Cameron Van-Lane

Key points

- Cotton and wool prices forecast to fall in 2022–23 as the global economic outlook worsens.

- Above average rainfall may stymie Australian cotton planting but support increased wool production volumes.

- Delays in harvesting the 2021–22 cotton crop will substantially increase export value in 2022–23.

- Wool export volumes to increase, while wool export value is forecast to fall in 2022–23.

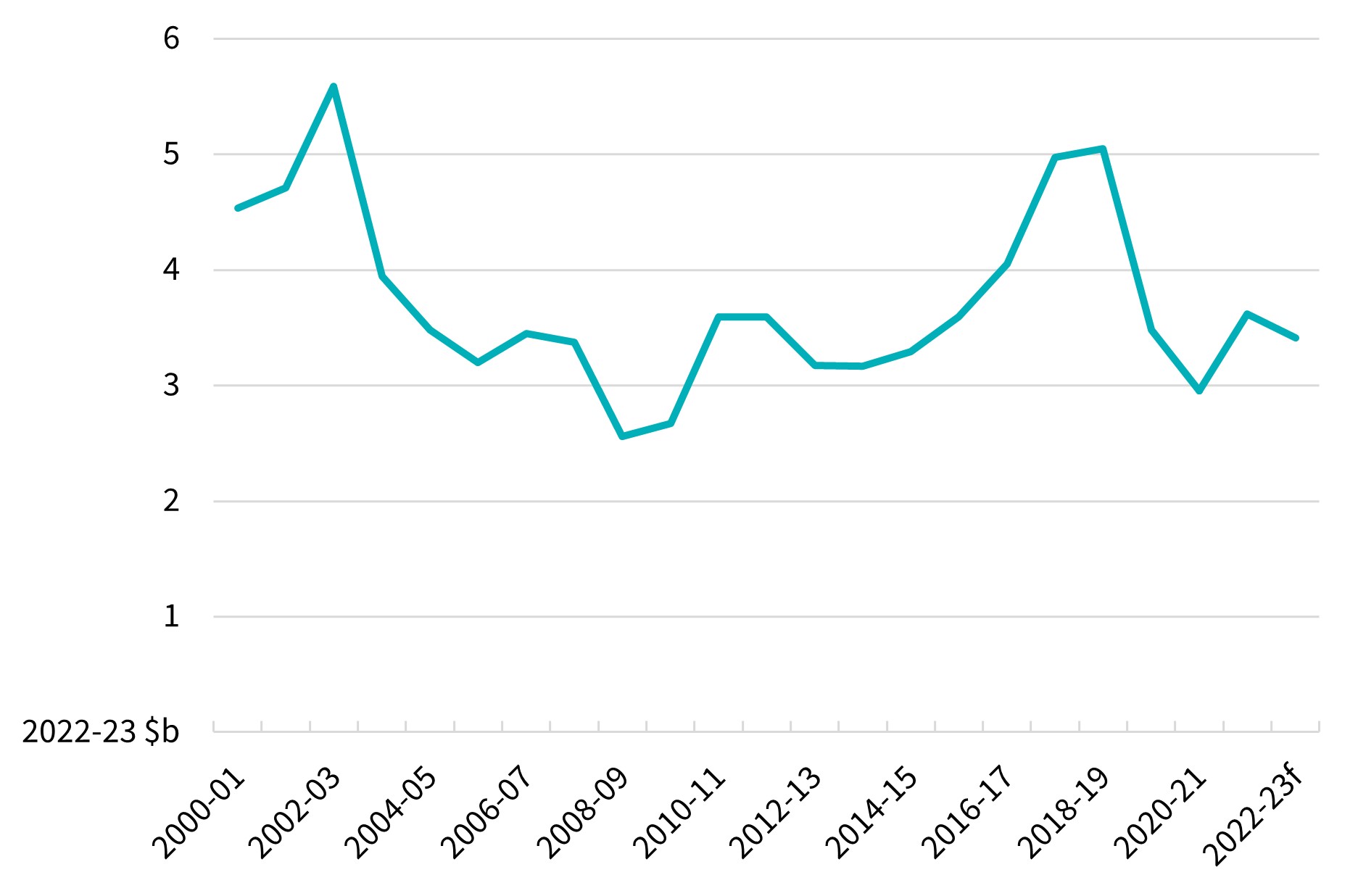

The gross value of cotton production is forecast to decrease by 31% to $3.6 billion in 2022–23, down from a record $5.3 billion in 2021–22. The substantial decrease is the result of lower international cotton prices as well as a drop in Australian production volumes. Speculative activity on the July 2022 futures contract saw international cotton prices surge in the latter half of 2021–22. However, the closing of the July contract and decreasing demand for cotton apparel led to a softening of prices in June and July. Prices are expected to remain subdued from recent highs, but well above the long-term average. Although strong incentives remain for Australian growers to plant cotton, back-to-back cotton plantings are expected to reduce yields, and above average forecast rainfall for spring may restrict field access for planting across major production regions, resulting in decreased production (Figure 1.1).

