Author: James Fell

In recent years China has announced big changes to its agricultural policies, changes which are likely to have an impact on Australian agricultural exporters.

ABARES analysed these changes and their potential implications for Australia’s beef, dairy and grains industries in its report The future of Chinese agricultural policy, released in February 2019 on the ABARES website.

Key insights from that report are summarised here.

[expand all]

China announced major changes in its agricultural policy direction

Each year China sets out policies in its No. 1 Central Document. In 2017 the No. 1 Central Document was unique because it marked a clear directional change for agricultural policy, one which emphasised supply-side reform.

The longevity of the stated reforms was unclear, but the 2018 No. 1 Document confirmed their continuation and supplemented them with an emphasis on revitalisation of rural areas.

The 2017 and 2018 reforms arose from a number of longstanding domestic issues. These included the degradation of farm soil and water quality, sluggish farm income growth, small average farm sizes, food safety concerns and high consumer prices, domestic grain production, imports and stock levels.

The 2019 No. 1 Central Document is expected to be released in early 2019 and is likely to continue the movement of recent reforms.

Xi Jinping Thought emphasises supply-side structural reform

In 2018 China’s ruling party cemented fourteen key ideas of the President into the country’s constitution.

These ideas became known as Xi Jinping Thought. One of these ideas is a comprehensive deepening of reform, which is consistent with what was announced for agriculture.

“China will keep deepening supply-side structural reform.”

Xi Jinping, Chinese President – July 2017

China makes a start on reducing distortions

A major agricultural policy change was actually made prior to the 2017 No. 1 Central Document. In 2016 China removed its minimum price policy for corn.

The policy distorted production decisions which resulted in very large corn stocks. In 2017 China announced that it would separate the subsidies it paid to producers from the price of corn. This should result in less distorted and more market driven outcomes.

Although the announcement was limited to corn, it was an important step towards less distortionary policies.

“We should resolutely carry forward the reform of market prices and price-subsidy separation for corn”

Chinese Communist Party and State Council – February 2017

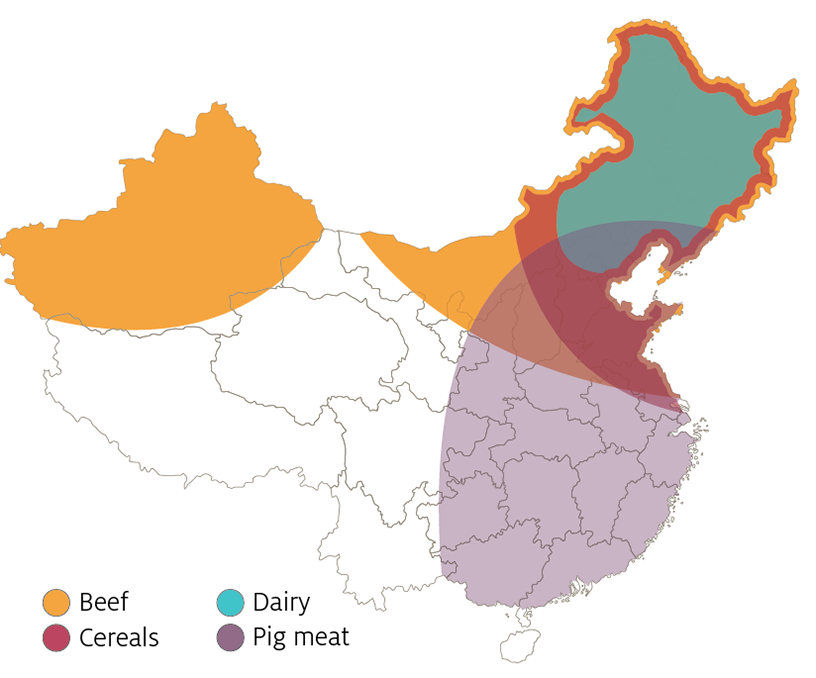

China is an important agricultural consumer, producer and importer

China’s size means that what happens in China affects global agricultural markets, which flows through to farmgate returns for Australian farmers. This was demonstrated by China’s increase in demand for dairy imports after its 2008 dairy melamine scandal, which helped support dairy prices. A further demonstration was China’s surge in demand for corn substitutes like sorghum after the 2013 enforcement of GM corn import rules. This contributed to higher sorghum prices.

