Authors: Lindsay Hogan, Caroline Gunning-Trant

Summary

The value of Australia’s farm production and agricultural exports have increased strongly over the past decade to $61 billion and $48 billion, respectively, in 2019–20. The National Farmers Federation (NFF) has proposed a roadmap to achieve farm production of at least $100 billion by 2030. The Australian Government’s recent Agriculture 2030 package seeks to expand trade opportunities and build the competitiveness, resilience and innovative capacity of the industry. To further support this goal, industry and government need to identify priority markets where there are economic opportunities for agricultural export growth. A better understanding of what factors have underpinned historical growth will support future export success.

This introductory report briefly examines key drivers of Australia’s agricultural export growth following biosecurity market access. It provides a framework for looking at the drivers across a paddock-to-plate spectrum that have been fundamental to the sector's success. This framework is constructed with a view to subsequently focus the analysis across commodity and country-specific case studies.

[expand all]

Market access supports increased farm production and agricultural exports

New and enhanced market access provides industry with additional economic opportunities to supply agricultural products to overseas markets. Access to a wide variety of markets also provides farmers the flexibility to respond to changing market circumstances.

- The Department of Agriculture, Water and the Environment (the Department) also negotiated 341 key market access achievements for Australia’s agricultural, fisheries and forestry exports between July 2013 and April 2020, an average of 49 per year. These achievements mainly relate to biosecurity market access where biosecurity protocols are required to manage the risk of pest spread. Without biosecurity market access, it is not feasible to establish an agricultural export supply chain to the overseas market.

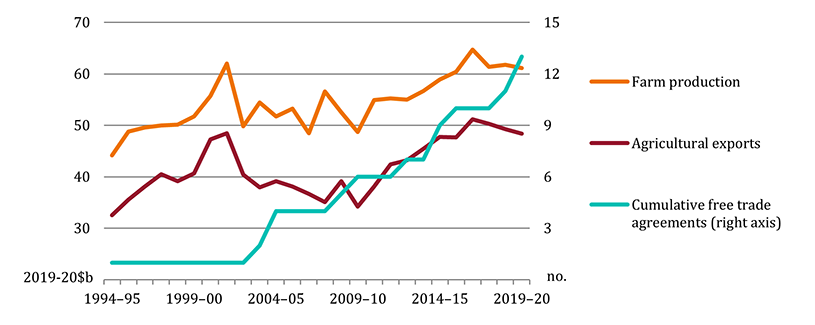

- The Australian Government has negotiated 15 free trade agreements (FTAs), 14 since 2003. A further 8 are either awaiting ratification or are under negotiation (Figure S1). FTAs lower trade barriers by, for example, reducing the tariff imposed on Australia’s agricultural exports in the importing country.

Figure S1 Australia's market access and agricultural production and exports, 1994–95 to 2019–20

Note: Inflation-adjusted values. Farm production and agricultural exports in the last 2 years were adversely affected by drought conditions.

Sources: ABARES 2020, 2021a; ABS 2020a; Department of Foreign Affairs and Trade 2021a

The Australian Government’s new and enhanced market access achievements are likely to have been major contributing factors supporting strong agricultural export value growth in the 2010s. Over the longer term, the value of Australia’s farm production and agricultural exports increased significantly—on average, by 1.3% and 1.6% per year, respectively, between 1994–95 and 2019–20 (Figure S1). However, long-term growth in Australia’s farm production and agricultural export value was disrupted by the effects of the resources boom in the 2000s, particularly with the strong rise in the value of the Australian dollar.

Following Australia’s new and enhanced access to overseas markets since the early 2000s, there are 4 key factors that have contributed to agricultural export growth:

- increased demand for higher-quality, higher-priced food products in overseas markets, particularly in the strongly growing Asian market, which has been the main focus of enhanced market access

- on-farm productivity growth that has enhanced Australia’s farm performance over the longer term

- increased international price competitiveness of Australia’s agricultural industries in the 2010s, mainly as a result of the large fall in the value of the Australian dollar after 2012–13, and

- more reliable and efficient export supply chains in the 2010s.

These key factors are also important for Australia’s agricultural export growth to non-protocol countries that are open to trade without technical negotiations. Following biosecurity market access, Australia’s agricultural exports may increase over a relatively short time frame if the access is to an overseas market where there is unmet demand for Australian agricultural products. New and enhanced market access also provides Australia’s farmers with a greater range of options to consider for future export expansion.

Asian demand underpins Australia’s agricultural export growth

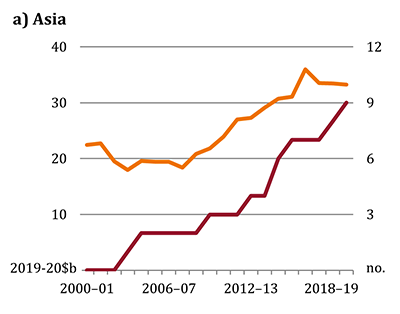

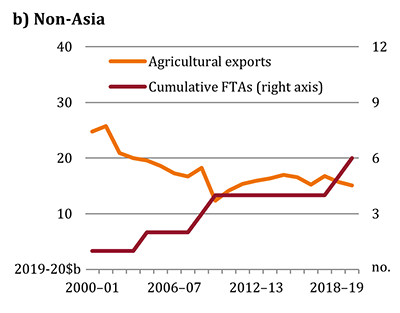

Relatively strong agricultural import demand growth in the important Asian market has underpinned Australia’s recent agricultural export growth (Figure S2). For example, between 2000–01 and 2019–20, the value of Australia’s agricultural exports increased, on average, by 4.3% per year to Asian markets, more than double the growth rate of 2.0% per year to non-Asian markets.

Australia contributes to the wellbeing and economic opportunities in overseas countries by exporting food for household consumption, particularly higher-quality food products, and by exporting agricultural products that are inputs to agricultural processing or to agricultural industries abroad, such as cereals, animal feed and seeds.

World population and income growth are 2 key drivers of long-term world agricultural demand growth, and hence world agricultural trade opportunities. Higher incomes and changing preferences toward safe and nutritious food—particularly shifting from a high reliance on staples such as rice toward meat, dairy, and fruit and vegetables—will continue to influence the demand for higher-quality food products, such as those exported from Australia (OECD/FAO 2020). These have been key drivers of Asia’s relatively strong agricultural import demand growth over the past decade.

Figure S2 Australia's market access and agricultural exports, Asia and non-Asia, 2000–01 to 2019–20

Note: Inflation-adjusted values. Cumulative FTAs for the corresponding region (including FTAs across both regions).

Sources: ABARES 2020, 2021a; ABS 2020a; Department of Foreign Affairs and Trade 2021a

Future market access negotiations will play an important part in facilitating further growth in Australia’s agricultural exports and providing options in times of trade disruptions, which will support the NFF goal of a $100 billion agricultural industry by 2030. ABARES case studies will provide a better understanding of key drivers of export growth following biosecurity market access achievements for specific commodities. These case studies will explore the export outcomes of previous market access achievements to identify those economic factors that most strongly supported the subsequent increase in exports. That information will assist and inform government and industry in their efforts to identify and prioritise new markets into which to expand Australia’s exports.

Download this report

Australia's biosecurity market access and agricultural exports.PDF

Australia's biosecurity market access and agricultural exports.DOCX