Figure 1.1 Gross value of cotton production, Australia, 2000–01 to 2022–23

Sources: ABARES; ABS

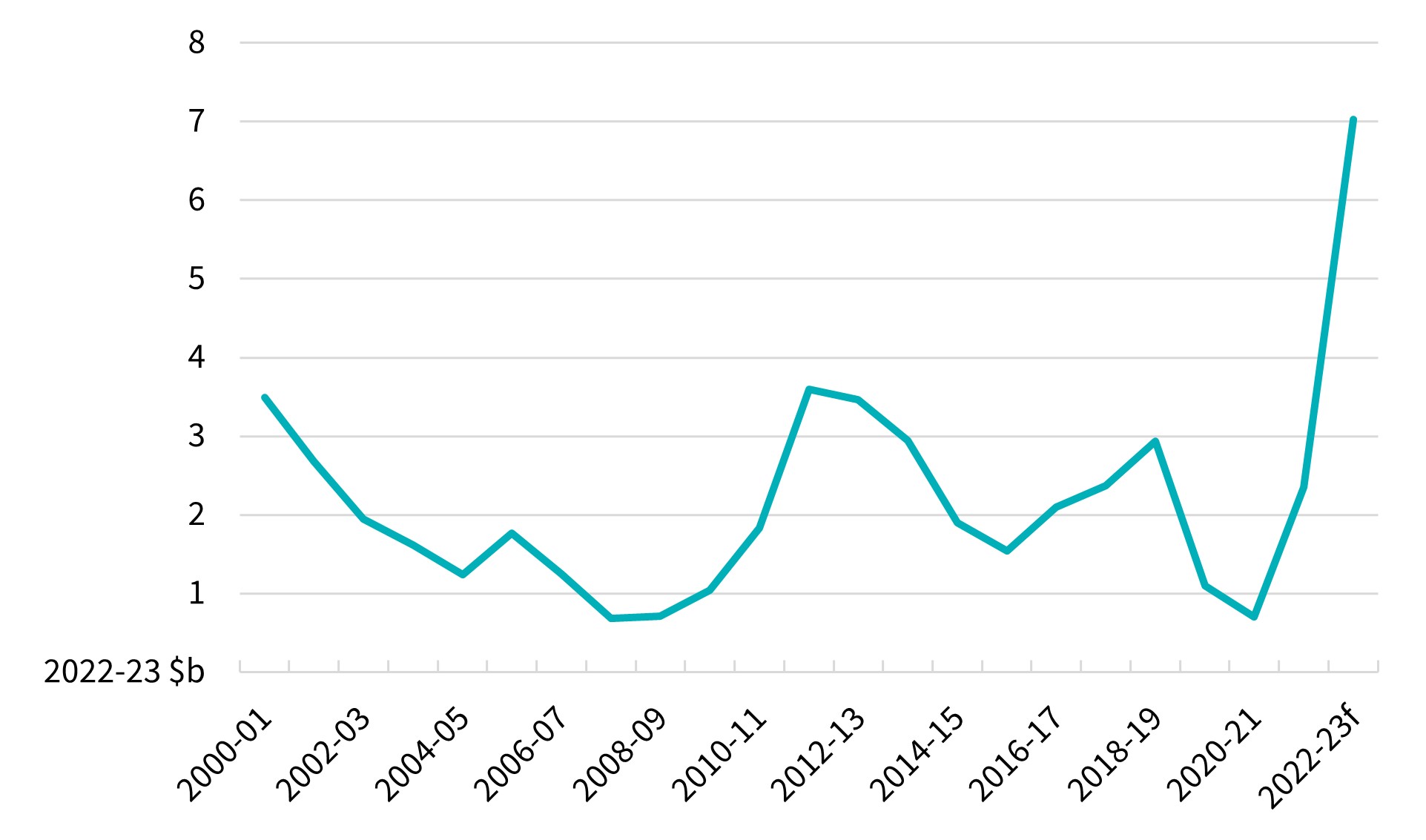

The gross value of wool production is expected to remain unchanged at $3.4 billion in 2022–23. A significant decrease in Australian wool prices is forecast to be offset by increased production volumes. The decline of real incomes in major economies, such as China and the United States, is expected to decrease discretionary spending, especially on luxury goods such as woollen apparel. The decrease in demand will flow through to lower raw wool prices in Australia. A third straight year of favourable production conditions is expected to increase wool production volumes in 2022–23, with above average rainfall and pasture growth continuing to support the rebuild of the Australian sheep flock. Given that Australia is the largest producer of fine and super-fine wool, increased domestic wool production will also put further downward pressure on prices in domestic markets (Figure 1.2).

