Author: Jared Greenville

The world’s food and fibre is increasingly being produced within global production networks that span a number of countries.

Australian agriculture is already part of these chains and benefiting through export and employment growth. However, while global value chains are offering new opportunities, both within agriculture and for the sectors that support it, recent trade disruptions and a lack of progress in multilateral trade negotiations pose risks. For Australian agriculture, continued growth opportunities will require further opening of import markets, along with freer bilateral and multilateral trade in agriculture and food products.

[expand all]

Global agriculture and food trade is evolving

Agriculture and food trade is changing. Trade is increasingly becoming fragmented to include multiple parties as a product makes its way to the end consumer. The product we see on our supermarket shelves is often produced in different stages in different countries around the world. This unbundling of production has created a supply chain that spans across countries. This is termed a Global Value Chain (GVC), and global developments have created new opportunities for Australian agriculture.

For Australian agriculture, and agricultural trade policy, these changes mean that it is not only bilateral trading relationships that are an important driver of export demand. Rather, the demand for exports is influenced by the relationships our trading partners have with other nations. Gaining from GVCs requires open markets globally. Furthermore, the impact of unbundling and the consumer focused nature of many GVCs have created new value-adding opportunities targeted towards adding value to primary products.

To take advantage of these, producers have had to make use of greater services inputs, meaning much of the value adding is captured in other supporting service sectors in an analogous way to moving into downstream food processing.

What are Global Value Chains (GVCs)?

GVCs recognise that food is no longer grown and transformed into a final product in one location.

Australian agricultural exports include both domestically produced and imported inputs. And those exports are used to produce food in other countries.

Take the example of Australian wheat (Figure 1). In 2014 around 8% of the value of wheat exports came from inputs sourced overseas. This came in the form of fertilisers, fuel and business services, used on Australian farms with Australian inputs to produce the wheat we export. The wheat is then milled overseas into flour – in places such as Indonesia. The flour is then used as an input into other production activities, such as noodles, which are consumed locally and also exported.

GVCs mean that production and trade is occurring within a network of industries that work together to produce the products seen by consumers.

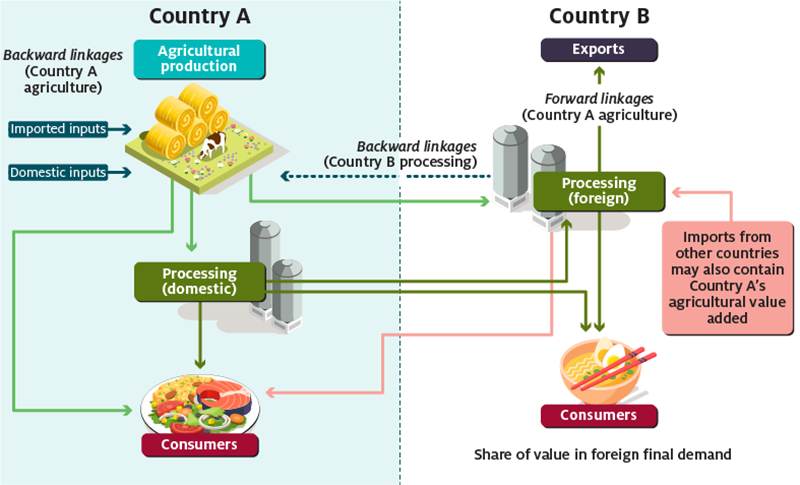

The production network has multiple linkages (Figure 2). These are described through three different relationships: backward linkages, forward linkages and final demand. Backward linkages describe a country’s reliance on imports and how much foreign value is in exports. Forward linkages describe how others use a country’s exports as input into their own exports – for example, how much Australian value is in another country’s exports. Final demand, foreign and domestic, shows the end point of the GVC—that is, where food is consumed or the final place of sale.