Food demand to keep growing

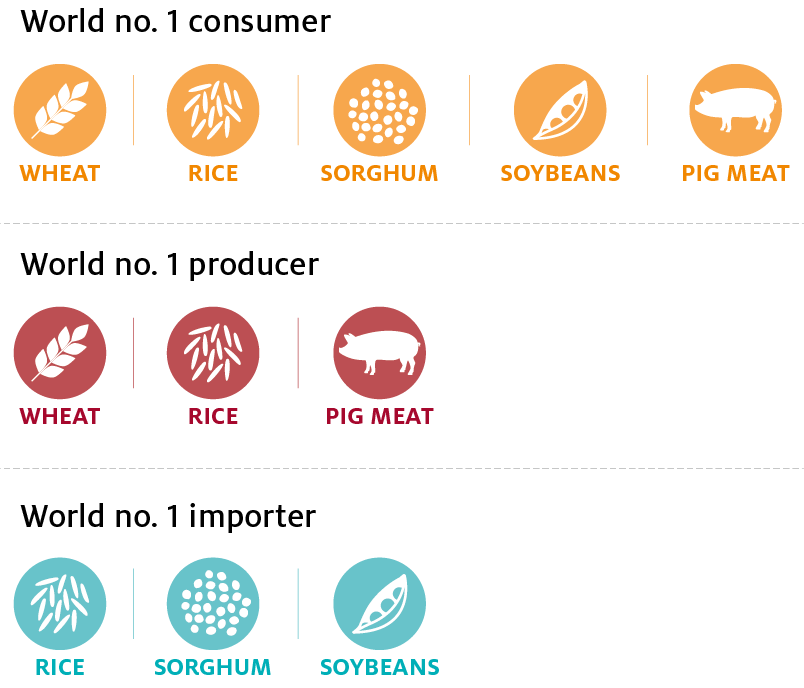

The recent changes to China’s agricultural policies are expected to affect the rate of import demand growth. It is important to recognise that this would be against a background of what is expected to be very strong growth in import demand. In ABARES’ 2014 report What China Wants, Hamshere et al. projected China’s agriculture and food demand out to 2050.

The rise of food consumption in China will be characterised by a move towards more western-style diets, with higher intake of high-value foods, such as dairy products, beef, sheep and goat meat, fruit and vegetables. Consumption of starchy staples, such as rice, is expected to fall as rising incomes allow households to diversify the foods they consume.