Figure 1.2 Gross value of wool production, Australia, 2000–01 to 2022–23

Sources: ABARES; ABS

Slower global growth, as well as elevated inflation and interest rates, are expected to reduce demand for cotton and wool garments in major markets in 2022–23. The world economic outlook appears increasingly pessimistic, with the International Monetary Fund downgrading its global growth forecast for 2022 and 2023 (see the Economic Overview). Reflecting the pessimistic outlook, consumer confidence across major economies has deteriorated sharply in recent months. In China, the combination of COVID lockdowns in major cities and a deepening real estate crisis has precipitated its recent downturn, with second quarter garment sales falling 14% year-on-year. In the United States and Europe, surging inflation has prompted central banks to lift interest rates, thereby constraining economic activity and consumer spending.

The impact of deteriorating economic conditions is being felt right along textile supply chains. The International Textile Manufacturing Federation’s survey of manufacturers found current business sentiment and expectations have deteriorated in the first half of 2022, with East Asian and downstream businesses (such as weavers, knitters and garment manufacturers) struggling the most. Order intake has likewise decreased over the first half of 2022. Over the initial weeks of 2022–23, cotton import buying by spinning mills has been subdued, with downstream demand for cotton yarn and textiles remaining weak. To avoid mounting stockpiles of yarn, many mills are operating below capacity. While cotton yarn prices closely track movements in cotton fibre prices, the surge in raw cotton prices in the latter half of 2021–22, saw spinning mill margins being squeezed as downstream manufacturers were unwilling to absorb further yarn price increases (Figure 1.3). However, the decline in cotton and yarn prices in recent months reflects lacklustre demand downstream. Processors now face significant losses due to a build-up of cotton inventories purchased at much higher prices. Overall, mill demand in 2022–23 is expected to remain subdued.

Figure 1.3 Monthly domestic prices for middling grade cotton fibre and yarn, China, January 2015 to July 2022

However, the US ban on Xinjian cotton and strong global oil prices will provide some upside to demand for Australian cotton. Under the Uyghur Forced Labor Prevention Act, major brands will be forced to avoid yarn that may contain cotton originating from China’s major production province (Xinjian). Consequently, there is likely to be greater demand for yarn from non-Chinese mills and lint from major exporter countries, such as Australia. Additionally, the price of Brent crude oil is forecast to remain elevated throughout 2022–23. High oil prices push up the price of synthetic alternatives to cotton and wool, such as polyester, limiting the substitution away from natural fibres.

The economic slowdown is likely to impact demand for wool even more heavily, given its status as a niche, luxury fibre. Wool suit imports in major economies have recovered significantly over the past year but remain below pre-pandemic levels. A decline in demand for traditional wool suits has been attributed to the relaxation of work dress codes and professionals increasingly working from home. Reflecting this, the United Kingdom’s Office of National Statistics has officially dropped men’s suits from its basket of more than 700 items used to determine inflation. The suit, which had been in the basket since inflation tracking began (1947), has been replaced with “men’s formal jacket/blazer”, mirroring the shift in consumption habits.

Cotton export value is expected to increase by 220% to $7.0 billion in 2022–23. Delays in harvesting a record cotton crop in 2021–22 has left much of it (87%) to be exported in 2022–23. A large proportion of the 2021–22 cotton crop was also forward sold on December contracts at a time when prices were higher, further adding to the export value for 2022–23. Export values will be additionally supported by a sizeable 2022–23 cotton crop, with exports getting underway in the final quarter of 2022–23 (Figure 1.4). The forecast would make cotton the third most valuable agricultural export, behind beef and wheat, in 2022–23.

Figure 1.4 Cotton export value, Australia, 2000–01 to 2022–23

Sources: ABARES; ABS

Since the unconfirmed reports that Chinese cotton importers were advised not to use quota allocation on Australian cotton in October 2020, Australian cotton exports have become more diversified. The decline in the Australian cotton basis (the difference between the futures contract price and the local cash price) since October 2020 continues to provide Australian cotton with a competitive price point compared to other machine picked producers. In 2019–20, the top 5 destinations accounted for 91% of Australian exports, while in 2021–22, they accounted for only 80% (Figure 1.4). In 2019–20, exports were heavily concentrated on the Chinese market, accounting for 62% of Australian cotton exports. In 2021–22, Vietnam and Indonesia have emerged as the largest export destinations, accounting for 41% and 20%, respectively. Turkey and Thailand have also become major destinations for Australian cotton. The shift in export destinations also occurred at a time when cotton exports grew by 128% between 2019–20 and 2021–22 (see Agricultural Commodities: September quarter 2021).