GVC are becoming more ‘global’ but are also changing trading relationships between countries

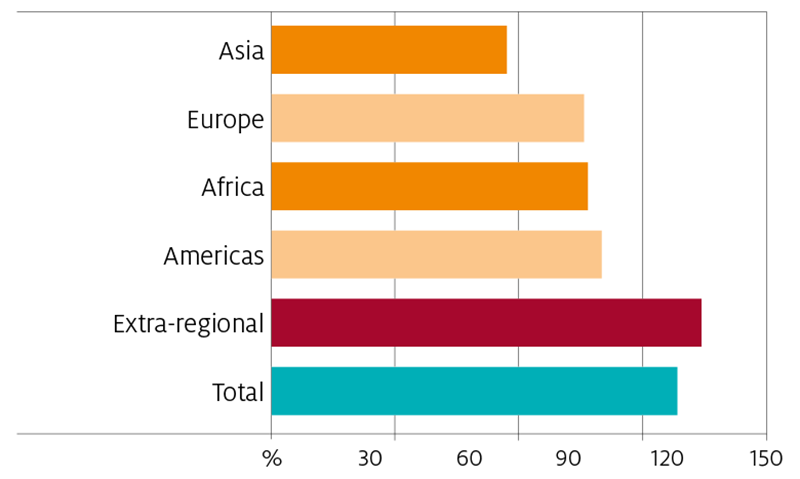

GVC trade for agriculture and food is growing relatively fast. Traditionally, intra-regional trade linkages have dominated the trade landscape. Countries have tended to trade with their closest neighbours: Australia with New Zealand, Canada with the United States, and so forth. While this type of trade is also growing, GVC trade between countries in different regions is accelerating faster.

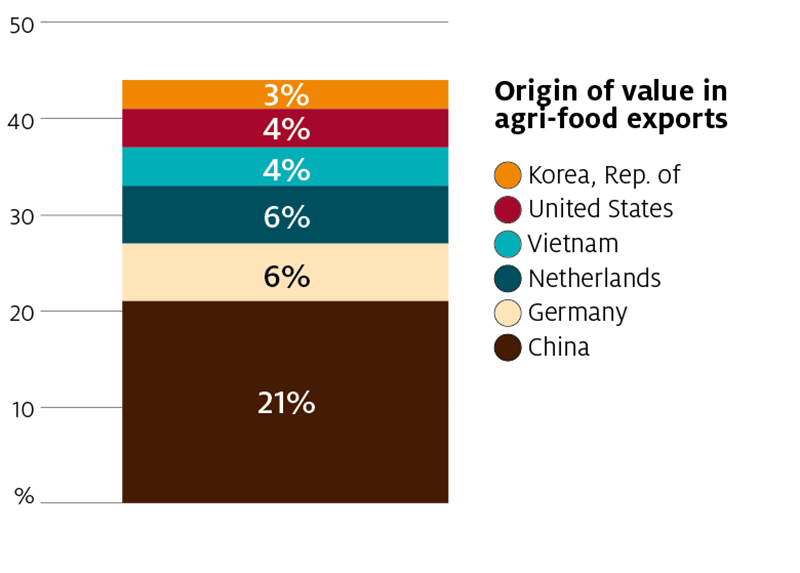

While the reach of the international agriculture and food trading system is extending, we are now seeing concentrated ‘hubs’ emerge in different parts of the value chain. Between 2004 and 2014 almost 45% of growth in agriculture and food exports used as inputs to other country exports was concentrated in just six countries.

China is the most active player in agriculture and food GVCs, both as a seller of inputs into other country exports (forward linkages) and as a buyer of produce for use in its own exports (backward linkages).

Between 2004 and 2014, China was responsible for 21% of the total growth in forward linkages into GVCs, making it the world’s largest GVC concentration point.

Similar trends are seen for backward linkage growth, where China also dominates the global share of who is importing for use in exports.

Where does Australian agriculture fit within GVCs?

