market to Australian nectarines in 2016, and apricots, peaches and plums in 2017. The China–Australia Free Trade Agreement (ChAFTA) entered into effect on 20 December 2015 and provided for the phased removal of the 25% tariff on Australian apricots and the 10% tariff on cherries, nectarines, peaches and plums (Table 1 ). All Australian stone fruit exports to China were tariff-free by 1 January 2019.

Source: DAWE 2020e; DFAT 2020

In some cases, bilateral negotiations to establish or improve market access protocols for Australian exports involve reciprocal market access provisions for the trading partner. For example, during negotiations in which Australia ultimately gained access to the Chinese market for summerfruit, Australia worked to improve China's access to the Australian market for apples and pears.

Effect of changes to market access on stone fruit exports

Establishing market access protocols with China has been highly valuable for the Australian stone fruit industry. From 2014–15 to 2018–19 the total value of Australia's cherry exports grew by 55% in constant dollar terms. Only in 2016–17 did exports decline, when unfavorable seasonal conditions caused a 37% drop in production (ABS 2019). The value of Australian nectarine exports also grew strongly after gaining market access to China in 2016, increasing by 81% between 2016–17 and 2018–19. Similarly, the export value of peaches grew by 64% and plums by 52%, after the industry gained market access in 2017 (ABS 2019).

Cherries were Australia's most valuable stone fruit export in 2018–19 at 5,000 tonnes ($79.3 million) (Figure 1 and Figure 2 ). Nectarines were the most valuable summerfruit export ($34.9 million), followed by peaches ($25.6 million), plums ($25 million) and apricots ($2.4 million).

China has become Australia's most valuable stone fruit export market since market access protocols were established between the 2 countries. Between 2014–15 and 2018–19, the value of Australian cherry exports to China increased from $6.8 million to $27.4 million. By 2018–19 China accounted for 35% of Australia's total cherry exports (Figure 3 ). In the same year, Australian cherry exports to China commanded a 14% price premium compared with the weighted average price of cherry exports to all other markets (Table 2 ).

Note: Percentage price premium of Australian stone fruit exports to China compared with a weighted average export unit price to all other markets.

Source: ABS 2020

Australian summerfruit exports to China grew strongly in the 3 years to 2018–19 when they were valued at $42.4 million, while exports to Hong Kong nearly halved. China accounted for 48% of Australia's total summerfruit exports in that year (Figure 4).

Australian summerfruit exports also attract a premium price in the Chinese market. In 2018–19 Australian summerfruit exports to China commanded an average per kilogram price premium of 41% compared with the weighted average price of summerfruit exports to all other markets (Table 2 ). The price premium for peaches was the largest of all stone fruit exports. These premiums have underpinned the rapid growth in the value of summerfruit exports to China.

Stone fruit production

Growers of summerfruit and cherries are unlikely to be able to increase production immediately following improvements to market access. Supply of orchard fruits cannot be easily increased in the short term, because new plantings may take up to 10 years to reach full bearing age. Any increase in exports is more likely to be achieved by diverting product out of less profitable markets to new, higher-value export markets. Adjustments to production can be made over a longer time frame once market relationships are established.

Despite the growth in the value of cherry exports since 2011–12, production has not increased significantly. Between 2011–12 and 2017–18 the number of cherry trees nationally fell by 9%, but the number in Tasmania increased by 13% (ABS 2019). This shift in production out of the mainland occurred because Tasmania is recognised as a pest-free area. As a result, export consignments from Tasmania to some high-value north Asian and South-East Asian markets and the United States do not have to undergo post-harvest treatment. They therefore command a higher export value per unit than cherries from the mainland (ABS 2020).

The downturn in mainland production could reverse over the medium to long term given the improvements to export protocols achieved in November 2017 (Table 1). These allow mainland cherry growers to air freight produce directly to China.

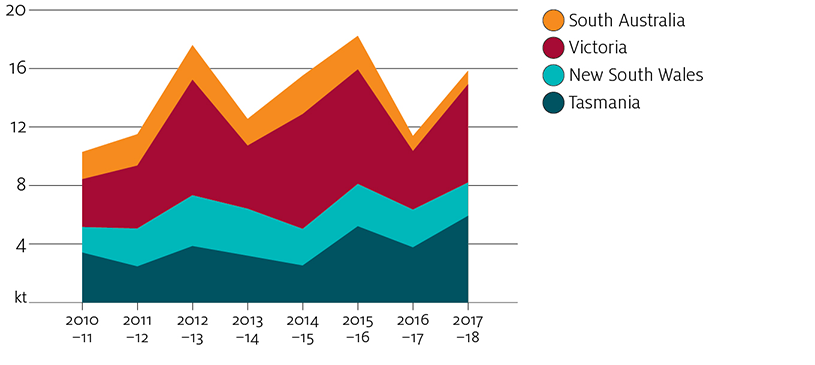

The production of stone fruit depends on favorable seasonal conditions. Australia's production of cherries fell from 18,400 tonnes in 2015–16 to 11,500 tonnes in 2016–17 (Figure 5), when seasonal conditions were poor. This was reflected in the lower volume and value of Australian cherry exports that year (Figure 1 and Figure 2). Production only partly recovered in 2017–18 to 15,900 tonnes.