Figure 1.5 Australian cotton export destinations, 2019–20 and 2021–22

Wool export value is expected to decrease by 3.8% to $3.5 billion in 2022–23, remaining well above historical averages. The decrease in wool export value is driven by decreasing wool prices, slightly offset by increasing export volumes. The vast majority of Australian wool is exported as greasy, raw wool for processing into yarn, textiles and garments overseas. Stagnant incomes in major economies will lead to a softening of demand for end products, flowing through to lower wool export prices.

The Cotlook ‘A’ Index (a benchmark of international medium grade raw cotton prices) is forecast to average US98 cents per pound in 2022–23, down 26% compared to 2021–22. Supply chain disruptions pushed many spinning mills to acquire additional stocks throughout 2021–22, with the added demand pushing cotton prices up. A combination of speculative activity (entities anticipating a rise in prices and buying cotton futures contracts) and a large number of unfixed mill contracts (options contracts where the price has yet to be determined) drove cotton prices higher still in the second half of 2021–22. However, international cotton prices declined significantly through June and July 2022. Supply chain bottlenecks also appear to be easing, with indications of containerised freight prices starting to decline. The sombre outlook for global income growth and a decline in global cotton consumption through 2022–23 is expected to decrease international cotton prices from recent highs, but with prices still remaining above the historical average. Decreased production out of the United States and Brazil (the world’s largest cotton exporters) will limit downside price risks.

The Eastern Market Indicator (EMI; an index of Australian wool prices used internationally) is forecast to average 1,320 cents per kilogram in 2022–23, down 5% compared to 2021–22. The EMI increased strongly throughout 2021–22, despite larger volumes of raw wool being brought to market. However, the recovery in demand seen in 2021–22 is likely to weaken in 2022–23, as consumers cut back on luxury apparel. While Chinese bans on South African wool imports remain in place, Australian prices are less likely to face significant pressure from competitors.

Australian cotton production is expected to decrease by 10% to 5.1 million bales in 2022–23, despite another forecast year of above average rainfall (see Seasonal Conditions). The planting of back-to-back cotton crops for many growers is likely to diminish yields slightly, due to disease pressure and soil compaction. In addition, heavy rainfall over recent months has left soil moisture levels well above average. The combination of heavy clay soils and above average rainfall forecast throughout the cotton planting window poses a risk that growers will not get access to fields for planting. In the southern Murray-Darling Basin, irrigated cotton production is forecast to fall in 2022–23, off a record high, in response to falling cotton prices and a forecast increase in water prices in the primary growing region (New South Wales Murrumbidgee; see ABARES Water Market Outlook).

However, considerable uncertainty exists for the forecast. If conditions allow for timely planting of cotton, there is potential for an increase in production in 2022–23. The availability of irrigation water across the northern Murray-Darling Basin could incentivise another large irrigated crop in 2022–23. High relative soil moisture levels and high relative crop returns could also provide a strong incentive to plant dryland cotton.