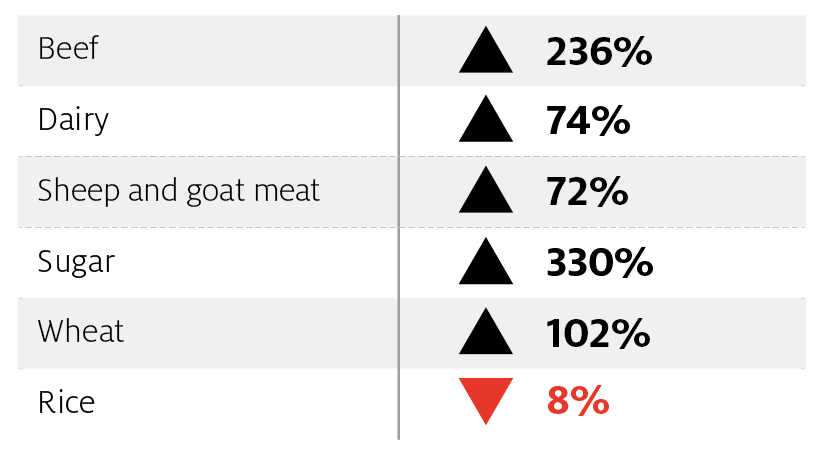

China’s import demand is important to Australia

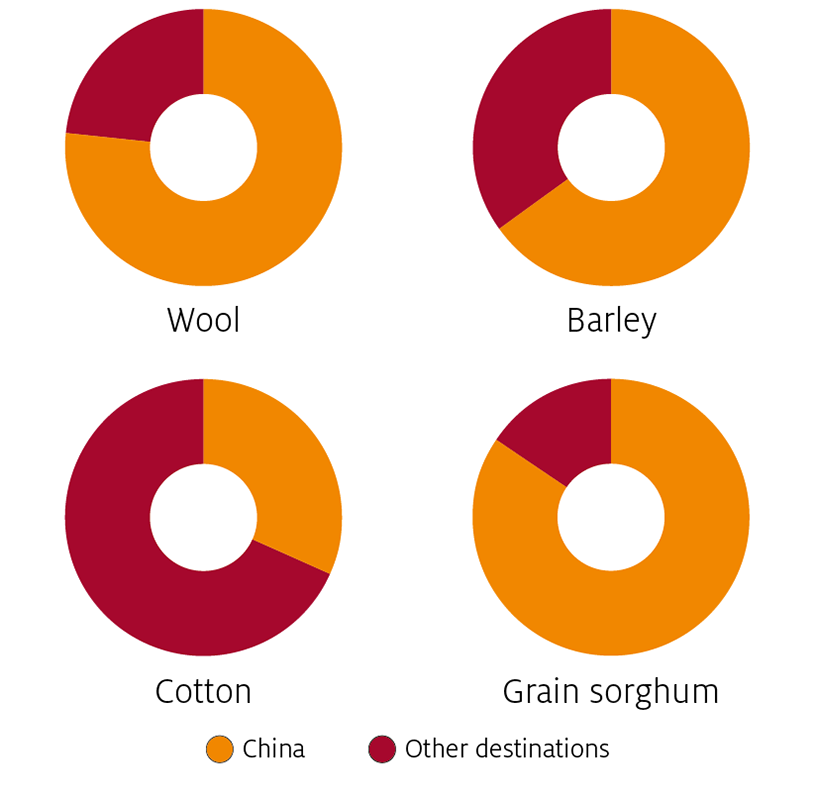

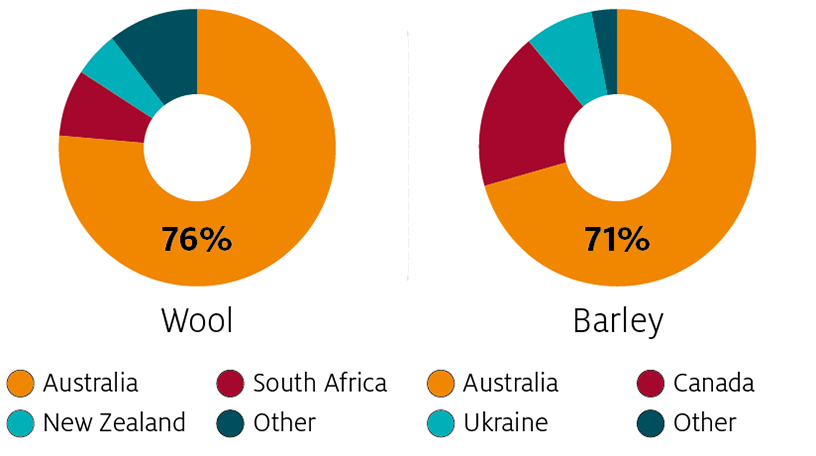

China has been Australia’s top agricultural export market since 2010–11. Around 25%, or $11.8 billion, of Australian agricultural exports were destined for China in 2017–18. Wool ($3.3b), barley ($1.5b) and beef ($1.0b) were the top three commodities exported.

While China is by far Australia’s largest agricultural export destination, its share of our exports is similar to Japan’s in the 1990s. Japan accounted for 27% of our agricultural exports at its peak in 1993–94, while China accounted for 25% in 2017–18.

Over that twenty-five year period the number of countries to which Australia exports has increased. However, given China’s rising prominence, fewer countries now account for a larger share of our trade. In 2010–11 China took over as our top agricultural export destination. In that year 17 destinations accounted for 75% of Australia’s agricultural exports. In 2017–18 only 13 destinations accounted for the same proportion.

Note: Excludes adjustments for destination confidentiality.

Source: Australian Bureau of Statistics (2019)

Source: Australian Bureau of Statistics (2019)

Source: UN Statistics Division (2019)

Changes bring opportunities and challenges for Australia’s exporters

It is important for Australian exporters to be informed about changes in Chinese agricultural policy given the impact China can have on world markets. ABARES has assessed that the recent changes are likely to be positive for Australian beef and dairy export demand but for grains the outlook is mixed. Overall, strong demand growth underpinned by rising incomes will be the principal driver of import growth in China.

Opportunity: Stronger demand for safe and high quality goods

China’s policies aimed at improving food safety and food quality are expected to result in stricter standards for beef. Australian exporters would be expected to be able to more readily comply compared with some competitors, at least in the short term.

For dairy, China’s policies to improve food safety are expected to stimulate consumer demand for domestically-produced products as local quality improves over the long run. Even though Australian dairy is likely to be able to comply with stricter standards, other major dairy exporters, like New Zealand, are also likely to be able to comply. However, the overarching strong demand growth is likely to underpin increased Australian dairy exports to China.