Source: ABS 2019

Risks and conclusion

Risks to market access

Despite Australia's success gaining new or improved access to export markets, there is always the risk of access being lost. Market access can be revoked by the importing country if the exporting country is found to be non-compliant with existing protocols. The importing country can also impose additional SPS measures that fall outside the existing protocol. This can be the result of a political decision in the export market, a new or increased risk from a pest or disease, or other food safety or quality concerns. Once lost, restoration of market access can be a long process.

An example of Australia losing market access occurred in 2015. On 1 January 2015 Vietnam restricted all imports of Australian fruit due to concerns that fruit flies might be present in Australian export consignments (ABC 2015). This caused the complete loss of trade of cherry and summerfruit exports to Vietnam in 2015–16. In 2013–14 cherry exports to Vietnam had been worth $2.3 million (6% of total cherry exports) and summerfruit $1.9 million (4% of total summerfruit exports) (Figure 3 and Figure 4 ). Market access for cherries was restored on 3 October 2017 (DAWE 2020e). By 2018–19 cherry exports to Vietnam were valued at $9.4 million (12% of total cherry exports). Market access for Australian summerfruit to Vietnam has not yet been restored.

Over-reliance on a single overseas market is another potential risk to Australian exporters. Any disruption to trade to this market can leave exporters vulnerable if they do not have established commercial links to other markets. The obvious consequence is loss of export returns in the short term. However, despite the risk of losses, the reliance on a single or limited number of export markets arises as a rational commercial response to the premiums received for Australian products from those markets. The higher returns from those markets in the long term may outweigh the risk of short-term losses caused by potential market disruptions. The current outbreak of coronavirus (COVID-19) provides an example of the challenges caused by reliance on one market when there is a trade disruption. The response by China's government to the outbreak has caused a slowdown in trade, forcing some Australian exporters to seek alternative markets for agricultural shipments. The expected losses from this outbreak may be significant for some industries, but they are likely to be short-lived. The long-term impact of this outbreak on Australian producers and exporters is unknown.

Conclusion

Improved market access to China since January 2014 has facilitated the rapid growth of exports of Australian stone fruit. Gaining access for cherries into the Chinese market has been particularly beneficial given the strong growth in the value of exports since 2014–15. Exports of apricots, nectarines, peaches and plums have also benefited significantly since gaining access, allowing producers to receive higher prices for their product compared with other markets.

In this case study the uptake of new or improved market access opportunities occurred quickly and was significant, but this may not always be the case. This can occur for several reasons, including high costs of compliance, the inability of an industry to respond quickly for products with longer production cycles, or because the product may not be competitive in the new market. However, slow uptake notwithstanding, it is generally important for agricultural industries to have a broad range of accessible markets to mitigate the risk of losses from sudden market closures or disruptions, or imposition of trade barriers.

References

ABC 2015, Vietnam closes door on Australian fruit and vegetables, Australian Broadcasting Corporation, Sydney, accessed 20 January 2020.

ABARES 2019, Non-tariff measures affecting Australian agriculture, Australian Bureau of Agricultural and Resource Economics and Sciences, Canberra, accessed 23 January 2019.

ABS 2019, Agricultural commodities, 2017–18, cat. no. 7121.0, Australian Bureau of Statistics, Canberra.

——2020, International trade, Australia—Information Consultancy Subscription Service, 2000, cat. no. 5465.0, Australian Bureau of Statistics, Canberra, January.

DAWE 2020a, China: Cherries, Department of Agriculture, Water and the Environment, Canberra, accessed 17 January 2020.

——2020b, China: Nectarines, Department of Agriculture, Water and the Environment, Canberra, accessed 17 January 2020.

——2020c, Hong Kong: All, Department of Agriculture, Water and the Environment, Canberra, accessed 17 January 2020.

——2020d, Malaysia: Other, Department of Agriculture, Water and the Environment, Canberra, accessed 17 January 2020.

——2020e, Market access achievements, Department of Agriculture and Water Resources, Canberra, accessed 17 January 2020.

——2020f, New Zealand: Other, Department of Agriculture, Water and the Environment, Canberra, accessed 17 January 2020.

——2020g, Singapore: All, Department of Agriculture, Water and the Environment, Canberra, accessed 17 January 2020.

——2020h, Vietnam: Apricot, nectarine, peach, plum, Department of Agriculture, Water and the Environment, Canberra, accessed 17 January 2020.

——2020i, Vietnam: Cherries, Department of Agriculture, Water and the Environment, Canberra, accessed 17 January 2020.

DFAT 2020, China–Australia Free Trade Agreement: FTA text and tariff schedules, Department of Foreign Affairs and Trade, Canberra. Summerfruit Australia 2020, Australian summerfruit, Aldgate, accessed 23 January 2020.

UNCTAD 2019, International classification of non-tariff measures: 2012 version, United Nations Conference on Trade and Development, New York, accessed 20 January 2020.

WTO 1995, The WTO Agreement on the Application of Sanitary and Phytosanitary Measures (SPS Agreement), World Trade Organization, Geneva, accessed 17 January 2020.

——1998, Understanding the WTO Agreement on Sanitary and Phytosanitary Measures, World Trade Organization, Geneva, accessed 20 January 2020.

Xia, C & Nelson, R 2018. Exploring Australia’s comparative advantage for exporting fresh produce. Agricultural Commodities–March quarter, Vol. 8, No. 1, pp 176–198.

Download the report

| Documents | Pages | File size |

|---|---|---|

Market access improvements: A case study of stone fruit exports to China PDF  |

xx | 680 KB |

If you have difficulty accessing these files, visit web accessibility for assistance.