Authors: Steve Hatfield-Dodds, Neal Hughes, Andrew Cameron, Matthew Miller, Tom Jackson

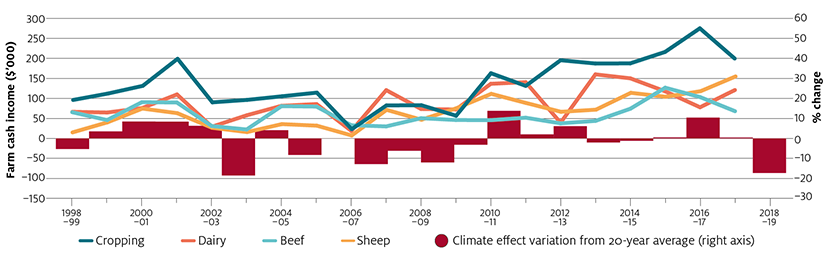

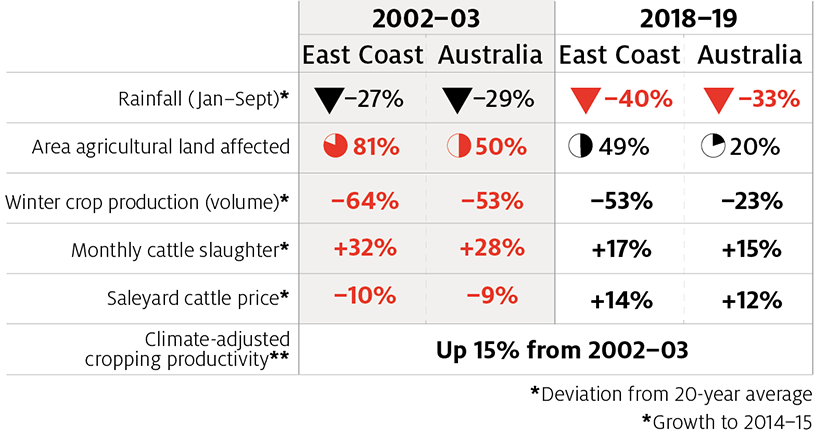

This brief is based on a presentation by ABARES’ Executive Director to the National Drought Summit in October 2018 describing the effects of the current drought on Australian agriculture. The brief summarises current livestock market conditions, the extent of rainfall deficiencies, and the effects on crop production and farm incomes. The climate information in Figures 1 and 2 was presented to the Drought Summit by the Bureau of Meteorology.

[expand all]

The current drought is severe in some regions but covers a smaller area than previous events

The current drought conditions are severe in some regions – particularly in NSW. Rainfall to the end of September 2018 in NSW is the 3rd lowest ever recorded at 190.9mm. Rainfall to date across Australia is as poor as any period in the last 20 years (Figure 1).

However, the extent of rainfall deficiencies is currently smaller than in previous droughts. Analysis of rainfall deficiencies for the first nine months of 2018 indicates that 49 per cent of agricultural land in south-eastern Australia (Queensland south of the Tropic of Capricorn, New South Wales and Victoria) is experiencing 1 in 20 year drought conditions, compared with 81 per cent of agricultural land at the height of the 2002-03 drought (March 2002 to January 2003) (Figures 1 and 2).

Note: Growing season defined as January to September rainfall. South-eastern Australia refers to New South Wales, Victoria and Queensland south of the Tropic of Capricorn.

Source: Bureau of Meteorology.

