Compiled by James Fell, based on research by Patrick Hamshere, Yu Sheng, Brian Moir, Caroline Gunning-Trant, David Mobsby.

Summary

India has been one of the world’s fastest growing economies over the past twenty years, bringing opportunities for Australia’s exporters. Income growth, population growth and urbanisation are projected to underpin large increases in agrifood consumption in the future. By 2050, large increases are expected in import demand for vegetables, fruit and dairy products.

India is growing

India has been one of the world’s fastest growing economies over the past twenty years. That growth mainly reflects government reforms to support economic activity and to increase the openness of the economy to global markets.

The resulting rise in household incomes and urbanisation have been positive influences behind the long-term upwards trend in agrifood consumption, a trend that is not expected to abate for decades. This paper discusses the factors that are expected to drive agriculture in India in the future and presents ABARES’ projections of India’s agricultural consumption to 20501.

[expand all]

What does India want?

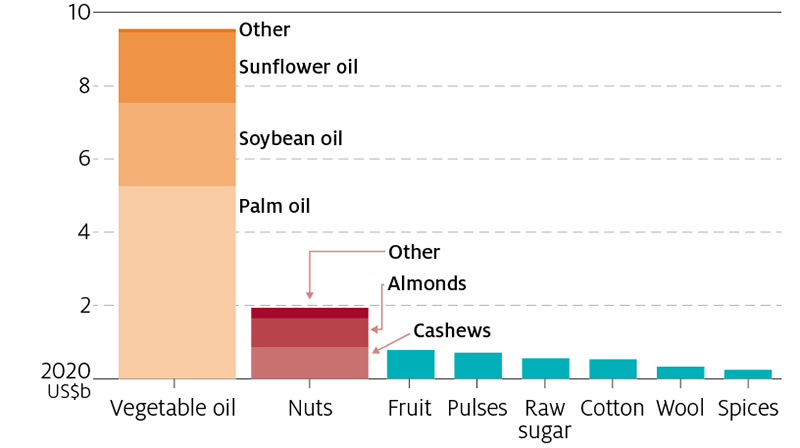

Over the 5 years from 2014 to 2018, the world’s agricultural exports to India have averaged around US$18 billion annually, a trade that has been dominated by vegetable oils (Figure 1). India’s agricultural imports are concentrated across eight main categories representing 80% of total agricultural imports (Figure 1). India’s import demand broadly reflects its status as a largely vegetarian society.

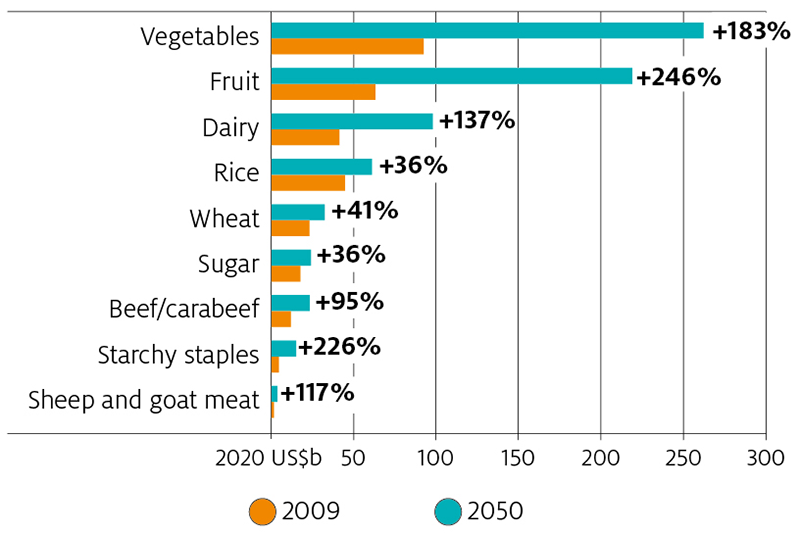

Over the longer term, population growth, income growth and urbanisation are expected to support India’s growing demand for a wider variety of agricultural products. Dairy products, fruit and vegetables will be those commodities most strongly in demand by 2050 (Figure 2).

India’s growth drivers

Significant potential because of income growth

Over the past two decades, India has emerged as one of the world’s fastest growing economies. In the 20 years to 2018, real gross domestic product (GDP) per person increased at an annual average rate of 6% (Figure 3)—a tripling of real GDP per person (IMF 2019).