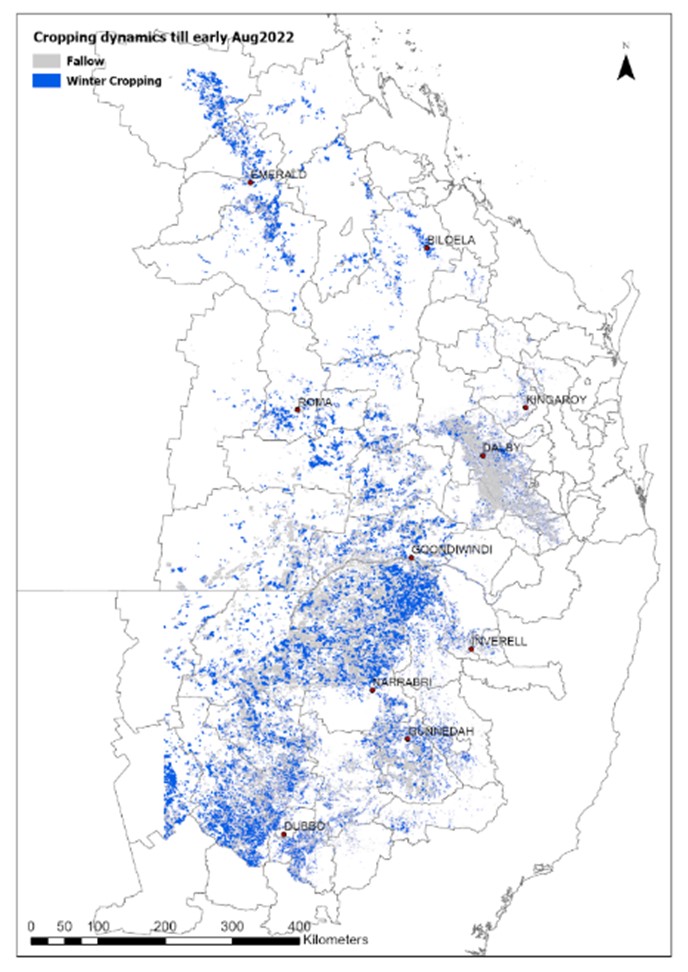

Moreover, many growers will also look to plant a dryland summer crop in lieu of the missed 2022 winter planting. The exceptionally wet conditions during the winter crop planting window resulted in large areas being left fallow. August estimates from the Queensland Alliance for Agriculture and Food Innovation’s CropVision ARC Linkage Project, indicates winter cropping area was down 30% in southern Queensland and 14% in northern New South Wales on the 6-year median (Figure 1.6). Accordingly, dryland cotton area may expand on the fallowed area.

Figure 1.6 Winter crop area and fallow area across northern New South Wales and southern Queensland, as of first week of August 2022

Australian shorn wool production is forecast to increase by 5% to 341,000 tonnes in 2022–23. Consistently wet conditions over recent months have led to well above average to extremely high pasture growth across major grazing regions. With the expectation of favourable rainfall conditions to continue, it is likely that sheep flock rebuilding will continue. According to Meat and Livestock Australia and Australian Wool Innovation’s June Wool and Sheep Meat Survey, 27% of growers intend to increase their flock size. As a consequence, Australia’s sheep flock is expected to grow by 0.5% to 71 million. Improved access to shearing labour with the easing of travel restrictions, especially by New Zealand, will see sheep shorn ratios improve. Despite the decrease in shearing intervals, good pasture availability is expected to see wool cut per head remain unchanged at 4.54 kilograms per head.

Global cotton production is forecast to remain unchanged at 111 million bales. Unchanged cotton production levels in 2022–23 and falling demand will maintain downward pressure on international prices. Significant decreases in production from the world's largest exporter, the Unites States, will be offset by increased production from India and Brazil. According to the US Department of Agriculture, approximately 66% of US cotton production is in areas experiencing drought. The poor conditions and associated high rates of abandonment is forecast to reduce US production by 28% compared to 2021–22. Brazilian production is anticipated to be up 5% compared to 2021–22, with dry conditions during critical crop development stages limiting further increases. In India, a favourable outlook for the monsoon is also expected to lift yields on last year, with total production up 13%. A large increase in production area in Pakistan is expected to see production rise only 0.3%, due to pest damage. In China, planted area increased only marginally this season, and despite dry conditions in Xinjian, production is expected to increase by 2%.

Foot and Mouth Disease threatens market access for Australian wool

The arrival of FMD in Australia would have a severe impact on Australia’s livestock industries, with the greatest impact due to the loss of market access. As a product of cloven-hoofed animals, wool exports would also be significantly impacted. Recent outbreaks in South Africa provide some insights. In 2019, South Africa lost its FMD-free status following an incursion and wool imports to China (its largest export partner, like Australia) were banned for 6-months until biosecurity protocols (pre-export treatment) could be negotiated. Another outbreak of FMD in 2022 has resulted in an ongoing ban of South African wool exports to China, despite the negotiated protocols.

Stagnant economic conditions hinder demand for natural fibres

The recent surge in inflation and the slowdown in economic growth in major world economies diminishes the disposable income of consumers around the world. Global output contracted in the second quarter of 2022, with the Chinese economy shrinking by 2.6% and the United States recording its second quarter of negative growth. Of all major agricultural commodities, natural fibres are the most sensitive to changes in disposable income and consumer confidence. As a consequence, with decreased disposable income, consumers spend less on clothing and apparel, as well as switching to cheaper, synthetic alternatives. There are signs that inflation in the United States is beginning to ease, but the economic troubles impacting China are expected to persist. Ongoing COVID-19 lockdowns and a deepening real estate crisis may continue to weigh down the global economy and demand for natural fibres in the short-term.