Australia is a relatively small global agricultural producer, ranking 23rd in the world and representing just 1% of global production value in 2014–16 (FAO, 2019). As an exporter, however, Australia is more significant, ranked 12th in the world and accounting for 3% of total agricultural trade in 2014–16 (WITS, 2019). In value terms, around two-thirds of Australian agricultural production is exported (ABARES, 2018) and in 2017–18 represented 19% of total merchandise exports (ABS, 2019).

Australia does not just produce exports in isolation. Australian agriculture is both downstream and upstream of various industries in GVCs. Australia’s agricultural exports are underpinned by imports, with around 10% of total gross value of trade made up of foreign value added – that amounted to around US$4 billion of foreign value in 2014. China is our largest supplier, supplying around US$530 million, or 1.4% of Australia’s gross value of agricultural and food exports in 2014, followed by the US, who supplied 1.2%.

At the sector level, reliance on foreign value varies. In dairy, for example, New Zealand is a significant supplier, contributing around USD 18 million of inputs in 2014 to dairy exports. Imports include products such as milk powders, whey and casein. In total, the sector used US$260 million of foreign value in its US$2.2 billion exports—in other words, foreign value added represented 12% of total export value.

Participation in GVCs allows Australian dairy exporters to be internationally competitive, as they are able to rely on backward linkages to obtain specialised inputs from New Zealand and elsewhere.

For Australian exports, our first market is not our last. In 2014, 21% Australian agriculture and food exports (in domestic value added terms) was re-exported by our trading partners. The largest re-exporter was China, using 4% of total Australian agriculture and food exports as inputs into their own exports.

These links also extended into other sectors, including clothing and motor vehicles (e.g. Australian cattle hides as leather seats in cars exported from China and Korea).

Compared to other major agricultural traders, the share of Australian agricultural exports re‑exported is similar to China and countries in Europe, but above that of the US (18% in 2014) and below that of the UK (30% in 2014, largely via links to Ireland and other EU trading partners).

What is driving GVC growth in the agriculture and food sectors?

The development of GVCs has largely been driven by consumers and their growing demand for different attributes in food. These demands are transformed into conditions placed on producers in order to access GVCs.

Examples of attributes required by downstream GVC firms include traceability, free range, hormone-free, organic, carbon-neutral, amongst others. As GVCs span a number of countries, downstream firms require consistency across producers from different countries often leading to rules and requirements more stringent than those set within official trading rules. Developments in contracting and marketing arrangements have made it possible for downstream firms to acquire greater consistency across different sources of supply (Rhodes, 1993; Royer, 1995; Drabenstott, 1995; Unneveher, 2000; Kirsten and Sartorius, 2002). These developments have resulted in the integration of various agriculture and food chains with marketing channels and led to an increase in the importance of services both upstream and downstream in the chain.

Entering into GVCs has a number of benefits for agricultural sectors themselves—in terms of growth in overall production and in exports. Growth is spurred through greater market access by meeting consumer demand, but also through access to enhanced foreign technology and inputs that have helped changed the way farms produce, contributing to productivity growth. Over time, through access to larger markets and productivity improvements, GVCs also provide additional incentives to invest in farming businesses, allowing producers to benefit further through achieving scale economies.

Policy developments have also supported GVC development. Reductions in global trading market distortions have further enabled trade, reducing trade barriers and trade costs. Since 2000, commitments under the World Trade Organisation (WTO) Agreement on Agriculture have come into effect, China joined the WTO, and Australia and other countries entered into a number of free trade agreements. These developments have all encouraged more diverse interactions than under earlier trade arrangements.

The value of GVCs to Australian agriculture

To understand the value of GVCs for Australian agriculture, trade must be explored in ‘value added’ terms rather than looking at gross trade values.

Value added represents the returns to land, labour and capital for one country—that is, the domestic returns created from agriculture and food—and removes values that come from other countries.

Value added helps to directly capture the contribution that agriculture and food trade makes to Australia’s economy (in terms of GDP) and provides better insight into how participation and trade is maximising the total returns from agri-food trade.