Source: ABARES, Bureau of Meteorology

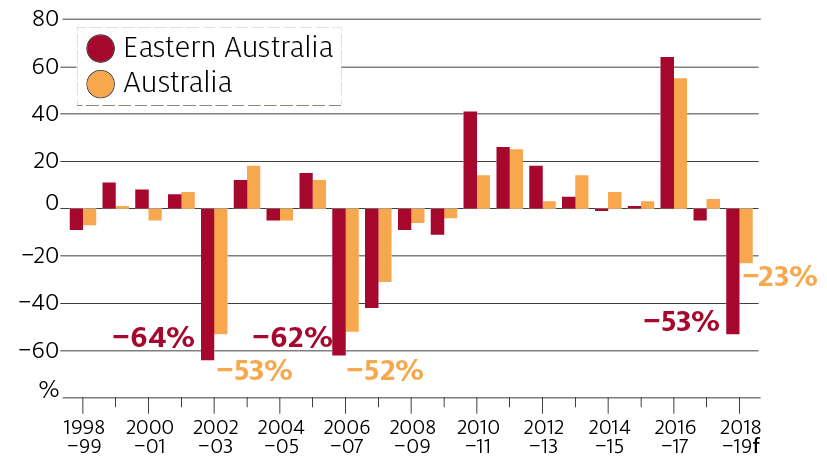

Winter crop production will be much lower in eastern Australia, and below average nationally

Crop production in the eastern Australian wheat-sheep zone in 2018-19 is forecast to be down by 53 per cent from the 20-year average from 1998-99 to 2017-18 (Figure 3). The main source of the decline is NSW, where the winter crop is forecast to be 65 per cent below the 20-year average. A larger than average crop in Western Australia is expected to partially offset the decline at the national level, although national production is still forecast to be 23 per cent below the 20-year average in 2018-19.

Note: f ABARES forecast. Eastern Australia refers to New South Wales, Victoria and Queensland.

Source: Bureau of Meteorology

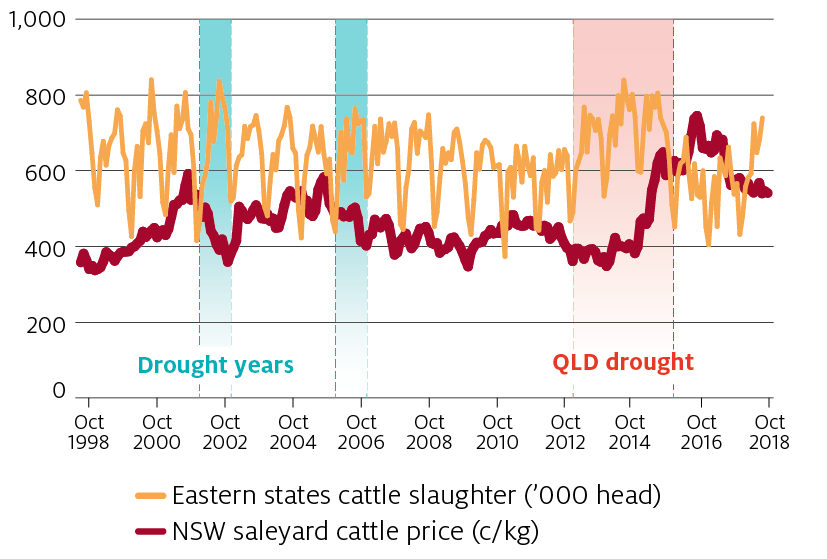

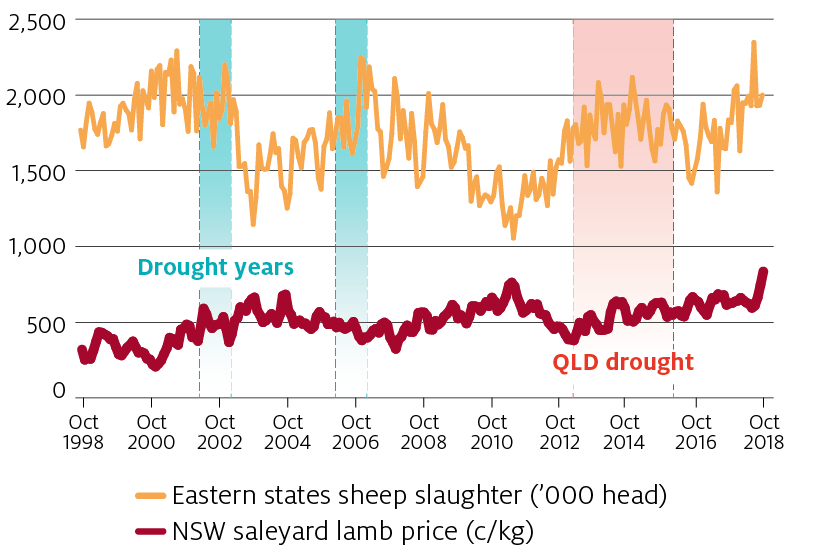

Livestock markets are operating within the bounds of historical variation

Slaughter of cattle and sheep remains within the range observed over the past 20 years and prices remain high by historical standards (Figures 4 and 5).