“Improve the quality of agricultural products and the food safety level”

Chinese Communist Party and State Council – February 2017

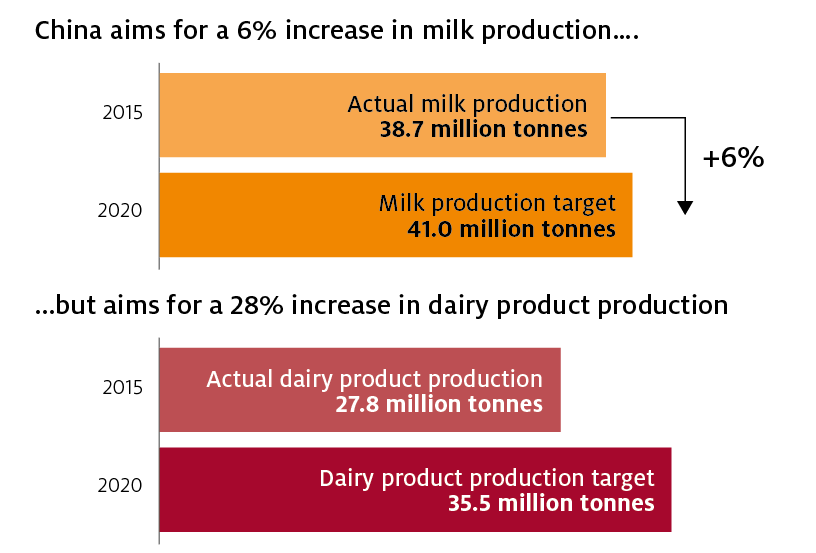

Opportunity: China needs more milk powder for manufacturing

China’s stated objectives for its dairy industry will require more imports if they are to be achieved. An inadequate supply of domestically-produced milk powder to meet projected demand by the processing sector will present Australia with an export opportunity. China aims to increase milk production by 6% and dairy product production by 28% by 2020. To achieve the latter, an increase in imported whole milk powder is likely to be required.

Challenge: trade friction

China has stated that it wants to “create a good environment for international trade of agricultural products.” However, trade in coming years has potential to be affected by China’s caveats to this point. China aims to “refine laws and regulations concerning anti-subsidy, anti-dumping and security measures against agricultural products, and investigate trade subsidies against imported agricultural products according to the law.” (Chinese Communist Party and State Council 2017). Depending on interpretation, this could signal a heightened focus on import-related measures, such as anti-dumping.

Opportunity: Higher demand for feeders, breeders and bovine semen

The policy to increase the scale of beef production is expected to result in higher demand for live feeder cattle. At the same time, policies to improve beef and dairy herd genetics in China are likely to lead to stronger import demand for bovine semen and live breeder cows. Importantly, this is only an opportunity until such a time that China decides its bovine genetic stock has reached an adequate quality.

“Accelerate the improvement in breeds and varieties”

Chinese Communist Party and State Council – February 2017

Challenge: Higher domestic livestock production

The Chinese government aims to increase herbivorous livestock production. This is expected to lead to higher domestic beef production and partially offset some of the positive export opportunities for Australia that are presented in the 2017 No. 1 Document. However, overall import demand for beef is still expected to remain positive if China is to meet projected growth in its consumer demand. The main challenge for Australia will be to remain competitive relative to other beef exporters.

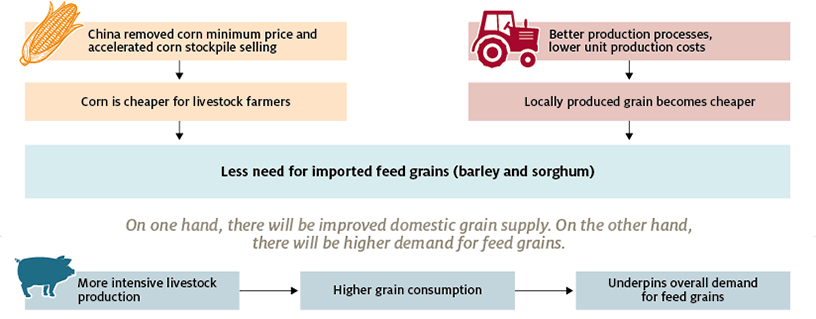

Challenge: More competitive local grain

There are policies that will make China’s local farmers more competitive by lowering unit production costs. These include improving crop varieties, better use of technology and identification of land that is better suited to growing grain. As a result the local grains sector is expected to be more competitive.

However, this is against a backdrop of generally increased demand for grains, and the expected net effect for Australia’s grain exports is ambiguous without detailed quantitative analysis.

Challenge: Cheaper local corn

As a major producer of livestock products, China is a large consumer of feed grains. Lower domestic corn prices can increase the attractiveness of domestically-produced corn relative to other feed grains. Livestock producers would be expected to substitute towards corn from other feed grains, such as barley and grain sorghum, the supply of which is partly sourced from imports. As a result, Chinese import demand for these two grains would soften.