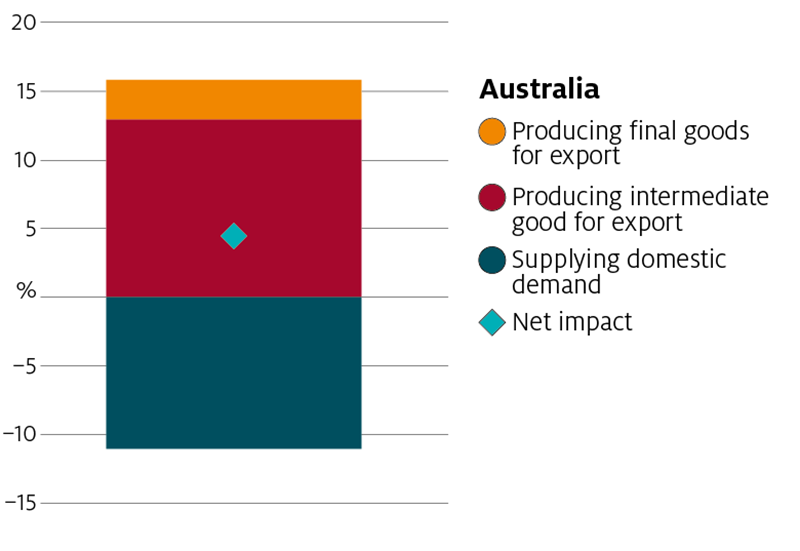

Agricultural employment growth has been spurred by Australia’s participation in GVCs. Between 2007 and 2014, increased productivity in the agriculture sector led to a decrease in the number of jobs required to supply food and fibre to the domestic economy—that is, due to productivity improvements that allow producers to produce the same with less, to supply domestic demand the number of jobs required fell by 10% between 2007 and 2014 (Figure 5). However, this effect has been offset through growth in trade within GVCs.

Jobs created in supplying inputs into GVCs (captured by trade in intermediate products) grew by 12% over the same period, with a further 3% increase in trade jobs associated with exporting good directly to foreign consumers. The net effect of these changes has been an overall increase in sector employment. That is, the sector increased productivity and increased employment as it took advantage of GVCs.

Overall, Australian exports of value added have grown, nearly doubling in nominal US dollar terms between 2004 and 2014. However, participating in GVCs also creates opportunities for value adding at the farm gate, rather than adding value by moving down the value chain. Examples of this include the shift to trade in products with added attributes (such as hormone free, free range, low emissions, among others). While higher cost to produce due to the need for additional inputs (often in the form of additional services, which are most often sourced from domestic suppliers), these products can garner a higher price. However, the higher cost of production in servicing GVCs and in providing consumers with the attributes they demand is not just a cost. They also create jobs in Australia, akin to the jobs created by downstream sectors that transform primary agricultural products (traditionally viewed as ‘value-adding’).

Such additional inputs can be significant. Around 29% of the total value of Australian agricultural exports (in 2014) comes from services sectors, with the majority of that outside of transport and logistics (in areas such as business services which include a range of on-farm services from agronomists to machinery contractors).

For Australia, the majority of growth opportunities for agriculture sector participation in GVCs have come from participation as an upstream supplier—that is through forward linkages. Taking advantage of these opportunities has helped maximise the total economy-wide returns for Australian from its agriculture sector—countries such as Australia that specialise in primary exports create as much or more total value in the economy than those that predominately export processed products (Greenville, Kawasaki and Jouanjean, 2019b).

The unbundling of food production has meant that Australia’s exports can take advantage of increased competition in food sectors around the world without having to actually compete with them directly.

Australia’s agriculture sector has been able to sell more products to international consumers than would likely have occurred if it had relied on domestic downstream sectors. With higher volumes from agriculture, and the addition of value adding services at the farm gate, total jobs and economic activity in the agriculture sector have increased.

Challenges in participating in and growing GVCs

While many benefits exist, GVCs also create a number of challenges. They include greater exposure to international policies and economic conditions.