Higher incomes have helped address food insecurity and contributed to the rise in per capita consumption of food over this period (Figure 3).

Note: 2018 consumption data were unavailable at time of publication. GDP per capita is used as a proxy for average income.

Source: IMF (2019), FAO (2020)

Significant potential because of population growth

India's projected population growth also supports increased food demand. The United Nations (UNDESA 2019) projects India's population will grow by 0.9% per year on average between 2020 and 2030, and 0.4% per year between 2030 and 2050, which is faster than China and Vietnam, but similar to Indonesia over the same two periods. The increase in India's population is equivalent to over 300 million people between 2030 and 2050.

Growth in food consumption in India will be relatively stronger than elsewhere because food consumption in populations with a larger proportion of younger people is more likely to increase significantly, reflecting higher energy needs (Johnstone 2018). India's population is expected to remain relatively young by 2050, when around 74% of its population is projected to be aged under 55 (UNDESA 2019).

Note: Medium-variant projections.

Source: UNDESA (2019)

Significant potential because of urbanisation

Urbanisation is an important determinant of the quantity and type of food demanded by final consumers. Urban dwellers typically have higher incomes than their rural counterparts, access to a wider variety of foodstuffs and different dietary patterns. For example, between 1993–94 and 2009–10, consumption of meals at commercial establishments increased by 58% in urban areas, but only 34% in rural areas (Smith 2013).

This means that final consumers are increasingly consuming value-added products, which has implications for what consumers demand. Hence, Australia's exports of raw commodities should be balanced with exports of value-added products to gain greater benefit from the opportunities in the Indian market (Varghese 2018).

With incomes around double those of rural areas, the share of India's population living in urban areas increased from 26% in 1990 to 31% in 2010 (Desai et al. 2010). This trend is projected to continue, with 52% of the population living in urban areas by 2050 (Figure 5) (UNDESA 2019), underpinning future demand for value-added products.

Source: UNDESA (2019)

India and Australia now

Impressive growth in some commodities

World exports to India of a number of commodities grew strongly between 2009 and 2018 (Figure 6). Exports to India of fruit and nuts more than doubled over the ten years to 2018 and barley exports quadrupled, albeit from a small base. Rapid import growth is expected to continue given projections for economic growth over the long term.

Notes: Other dairy includes milk, cream, yoghurt, whey, lactose, infant formula, ice cream and milk albumin. Figure shows value of exports to India by commodity for 2009 and 2018, and percentage change over this period.

Source: UN Statistics Division (2020)

What does Australia currently export to India?

Significant opportunities may exist for Australia to increase its exports to India. Six out of the top seven commodity groups shipped by the world’s exporters to India are products that Australia produces and exports. These include cotton, fruit, nuts, pulses, unrefined sugar and wool. Indian demand for dairy products, including infant formula, has also been rising recently (Figure 6).

In 2018–19 Australia’s top exports to India (in descending order) were wool ($225m), nuts ($129m), milled oats ($98m) and cotton ($55m). Australia has previously shipped large volumes of chickpeas and wheat, but trade of these commodities is subject to fluctuations in India’s tariffs, agricultural support policies and monsoon-related domestic production volatility.

India to 2050

India’s potential food and agricultural consumption has significant scope to increase. Even without any changes to Indian government policies, the real value of agrifood consumption is projected to more than double between 2009 and 2050 (Linehan et al. 2012). Agrifood consumption volumes between 2009 and 2017 already increased significantly: dairy by 53%, fruit by 32%, rice by 62% and vegetables by 29% (FAO 2020).

India’s long-term consumption increases will be characterised by a move towards more diverse diets, with higher intake of dairy products, fruit and vegetables. Between 2009 and 2050, the real value of dairy consumption is projected to rise by 137%, fruit by 246% and vegetables by 183% (Figure 7). The upward consumption trend is most pronounced among urban households, where income growth is assumed to be greater than rural households.

Note: Starchy staples include pulses and yams. The 2009 base year reflects available FAO food consumption data at the time of analysis.

Source: Hamshere et al. (2014)

While projections show a positive outlook for India’s consumption, what matters to Australia’s exporters is the outlook for India’s import demand (Figure 8). In 2050, imports of dairy products and vegetables could be around US$24 billion and US$57 billion, respectively (in 2020 US dollars), compared with negligible dairy and vegetable trade in 2018. Imports of fruit are projected to be around US$71 billion in 2050, compared with imports of just US$0.8 billion in 2018.