Challenge: Improvements in local wheat

The 2017 No. 1 Document targets improving the quality of domestically-produced wheat. This includes increasing production of high and low protein wheats. Currently, when China lacks wheat of a specific protein specification, it is able to import it from Australia and other countries under a tariff-rate quota. However, if the policy to raise production of both high and low protein wheat is successful, it would lead to substitution away from imports.

“Focus on developing… high and low protein wheat”

Chinese Communist Party and State Council – February 2017

Opportunity: Growth in meat and dairy demand to drive grains

Mitigating the challenge of more efficient and increased Chinese grains production will be the push to increase livestock production. Animals need feed grain in order to achieve quality specifications. Total demand for feed grains should increase, but the net impact on import demand is ambiguous.

Future policies and productivity

ABARES is developing a modelling approach collaboratively with researchers in the Chinese Government to examine price variability and future policy responses.

Given that Xi Jinping Thought has instilled a significant reform agenda in Chinese policy making, there are likely to be further reforms in the coming years. Forthcoming work simulates changes to Chinese agricultural policy and the effects on the country’s imports and broader economy, including agricultural and non-agricultural incomes. How China will improve rural welfare is a key policy question and it is important to understand.

Recent announcements will prompt improvements in technology and identification of optimal land for different crops. In forthcoming work, ABARES seeks to understand the nature and level of Chinese productivity and how much it can grow. This will help provide insights on the question of where Chinese domestic production and import demand are headed.

References and further reading

Australian Bureau of Statistics 2019, International Trade, Australia: January 2019 [unpublished data], cat. no. 5465.0, Australian Bureau of Statistics, Canberra.

UN Statistics Division 2018, UN Comtrade, New York, accessed 31 January 2019.

Chinese Communist Party and State Council 2017, ‘Deepening supply side structural reform of agriculture - views on accelerating the cultivation of new momentum for agricultural and rural development’ (in Chinese), Central No. 1 Document, Central Committee of the Chinese Communist Party and State Council, Beijing.

Chinese Communist Party and State Council 2017, Plan on rural vitalisation strategy (in Chinese), Central Committee of the Communist Party of China and State Council, Beijing.

Chinese Communist Party and State Council 2018, ‘Central Committee and State Council views on implementing the rural revitalisation strategy’ (in Chinese), Central No. 1 Document, Central Committee of the Chinese Communist Party and State Council, Beijing.

Hamshere, P, Sheng, Y, Moir, B, Syed, F & Gunning‐Trant, C 2014, What China wants: Analysis of China’s food demand to 2050, ABARES conference paper 14.3, Canberra, March.

Fell, J & Waring, A 2017, ‘China’s grain policies’, in Agricultural commodities: June quarter 2017, Australian Bureau of Agricultural and Resource Economics and Sciences, Canberra.

Fell, J 2018, ‘China’s grain policies—an update’, in Agricultural commodities: March quarter 2018, Australian Bureau of Agricultural and Resource Economics and Sciences, Canberra.

Fell, J 2019, The future of Chinese agricultural policy, ABARES, Canberra, February.

Government of China 2017, Development Plan for the Milk Industry (in Chinese), China Food and Drug Administration, Ministry of Agriculture, Ministry of Industry and Information Technology, Ministry of Commerce and National Development and Reform Commission, Beijing, accessed 24 August.

USDA–FAS 2017, China’s annual agricultural policy goals: The 2017 No. 1 document of the CCCPC and the State Council, GAIN report, no. CH17006, Foreign Agricultural Service, US Department of Agriculture, Washington, DC, 15 February.

USDA–FAS 2018, China’s annual agricultural policy goals: The 2018 No. 1 document of the CCCPC and the State Council, GAIN report, no. CH18007, Foreign Agricultural Service, US Department of Agriculture, Washington, DC, 2 March.

Yu, Wusheng 2017, ‘How China’s Farm Policy Reforms Could Affect Trade and Markets: A Focus on Grains and Cotton’, International Centre for Trade and Sustainable Development, Geneva.

Forthcoming China-related research

1 ABARES and the Chinese Government are conducting collaborative research, developing a modelling approach to analyse the impact of agricultural price changes on China’s grain sector and broader economy. The work encompasses the modelling of different policy scenarios and covers the important policy area of effects on rural incomes.

2 ABARES is conducting collaborative research with Chinese agencies analysing the patterns of agricultural productivity in both countries. The results will also be used to analyse the potential drivers of productivity growth (such as public R&D investment, market support and market access policies), to better inform decision making.

Download this Insights paper

ABARES Insights: Analysis of Chinese agriculture policy