Slower international economic growth (following the global financial crisis), the increase in protectionism around different trade measures, and greater trade uncertainty, have all influenced returns.

To continue to grow and take advantage of opportunities, several aspects require ongoing focus.

Firstly, competitiveness is critical. On the domestic side, the competitiveness of services markets underpins export performance. Investments in new ways to meet consumer expectations is key, including research and development, on farm services and logistics.

Similarly, access to foreign inputs and capital is essential. Ensuring low trade barriers exist for imports, including our own sector imports is key. This includes imports of goods, along with services and capital through foreign direct investment.

Because our first market is not our last market, GVCs can compound some of the effects of trade distortions, both non-tariff and tariff measures. Continued access to global markets, such as through regional trade agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the WTO, is particularly important, along with our free trade agreement strategy.

Rising populations and climate change will influence global food availability, increasing the need and value of GVCs. Further growth and opportunities for Australian agriculture in GVCs requires more than bilateral trading relationships. Not only is demand for Australian exports driven by improvements in our own bilateral market access, but is also underpinned by market access existing between our trading partners and the rest of the world. Continued disruption and dispute in international trading relationships can have wider implications than seen between two countries, and may also have wider implications for those involved due to disruptions to the trading network.

For Australian agriculture, further opening of import markets, along with freer bilateral and multilateral trade in agriculture and food products will be critical for future growth.

References

Food and Agriculture Organisation of the United Nations (FAO) (2019), FAOSTAT, FAO, Rome, available at: http://www.fao.org/faostat/en/.

ABARES 2018, Agricultural commodities: December quarter 2018, Australian Bureau of Agricultural and Resource Economics and Sciences, Canberra, December. CC BY 4.0. https://doi.org/10.25814/5c07aed43fec2

Australian Bureau Statistics (ABS) (2018), Balance of payments, Australia, cat. No. 5302.0, Canberra, September quarter.

Greenville, J., K. Kawasaki and M. Jouanjean (2019a), "Dynamic Changes and Effects of Agro-Food GVCS", OECD Food, Agriculture and Fisheries Papers, No. 119, OECD Publishing, Paris, https://doi.org/10.1787/43b7bcec-en.

Greenville, J., K. Kawasaki and M. Jouanjean (2019b), "Value Adding Pathways in Agriculture and Food Trade: The Role of GVCs and Services", OECD Food, Agriculture and Fisheries Papers, No. 123, OECD Publishing, Paris, https://doi.org/10.1787/bb8bb93d-e.

Greenville, J., K. Kawasaki and M. Jouanjean (2019c), "Employment in Agriculture and Food Trade: Assessing the Role of GVCs", OECD Food, Agriculture and Fisheries Papers, No. 124, OECD Publishing, Paris, https://doi.org/10.1787/5ed3b181-e.

Unneveher, L.J. (2000), “Food Safety Issues and Fresh Food Product Exports from LDCs”, Agricultural Economics, Vol. 23(September), pp. 231–240.

Rhodes, V.J. (1993), “Industrialization of Agriculture: Discussion”, American Journal of Agricultural Economics, Vol. 75(5), pp. 1137–40.

Royer, J.S. (1995), “Potential for Cooperative Involvement in Vertical Coordination and Value Added Activities”, Agribusiness, Vol. 11(3), pp. 473–81.

Kirsten, J. and K. Sartorius (2002), “Linking Agribusiness and Small-scale Farmers in Developing Countries: is There a New Role for Contract Farming?”, Development Southern Africa, Vol. 17(4).

Drabenstott, M, (1995), “Agricultural Industrialization: Implications for Economic Development and Public Policy”, Journal of Agricultural and Applied Economics, Vol. 27(1), pp. 13–20.

WITS (2018), UNCTAD Trade Analysis Information System (TRAINS) (database), World Integrated Trade Solution, https://wits.worldbank.org/WITS/WITS/Restricted/Login.aspx.

Download this Insights paper

ABARES Insights: Snapshot of Australia’s place in global agriculture and food value chains