Note: In 2009, of the commodities shown here, the only categories with import share greater than 5% were starchy staples (16%), sugar (10%) and wheat (16%).

Source: Hamshere et al. (2014)

The projected increases are large, but this reflects economic “catch-up”

The large increases in Indian food consumption to 2050 are the result of the current low consumption levels. Undernourishment in India was estimated at 15% between 2016 and 2018 (FAO 2019), with low per person GDP contributing to high rates of food insecurity. Income growth will alter food consumption rates and composition. The India of today has significantly lower rates of consumption compared to other countries, sharing similarities to the China of 20 to 30 years ago. For example, per person vegetable consumption in India is 60% less than China. Even in 2050, India’s per person consumption of most commodities is still projected to be below the 2050 consumption projections for China (Hamshere et al. 2014).

India is a highly protected market

India's applied tariffs (the actual tariffs faced by an importer) have declined significantly since 1991 and significant headway has been made in opening the economy. India's average applied tariff across all goods is now one-tenth what it was in 1990 (Varghese 2018).

Applied tariffs on cereals and cereal preparations average 37%, dairy products 35% and fruit, vegetables and plants 32% (Figure 9). The magnitude of these tariffs create an effective barrier to trade for many countries. While protectionist measures are often politically popular, reducing tariffs over time would improve food access and security, particularly as urban populations grow.

Source: WTO (2019)

India as an opportunity

There are overarching reasons that make India an attractive opportunity for Australian exporters. India's current and projected population and income growth is extraordinary, and the potential export growth opportunities are large (Varghese 2018).

The real value of total agricultural consumption in India is projected to nearly double to 2050. Dairy, fruit and vegetables contribute to the majority of the increase in projected consumption. Significant headway has already been made towards reaching this projection. India’s per person consumption of milk already increased by nearly 40% between 2009 and 2018, and per person consumption of fruit by 21%.

These growth achievements suggest that India is well on its way to meeting the 2050 growth projections, providing an opportunity for Australian exporters. The Indian market also presents challenges, with trade barriers and associated uncertainty a problem shared with other developing markets.

References

Desai, S, Dubey, A, Joshi, B, Sen, M, Shariff, A & Vanneman, R 2010, Human development in India: Challenges for a society in transition, Oxford University Press, New Delhi.

FAO 2019, Food security indicators, Food and Agriculture Organization of the United Nations, Rome, October, accessed 24 February 2020.

—— 2020, FAOStat Database, Food and Agriculture Organization of the United Nations, Rome, accessed 25 February 2020.

Hamshere, P, Sheng, Y, Moir, B, Gunning-Trant, C & Mobsby, D 2014, What India wants: Analysis ofIndia’s food demand to 2050, ABARES research report no. 14.16, Canberra, November.

Hamshere, P, Sheng, Y, Moir, B, Syed, F & Gunning- Trant, C 2014, What China wants: Analysis of China’sfood demand to 2050, ABARES conference paper 14.3, Canberra, March.

IMF 2019, World Economic Outlook Database October2019, International Monetary Fund, Washington DC.

Johnstone, A 2018. 'How a better understanding ofthe seven ages of appetite could help us stay healthy', The Conversation, May.

Linehan, V, Thorpe, S, Andrews, N & Beaini, F 2012, Food demand to 2050: Opportunities for Australian agriculture–Algebraic description of agrifood model, Technical annex to ABARES Outlook conference paper 12.4, Canberra, May.

Smith, L 2013, The Great Indian Calorie Debate: Explaining Rising Undernourishment during India’s Rapid Economic Growth, Institute of Development Studies, IDS working paper 430, Brighton, United Kingdom.

UN Statistics Division 2020, UN Comtrade Database, United Nations, New York, accessed 12 February 2020.

UNDESA 2019, World population prospects 2019, United Nations Department of Economic and Social Affairs, Population Division, New York.

WTO 2019, World Tariff Profiles 2019, World Trade Organization, Geneva.

Varghese, P 2018, An India economic strategy to 2035, Department of Foreign Affairs and Trade, Canberra.

Download the report

ABARES Insights: Analysis of opportunities in India

Foot note

1 The material presented here is abbreviated from the ABARES report What India Wants by Hamshere et al. (2014).