Note: Eastern Australia refers to New South Wales, Victoria and Queensland.

Source: MLA

Note: Eastern Australia refers to New South Wales, Victoria and Queensland.

Source: MLA

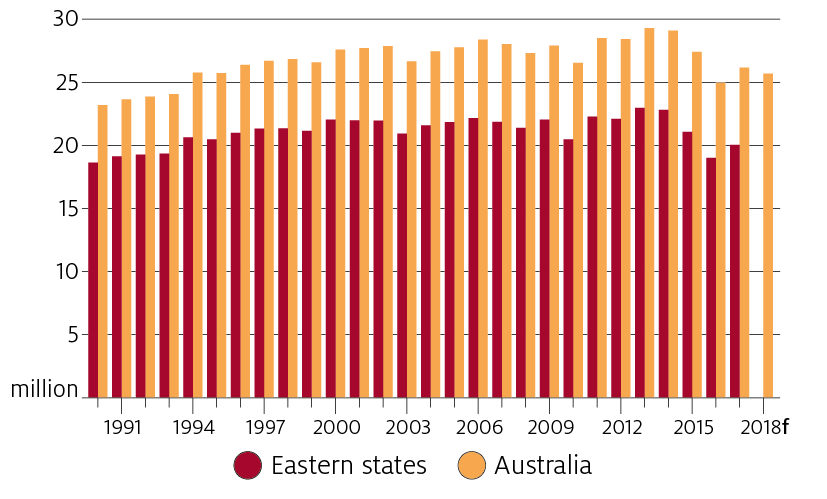

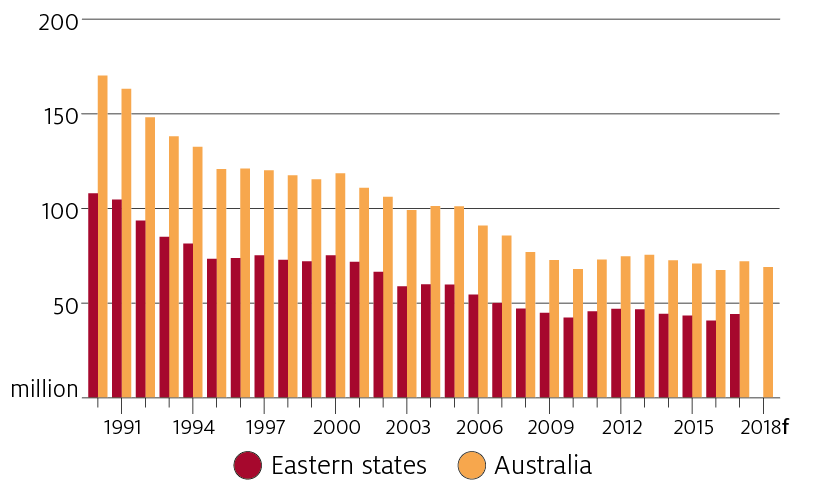

It is likely that overall cattle and sheep numbers will decline as a result of this drought, however these are likely to increase shortly thereafter, as in previous droughts (Figure 6 and Figure 7).

Note: f ABARES forecast (national herd only). Eastern Australia refers to New South Wales, Victoria and Queensland.

Source: MLA

Note: f ABARES forecast (national herd only). Eastern Australia refers to New South Wales, Victoria and Queensland.

Source: MLA

Relatively little change in livestock markets despite a period of limited pasture growth suggests that many livestock producers in south-eastern Australia have so far opted to use supplementary feed to balance energy requirements, rather than selling stock for slaughter.

There are three reasons for this:

- Prices for sheep and cattle are high by historical standards, and much higher than in previous droughts such as 2002-03 and 2006-07 (figures 4 and 5), which means that feeding stock has been profitable in many cases.

- On-farm supplies of feed and fodder were relatively high and feed and fodder prices were low going into the drought (figures 8 and 9). This drought follows several years with favourable conditions for crop and pasture growth.

- Many farmers are expecting livestock prices to increase when conditions improve and do not want to be exposed to the cost and risk associated with buying relatively high-priced cattle in future years.

It is also likely that many sheep and cattle have been moved from the most affected farms in northern New South Wales to regions where conditions are better, such as south-east Queensland, southern New South Wales and Victoria. Cattle numbers in feedlots are at all-time highs. In previous droughts, such movements of cattle were somewhat less feasible because poor conditions were more widespread, and feedlot capacities were lower.

On-farm stocks of feed and fodder were relatively high going into the drought

On-farm stocks of feed and fodder in south-Eastern Australia were relatively high going into the drought, and prices of hay and feed grain were relatively low. However, as poor conditions have continued, prices have increased rapidly, and are now approaching levels observed during the 2006-07 drought (Figure 8, Figure 9).

Note: South-eastern Australia refers to New South Wales, Victoria and Queensland south of the Tropic of Capricorn.

Source: ABARES, The Weekly Times

Note: South-eastern Australia refers to New South Wales, Victoria and Queensland south of the Tropic of Capricorn.

Source: ABARES, The Land

Feed prices are likely to remain at these levels only until additional fodder can be produced, likely from November 2018, as pasture hay growers in Victoria enter peak spring production and some grain crops are converted to fodder.

In addition, alternative sources of roughage for livestock (for example sugarcane bagasse) are likely to be utilised if feed prices remain high.

Climate effects are currently severe but farm incomes are likely to be less affected than in previous droughts

ABARES estimates the effect of climate on farm cash income (holding all other factors constant) is among the worst two years since 1978, comparable only to the 2002-03 drought (Figure 10).

Note: South-eastern Australia refers to New South Wales, Victoria and Queensland south of the Tropic of Capricorn.

Source: ABARES

However, farmer incomes are likely to decline by substantially less than in previous droughts, as comparable poor climate effects are being buffered, or offset to some extent, by more favourable economic circumstances and other factors (Figure 11).

- Crop farm incomes are likely to be buffered somewhat by improved productivity, and in particular a greater capacity to manage through poor years.

- For livestock farms, while feed costs will be higher, output prices remain relatively high, and this is likely to at least partly offset the increase in costs. Livestock farms also had relatively high reserves of feed going into the drought.

- For dairy farms, the main effects of drought are likely to be through higher fodder prices. Milk prices are forecast to increase slightly in 2018-19, which will only partly offset rising input costs for these farms. In addition, dairy farms in dry regions are likely to reduce stock numbers.

It is important to recognise that aggregate trends in farm performance mask significant variation between individual farms and regions. A significant proportion of farms are likely to make significant cash losses in 2018-19, while some farms are likely to perform relatively well.

The experience of previous droughts is that many farms have the capacity to manage through a single dry year, particularly when coming out of a period with relatively high incomes (see Figure 10) – but this becomes increasingly difficult if dry conditions persist.

Drought policy is complicated and there are inevitable trade-offs

While attention is focused on responding to the current situation, it is important to understand the wider context – and tensions – around drought policy and climate change. Most importantly, while supporting those in need is appropriate, there is a risk that some interventions intended to assist farmers during droughts can have negative consequences in the longer term.

For example, the process of shifting resources between farms as some grow and others shrink or disappear is essential for industry-level productivity growth – ABARES has estimated that it could account for as much as half of all productivity growth in Australian agriculture over the past three decades. Policies that impede structural adjustment have the potential to weaken overall productivity growth and hence competitiveness in international markets.

Download this Insights paper

ABARES Insights: Analysis of 2018 Drought